Social-Fi: How Blockchain is Creating Billion-Dollar Opportunities in Social Media

4.5 min read

Updated: Dec 21, 2025 - 11:12:56

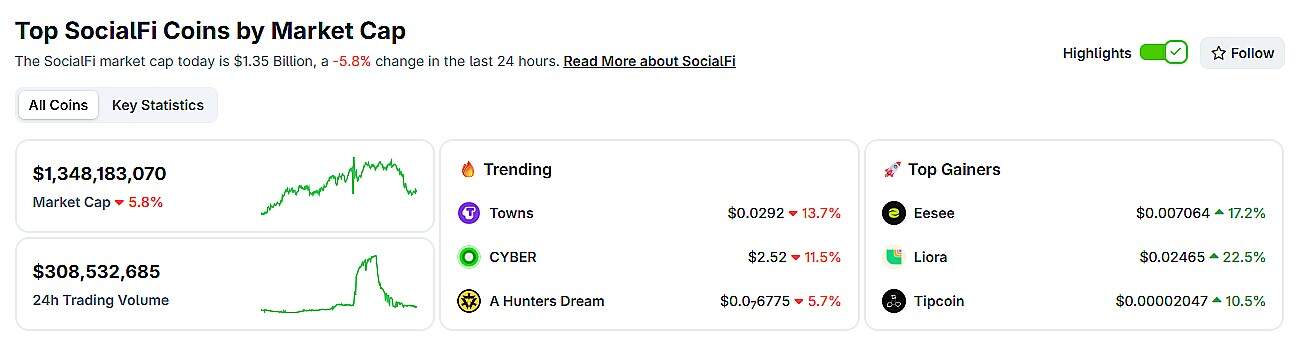

Social-Fi, the merger of social networking and decentralized finance, has grown from Friend.tech’s 2023 experiment into a $1.34 billion market by 2025. Unlike ad-driven platforms like Facebook, Social-Fi rewards users directly through tokenized engagement, NFTs, and on-chain ownership. Despite volatility, regulation risks, and scalability hurdles, forecasts from Verified Market Reports and others project 25–40% annual growth through the next decade. Coinbase’s BASE app and platforms like Lens, CyberConnect, and Cheelee are positioning Social-Fi to challenge Big Tech’s dominance if they can simplify onboarding and deliver sustainable tokenomics.

- Market surge: Social-Fi market cap hit $1.34B in 2025 with $311M daily trading volume.

- Platform leaders: Friend.tech, Lens Protocol, Cheelee, CyberConnect, and Farcaster anchor the ecosystem with distinct models.

- Investor appeal: Transaction fees, NFT commissions, and premium features offer instant monetization potential.

- Risks: Token volatility, user onboarding complexity, and securities regulation loom large.

- Future outlook: With crypto adoption at 12% of Americans and Layer 2 scaling advances, Social-Fi could redefine the creator economy.

In the summer of 2023, a new kind of social platform began making waves. Friend.tech, built on Coinbase’s Base network, let people buy and sell “keys” tied to an individual’s online presence. At its peak, the platform generated millions in fees, briefly outpacing DeFi heavyweights like Uniswap. For early adopters, it felt like the dawn of a new social internet, one where users didn’t just post and scroll, but earned directly from their influence.

By August 2025, that early spark has evolved into a growing market known as Social-Fi, the fusion of social networking and decentralized finance. This movement challenges the ad-driven dominance of traditional social platforms by giving users ownership of their social content, graphs, and revenue streams.

The Rise of Tokenized Social Interactions

Unlike Facebook or Instagram, where companies like Meta control user data and keep advertising profits, Social-Fi platforms use blockchain smart contracts to distribute rewards directly to users. Engagement, content creation, and community building can all translate into tokenized assets, digital coins or NFTs that hold real market value.

According to CoinGecko’s real-time data, the Social-Fi sector now commands a market capitalization of roughly $1.34 billion, with a 24-hour trading volume at $311.85 million. Even at the lower estimate, that’s a remarkable rise for a niche that barely existed three years ago.

Source: CoinGecko

Platforms Leading the Charge

While dozens of projects now claim the Social-Fi banner, a few have emerged as clear frontrunners:

-

Friend.tech (FRIEND)—Known for its “key” trading model, it has seen over $64 million in cumulative fees according to DefiLlama. Despite a market cap now around $4.36 million and a token price near $0.046, it remains one of the sector’s best-known names.

-

Lens Protocol—Created by Avara (formerly Aave Companies), Lens is building a decentralized social graph on Polygon, moving toward zkSync validium technology to scale cheaply. Backed by $31 million in funding led by Lightspeed Faction, Lens launched v3 on mainnet in Q1 2025 .

-

Cheelee—A BNB Smart Chain platform with a dual-token system (CHEEL and LEE) focused on monetizing video engagement.

-

CyberConnect and Farcaster — Infrastructure and microblogging projects building decentralized social layers for developers and communities.

Social-Fi is a major part of Coinbase’s new BASE app too – and will perhaps be the launch of the year in terms of Social-Fi cut-through – as Coinbase’s massive user base will give it a major edge over all competitors in the space.

Why Investors Are Paying Attention

The investment case for Social-Fi is rooted in immediate monetization. Where traditional platforms took years to figure out revenue, blockchain-based networks can collect and distribute funds from day one through:

-

Transaction fees on token trades

-

NFT marketplace commissions

-

Premium social features

Verified Market Reports projects the sector will grow from $2.5 billion in 2024 to $15.7 billion by 2033, a 26.5% CAGR. Other forecasts, like Data Insights Market, are even more bullish, predicting a 40% CAGR and a $2 billion market in 2025 alone.

Source: Verified Market Reports

The Roadblocks Ahead

For all its promise, Social-Fi faces daunting challenges. Scalability remains a hurdle; most blockchains struggle with the transaction volumes mainstream social media demands. User experience is another sticking point; wallet setup and token mechanics are still intimidating for newcomers.

Regulation is perhaps the largest unknown. Social tokens could be classified as securities, triggering compliance obligations in multiple jurisdictions. Privacy rules like the GDPR also add complexity for any platform managing user-generated content.

And of course volatility is an ever-present risk. Friend.tech’s 10% fee on both buying and selling keys limits profitability for casual users, and token prices can swing wildly within days. Meanwhile, tech giants like Meta and TikTok have the resources to roll out Web3 features quickly if the model proves viable.

The Future: A Creator-Owned Internet?

Despite the risks, several trends suggest Social-Fi is more than a passing fad. The global creator economy continues to expand, and over 12% of Americans now own cryptocurrency. Layer 2 solutions like zkSync are making blockchain transactions faster and cheaper, improving the odds of mainstream adoption.

If the current leaders can bridge the usability gap between crypto-natives and the average Instagram user, Social-Fi could redefine how online communities are built, and who profits from them.

Bottom line

Social-Fi is a high-risk, high-potential frontier at the intersection of blockchain and social networking. The winners will be those who combine sustainable tokenomics with real user value, navigating the long road from early-adopter buzz to everyday utility.