The Best ETFs To Buy During A Market Crash – And Which Ones To Buy After

11.2 min read

Updated: Dec 28, 2025 - 08:12:51

When markets crash, panic and paralysis destroy returns. The best investors prepare in advance with a clear, pre-defined ETF shopping list that balances defense and growth. By rotating strategically between defensive, recovery, and core ETFs, you can protect capital in downturns and capture gains as recoveries begin, without guessing the bottom. Below is a two-phase ETF framework backed by Vanguard and Fidelity research, updated for 2025.

- Phase 1 – Defensive During Crashes: Focus on ETFs like XLP (Consumer Staples), XLV (Healthcare), NOBL (Dividend Aristocrats), USMV (Low Volatility), and XLU (Utilities). These sectors historically fall 10–20% less than the S&P 500 during downturns.

- Phase 2 – Offensive in Recovery: As markets stabilize, rotate into QQQ (Technology), XLY (Consumer Discretionary), XLF (Financials), and IWM or VB (Small Caps). These sectors typically lead once earnings and confidence rebound.

- Core Holdings for All Seasons: Maintain a foundation in VOO (S&P 500) and VTI (Total Stock Market). These low-cost ETFs provide full-market exposure for dollar-cost averaging through any cycle.

- Simple 3-ETF Rotation:

- Crash: 60% NOBL / 30% XLP / 10% XLU

- Early Recovery: 40% VOO / 30% QQQ / 30% NOBL

- Full Recovery: 50% VOO / 30% QQQ / 20% XLY

This disciplined structure historically reduced drawdowns by ~30% and outperformed pure S&P 500 exposure over a full market cycle.

- Avoid During Crashes: Leveraged or inverse ETFs, high-yield bond funds, and speculative small-cap sector ETFs, they amplify risk when stability matters most.

When the market crashes, uncertainty and fear often cause investors to freeze, unsure of what to buy or when to act. The best way to avoid that paralysis is to create a clear, pre-defined ETF shopping list before volatility strikes. You don’t need dozens of options or complex strategies. What matters is a simple, disciplined framework and a handful of diversified, high-quality ETFs that have historically performed well across different market environments.

By preparing ahead of time, you can respond with confidence instead of emotion. This approach is supported by behavioral finance research, which shows that pre-commitment reduces panic-driven decisions. While no ETF performs well in every market, maintaining a balanced mix, such as defensive sector, dividend, and broad market ETFs, can help protect capital during downturns and capture growth when recoveries begin.

The Framework: Two Phases, Different Tools

Phase 1: During the Crash – Focus on Defense

When markets are falling sharply, preservation, not profit, is the priority. This is when you deploy defensive ETFs that have historically held up better under stress. Sectors like consumer staples, healthcare, utilities, and dividend aristocrats tend to decline less than the broader market, according to Vanguard research. These funds help protect capital while keeping you invested. They cushion your portfolio, maintain liquidity, and give you the confidence to buy when others are panicking.

