Are Crypto Brokers Worth It? Breaking Down the Costs, Risks, and Real Value

4.6 min read

Updated: Jan 19, 2026 - 10:01:25

Bitcoin was built to eliminate middlemen, yet brokers like Coinbase, Fidelity Digital Assets, and Bakkt are thriving. They offer convenience, compliance, and custody, but at higher costs and with trade-offs in self-sovereignty. Whether brokers are “worth it” depends on your risk tolerance, technical skill, and goals.

- Convenience vs. philosophy: Brokers simplify crypto access with regulated platforms and custody, but users give up control of private keys, contradicting Bitcoin’s peer-to-peer vision.

- Hidden costs: Retail fees reach up to 3.99% on Coinbase; institutional custody ranges from 0.35%–1.5% annually vs. 0.02%–0.10% in traditional finance. Withdrawal and spread markups further erode gains.

- Regulation gaps: Unlike SIPC-insured traditional brokers, crypto users face fragmented rules. Insurance often excludes cyberattacks, as FTX’s collapse showed.

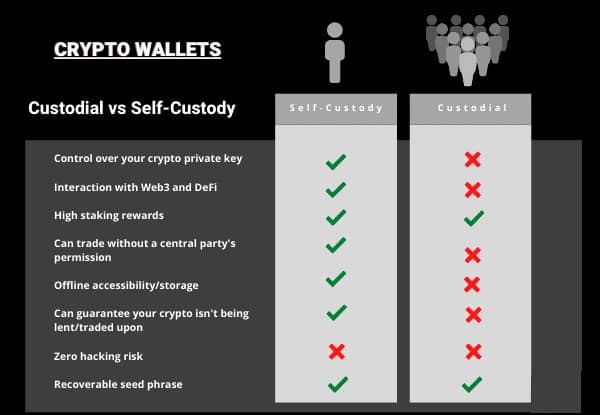

- Custody trade-offs: Broker custody adds counterparty risk, including rehypothecation, while self-custody risks permanent loss of funds, about 20% of BTC is believed lost.

- Who benefits: Institutions and high-net-worth investors gain compliant solutions; tech-savvy retail users often save more with exchanges and hardware wallets.

Bitcoin was built on the promise of eliminating middlemen. Yet today, crypto brokers are thriving, ironically reintroducing the very intermediaries blockchain was designed to avoid. The entry of platforms like Bakkt into brokerage services marks a broader shift toward centralized access points in the digital asset space. While some see this as a necessary bridge to mass adoption, others view it as the “re-banking” of crypto. So, are crypto brokers actually worth it?

Brokers vs. Crypto’s Core Philosophy

At the heart of the crypto broker debate lies a contradiction. Bitcoin’s whitepaper envisioned a peer-to-peer system without trusted third parties. In contrast, brokers like Coinbase Prime and Fidelity Digital Assets function as centralized intermediaries, offering services that crypto was meant to disrupt.

These platforms solve a real problem: complexity. For institutions and less tech-savvy users, brokers offer user-friendly interfaces, regulated environments, and professional custody solutions. But this comes at the expense of self-sovereignty. Users who rely on brokers give up control over their private keys and assets, a significant philosophical compromise.

The Hidden Fees of Crypto Brokers

One of the most overlooked aspects of crypto brokerage is cost. Despite the digital nature of assets, many brokers charge more than their traditional finance counterparts. For example, Coinbase charges up to 3.99% for debit card purchases on its retail platform. Even on its Pro platform, spreads can reach 0.5% on smaller trades.

On the institutional side, firms like Fidelity Digital Assets don’t publicly disclose their fees, but industry estimates suggest they range from 0.35% to 1.5% annually, significantly higher than traditional asset custody fees, which typically fall between 0.02% and 0.10%.

Hidden Charges Add Up

Beyond published fees, there are often additional costs:

- Withdrawal fees, labeled as “network fees,” can be inflated by 300–500% over actual blockchain costs

- Spreads, the difference between buy and sell prices, may add another 0.1% to 2% per transaction

These seemingly small fees can erode long-term gains, especially for active traders or unaware retail users.

Regulatory Landscape: Safety or Illusion?

Unlike traditional brokers governed by the SEC and covered by SIPC insurance, crypto brokers operate in a fragmented regulatory environment. Some, like those in New York, must comply with BitLicense regulations, which impose strict compliance measures. Others operate in more lenient jurisdictions like Wyoming.

This patchwork regulation leads to inconsistent consumer protections. Critically, crypto brokerage clients:

- Do not receive SIPC insurance

- Rely on private insurance, which often excludes key risks like cyberattacks or internal fraud

The FTX collapse exposed the fragility of this system. Investors lost billions with little recourse, a situation unlikely in traditional finance due to stronger oversight and consumer protections.

Broker Custody vs. Self-Custody: Risk Trade-Offs

Using a crypto broker means trusting them as custodians of your assets, which introduces a concept known as custodial risk. Many brokers engage in practices like rehypothecation, where they lend out user assets to earn yield, creating a fractional reserve setup similar to banks but without FDIC protection.

On the flip side, self-custody comes with its own challenges. Managing private keys securely requires both technical skill and diligence. According to Chainalysis, nearly 3.7 million BTC (about 20% of supply) is believed to be lost due to misplaced keys or wallets.

In short, both custody options involve risk, but of different types. The choice depends on your confidence in managing your own assets versus your trust in third-party platforms.

Who Actually Needs Crypto Brokers?

Institutions

Crypto brokers are essential for institutions that require audited custody, regulatory compliance, and secure infrastructure. Products like BlackRock’s IBIT ETF rely on institutional-grade custody to function within legal frameworks.

High-Net-Worth Individuals:

Services like iTrustCapital cater to wealthy individuals who want crypto exposure inside retirement accounts. These brokers provide compliant custody options, albeit at premium fees, that wouldn’t be available through self-custody.

Retail Investors:

Tech-savvy users can save significantly by using exchanges and hardware wallets. However, studies suggest over 60% of retail crypto investors still choose brokers for the convenience and ease of use, despite the added costs.

Conclusion: Are Crypto Brokers Worth It?

Crypto brokers are neither inherently good nor bad; their value depends on your goals, technical ability, and risk appetite. They serve a legitimate purpose for institutions and those needing compliant, custodial solutions. But they also introduce costs, custodial risk, and philosophical compromises for anyone seeking true financial independence. If you’re confident in managing your own assets, self-custody may align better with the ethos of crypto. If you value convenience, support, and regulation, brokers may be a smart choice; just make sure you know what you’re paying for.