How REITs Beat Real Estate by 340% Over 20 Years

4.9 min read

Updated: Dec 28, 2025 - 09:12:14

Over the past two decades, Real Estate Investment Trusts (REITs) have consistently outperformed direct property ownership, delivering roughly 9–10% annualized returns vs. 3–4% for home prices. Backed by Nareit and independent research, REITs’ superior performance stems from liquidity, diversification, and mandatory dividend payouts. While direct real estate provides stability, leverage opportunities, and personal utility, REITs have proven more effective for long-term income and wealth creation despite higher market volatility and less favorable tax treatment.

- From 2003–2023, $100,000 in REITs grew to about $540,000 vs. ~$150,000 for a home.

- REITs must distribute 90% of taxable income as dividends, creating steady cash flow.

- Studies from MIT, Wharton, and Real Estate Economics confirm REITs outperform direct real estate over multiple cycles.

- Advantages: instant liquidity, professional management, scale efficiencies, and sector/geographic diversification.

- Tradeoffs: share-price volatility, ordinary-income dividend taxation, and sector-specific risks (e.g., office, retail).

A Real Estate Investment Trust (REIT) is a company that owns, operates, or finances income-producing real estate across a variety of sectors, including apartments, office buildings, warehouses, healthcare facilities, shopping centers, and data centers. Unlike direct property ownership, where an individual invests in a single home or commercial building, REITs pool capital from many investors to build large, diversified portfolios.

Their shares trade on major stock exchanges, making them accessible to retail investors in the same way as stocks and bonds. Importantly, U.S. law requires that a REIT distribute at least 90% of its taxable income as dividends to shareholders. This rule creates a reliable stream of income, which has historically attracted retirees and income-oriented investors.

REITs vs. Direct Real Estate: A 20-Year Return Story

Two decades of performance data reveal the stark difference between REITs and direct real estate. According to the FTSE Nareit All Equity REITs Index from 2003 to 2023, investors achieved annualized total returns of roughly 9–10%. In comparison, the S&P CoreLogic Case-Shiller U.S. Home Price Index during the same period recorded only about 3–4% annualized growth in home prices.

To illustrate, an investor who placed $100,000 into a diversified REIT portfolio in 2003 would have seen it grow to approximately $540,000 by 2023. By contrast, investing the same amount in a home would have raised its property value to only around $150,000 before accounting for rental income, maintenance costs, or taxes. That translates into a 340% advantage in favor of REITs.

REITs Outperform Direct Real Estate

The performance gap between REITs and direct real estate is not anecdotal, it has been verified by multiple independent studies:

-

MIT (Connors, 2000) found that between 1979 and 1997, REITs delivered about 15% annual returns compared to around 9% for direct real estate.

-

Wharton School (Pavlov & Wachter, 2011) showed that REITs respond more to capital market forces than appraised values, indicating weaker correlation with direct property but stronger integration with financial markets.

-

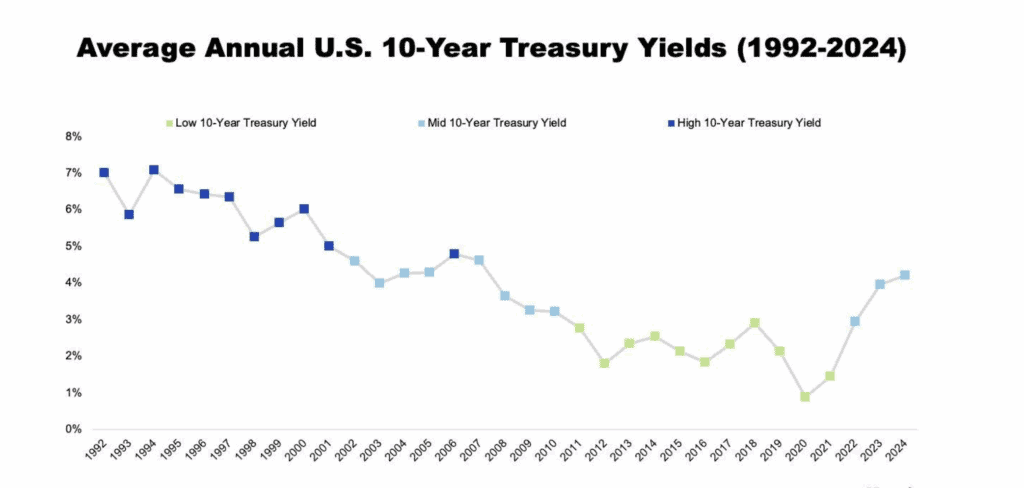

Nareit (2025 data) observed that from 1992 to 2024, REITs consistently outperformed private real estate by 1.6–5.5% annually, depending on the prevailing interest rate environment.

