Collectibles vs. Traditional Investments: The 10-Year Performance Test

5.8 min read

Updated: Dec 28, 2025 - 09:12:58

Collectibles have gained traction as alternative assets, offering cultural value and diversification, but they come with higher taxes, illiquidity, and volatility. Over the past decade, traditional investments like the S&P 500 have consistently outperformed most collectibles in financial returns, though certain niches, fine wine, rare whiskey, and trading cards, saw strong, if cyclical, gains. For most U.S. households, collectibles should remain a small (≤5%) portfolio slice, purchased primarily for passion rather than predictable wealth-building.

- Performance: Stocks and bonds outpaced collectibles long term, though fine wine (+315% since inception) and rare whiskey (+280–400% decade returns) saw strong but volatile growth.

- Market cycles: Art rose 29% in 2022 but lagged equities; watches, sneakers, and whiskey corrected sharply after pandemic-era booms.

- Trading cards: Now a $10.8B global market (2023), projected to double by 2034, with record-breaking multimillion-dollar sales via Sotheby’s, Christie’s, and eBay.

- Risks: Collectibles face a 28% U.S. capital gains tax (IRS), high transaction costs, subjective pricing, and long sale timelines.

- Portfolio role: Financial planners advise capping collectibles at 5% of assets, better for diversification and cultural engagement than retirement security.

Traditional investments like stocks, bonds, and real estate have long served as the foundation of wealth-building for U.S. households. These assets benefit from established markets, strong liquidity, and predictable long-term returns. However, the last decade has seen a surge of interest in collectibles, ranging from fine art and vintage whiskey to luxury watches and trading cards, as investors search for diversification, inflation protection, and culturally significant stores of value. Understanding how these alternatives stack up against traditional assets requires examining their market structures, performance trends, and risks in detail.

What Counts as a Collectible Investment?

Collectibles are tangible items purchased primarily for their rarity, cultural significance, or potential appreciation in value. Unlike traditional securities, they lack standardized exchanges and are often sold through private transactions, specialized platforms, or auction houses. Major categories include:

-

Fine art and photography, driven by rarity, artist reputation, and cultural importance.

-

Vintage wine and whiskey, where aging and limited supply create scarcity value.

-

Luxury watches and jewelry, often linked to brand prestige and craftsmanship.

-

Sports and gaming trading cards, propelled by nostalgia and community demand.

-

Sneakers and pop culture memorabilia, whose value is tied to cultural trends and limited editions.

Prices in these markets depend heavily on supply-and-demand dynamics, rarity, and cultural relevance rather than earnings, dividends, or cash flow models seen in equities and bonds.

10-Year Performance: Collectibles vs. Stocks and Bonds

Art Market Returns

The Knight Frank Luxury Investment Index shows that art has been one of the best-performing luxury assets in recent years, rising 29% in 2022 and 11% in 2023. Contemporary art in particular gained momentum, attracting wealthy collectors and institutional interest. Still, when compared with the S&P 500, which delivered more than 150% in total returns between 2013 and 2023, art lags as a pure financial vehicle, underscoring its dual role as both a cultural asset and an investment.

Fine Wine and Whiskey

Fine wine has delivered strong long-term growth, with the Liv-ex 1000 index rising about 315% since inception, though its exact 10-year return is less clear. Rare whisky has been an even bigger winner, climbing between 280% and 400% over the past decade according to Knight Frank and market studies. However, performance cooled after 2022, with values dropping by up to 40% in 2024. Both assets remain viewed as cultural stores of value, but recent corrections highlight their cyclical nature.

Luxury Watches, Sneakers, and Other Goods

The luxury watch market surged during the pandemic but corrected sharply from mid-2022, with the WatchCharts index falling about 26% and resale prices of many models dropping nearly 30% according to WSJ/Hodinkee. Iconic brands like Rolex and Patek Philippe remain in demand, still trading above retail despite volatility, with performance closely tied to global economic sentiment. A similar boom-and-bust pattern hit sneakers and other pop-culture assets, which spiked during the pandemic before correcting once speculative demand cooled.

