Beyond Stocks: 7 Alternative Assets With Long-Run Return and Risk Data

10.3 min read

Updated: Dec 28, 2025 - 09:12:40

With bond yields low and stock valuations high, investors are revisiting real assets and alternatives to stabilize returns. Seven mature categories, REITs, commodities, infrastructure, timberland, farmland, private credit, and art, have decades of measurable data showing distinct risk-return and inflation behaviors. The key is understanding their diversification power, not chasing equity-like returns.

- REITs: Since 1972, U.S. equity REITs have averaged ~12.7% annual returns, offering income (3–4% yield) and partial inflation protection but equity-like volatility.

- Commodities: Over 50 years of data (S&P GSCI) show strong inflation correlation and cyclical outperformance during inflation spikes, despite high drawdown risk.

- Infrastructure: Essential-service assets provide inflation-linked cash flows and steadier returns than equities, accessible via ETFs tracking the S&P Global Infrastructure Index.

- Farmland & Timberland: NCREIF data since the 1980s–1990s show 9–10% annualized returns with low volatility and near-zero stock correlation, ideal inflation hedges, though illiquid.

- Private Credit: The Cliffwater Direct Lending Index (since 2004) shows 9–10% annual returns from senior loans; best suited for long-term, high-net-worth investors.

- Bottom line: Liquid alternatives (REITs, commodities, infrastructure) can enhance diversification in 10–20% allocations, while illiquid assets fit investors with longer horizons and higher capital thresholds.

The traditional 60/40 stock-bond portfolio has rewarded investors for generations, balancing equity growth with fixed-income stability. However, today’s environment of lower bond yields, elevated equity valuations, and shifting stock-bond correlations has prompted investors to seek new sources of return and diversification. Alternative assets promise both, yet the key challenge remains separating marketing narratives from measurable reality.

Unlike stocks and bonds backed by a century of transparent market data, many alternative investments lack comparable long-term histories to assess true risk-return characteristics. How should investors evaluate an asset class with only five years of results, or one whose data resides in proprietary, institution-only databases?

This analysis examines seven alternative asset classes with sufficient historical depth to support evidence-based decisions. These are not speculative fads or experimental niches but established categories, such as real estate, farmland, timberland, hedge funds, and commodities, with decades of verifiable performance records. Their results reveal how mature alternatives behave across economic cycles, market drawdowns, and inflationary periods, offering valuable context for investors reconsidering diversification beyond the traditional 60/40 mix.

1. Real Estate Investment Trusts (REITs)

Real Estate Investment Trusts (REITs) remain one of the most transparent and accessible ways to invest in income-producing real estate. The FTSE Nareit U.S. Real Estate Index provides data dating back to 1972, offering over five decades of performance insights into returns, volatility, and income generation.

Over multi-decade periods, listed U.S. equity REITs have delivered strong annualized returns, typically ranging between 11% and 13% since the early 1970s. Data compiled by Sortis shows equity REITs achieving about 12.7% annualized total returns since 1972, compared to roughly 10.2% for the S&P 500. This long-term consistency highlights REITs’ strong risk-adjusted performance relative to equities.