Source: Nareit

-

Springer / Real Estate Economics (Zhu et al., 2024) documented that while direct real estate averaged around 8% returns with lower volatility, REITs generated higher overall returns but with increased market risk.

Together, this research confirms that REITs are not only competitive but consistently outperform direct property ownership over long horizons.

Why REITs Outperform Over Time

Several structural advantages explain why REITs have outpaced direct real estate for decades:

Liquidity and Accessibility

REITs trade on public markets, allowing investors to buy and sell shares instantly. Direct real estate transactions, in contrast, often take months and involve high fees, closing costs, and lengthy negotiations.

Diversification Across Sectors and Geography

A single REIT might own hundreds or thousands of properties across multiple asset classes, residential, industrial, retail, or healthcare, reducing concentration risk. Individual property investors typically depend on the performance of just one or two assets.

Professional Management and Scale

REITs are managed by teams with expertise in acquisitions, property development, leasing, and financing. Their scale allows them to negotiate lower borrowing costs and attract stable, long-term corporate tenants, advantages rarely available to small landlords.

Dividend Income

Because REITs are legally required to distribute 90% of their taxable income, they provide investors with consistent dividend streams, often exceeding the yields of bonds or savings accounts.

Risks and Downsides of REITs

While REITs offer strong advantages, they are not risk-free. Their share prices fluctuate with the broader stock market, exposing investors to volatility unrelated to real estate fundamentals.

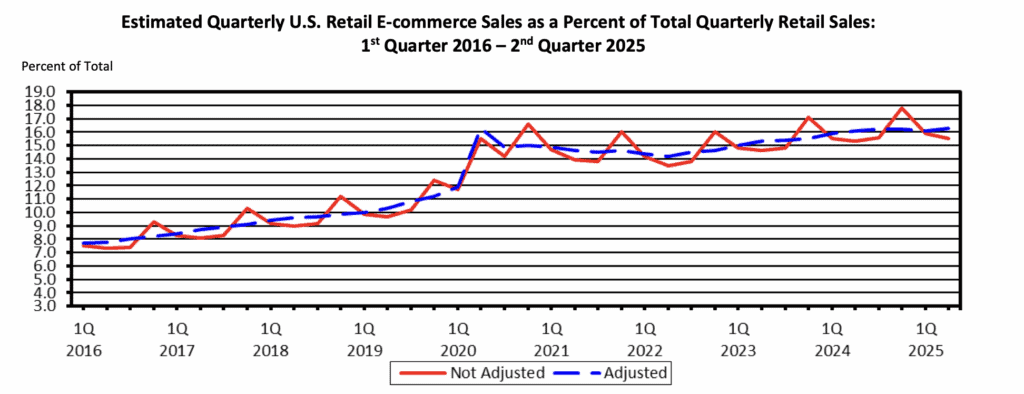

In addition, REIT dividends are generally taxed as ordinary income, which can be less favorable than capital gains rates. Finally, sector-specific risks apply, office REITs may underperform during remote-work trends, while retail REITs face challenges from e-commerce.

Source: Census

Which Strategy Fits Different Investors?

The choice between REITs and direct property depends on individual circumstances. REITs are better suited to investors who prioritize liquidity, income, and diversification without the responsibilities of being a landlord. Direct real estate may appeal to those who want to use leverage through mortgages, control their assets, or enjoy the personal utility of property ownership. Some investors also value real estate’s role as a tangible inflation hedge, despite its lower returns compared to REITs.

Bottom Line

Over the past 20 years, REITs have outperformed direct real estate by more than 340%, with support from both academic research and industry data. They combine liquidity, professional management, and diversification to deliver superior long-term performance, albeit with higher volatility and less favorable tax treatment.

Direct real estate offers stability and control but tends to lag in wealth creation. Ultimately, the better choice depends on each investor’s goals, tolerance for risk, and tax planning strategies, but the evidence overwhelmingly demonstrates that REITs provide a compelling case for long-term growth and income.

This article belongs to Mooloo’s Asset Classes series, which examines how different assets behave over time and how they are used together to build resilient portfolios. View the full Asset Classes overview to see how each asset fits within a broader investment structure.