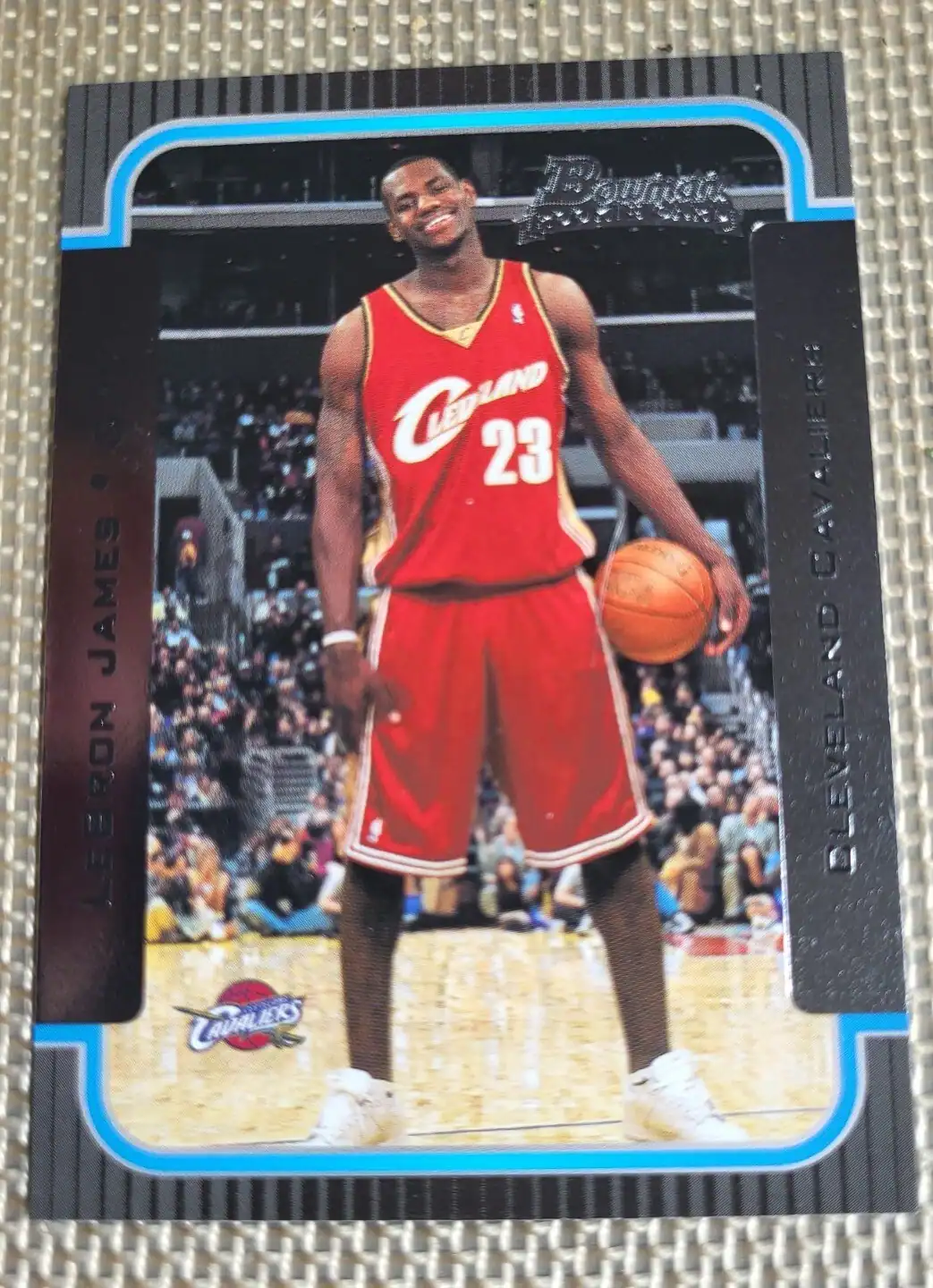

2003 Bowman Lebron James Rookie Card – $2500. Source: Ebay

Trading Cards: From Hobby to Asset Class

Perhaps the most dramatic shift has been in trading cards. Once a niche hobby, they are now recognized as serious investment vehicles:

-

-

Valued at USD 10.8 billion in 2023, the global trading card market is projected to grow at a compound annual rate (CAGR) of around 5%, reaching USD 21 billion by 2034.

-

Major auction houses like Sotheby’s and Christie’s now regularly feature rare trading cards alongside fine art, cementing legitimacy, a trend well-documented across collectibles media.

-

Record-breaking sales, such as a LeBron James rookie card selling for USD 5.2 million, highlight investor appetite.

-

Platforms like eBay, Rally, and Collectable have democratized access, while Pokémon and non-sports cards surged: for example, major retailers reported over 10× year-over-year growth in Pokémon card sales during 2024–2025.

-

While volatile, the trading card industry has become one of the clearest examples of how passion-driven collectibles can evolve into billion-dollar markets.

Key Differences in Risk and Liquidity

-

Liquidity: Stocks and bonds can be sold within seconds; collectibles may take weeks or months to find the right buyer.

-

Volatility: Collectibles are especially sensitive to cultural shifts and generational preferences.

-

Costs: Transaction fees at auction houses, insurance costs, and secure storage reduce net returns.

-

Transparency: Unlike financial assets with audited statements, valuations of collectibles are subjective and often influenced by hype.

Tax and Regulatory Considerations

In the U.S., collectibles face a 28% long-term capital gains tax, higher than the 15–20% applied to stocks and bonds. Proper documentation is essential, as the IRS requires detailed records of purchases, sales, and holding periods. Unlike regulated markets for securities, collectibles lack uniform oversight, which can increase risks of fraud and mispricing.

Where Collectibles Fit in a Portfolio

Financial advisors generally recommend limiting collectibles to 5 % of investable assets. Their role is not to replace traditional holdings but to complement them by offering diversification, cultural engagement, and potential outsized returns. However, in general terms their illiquidity and volatility make them unsuitable as a core component of retirement planning.

Takeaways for Everyday Investors

Collectibles offer both opportunity and risk, making them a unique but cautious addition to any portfolio. While they can provide diversification and personal satisfaction, their returns vary widely, ranging from the steady rise of fine wine to the boom-and-bust cycles seen in sneakers and other trend-driven assets.

Compared to equities and bonds, collectibles are less efficient due to illiquidity and higher taxes, which can significantly reduce overall gains. For this reason, they are best purchased out of passion, with the potential for profit considered a secondary benefit.

For investors exploring alternative assets, collectibles can play a meaningful yet limited role in wealth building. Their cultural relevance, growing institutional acceptance, and expanding markets underscore their legitimacy, but they remain high-risk, high-reward complements to the stability of traditional investments.

This article belongs to Mooloo’s Asset Classes series, which examines how different assets behave over time and how they are used together to build resilient portfolios. View the full Asset Classes overview to see how each asset fits within a broader investment structure.