Targeting China’s Consumer Recovery: Where Entrepreneurs Can Find Growth

5.8 min read

Updated: Dec 20, 2025 - 08:12:11

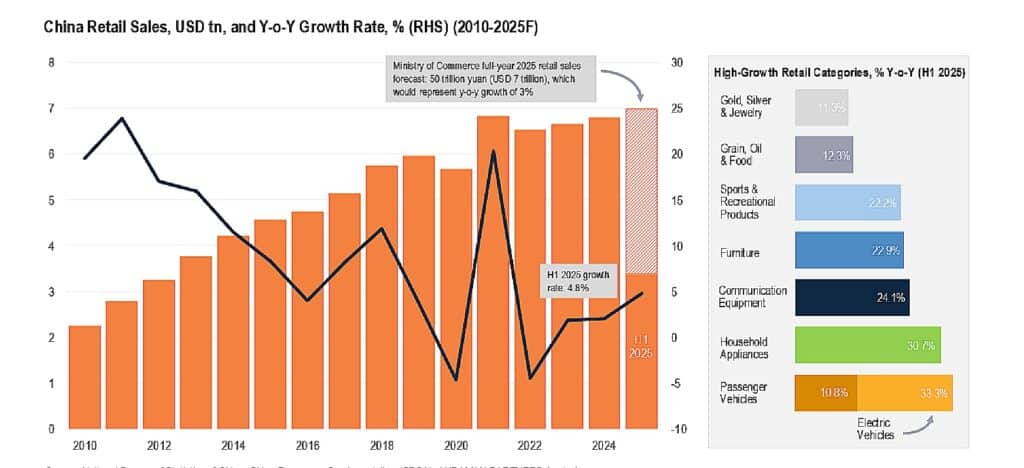

Despite slower GDP growth, China remains one of the world’s largest and most dynamic consumer markets. In 2025, private consumption accounted for over half of GDP growth, signaling a sustained shift toward higher-quality, innovation-driven spending. Exporters that focus on differentiated, premium, and tech-enabled products will find expanding opportunities across key lifestyle and digital categories.

- Recovery driven by value, not volume: Retail sales rose 4.8% in H1 2025, led by upgrades in home appliances (+30.7%) and tech devices (+24.1%).

- Lifestyle and wellness surge: Sports and outdoor goods climbed 22.2%, reflecting demand for fitness, recreation, and sustainable living.

- Premium food and beverage growth: Health-focused imports and transparent sourcing boosted “Grain, Oil & Food” sales by 12.3%.

- Experiences rebound: Domestic travel reached 329 million trips, 18% above 2019, spurring leisure and hospitality demand.

- Digital-first strategy essential: Presence on JD Worldwide, Tmall Global, and Douyin is critical for brand visibility and consumer engagement.

For entrepreneurs looking abroad, China remains one of the largest and most dynamic consumer markets. Despite recent challenges, its 1.4 billion-plus population continues to shift toward higher-quality and premium consumption. For exporters, understanding where and how this recovery is taking shape is key to uncovering new growth opportunities.

Why China still matters as a consumer market

Despite slower GDP growth than a decade ago, China remains a heavyweight in global demand. In the first half of 2025, private consumption contributed more than half of China’s GDP growth, according to the ASEAN+3 Macroeconomic Research Office (AMRO).

Private consumption is expected to remain a key pillar of growth as the economy shifts from investment-led expansion to a more sustainable, consumer-driven model. This transition highlights China’s ongoing move toward “high-quality growth,” where domestic demand and innovation play a greater role than traditional heavy industry.

For exporters, the Chinese market has become more selective but also more sophisticated. The opportunity now lies in value-added, differentiated products that meet rising demand for quality, sustainability, and lifestyle upgrades, rather than relying on low-cost, mass imports.

The post-Covid recovery story

From Lockdown to Rebound

China was among the first major economies to lift its Covid-19 restrictions, but household sentiment took time to recover. After a cautious reopening, consumption is showing consistent improvement. According to Andaman Partners’ China Retail Outlook 2025, retail sales grew 4.8% year-on-year in the first half of 2025. While still below pre-pandemic highs, the report notes a gradual but steady rebound in consumer activity across key categories.

What the Data Say About Spending Patterns

As detailed in the Andaman Partners report, Chinese consumers are buying fewer basic goods but spending more on lifestyle upgrades and experiences. In the first half of 2025, categories with the strongest gains included household appliances (+30.7%), communication equipment (+24.1%), furniture (+22.9%), sports and outdoor products (+22.2%), and jewellery (+11.3%), reflecting a nationwide shift toward quality-of-life improvements.

