As Washington Attacks Credit Cards, Smart Users Are Banking Record Bonuses

6.4 min read

Updated: Dec 26, 2025 - 06:12:28

The credit card signup bonus landscape has undergone dramatic changes in 2025, with record-breaking offers competing against mounting regulatory pressures. Our investigation reveals not just a market at a crossroads, but unprecedented opportunities for savvy consumers who understand how to exploit industry desperation.

Why Credit Card Companies Are Throwing Money at You

Credit card signup bonuses have reached historic heights in 2025, with premium cards offering rewards that reflect genuine panic among issuers. The most aggressive offers now include:

- 200,000 Membership Rewards points requiring $15,000 in spending over three months

- 200,000 Ultimate Rewards points with a $30,000 spending requirement over six months

- 175,000 Amex Platinum points after $8,000 spend in six months

Chase’s newest premium business offering, the Sapphire Reserve for Business, represents the company’s most aggressive customer acquisition strategy yet. The card targets high-spending businesses with unprecedented bonus structures. Meanwhile, Citi’s return to the premium market with the Strata Elite card signals that even conservative issuers are joining the arms race.

According to Doctor of Credit, which tracks offers without affiliate bias, many current bonuses represent all-time highs. This represents a fundamental shift from the measured bonus increases of previous years to what industry insiders describe as “panic pricing” for new customer acquisition.

How to Exploit the Regulatory Panic

The specter of the Credit Card Competition Act has created a unique opportunity window that smart consumers can exploit. The legislative timeline is creating genuine urgency among issuers, with the bill initially introduced in 2022 and reintroduced with stronger bipartisan support in June 2023. Most recently, Sen. Roger Marshall filed an amendment to attach the Competition Act to the GENIUS Act stablecoin bill, showing continued momentum.

Industry executives know that each legislative session increases the probability of passage. This creates a compelling case for immediate action on premium card applications. Issuers are offering “highest level ever” bonuses to build customer bases before potential reduced interchange fee income forces dramatic bonus cuts.

Maximizing Value Through Volatile Point Economics

Point valuations have become increasingly volatile, creating arbitrage opportunities for informed consumers. Bilt Rewards recently increased to 2.2 cents per point from 2.05, while Citi ThankYou Rewards rose to 1.85 cents from 1.8. However, hotel programs remain particularly volatile, with IHG dropping from 0.8 to 0.5 cents recently—demonstrating why quick redemption beats hoarding.

The key is earning points during bonus periods and redeeming quickly before devaluations. A 200,000 Ultimate Rewards point bonus translates to approximately $3,200 in travel value when redeemed strategically. Even with high spending requirements, the ROI often exceeds 10% when executed properly. The Points Guy now uses “extensive data for the top seven U.S. airline loyalty programs” in their methodology, moving away from subjective valuations that previously inflated point worth.

Smart Strategies for Meeting Massive Spending Requirements

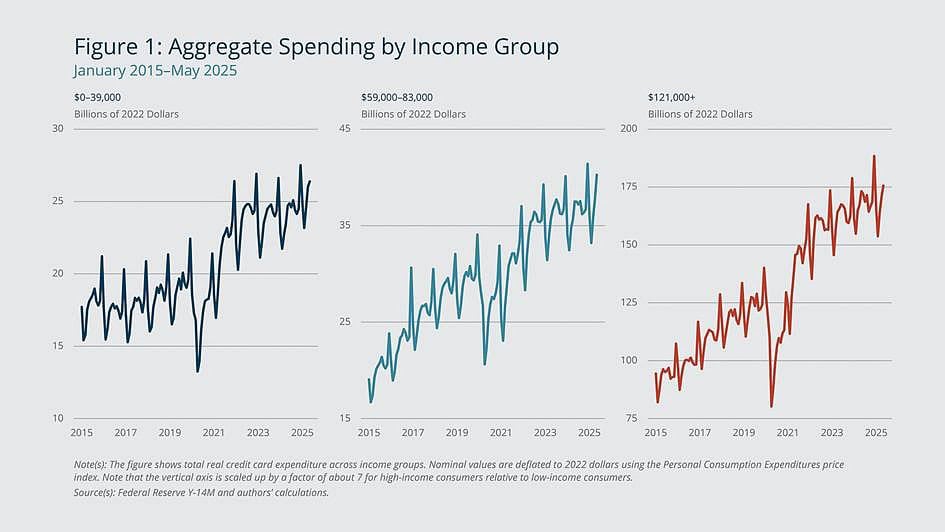

The new reality of $15,000-$30,000 spending requirements demands strategic planning, but the math can work in your favor. Federal Reserve data shows high-income consumers average $1,400 monthly per-card spending, making these card thresholds achievable with proper timing.

Source: Federal Reserve Bank of Boston

The strategic application priority should target Visa and Mastercard issuers first, since they face the most regulatory pressure. Premium cards should take precedence over basic offerings, as they have the most to lose and are offering the highest bonuses. Business cards often provide higher bonuses with different approval criteria, making them attractive secondary targets for those who qualify.

The most effective approach involves timing applications around natural spending peaks. For example;

- business equipment purchases,

- tax payments for quarterly estimated taxes,

- insurance annual premiums,

- major home improvements.

Business cards often offer higher bonuses with similar spending requirements but different approval criteria based on revenue rather than personal income.

