Streaming Platforms vs Gaming — Which Is the WORST Investment?

7.3 min read

Updated: Dec 20, 2025 - 08:12:25

As of 2025, the global entertainment economy has split into two mature ecosystems, streaming and gaming, but investors should note a clear divergence: gaming remains resilient while streaming faces stagnation. Streaming growth is slowing amid saturation, rising content costs, and margin compression, while gaming sustains steady expansion through diversified revenue streams and recurring engagement. The result: streaming is the tougher bet ahead.

- Growth slowdown: The global streaming market (~US$129 billion in 2024) is expanding but losing momentum as customer acquisition costs rise and competition intensifies.

- Margin pressure: Content spend surpassed US$200 billion in 2024, with sports rights alone nearing US$30 billion, squeezing profitability as ad tiers and churn grow.

- Gaming resilience: The games market, projected at ~US$189 billion in 2025, benefits from recurring in-game spending and long-tail franchise economics.

- Capital intensity gap: Netflix and Disney+ each spend tens of billions annually on new content, while gaming studios amortize IP across sequels, DLC, and merchandise, compounding long-term value.

- Investment takeaway: Streaming platforms risk utility-like margins without innovation; gaming’s diversified monetization and global reach make it the steadier entertainment play for 2025.

The modern entertainment economy revolves around two dominant ecosystems: streaming platforms like Netflix, Disney+, and Amazon Prime Video, and the global gaming industry spanning consoles, PCs, and mobile devices. Both sectors have captured billions of users, redefined leisure time, and built enormous market capitalizations. Yet as 2025 unfolds, one of these industries faces a far steeper climb ahead.

While gaming growth has slowed to low single digits after years of pandemic-era expansion, streaming platforms are confronting deeper structural issues, saturation, rising content costs, and thinning margins. Subscriber fatigue is spreading as households juggle multiple paid services, forcing companies to pivot from growth to profitability. The result is slower user gains, heavier ad-tier reliance, and mounting pressure on free cash flow.

For investors, that combination makes streaming the tougher bet in 2025. Gaming remains cyclical but resilient, buoyed by recurring in-game spending and platform ecosystems. Streaming, by contrast, is entering a phase of stagnation and margin compression that signals tougher years ahead.

Growth trajectories and market saturation

The streaming industry is still expanding, but its strongest growth phase appears to be behind it. According to Grand View Research, the global video streaming market was valued at roughly US$129 billion in 2024 and is projected to reach ~US$417 billion by 2030, implying a CAGR of ~21%. However, Future Market Insights projects a slower long-term CAGR of ~12% through 2035. This divergence indicates that expansion continues, but momentum is moderating as market penetration rises, customer acquisition costs increase, and competitive intensity squeezes margins.

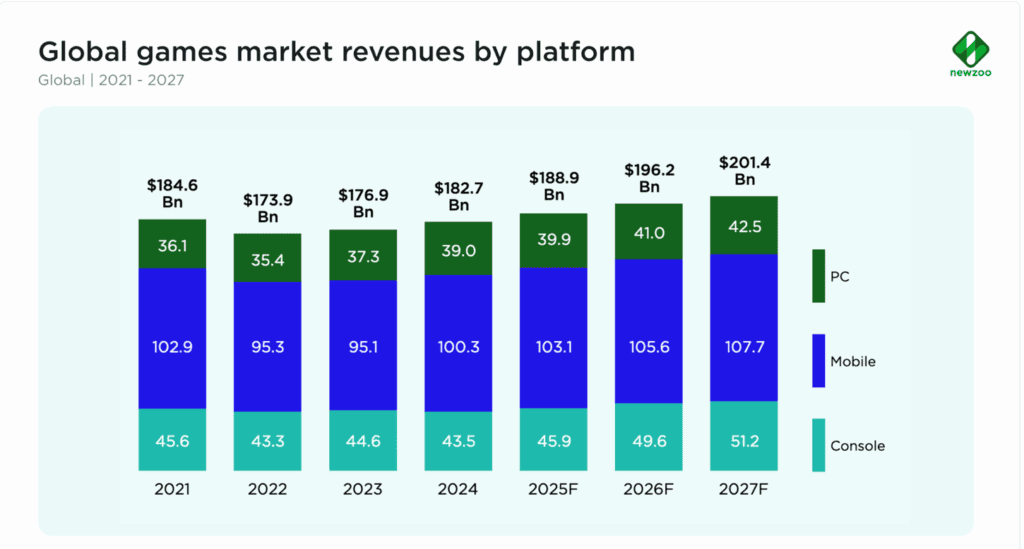

The gaming industry shows a different cadence. Newzoo’s Global Games Market Report 2025 estimates 2025 gaming revenues near US$189 billion, up ~3% year-on-year, reflecting steady but moderate growth. Meanwhile, IMARC Group values the total gaming market at ~US$241 billion in 2024 and projects ~8% annual growth over the next decade.

Source: Newzoo

In short, gaming appears large and steady, supported by diversified platforms (console, PC, mobile) and recurring in-game monetization. Streaming, by contrast, faces maturing user bases after years of rapid subscriber gains, incremental growth is costlier, churn control is critical, and margin pressure mounts as platforms compete on price, content investment, and bundling.