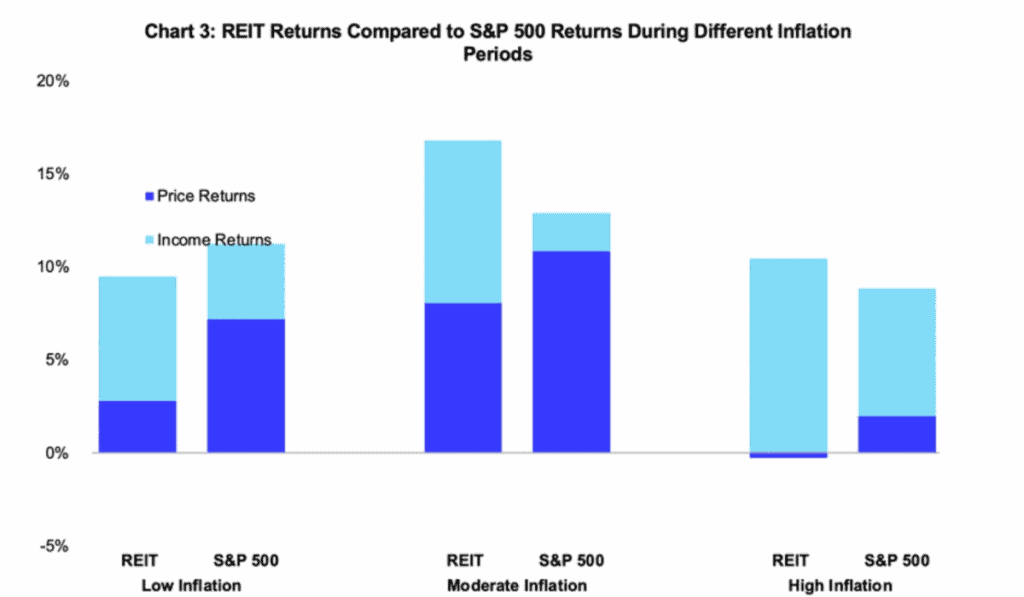

REITs also provide partial inflation protection since property rents and values often rise alongside consumer prices. REIT.com notes that U.S. REIT dividends have outpaced inflation in all but three of the last twenty years, particularly during the high-inflation 1970s. Still, this hedge can vary depending on economic cycles and property sectors.

Source: REIT.com

Income remains a key attraction. The FTSE Nareit All Equity REITs Index currently yields around 3–4%, notably higher than the S&P 500’s 1.5–2%. These consistent distributions appeal to income-focused investors, though payouts can fluctuate during market downturns.

While backed by tangible assets, publicly traded REITs behave more like equities than bonds. During the 2008 financial crisis, equity REITs suffered deep drawdowns before rebounding strongly, showing that real estate exposure doesn’t eliminate volatility. As EPRA research highlights, they remain subject to equity-like risk patterns.

REITs maintain moderate correlation with broader equities, providing diversification benefits. However, studies such as Dynamic Correlations among Asset Classes show that as REITs became more liquid and widely held, correlations increased slightly, reducing but not eliminating their diversification advantage.

Publicly traded REITs are easily accessible through standard brokerage accounts, with minimum investments as low as a single share. Their liquidity, transparency, and long-term performance make them an efficient entry point into real estate for both retail and institutional investors.

2. Commodities

Commodity investing remains one of the most debated areas of portfolio construction, but unlike many alternatives, it offers more than half a century of data to inform that debate. The S&P GSCI (formerly the Goldman Sachs Commodity Index) provides performance records dating back to 1970, giving investors over 50 years of return history across energy, metals, and agricultural markets.

Historically, commodities have underperformed equities over the long run but have delivered powerful returns during specific cycles. The 1970s oil crisis and the 2000s supercycle are standout examples, periods when commodity prices surged while traditional assets struggled. Still, volatility remains equity-like, and major bear markets have seen drawdowns exceeding 70%, underscoring the high-risk nature of the asset class.

From a diversification perspective, the appeal lies in low correlation with stocks and bonds over extended periods. Commodities often move independently of traditional assets, enhancing portfolio resilience during market stress. Their strongest contribution, however, is their positive correlation with inflation, making them one of the few asset classes that can preserve purchasing power when consumer prices rise.

For investors, exposure is straightforward through commodity ETFs and mutual funds, most of which track futures-based benchmarks rather than holding physical assets. These vehicles typically have low minimums, often just one ETF share, generally priced under $100, making inflation-sensitive diversification accessible to retail portfolios.

3. Infrastructure

Infrastructure investments, spanning toll roads, utilities, airports, and communication towers, offer investors stable, inflation-linked cash flows and quasi-monopolistic characteristics that make them attractive for long-term portfolios. Historically, the main challenge was limited data, but indices like the S&P Global Infrastructure Index now provide decades of reliable performance history.

Source: Global Infrastructure Hub

Over the long run, listed infrastructure securities have delivered competitive total returns, with dividends contributing a substantial share. Many infrastructure assets operate under regulated frameworks or long-term contracts that allow for periodic inflation adjustments, helping preserve real returns even in high-inflation environments. Research shows that these assets tend to outperform broader equities during inflationary periods, underscoring their value as a partial hedge.

