Commercial vs. Residential Real Estate Investment: Which Actually Delivers Higher Returns?

6.2 min read

Updated: Dec 21, 2025 - 10:12:33

Choosing between residential rentals and commercial real estate comes down to your financial goals, risk tolerance, tax strategy, and access to capital. Residential properties offer accessibility, easier financing, and strong appreciation potential in hot housing markets, while commercial assets deliver higher cash flow, long-term lease stability, and advanced tax strategies. The best option depends on whether you value steady equity growth with lower barriers to entry, or larger-scale cash flow with more complexity and risk.

- Cash flow: Commercial yields average 6%–12% annually vs. 4%–8% for residential, with long-term leases providing predictable income.

- Financing: Residential loans are easier to obtain with down payments as low as 3.5% (FHA), while commercial loans often require 20%–30% down, higher rates, and balloon terms.

- Taxes: Residential depreciates over 27.5 years, commercial over 39 years. Cost segregation and NNN leases make commercial highly tax-efficient.

- Accessibility: Residential offers lower entry costs and easier liquidity, while commercial demands higher capital, due diligence, and professional management.

- Investor fit: Residential favors beginners and small investors seeking appreciation, while commercial suits experienced investors targeting cash flow and institutional-scale opportunities.

For investors, real estate remains one of the most established and effective ways to build long-term wealth. Yet, the decision between residential rentals (single-family homes, condos, small multifamily) and commercial properties (offices, warehouses, retail centers, and large multifamily complexes) requires careful evaluation. The real question isn’t simply which asset class makes more money, but which aligns better with an investor’s financial goals, risk profile, tax strategy, and access to capital.

Residential vs. Commercial: The Fundamentals

Residential properties are designed for people to live in, ranging from single-family homes to multifamily units of up to four units. These investments tend to be more accessible, liquid, and relatively easier to manage. Financing is usually straightforward, with familiar mortgage products and government-backed options available.

Commercial properties, by contrast, are designed for business activity. This includes office buildings, industrial warehouses, medical centers, retail stores, and apartment complexes with five or more units. These assets are often favored by institutional investors because they offer stronger cash flow potential, portfolio diversification, and tax optimization strategies. However, they require significantly more capital and expertise.

Cash Flow and Return Potential

Commercial properties typically deliver annual yields between 6% and 12%, while residential rentals generally fall in the 4% to 8% range. The reason is structural: businesses tend to pay higher rents per square foot and are often willing to sign long-term leases with built-in rent escalations. This creates more predictable, and often higher, income streams.

Source: Commercial Edge

Residential properties, while less lucrative in terms of yield, have historically shown stronger appreciation in hot housing markets. Driven by consumer demand, housing prices can surge rapidly, providing investors with equity growth that may outweigh lower rental cash flow. For example, during housing booms in markets like Austin, Miami, or Phoenix, residential property owners often saw double-digit appreciation that rivaled returns in commercial real estate.

Lease Structures and Stability

Residential leases usually run 12 months or less, which gives investors flexibility but also increases turnover costs. Frequent tenant changes mean advertising, repairs, and vacancy periods must be factored into returns.

Commercial leases, on the other hand, commonly span 3 to 10 years. Some agreements even extend beyond a decade, especially with national retail chains or large industrial tenants. Longer leases provide cash flow stability, but vacancies can be more painful, when a business leaves, it might take months or even years to replace them, especially in specialized spaces like warehouses or medical offices.

Financing and Accessibility

Residential loans are generally easier to obtain. Investors purchasing non-owner-occupied properties often need 15%–25% down, while programs like FHA loans allow first-time or owner-occupant buyers to purchase with as little as 3.5% down if credit requirements are met. Loan terms are usually 15–30 years with fixed rates, making monthly payments predictable and accessible to smaller investors.

Commercial loans are more complex. They typically require 20%–30% down, although certain government-backed programs like SBA 7(a) and 504 loans can lower this to about 10%. Repayment terms are shorter, often capped at 20–25 years, and many structures include balloon payments. Interest rates are higher, commonly in the 6%–10% range, reflecting greater risk. Lenders scrutinize both the property’s income potential and the investor’s financial strength, creating a higher barrier to entry but rewarding those who can qualify with larger-scale opportunities.

Tax Strategy and Depreciation Benefits

One of the most important factors in comparing returns is tax treatment.

- Depreciation: Under U.S. tax law, residential rental property is depreciated over 27.5 years, while commercial property is depreciated over 39 years. This means residential investors enjoy larger annual deductions on paper, though commercial owners can offset this through cost segregation.

- Cost Segregation: Commercial investors can accelerate deductions by reclassifying parts of a building, such as lighting, HVAC systems, or parking lots, into shorter depreciation schedules of 5, 7, or 15 years. This strategy front-loads tax benefits and enhances early cash flow, especially when paired with bonus depreciation.