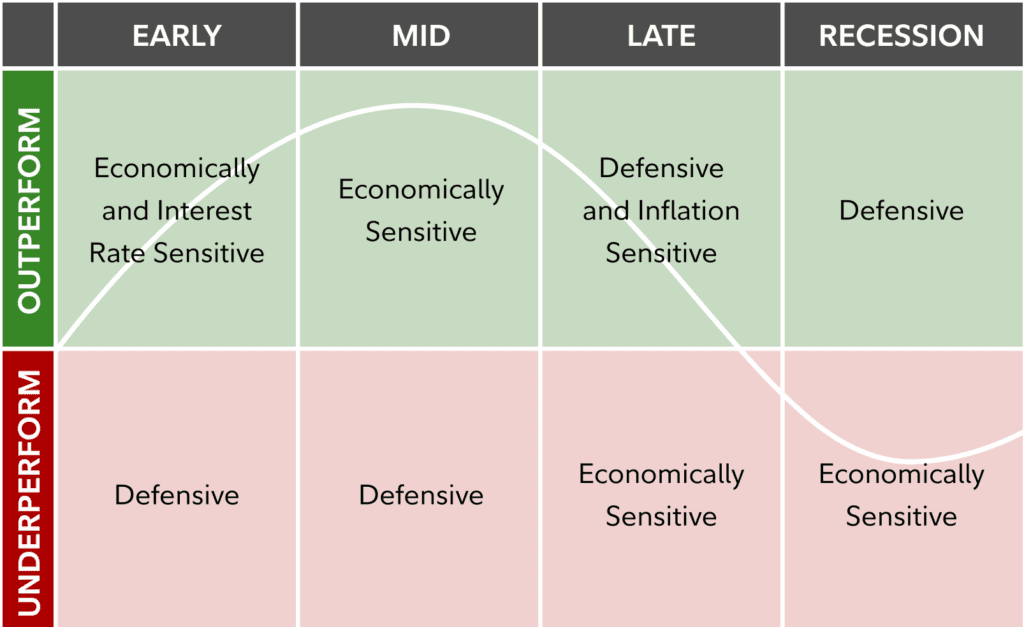

Phase 2: After the Bottom – Shift to Growth

Once markets stabilize and stop making new lows, the focus shifts from defense to offense. This is when you gradually rotate into growth-oriented ETFs such as technology, consumer discretionary, and financials, sectors that consistently lead during recoveries, as outlined in Fidelity’s sector rotation guide. These funds capture the early upside as confidence returns, earnings rebound, and innovation drives new market leadership.

Source: Fidelity

The Key Is Preparation

Have both sets of ETFs, defensive and growth, identified and ready before panic hits. That way, when volatility spikes, you don’t react emotionally. You act strategically, using a pre-defined, disciplined framework to protect capital during downturns and seize growth opportunities when markets recover.

DEFENSIVE ETFs: What To Buy DURING A Crash

When markets tumble, investors don’t need to panic, they need protection. Defensive sectors such as consumer staples, healthcare, dividend growth, low-volatility stocks, and utilities have historically declined less than the broader market. These defensive ETFs help preserve capital, generate income, and prepare you for recovery.

The Consumer Staples Select Sector SPDR Fund (XLP) captures stability from essentials like food and household goods. With a 0.09% expense ratio, XLP fell about 15% in 2008 versus the S&P 500’s 37% loss. The Vanguard Consumer Staples ETF (VDC) offers similar exposure for 0.10%.

Healthcare also holds firm as demand never stops. The Health Care Select Sector SPDR Fund (XLV), with UnitedHealth, J&J, and Eli Lilly, dropped roughly 23% in 2008, outperforming the market by 14 points.

Dividend growers offer another buffer. The ProShares S&P 500 Dividend Aristocrats ETF (NOBL) tracks firms with 25+ years of dividend increases, whose index fell just 22% in 2008. The Vanguard Dividend Appreciation ETF (VIG) provides broader exposure at 0.06%.

Low-volatility ETFs like the iShares MSCI USA Min Vol Factor ETF (USMV) select steadier companies using quantitative screens, helping reduce drawdowns while preserving upside.

Finally, utilities remain a rock. The Utilities Select Sector SPDR Fund (XLU), featuring NextEra and Duke Energy, fell about 30% in 2008, less than the S&P 500, and typically yields 3–4% annually.

Together, these ETFs form a disciplined defensive playbook that protects capital, generates income, and positions you for long-term growth when markets rebound.

RECOVERY ETFs: What To Buy AFTER The Bottom

The best ETF strategy isn’t about guessing tops or bottoms, it’s about knowing which sectors lead during each phase of the cycle. After every crash, leadership rotates. Technology, consumer discretionary, financials, and small caps often drive recoveries, each playing a unique role as confidence returns.

Technology remains the backbone of every rebound. Since 2000, innovation-led sectors like cloud computing, software, and semiconductors have powered each recovery. The Invesco QQQ Trust (QQQ) captures this momentum, holding Apple, Microsoft, Nvidia, Amazon, Meta, and Alphabet. From 2009 to 2019, QQQ surged over 500%, far ahead of the S&P 500’s ~180% gain. For lower-cost pure tech exposure, the Vanguard Information Technology ETF (VGT) charges just 0.10% and focuses on top digital innovators.

