Complete Guide: How to Track and Copy Billionaire Investment Moves

7.3 min read

Updated: Dec 22, 2025 - 09:12:12

Retail investors can legally track and replicate billionaire investors’ stock picks using SEC Form 13F filings, which disclose quarterly holdings of institutions with over $100 million AUM. Academic research shows cloned portfolios have, in some cases, significantly outperformed the S&P 500, but success depends on disciplined execution, diversification, and risk management. While results vary and delays limit real-time replication, 13F filings remain one of the most powerful transparency tools available in U.S. markets.

- 13F filings: Required quarterly by the SEC, revealing stock holdings of hedge funds, mutual funds, and pension funds (SEC EDGAR).

- Evidence of outperformance: A 2024 study found top-quartile cloned portfolios beat the S&P 500 by 24.25% risk-adjusted annually (2013–2023), though past performance is no guarantee of future returns.

- Strategy options: Investors can fully clone portfolios, focus on “best ideas” (largest/newest holdings), or pursue consensus investing across multiple managers.

- Risks and limits: 45-day filing delay, no short or private holdings, and potential underperformance even for legendary managers like Warren Buffett.

- Tools to track: Platforms like WhaleWisdom, HedgeFollow, and Fintel.io help analyze filings beyond raw SEC data, making billionaire tracking more accessible to individuals.

You can legally track and replicate the exact stock picks of billionaire investors through SEC 13F filings. For retail investors, this presents an unusual opportunity: access to the same holdings information that drives hedge fund strategies. Academic research has shown that cloned portfolios in the top quartile outperformed the S&P 500 by 24.25% on an annualized risk-adjusted basis between 2013 and 2023. While these findings are compelling, results vary significantly, and past performance is no guarantee of future returns. Still, for those who approach this strategy with discipline, 13F filings represent one of the most powerful transparency tools available in U.S. markets.

What Are 13F Filings and Why They Matter

Under U.S. securities law, any institutional investment manager controlling more than $100 million in assets must file Form 13F quarterly with the Securities and Exchange Commission (SEC). These reports, due within 45 days of each calendar quarter’s end, reveal the equity positions of hedge funds, mutual funds, pension funds, and other major players.

Each filing discloses the number of shares held, market value, and position size across all publicly traded U.S. equities. While originally intended to increase transparency and market oversight, this regulatory system has had an unintended side effect: it gives everyday investors unprecedented access to the strategies of some of the most successful financial institutions in the world. Today, more than 10,000 institutional managers globally submit these filings, creating a vast and publicly accessible database of investment intelligence.

The Academic Evidence for Copycat Investing

A growing body of research has tested whether following billionaire moves can generate superior returns. The evidence suggests that, under certain conditions, it can.

-

A 2024 academic study analyzing over 150,000 cloned portfolios from 2013 to 2023 found that the top quartile outperformed the S&P 500 by 24.25% on a risk-adjusted annualized basis.

-

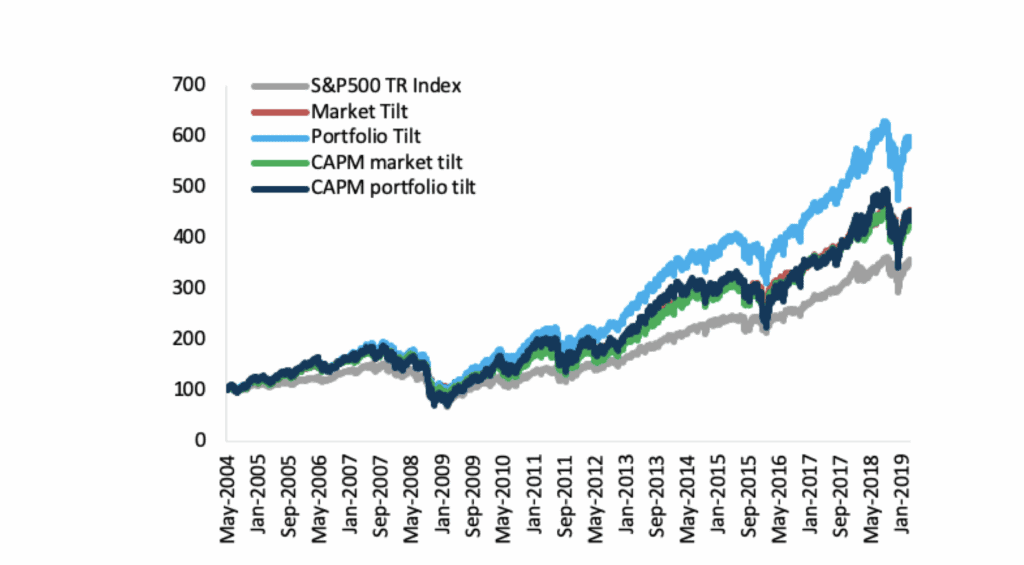

Another study spanning Q1 2004 to Q2 2019 found that strategies combining “conviction” (large positions) with “consensus” (stocks held by multiple hedge funds) outperformed the S&P 500 by 3.8% annually on average.

Source: SSRN

-

Research also shows that stocks disclosed in 13F filings often experience positive excess returns for up to two days following disclosure, suggesting that even short-term traders may benefit from monitoring filings.