Volatility patterns reveal that while infrastructure can decline during market stress, drawdowns are typically less severe than traditional equities, reflecting their essential-service nature. Correlations with equities remain moderate, higher than bonds but lower than broader stock indices, making them an effective diversification tool within a balanced portfolio.

Investors can gain liquid exposure through infrastructure-focused ETFs and mutual funds, many of which track established benchmarks like the S&P Global Infrastructure Index. Minimum investments are typically modest, often under $100 per ETF share, making this asset class accessible to both institutional and retail investors.

4. Timberland

Timberland investments combine biological growth, trees grow and add volume regardless of market fluctuations, with exposure to lumber prices and underlying land appreciation. Institutional investors have long allocated to this asset class, with the NCREIF Timberland Index tracking quarterly returns since 1987, offering one of the most comprehensive datasets on private timberland performance.

Over its 35+ year history, the index shows strong annualized returns averaging around 10%, competitive with equities but achieved with roughly half the volatility. Standard deviation has typically hovered near 6–7%, reflecting a far smoother ride than traditional stock markets. This risk-adjusted performance explains why pension funds and endowments include timberland as a core real asset allocation.

Diversification benefits are clear. Timberland maintains low correlation with stocks and bonds while exhibiting a modest positive relationship with inflation, making it an effective inflation hedge. During the 2008 financial crisis, timberland declined far less than equities or REITs, though it still faced pressure as housing demand and lumber prices fell, a reminder of its sector-specific sensitivity.

Access remains limited for individual investors. Publicly traded timber REITs such as Weyerhaeuser and Rayonier offer indirect exposure with minimum investments starting at a single share, typically priced between $20 and $40.

5. Farmland

Farmland combines productive utility with inflation resilience and low correlation to traditional assets. The NCREIF Farmland Index tracks U.S. institutional farmland since 1990, offering more than 30 years of verified data. Historical results show farmland delivering around 10% annualized total returns, driven by steady income from rent or crop revenue and long-term capital appreciation. Volatility remains low, typically in the 6–8% range, far below equity markets.

Correlation with stocks is near zero and minimal with bonds, making farmland a powerful portfolio diversifier. It also demonstrates strong inflation sensitivity, as rising food prices and replacement costs push land values higher. During the 2008 financial crisis, farmland posted positive returns while equities plunged, highlighting its defensive characteristics. However, performance fluctuates with agricultural price cycles, 2024, for instance, saw a -1.03% total return due to weaker commodity prices and falling permanent-crop valuations.

Retail access remains limited. Platforms like AcreTrader and FarmTogether now offer fractional farmland investments with minimums from $10,000–$25,000, though track records are short. Publicly traded options include farmland REITs such as Gladstone Land (LAND), providing easier entry for investors seeking inflation-hedged, income-producing exposure to U.S. agriculture.

6. Private Credit/Direct Lending

Private credit, also known as direct lending, involves loans made to middle-market companies outside the traditional banking system. The Cliffwater Direct Lending Index (CDLI) tracks this market with performance data beginning in September 2004, providing nearly two decades of measurable results.

Since inception, the CDLI has delivered annualized returns around 9–10%, largely derived from interest income on floating-rate, senior secured loans. This produces bond-like income with higher-than-bond returns, though actual volatility is likely understated because valuations rely on quarterly appraisals rather than daily market pricing.

Correlation with public equities tends to be moderately low, giving private credit meaningful diversification potential. However, liquidity remains severely constrained, investors typically commit funds for multiple years with limited or no secondary markets.

