Women-Owned Business Grants: 25+ Funding Opportunities You Can Apply for Today

12.9 min read

Updated: Dec 22, 2025 - 07:12:43

From $500 microgrants to $200,000 funding awards, women entrepreneurs in 2025 can access a growing ecosystem of verified, non-repayable grants across federal, corporate, and nonprofit programs. These opportunities help founders launch, scale, and sustain their businesses without taking on debt or giving up equity.

- Monthly & Quarterly Grants: The Amber Grant ($10K monthly + $25K annual), Freed Fellowship ($500 + $2.5K annual), and Greatness Grant ($2.5K quarterly) provide recurring funding for women-owned small businesses.

- Corporate Programs: Apply for $10K – $25K grants through Verizon Small Business Digital Ready, Amazon Small Business Grant, Allstate × Hello Alice, and Comcast RISE.

- Startup & Creative Funding: The HoneyBook Breakthrough Grant ($18K + perks), Innovate Grant ($1.8K), and FedEx E-Commerce Learning Lab ($5K) target early-stage founders and creatives.

- Regional & Federal Options: Explore state-specific programs like New York Public Library StartUP! ($7.5K – $15K), MBDA support centers, and the SBA STEP Program for export-focused women-owned businesses.

- Grant Aggregators: Platforms such as Hello Alice Funding Center and IFundWomen curate active and upcoming opportunities from major corporate and nonprofit partners.

From $500 microgrants to $200,000 business funding, women entrepreneurs today have access to a growing range of opportunities at every stage of business. Despite this progress, the gender funding gap remains significant, studies show that women-owned startups receive only a small fraction of total venture capital compared to men.

Fortunately, a robust ecosystem of grants for women entrepreneurs, funding that doesn’t require repayment or equity, is expanding across federal, corporate, and nonprofit programs. These initiatives offer real capital to help women founders launch, scale, and sustain their businesses.

These aren’t symbolic gestures. Verified programs such as the Amber Grant for Women, the Cartier Women’s Initiative, and the Tory Burch Foundation Fellows Program provide funding ranging from $500 to $200,000, empowering women-owned businesses across industries. For founders seeking accessible, non-dilutive funding, these grants represent one of the most effective ways to close the capital gap and fuel long-term growth.