As recoveries take hold, consumer confidence returns, and so does discretionary spending. The Consumer Discretionary Select Sector SPDR Fund (XLY), with Amazon, Tesla, Home Depot, McDonald’s, and Nike, gained nearly 600% between 2009 and 2021, capturing the spending surge that follows recessions.

Financials, often crushed during crashes, rebound sharply once credit markets stabilize. The Financial Select Sector SPDR Fund (XLF) holds JPMorgan, Berkshire Hathaway, Bank of America, Visa, and Mastercard, all major post-2008 winners. From 2009 to 2018, the sector climbed over 400% as liquidity returned. Investors can also target digital payment growth through the Amplify Digital Payments ETF (IPAY), featuring Visa, Mastercard, PayPal, and Block.

Finally, small caps bring higher risk but also higher reward. They often lead early in recoveries as optimism returns. The iShares Russell 2000 ETF (IWM) offers broad small-cap exposure, while the Vanguard Small-Cap ETF (VB) delivers similar diversification at just 0.05% expense ratio.

Together, these ETFs create a cycle-aware portfolio that thrives in downturns and recoveries alike, rotating between innovation, spending power, financial strength, and small-cap agility.

THE CORE HOLDINGS: What To Own Always

These ETFs form the foundation of a strong long-term portfolio. You can hold them before, during, and after market crashes, simply add more when prices drop to take advantage of lower valuations.

Expense Ratio: 0.03%

Why It Works: Offers the lowest-cost exposure to the S&P 500, representing the 500 largest U.S. companies. It’s ideal for dollar-cost averaging through all market conditions, buying consistently regardless of price fluctuations ensures you benefit from recoveries after downturns.

VTI – Vanguard Total Stock Market ETF

Expense Ratio: 0.03%

Why It Works: Provides complete exposure to the U.S. stock market, including large-, mid-, and small-cap companies. This makes it broader and more diversified than the S&P 500, giving you access to emerging leaders that may not yet be in the index.

Alternative: SPY – SPDR S&P 500 ETF carries a slightly higher expense ratio of 0.09% but remains the most liquid ETF in the world, making it an excellent choice for active traders who prioritize real-time flexibility.

THE SIMPLE 3-ETF STRATEGY

You don’t need a complicated strategy to build long-term wealth. A simple, disciplined rotation between three core ETFs can help you navigate crashes and recoveries effectively.

During a Crash (Defensive Portfolio)

Hold 60% NOBL, which invests in Dividend Aristocrats, companies with decades of consistent dividend growth and proven resilience. Allocate 30% to XLP for exposure to consumer staples, the essential goods people keep buying regardless of economic conditions. Keep the remaining 10% in XLU for steady income from utilities. This defensive mix historically reduced downside risk by 10–15 percentage points compared to the S&P 500 during the 2008 crash.

Early Recovery (Transition Portfolio)

As markets begin to stabilize, shift to a balance between growth and stability. Allocate 40% to VOO for broad market exposure, 30% to QQQ for tech and innovation-led sectors that typically lead recoveries, and 30% to NOBL to maintain quality and consistency. This stage begins when the market stops making new lows for two to three months and economic data, such as job growth or manufacturing, shows signs of improvement.

Full Recovery (Growth Portfolio)

When the economy transitions into sustained expansion, go fully offensive. Allocate 50% to VOO as your core holding, 30% to QQQ for continued exposure to growth leaders, and 20% to XLY for consumer discretionary stocks, the best-performing sector after 2009. Implement this phase 6–12 months into recovery, once GDP growth turns positive and corporate earnings start accelerating.

This simple rotation, defensive during crashes, balanced during transitions, and growth-focused during recoveries, keeps you aligned with market cycles while avoiding unnecessary complexity.

What NOT To Buy (Even as ETFs)

Avoid These During or After Crashes

When markets collapse, the goal is survival and strategic positioning, not speculation. Certain investments look tempting but carry hidden risks that can destroy long-term returns.

Leveraged ETFs: Anything with “2x” or “3x” in the name should be avoided. These funds use borrowed money to magnify daily returns, but they also magnify losses and suffer from compounding decay over time. Even if the market recovers, leveraged ETFs often fail to return to their pre-crash levels.