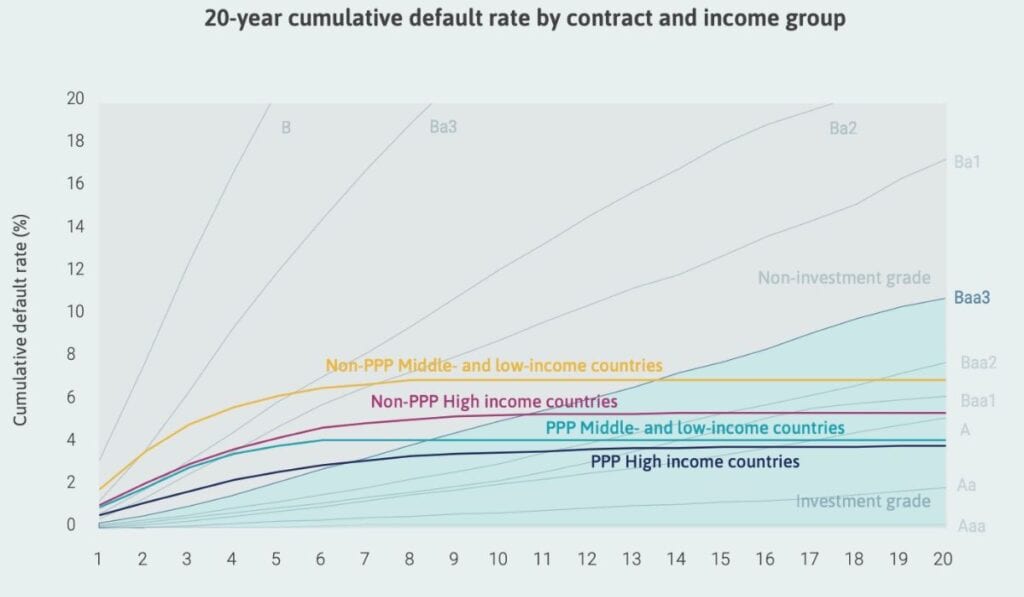

Default risk rises sharply during recessions. While periods of economic expansion show low defaults, downturns can bring increased borrower stress, though well-managed portfolios have historically kept losses contained.

Access is primarily institutional, but individual investors can gain exposure through Business Development Companies (BDCs), which trade on public exchanges and invest directly in private loans. These vehicles offer daily liquidity, with share prices typically ranging from $15 to $25, providing one of the few retail entry points into this otherwise illiquid asset class.

7. Art and Collectibles

Fine art and collectibles have gained traction as alternative investments, with auction price indices like the Artnet Price Index and Mei Moses Index providing measurable data over the past two decades. Historical returns for fine art generally average in the low to mid-single digits annually, often trailing equities but offering diversification benefits.

Volatility appears moderate in index data, yet this conceals extreme dispersion among individual artworks, some pieces appreciate exponentially, while others become illiquid or lose value. Correlation with traditional financial assets remains very low, making fine art an effective portfolio diversifier during equity downturns.

However, high transaction and holding costs erode returns. Auction houses charge buyer’s premiums of 15–25%, while insurance, storage, and transport add further expenses, as detailed in the Guide to Hidden Costs When Purchasing Art. The illiquid nature of art also makes exit timing difficult.

Direct ownership requires expertise and capital. Traditional art funds often demand minimums of $250,000+, while fractional platforms like Masterworks lower entry to about $15,000, though extra fees apply.

The Allocation Decision

These seven alternatives offer genuine diversification backed by measurable data, but they’re not created equal. REITs, commodities, and infrastructure provide liquid exposure with minimal capital requirements. Timberland and farmland offer compelling risk-adjusted returns but limited access. Private credit serves institutional investors well but challenges retail access. Art and collectibles provide diversification but high costs question whether net returns justify the complexity.

For most investors, a 10-20% allocation to liquid alternatives (REITs, commodities, infrastructure) offers meaningful diversification without sacrificing liquidity or requiring specialized expertise. The less liquid alternatives merit consideration only for investors with substantial capital, long time horizons, and comfort with illiquid investments.

The key insight: alternatives with genuine long-run data often show lower returns than stocks but with different return patterns, lower volatility, and crucially, low correlation with traditional assets. They’re portfolio diversifiers, not outperformers – and understanding this distinction is essential to using them effectively.

This article belongs to Mooloo’s Asset Classes series, which examines how different assets behave over time and how they are used together to build resilient portfolios. View the full Asset Classes overview to see how each asset fits within a broader investment structure.