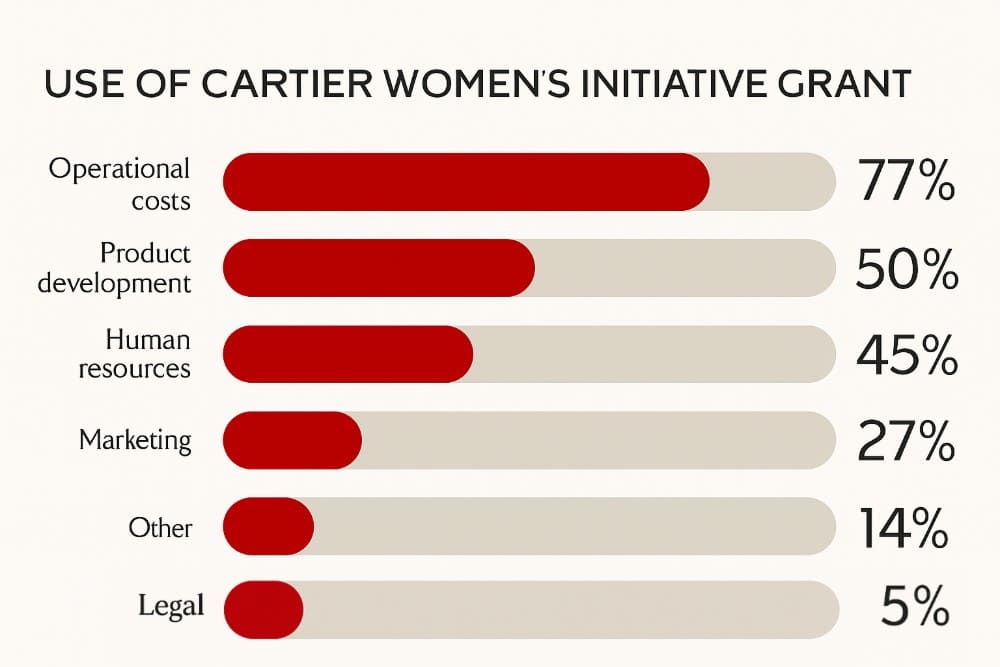

Source: Cartier Woman’s Initiative

Monthly and Quarterly Opportunities

Monthly and quarterly business grants remain a crucial source of funding for women and small business owners in 2025. The Amber Grant for Women from the WomensNet Foundation awards $10,000 each month to women-owned businesses, along with three annual $25,000 grants to previous monthly winners. A single application qualifies entrepreneurs for all current and future opportunities offered throughout the year. Both startups and existing women-owned ventures are eligible to apply, making it one of the most accessible ongoing funding programs for women entrepreneurs.

The Freed Fellowship Grant provides a $500 monthly microgrant to small business owners across the United States. Each monthly recipient automatically becomes eligible for a $2,500 annual grant. In addition to funding, winners receive one-on-one business strategy sessions and a year of access to the Freed Studio, a virtual community that connects entrepreneurs with mentorship and growth resources.

Entrepreneur Nehemiah Davis’s Greatness Grant offers $2,500 in quarterly funding to new or aspiring business owners who need financial assistance to launch or expand their operations. The program emphasizes empowerment, mentorship, and practical support for those looking to start their entrepreneurial journey.

For creatives, the Innovate Grant awards two $1,800 microgrants each quarter — one to a visual artist and one to a photographer. The grant supports independent artists seeking to develop their work and gain visibility within the global art community, making it ideal for creative professionals rather than general business applicants.

The Intuit QuickBooks and Mailchimp Small Business Hero Program highlights inspiring small businesses each quarter, awarding three winners $20,000 each, along with free access to QuickBooks and Mailchimp services and extensive social media promotion. This program aims to amplify the impact of purpose-driven small businesses through financial and marketing support.

Finally, the Breva Thrive Grant offers $5,000 quarterly grants to established small businesses that have been operating for at least one year and are already generating revenue, ideally over $35,000 annually. The grant favors companies creating measurable community impact, whether through job creation, innovative solutions, or support for underrepresented communities. Applications for the next round open July 1–31, 2025.

Together, these recurring grant programs provide ongoing opportunities for women entrepreneurs, creatives, and small business owners to access non-repayable funding, expand their ventures, and gain recognition on a national scale.

Major Corporate Grant Programs

The Verizon Small Business Digital Ready Grant helps entrepreneurs strengthen their digital presence through free online courses, live coaching, and community events. After completing any two eligible learning modules, U.S.-based small-business owners can apply for a $10,000 grant. The program aims to empower small businesses to build stronger digital foundations and expand their customer reach.

The Amazon Small Business Grant provides annual awards ranging from $15,000 to $25,000 to 15 small companies. Eligible applicants must have an Amazon Business account and less than $1 million in annual revenue. In addition to funding, winners receive extra visibility and business support through Amazon’s extensive network, helping them scale efficiently.

Through the Honeycomb Celebration Grant, small-business owners can access $2,500 microgrants to celebrate milestones or reinvest in growth. The grant, offered in partnership with IFundWomen, is open to entrepreneurs across all industries and business stages. Applications remain open until June 27, 2025, providing a simple, inclusive opportunity for funding.

The Allstate Main Street Grants Program, launched with Hello Alice and the Global Entrepreneurship Network, supports small businesses that strengthen local communities. A total of 250 entrepreneurs are chosen for a 12-week Boost Camp accelerator, and 63 participants receive $20,000 in grant funding. This initiative combines financial support with practical mentorship to help small businesses thrive.

The Comcast RISE program continues to champion business resilience by providing $5,000 grants along with business consultations, marketing services, and technology upgrades. The 2025 application window closed in May, with award recipients expected to be announced in August. Comcast’s initiative remains one of the most impactful corporate programs for diverse small-business growth in the U.S.

The Venmo Small Business Grant offers $10,000 grants to 20 small-business owners who use Venmo Business Profiles. To qualify, businesses must have fewer than 10 employees, under $50,000 in annual sales, and a verified account in good standing. Winners receive not only funding but also mentorship and promotional opportunities. Details for the 2025 application cycle are expected to be released later this year.