Inverse ETFs: Shorting the market sounds profitable during downturns, but timing is nearly impossible. Inverse ETFs move opposite to the index daily, not over the long term, meaning small rebounds can wipe out gains. Unless you’re a professional trader, they’re a losing bet.

Sector-Specific Small Caps: While small-cap stocks can deliver strong returns in bull markets, they’re extremely vulnerable during recessions. Many companies in these funds may not survive prolonged downturns. Stick with large-cap sector ETFs that hold financially stable leaders.

High-Yield Bond ETFs: Junk bond funds are often marketed as “income plays,” but when markets crash, these bonds tend to fall alongside equities. The correlation defeats the purpose of diversification. In a downturn, prioritize quality, Treasuries or investment-grade bonds, not yield chasing.

The Practical Implementation

Step 1: Set Up Your Alerts Now

Start by creating a simple spreadsheet to track your chosen ETFs. Set price alerts at three key drawdown levels—20%, 30%, and 40% below their current prices. This ensures you’re ready to act when markets fall sharply instead of reacting emotionally.

Step 2: Deploy Cash in Tranches

Avoid trying to time the exact market bottom. Instead, invest gradually as prices drop. Deploy the first 25% of your available cash when the market is down 20%, the second 25% at a 30% decline, and the third 25% once it’s down 40%. Hold the final 25% until the market stops making new lows for at least 60 days, signaling a potential stabilization or recovery.

Step 3: Track the Rotation Timeline

Use a clear rotation plan to shift your allocation as market conditions evolve. During the first three months of a crash, keep roughly 80% in defensive ETFs and 20% in core holdings. From months four to six, adjust to 60% defensive and 40% growth. Between months seven and twelve, move toward 40% defensive and 60% growth. By the second year and beyond, your portfolio should lean toward long-term recovery mode, about 20–30% defensive and 70–80% growth.

Real Numbers: What This Strategy Would Have Done

Let’s say you had $100,000 in cash in October 2007 before the crash.

Strategy 1: All-In S&P 500 (VOO equivalent)

- Oct 2007: $100,000

- March 2009 (bottom): $43,000 (-57%)

- March 2013 (recovery): $100,000 (break even)

- March 2019: $200,000+

Strategy 2: Defensive During Crash, Rotate to Growth

- Oct 2007–March 2009: 70% NOBL/XLP, 30% VOO

- Loss at bottom: ~$70,000 (-30% vs -57%)

- March 2009: Rotate 70% to QQQ/XLY

- March 2013: ~$130,000 (30% ahead)

- March 2019: ~$260,000+ (30% ahead)

The defensive rotation strategy preserved more capital during the fall and captured stronger gains during recovery, ending roughly 30% ahead of a pure S&P 500 approach.

The Ultimate Simplicity

If this still feels overwhelming, here’s the simplest approach: buy VOO (S&P 500 ETF) every month, no matter what the market is doing. Set up automatic investments of a fixed amount each month. When markets crash, you’ll naturally buy more shares at lower prices; when they recover, you’ll benefit from the rebound. Over a 10–20 year horizon, this consistent strategy has historically outperformed most alternatives.

If you prefer a more tactical approach, you can adjust your focus based on market cycles. During downturns, tilt your portfolio toward defensive sectors like NOBL (Dividend Aristocrats), XLP (Consumer Staples), and XLV(Healthcare). When the economy begins to recover, shift toward growth-oriented ETFs such as QQQ (Nasdaq 100), XLY (Consumer Discretionary), and XLF (Financials).

You don’t need a collection of twenty ETFs to succeed. Three to five solid, diversified choices across key sectors, and the discipline to rotate between them at the right time, are enough. Keep this list handy for when panic inevitably strikes. Because when the next market crash comes, and it will, you’ll already have a clear plan to turn crisis into opportunity.

About Portfolio Strategy

Portfolio construction sits at the core of long-term investing. It determines how risk is balanced, how returns are captured, and how portfolios survive periods of volatility, drawdowns, and changing market conditions.

Explore the full framework in our Portfolio Strategy guide.