Source: Andaman Partners

The report also highlights rapid expansion in services such as travel, dining, and entertainment, areas growing faster than general retail, supported by pent-up demand and an emphasis on wellness and leisure. Together, these trends underscore that China’s consumer recovery is broad but uneven, concentrated in sectors tied to technology, lifestyle, and experience-based spending.

In short, the post-pandemic rebound is no longer driven by volume but by value. As household spending continues to evolve, Andaman Partners concludes that China remains a pivotal force in global consumer demand.

Sectors showing renewed growth

Home and Appliance Upgrades

China’s middle-class households are increasingly focused on improving comfort and efficiency at home. Smart appliances, energy-saving devices, and high-quality furniture are among the top-performing categories. According to Andaman Partners’ China Retail Outlook 2025, retail sales of household appliances rose 30.7% year-on-year in the first half of 2025. For exporters, the best opportunities lie in design-driven, tech-enabled products that support household modernization and sustainability.

Technology and Mobility

China remains a global powerhouse in electric vehicles (EVs) and next-generation mobility. The International Energy Agency’s Global EV Outlook 2025 shows EV sales in China grew about 35–40% year-on-year in early 2025, underscoring strong consumer appetite. At the same time, mobile-related categories and smart-home devices continue to thrive, with communication equipment sales up 24.1%, based on Andaman Partners data. Products that complement this expanding tech ecosystem, charging systems, connected accessories, and digital-home integrations, are in high demand.

Health, Fitness and Outdoor Lifestyle

Health-conscious spending remains one of China’s most dynamic growth areas. Sales of sports and recreational goods rose 22.2% in the first half of 2025, according to Andaman Partners. The surge reflects a sustained focus on wellness, outdoor activities, and fitness, a trend that gained momentum during the pandemic. Exporters of premium fitness gear, performance apparel, and sustainable outdoor equipment are well positioned to benefit from this lifestyle shift.

Food, Beverage and Premiumisation

Food remains a stable necessity, but China’s premium food and beverage market is expanding fast. Andaman Partners’ report highlights a 12.3% year-on-year increase in “Grain, Oil & Food” retail sales during H1 2025. Urban consumers are increasingly drawn to imported, health-focused products with transparent sourcing, lower sugar content, and distinctive origin stories, especially in coffee, dairy, and snack categories.

Services, Travel and Experiences

Experience-based consumption is rebounding faster than any other sector. Domestic travel volumes reached 329 million trips in early 2025, about 18% above 2019 levels, according to Andaman Partners’ travel data. Spending on dining, leisure, and entertainment continues to strengthen, reflecting consumers’ desire for richer experiences. Exporters can benefit indirectly by supplying products that serve hospitality, outdoor recreation, and travel-related consumption.

What this means for exporters

Finding the right category

China is not a single market. Tier-1 cities like Shanghai and Beijing lead in premium trends, while Tier-2 and Tier-3 cities are more price-sensitive but growing faster. Exporters should test higher-value products in top-tier cities and adjust pricing or packaging for others.

Demand still exceeds local supply in areas where foreign brands hold credibility, smart home devices, wellness goods, specialty foods, and creative consumer tech, making them strong entry points.

Adapting to digital channels

China is a digital-first economy. Exporters need presence on platforms such as Tmall Global, JD Worldwide, and Douyin’s cross-border stores. Live-streaming and influencer marketing remain key to visibility, while limited offline exposure helps build consumer trust.

Risk factors to watch

Consumer confidence remains fragile amid high savings and property-market weakness. Exporters should expect longer sales cycles and review import duties, certification, and labeling rules carefully. China’s fast-evolving regulations on sustainability and product information make local expertise essential to stay compliant.

Key takeaways and next steps

China’s consumer recovery is real but uneven. Growth now comes from upgrading rather than overspending, consumers are seeking higher quality, smarter technology, and lifestyle improvements. For exporters, the winning approach is to identify where products can genuinely add value to this evolution, focusing on differentiation and quality rather than volume.

If you’re based in China, your local insights are a strategic advantage. Use them to monitor changing tastes, follow social-media trends, and test products through small-scale pilots before expanding. Combining these learnings with strong branding, cultural understanding, and digital engagement can help position your business to participate meaningfully in the next phase of China’s consumption growth.