Finally, Progressive’s Driving Small Business Forward Grant provides funding for entrepreneurs who rely on commercial vehicles. The 2024 program awarded $50,000 grants to 20 small businesses, along with access to a 12-week virtual coaching program designed to enhance operational efficiency. Official details for the 2025 cycle have yet to be announced, but the program remains a key opportunity for vehicle-dependent small businesses.

Startup-Focused Opportunities

The HoneyBook Breakthrough Grant provides a total package worth around $25,000, including an $18,000 cash award, a three-year HoneyBook Premium membership valued at $2,400, and $4,600 in expert support from HoneyBook Pros. Designed to help early-stage entrepreneurs accelerate growth, the program’s most recent application round closed in July 2024, with future rounds expected to reopen later.

The Sengo Spark Grant offers $3,000 to early-stage businesses and two runner-up grants of $1,000 each. To qualify for the top prize, applicants must be current Sengo subscribers, which costs $15 per month, while non-subscribers remain eligible for the smaller awards. Applications are open through July 8, 2025.

The Faire Small Business Grant provides $5,000 in Faire credit to independent retailers in the U.S. and Canada. The credit can be used to purchase inventory directly through Faire.com, helping small retailers expand product offerings and boost cash flow. Applications are open until June 30, 2025.

The FedEx E-Commerce Learning Lab, created in partnership with Accion Opportunity Fund, supports small businesses looking to strengthen their online presence. Participants complete a multi-month educational program focused on digital sales and marketing strategies and receive a $5,000 grant upon completion.

Pitch Competitions and Major Awards

The CO—100: America’s Top 100 Small Businesses by the U.S. Chamber of Commerce honors exceptional small businesses across the country. The top winner receives a $25,000 grant, while ten additional honorees are awarded $2,000 each for their contributions to the economy.

Regional and State Opportunities

The Route 66 Extraordinary Women Micro-Grant Program offers up to $2,000 to women-owned small businesses located along U.S. Route 66, covering the full stretch from Chicago to Los Angeles. Eligible applicants must have fewer than 20 full-time employees and operate on or near the historic highway. Launched by the Route 66 Road Ahead Partnership, the program highlights and supports women entrepreneurs who strengthen local economies along the iconic route.

The New York Public Library StartUP! Business Plan Competition awards between $7,500 and $15,000 to startup founders in Manhattan, the Bronx, and Staten Island. Applicants must submit a business plan, attend workshops, and collaborate with business advisors through the program. The competition fosters innovation and helps connect early-stage entrepreneurs with mentorship and funding opportunities.

In Colorado, the First Southwest Community Fund supports rural women and non-binary business owners through its Rural Women-Led Business Fund. This initiative combines education, mentorship, and access to loans or small grants after completing entrepreneurship training, promoting economic inclusion and empowering underrepresented founders across rural communities.

Federal and Government Programs

The Minority Business Development Agency (MBDA) operates a national network of Business and Specialty Centers that help minority business enterprises (MBEs) expand and compete in both domestic and international markets. These centers assist entrepreneurs in accessing capital, securing contracts, and identifying growth opportunities. While the MBDA doesn’t directly issue loans or grants to individual businesses, it funds organizations that manage these centers and posts grant competition updates on its website.

The Small Business Development Centers (SBDCs), overseen by the U.S. Small Business Administration (SBA), provide free and low-cost assistance to small-business owners and aspiring entrepreneurs. Often linked to universities or state economic development agencies, SBDCs offer training, personalized counseling, and business planning support. They also help connect entrepreneurs to funding programs and government resources tailored to their needs.

The State Trade Expansion Program (STEP) supports small businesses looking to enter or grow in international markets. Administered through the SBA, it provides federal grants to states, which then offer financial assistance or reimbursements to qualifying small businesses. Women- and minority-owned businesses are encouraged to apply through their state’s STEP office to access export-related funding and training opportunities.