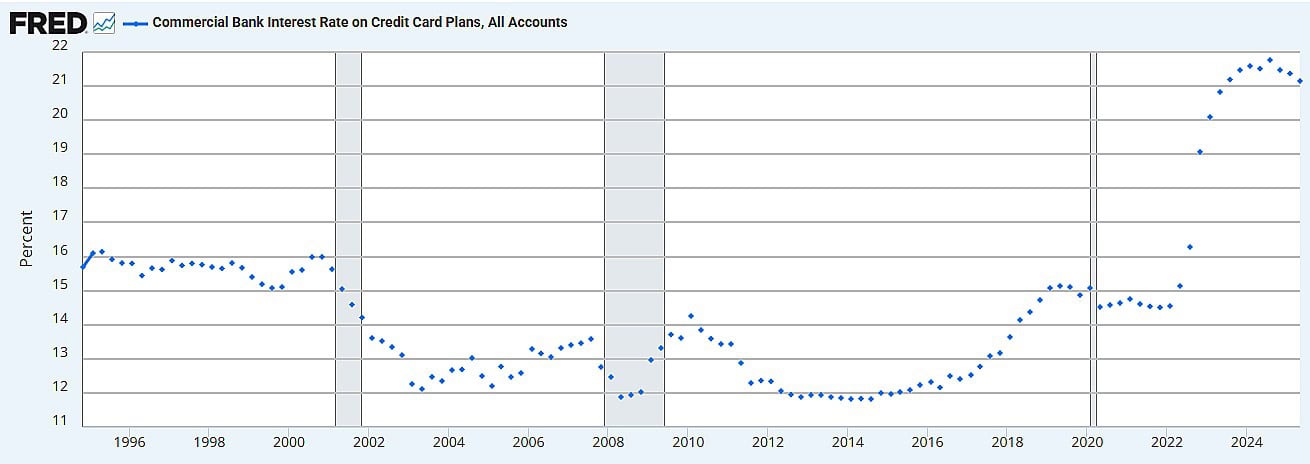

Risk management remains critical. With average card debt at $7,321 and APRs near 22%, never chase bonuses with borrowed money. The math only works with natural spending or planned major purchases that you’d make regardless of the card bonus.

Source: St Louis Fed

The Crypto Card Opportunity Gap

While investigating the crypto credit card space, we discovered a significant gap that creates opportunities for traditional card maximizers. The crypto credit card market has contracted significantly since 2022’s “crypto winter,” with many crypto cards disappearing after major exchange collapses.

Current crypto offerings pale in comparison to traditional card bonuses:

- Coinbase One Card: With up to 4% bitcoin back but no announced signup bonus

- Crypto.com Visa: Welcome bonuses up to $5,000 in CRO but requires holding vast sums of their volatile cryptocurrency

Despite intense recent marketing activity from credit credit cards like Gemini and Coinbase, crypto enthusiasts seeking substantial bonuses should consider earning traditional card bonuses and purchasing cryptocurrency separately which could often yielding better total value than native crypto cards.

Advanced Tactics for Maximum Extraction

Industry analysis shows that issuers review “260+ offers weekly,” suggesting high volatility and frequent opportunities. Smart consumers should apply during issuer quarterly pushes, typically occurring in March, June, September, and December when banks face earnings pressure.

Rather than maximizing single cards, consider a portfolio approach. Diversify across issuers to spread approval risk, time applications 60-90 days apart to manage credit inquiries, and focus on transferable points currencies for maximum flexibility. Given regulatory uncertainty, redemption acceleration becomes critical, book travel immediately rather than accumulating points speculatively.

The application timing strategy should account for issuer-specific patterns. Chase historically increases bonuses during competitive periods, while American Express tends to offer targeted higher bonuses to specific customer segments. Monitor these patterns and strike when opportunities arise.

Market Timing: Why 2025 Is Your Last Best Chance

Multiple industry indicators suggest the bonus bonanza has an expiration date. UK regulators are already investigating Visa and Mastercard’s market power, while bipartisan US support for interchange fee reduction continues building. Industry estimates of a $15 billion annual impact would mean unsustainable bonus economics under proposed regulations.

Consumer behavior shifts also threaten the current model. For example, 46% of Gen Z don’t own credit cards, reducing future customer pools, while contactless payments are reaching 50.1% of smartphone users. These digital-first preferences may favor different reward structures that don’t depend on traditional interchange fees.

Your Action Plan for Maximum Benefit

The immediate priority involves auditing your credit profile to ensure scores are optimized for premium card approvals. Identify natural spending opportunities over the next six months, including upcoming major purchases or business expenses. Target the highest-value offers first, prioritizing 200,000+ point bonuses from major issuers before they disappear.

Plan your redemption strategy before applying, don’t accumulate without clear usage plans. The volatility in point valuations means hoarding is increasingly risky. Focus on earning during bonus periods and redeeming quickly for maximum value extraction.

Medium-term strategy should monitor legislative developments around the Credit Card Competition Act while diversifying point portfolios across multiple transferable currencies. Maximize current bonuses rather than optimizing existing point balances, and prepare for a post-bonus landscape by identifying long-term keeper cards with strong ongoing rewards.

Conclusion: The Great Credit Card Bonus Grab

The credit card signup bonus market of 2025 represents a unique convergence of industry desperation and regulatory uncertainty. For informed consumers, this creates unprecedented opportunities to extract maximum value from issuers willing to pay premium prices for customer acquisition.

Our investigation reveals that current bonus levels are economically unsustainable under proposed regulatory frameworks. With bonus offers at historic highs and regulatory changes potentially reshaping the industry, 2025 may represent the last opportunity for consumers to benefit from credit card companies’ willingness to pay premium prices for new customers. The question isn’t whether this bonanza will end—it’s whether you’ll position yourself to benefit while it lasts.

Related: This topic is part of the broader credit system. For an overview of how credit scores, loans, and debt work together, see our Credit & Debt guide.