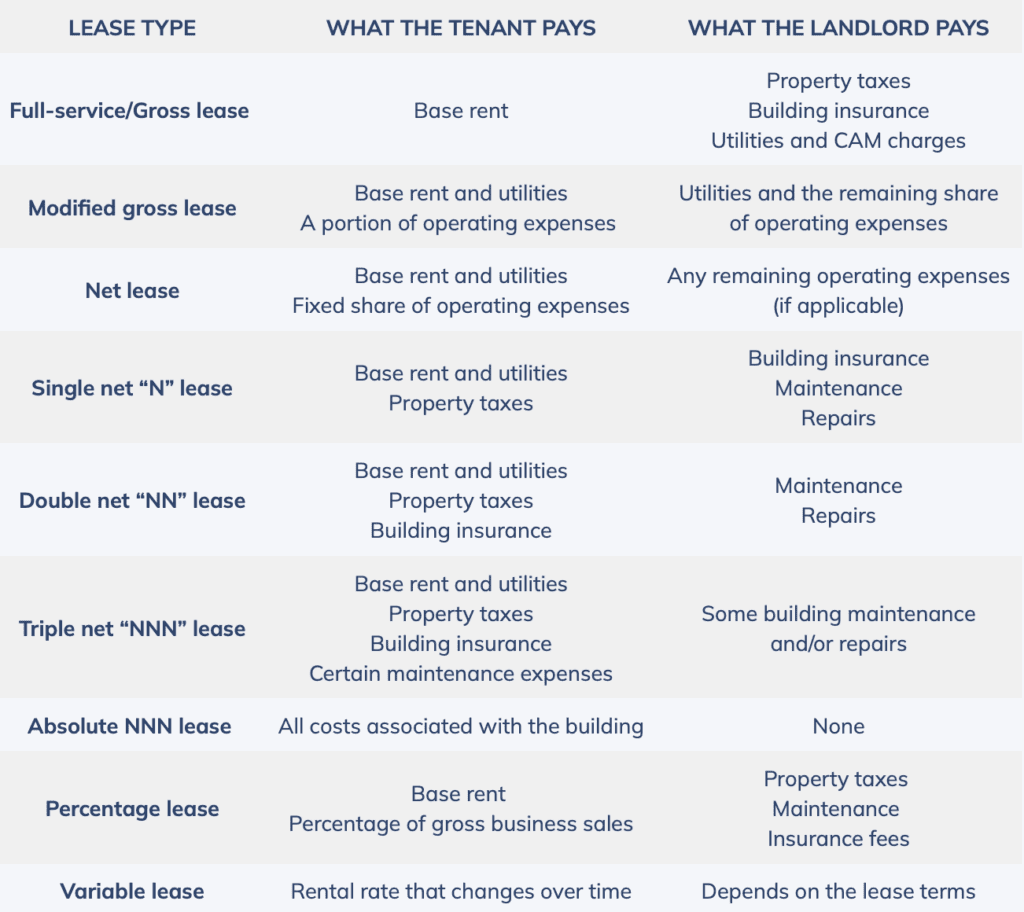

- Triple Net (NNN) Leases: In commercial real estate, NNN leases pass property taxes, insurance, and maintenance costs directly onto tenants, dramatically lowering landlord expenses. These are common in single-tenant and credit-tenant properties.

- 1031 Exchanges: Both residential (investment) and commercial properties qualify for Section 1031 like-kind exchanges, which allow investors to defer capital gains taxes by reinvesting proceeds into similar properties. Commercial investors often leverage 1031 exchanges to consolidate holdings or scale into larger portfolios, sometimes combining them with cost segregation for greater benefit.

Entry Costs and Market Participation

Residential real estate is accessible to small investors because purchase prices are typically lower, financing is easier, and management can often be handled by the owner. Many investors start with single-family rentals or small duplexes as a manageable way to enter the market.

Commercial real estate, however, requires higher upfront capital and deeper due diligence. Investors must consider zoning laws, environmental assessments, and higher legal and management costs. Property management firms often become necessary, especially for larger properties, which further adds to overhead.

Market Trends and Investor Profiles

The residential sector is heavily dominated by individual investors, mom-and-pop landlords, and small-scale operators. Its liquidity makes it easier to sell properties and realize appreciation.

Commercial real estate, on the other hand, attracts institutional investors such as REITs, hedge funds, and pension funds. These players value the scale, stable income streams, and diversification benefits. Multifamily properties (over five units) represent the crossover point, drawing interest from both small investors and institutions.

Who Should Invest in What?

Residential real estate is generally best suited for beginners, those with modest budgets, and investors who want simpler financing structures, faster depreciation, and steady appreciation potential.

Commercial real estate is better suited for experienced investors with significant capital and higher risk tolerance, particularly those looking for consistent cash flow, long-term leases, and advanced tax strategies. While the rewards can be higher, so too are the risks, especially when large vacancies or economic downturns hit.

Final Thoughts

The decision between residential and commercial real estate isn’t about which is universally “better,” but which aligns with your strategy. Residential properties offer accessibility, liquidity, and strong appreciation potential in hot housing markets. Commercial properties, meanwhile, promise higher yields, long-term lease stability, and powerful tax strategies, but demand greater capital and sophistication.

Ultimately, the right investment depends on whether your priority is stability and gradual equity growth—or higher cash flow and complex but lucrative tax optimization. Investors who understand their financial goals, manage risk carefully, and plan for long-term wealth building will find that either path can deliver success in the right hands.