Cost and monetization pressures

Streaming services are facing a profit squeeze. Content production, licensing fees, and bidding wars for live sports rights have pushed costs to record highs. Major entertainment companies collectively spent over US$200 billion on content in 2024, with streaming platforms accounting for a large share. In the U.S. alone, sports broadcasting and streaming rights approached US$30 billion, underscoring how expensive premium content has become.

Meanwhile, viewers are showing clear signs of subscription fatigue. A Deloitte Digital Media Trends survey found that nearly half of U.S. consumers believe they pay too much for streaming, and about 39% canceled at least one paid service in the past six months due to rising costs and overlapping content.

To offset churn, platforms are rolling out ad-supported tiers and bundled offers, but these models typically yield lower average revenue per user than premium subscriptions. The result is a business model squeezed between soaring content expenses and a customer base increasingly resistant to price hikes.

Gaming, while not immune to cost inflation, benefits from more diversified and recurring revenue streams. A mix of premium game sales, in-game purchases, downloadable content (DLC), and subscription services like Xbox Game Pass allows publishers to generate steady income without needing constant new releases. Digital distribution has also slashed physical costs, giving gaming a more sustainable margin structure than streaming’s high-burn economics.

Capital intensity and execution risk

Streaming platforms are among the most capital-intensive businesses in entertainment. To stay competitive, they must invest heavily in original content, technology infrastructure, and global expansion. Netflix continues to allocate roughly US $17–18 billion annually to content production and licensing. Disney has poured billions into building Disney+ but has only recently begun trimming losses after years of steep deficits in its streaming division. When subscriber growth slows, these massive sunk costs become harder to justify, pressuring margins and share valuations.

Gaming, though cyclical, manages risk through different dynamics. Developing major “AAA” titles can cost hundreds of millions of dollars, as shown by Sony’s recent budget disclosures. However, successful releases often generate long-tail revenue through online play, expansions, microtransactions, and merchandising. Iconic franchises can remain profitable for a decade or more, unlike most streaming series, whose value fades rapidly once initial engagement peaks. The result is a structural advantage: gaming intellectual property compounds over time, while streaming libraries depreciate quickly.

Margins and disruption risks

Streaming faces deep structural challenges that are proving difficult to fix. The first is competition for attention. Consumers have a finite number of entertainment hours, and streaming platforms are now battling not just each other but also social video giants like YouTube, TikTok, and Twitch. As the attention economy reaches saturation, growth turns into a zero-sum contest for viewer engagement.

The second pressure point is pricing power. The rise of ad-supported tiers and aggressive discounting has pushed average revenue per user lower, while subscription fatigue and persistent account sharing force companies to work harder just to hold their revenue base. Gaming, by contrast, benefits from its interactive nature, players participate rather than passively watch, and this engagement consistently drives higher in-game spending and longer monetization cycles.

Regulation has emerged as another wildcard. Heightened antitrust scrutiny of media mergers, tightening data privacy rules, and restrictions on advertising to minors are adding compliance costs and uncertainty to streaming models. Gaming faces its own hurdles, particularly over loot boxes and content moderation, but its global diversity offers insulation. Markets such as India, Southeast Asia, and Latin America remain strong growth engines for gaming in a way they are not for streaming.

Comparative verdict: Streaming is worse

Both industries face structural headwinds, slowing growth, rising costs, and intense competition, but streaming’s problems run deeper. The model relies on an endless cycle of new content, constant user acquisition, and heavy reinvestment. It’s a treadmill that speeds up as returns diminish. Gaming, meanwhile, continues to reinvent itself through new platforms and monetization strategies, from mobile and cloud to subscription and in-game models.

From an investment standpoint, gaming offers broader revenue diversity, stronger engagement, and lower churn risk. Streaming remains culturally dominant, but most platforms still lose money or earn meager returns despite massive spending. Unless a breakthrough, like AI-personalized or interactive video, reshapes its economics, streaming risks becoming what it once disrupted: a high-cost, low-margin utility disguised as innovation.

What investors should watch

For streaming, investors should track subscriber growth, churn rates, total content spend, average revenue per user (ARPU), and the performance of ad-supported tiers. Platforms that fail to expand profitably or manage production costs risk losing valuation multiples as competition intensifies. Engagement and retention metrics are becoming just as important as raw subscriber numbers.

In gaming, attention should center on publisher pipelines, the success of live-service and subscription models, and exposure to mobile and cloud gaming trends. Companies with strong franchises and active community ecosystems, such as Epic Games or Tencent, tend to maintain more stable revenue and user engagement through economic cycles, supported by recurring in-game purchases and digital distribution efficiencies.

Final word

Both streaming and gaming have reshaped global entertainment, but their trajectories are moving in opposite directions. Gaming has evolved into a multi-platform ecosystem built on durable franchises, recurring revenue, and deep community engagement. Streaming, by contrast, remains trapped in an expensive content arms race with little differentiation and mounting subscriber churn.

As of 2025, from a risk–return perspective, streaming platforms clearly carry the heavier burden. Gaming may face cycles and saturation risks, but streaming’s underlying economics, high costs, low margins, and slowing growth, make it the tougher model to sustain.