Additional Grant Opportunities

The Get Nearshored Grant offers $5,000 to three small businesses looking to nearshore their manufacturing operations. Eligible companies must generate less than $5 million in annual revenue and produce physical products. Applications are accepted on a rolling basis, with winners announced after each review period. The funds can be used toward materials, packaging, or production costs to bring manufacturing closer to home.

The Start.Pivot.Grow. Micro Grant provides $2,500 quarterly to eligible small business owners in the U.S. To qualify, applicants typically need to be in business for at least two years and meet specific revenue and employee criteria. Interested entrepreneurs should check the company’s website for the latest application deadlines and eligibility requirements.

Members of the National Association for the Self-Employed (NASE) can apply for Growth Grants worth up to $4,000. These grants are awarded throughout the year, with applications reviewed regularly. To qualify, applicants must be NASE members in good standing, and some membership tiers may require a minimum of three months before applying.

Finally, Skip Small Business Grants vary in amount and are offered through the Skip platform. Eligibility and requirements differ by round, and applicants are encouraged to check the Skip app or website for active grant opportunities and current application details.

Grant Aggregation Platforms

Hello Alice partners with various companies to offer different grants for small businesses. You can create an account to receive notifications about new opportunities and apply for grants relevant to your business. The platform regularly features programs specifically for women-owned businesses.

Hello Alice partners with major corporations and organizations to offer a wide range of small-business grants. Entrepreneurs can create a free account to receive personalized notifications about new funding opportunities and apply directly for grants that fit their business profile.

The Hello Alice Funding Center regularly features programs focused on underrepresented founders, including women-owned, minority-owned, and veteran-owned businesses. Through collaborations with partners like Progressive, eBay, and KKR, the platform provides access to grants, training, and resources that help small businesses grow.

While not every program is exclusive to women, Hello Alice frequently highlights initiatives that support women entrepreneurs. For example, its KKR Small Business Builders Grant and eBay Up & Running Grant have both prioritized women-led ventures in recent funding cycles.

How to Maximize Your Grant Success

Winning grants takes more than just filling out applications, it requires focus and consistency.

- Start with the right fit: Not every grant suits every business. Read eligibility rules carefully before applying. If a grant targets retailers and you run a consulting firm, move on to better matches.

- Tell your story: Reviewers read many applications. Women entrepreneurs who explain their journey, mission, and community impact stand out. Avoid jargon and write clearly about your goals.

- Demonstrate impact: Many programs favor businesses that create jobs, serve underrepresented groups, or innovate. Show the difference your work makes.

- Apply consistently: Few win on the first try. Treat applications as an ongoing growth strategy, not a one-time effort.

- Keep documentation ready: Have your registration, tax ID, financials, and business plan organized to save time.

- Follow instructions exactly: Missing deadlines or word limits can disqualify you. Careful attention to detail can make the difference.

For verified programs and resources, visit SBA, Hello Alice, and IFundWomen.

Beyond the Money

While funding is critical, the value of small-business grants for women extends well beyond financial support. Many programs incorporate mentorship and business education, helping founders gain the skills and connections needed for long-term success. For instance, the Freed Fellowship pairs grant recipients with expert strategy sessions and a year of membership in its entrepreneur community, while Verizon Small Business Digital Ready requires participants to complete free online courses and coaching sessions before qualifying for its $10,000 grants.

Winning a recognized grant also validates your business concept, signaling credibility when pitching to investors, customers, or lenders. Additionally, many programs foster strong networks of women entrepreneurs through online cohorts, community forums, and live events, offering invaluable peer support that can last far longer than the grant funds themselves.

The Reality Check

Grant funding isn’t unlimited or guaranteed. Competition can be intense, with many programs receiving thousands of applications for a limited number of awards. The application process often takes time, and award timelines can stretch for several months.

For women entrepreneurs who’ve struggled to access traditional financing, want to scale without taking on debt, or prefer growing their businesses without investor influence, grants offer a viable funding path.

The programs featured here represent real opportunities available now. Some accept rolling applications, while others operate on fixed cycles. The key is to take action, don’t wait for the perfect grant or the perfect moment in your business journey.

Dozens of programs exist today, each with its own focus and eligibility criteria. The question isn’t whether funding is available for women-owned businesses, it’s which application you’ll start first.