Why does this work? Institutional managers have resources far beyond what retail investors can access: large teams of analysts, direct contact with corporate leadership, advanced risk models, and decades of investment experience. Copying their holdings is, in effect, a way to “rent” their expertise at no cost.

Where to Track Billionaire Investments

The SEC’s EDGAR database remains the primary source for filings, though analyzing raw data can be time-consuming. Specialized platforms help investors turn filings into actionable insights:

-

WhaleWisdom: Offers real-time 13F analysis, cloning tools, backtesting, and its proprietary WhaleScore, which ranks managers based on performance.

-

HedgeFollow: Tracks the holdings of 10,000+ institutional investors, including prominent hedge fund managers like Warren Buffett and George Soros.

-

Valuesider: Focuses on value investors’ portfolios, highlighting long-term strategies suitable for retail investors interested in patience-driven stock selection.

-

Fintel.io: Covers all institutions with over $100M AUM, though data may lag by several months due to reporting deadlines.

-

13f.info: A free resource with a clean interface for beginners exploring filings.

How to Build a Copycat Strategy

Success in copycat investing depends on thoughtful execution. Investors must recognize the limitations of filings, including the 45-day delay, absence of international and private holdings, and lack of insight into short positions or derivatives. To mitigate these gaps, investors typically adopt one of three approaches:

-

Full Portfolio Cloning: Replicating all disclosed positions, best suited for investors with substantial capital and a desire for broad diversification.

-

Best Ideas Strategy: Focusing on the largest or newest holdings, which are often high-conviction bets.

-

Consensus Investing: Identifying stocks held across multiple managers, which can highlight sector trends or widely recognized undervalued opportunities.

Risk management is essential. Investors should avoid concentrating more than 5–10% of their portfolio in any single cloned stock, limit overall exposure to 20–30% of the portfolio, and retain independent allocations to bonds, cash, or other asset classes. Stop-losses and careful monitoring of subsequent filings provide additional layers of protection.

Real-World Case Study: Warren Buffett’s Berkshire Hathaway

No investor better illustrates the value of copycat investing than Warren Buffett. In Berkshire Hathaway’s Q2 2025 13F filing, the company disclosed 41 equity holdings worth $257.5 billion. The portfolio is dominated by a few large positions: Apple (22.31%), American Express (18.78%), Bank of America (11.12%), Coca-Cola (10.99%), and Chevron (6.79%).

Buffett’s strategy works well for cloning because:

-

His positions are long-term, often held for years or decades.

-

His philosophy is transparent, outlined in annual shareholder letters and consistent with the value principles of Benjamin Graham.

-

His moves tend to be high conviction, meaning his top positions reflect genuine belief in intrinsic value.

Still, even Buffett isn’t immune to underperformance. In 2025, Berkshire’s shares rose around 5%, trailing the S&P 500’s roughly 10% gain. This demonstrates that copycat investing, even when modeled on legendary investors, cannot eliminate cyclical underperformance.

Advanced Strategies and Risk Management

More sophisticated investors often combine elements of different approaches. Consensus investing, for instance, looks for overlap among several successful managers, reducing reliance on a single portfolio. Timing strategies can help by entering positions gradually, spreading purchases over time to manage valuation risks. Exit rules are equally important, such as selling when a manager reduces or eliminates a holding, as indicated in subsequent filings.

Prudent investors also adhere to strict risk management rules. Allocating more than 5–10% of a portfolio to a single position can create outsized risk. Keeping total exposure to copied positions between 20–30% of a portfolio ensures diversification. Stop-losses and regular reviews of filings further protect against sudden reversals.

Technology and the Democratization of Filings

Advances in financial technology have made copycat investing more accessible. Many brokerage apps now offer integrated watchlists and alerts for new filings. Premium platforms allow users to backtest strategies and receive real-time updates. Even large institutions recognize the potential, Goldman Sachs has launched ETFs based on hedge fund replication strategies. For retail investors, these tools make it easier than ever to analyze and act on institutional holdings.

Building Your Own Strategy

Success with copycat investing requires a phased approach:

Phase 1: Education and Setup Begin by choosing 3-5 managers to follow initially, establishing tracking systems and alerts, studying their historical moves and performance, and practicing with paper trading before committing real money.

Phase 2: Small-Scale Implementation

Start with modest position sizes representing 1-2% of your portfolio, focus on consensus picks or highest-conviction positions, track performance against your benchmark, and refine your selection and timing processes based on results.

Phase 3: Scale and Optimize Gradually increase allocation to successful strategies, add more sophisticated tracking and analysis, consider combinations with your own research and stock picks, and develop robust exit rules and risk management procedures.

The Bottom Line

SEC 13F filings give retail investors a legal, transparent window into the minds of some of the world’s most successful fund managers. Academic evidence suggests cloned portfolios can generate meaningful outperformance, though results vary widely and depend on disciplined implementation.

Copycat investing should be viewed not as a shortcut to instant wealth but as a learning tool and idea generator. By analyzing billionaire moves, retail investors can sharpen their own strategies, understand sector trends, and adopt best practices in portfolio management. But success ultimately requires independent judgment, careful risk management, and long-term discipline.

As Warren Buffett famously remarked, “Our favorite holding period is forever.” For investors seeking to mirror the best, the real advantage lies not just in buying what billionaires buy, but in learning how they think about value, conviction, and time horizons, and applying those lessons to build lasting wealth.