Should You Start Alone? The Solo Founder vs. Co-Founder Startup Equation

7.5 min read

Updated: Dec 23, 2025 - 12:12:20

Despite long-standing venture capital bias toward multi-founder teams, solo founders are becoming both more common and more durable. By 2024, roughly 35% of new startups were founded by a single entrepreneur, more than double the share seen a decade earlier, driven by AI tools, cloud infrastructure, and lower startup costs. While solo founders still face fundraising headwinds and lower early valuations, multiple large datasets show they often match or outperform teams on long-term survival and successful exits. The evidence suggests that solo founding is no longer an exception strategy, but a viable, and sometimes optimal, default for founders with clear vision and strong execution discipline.

- Solo founding is surging: According to Carta’s 2025 Founder Ownership Report, solo founders accounted for ~35% of new startups in 2024, up from ~17% in the mid-2010s.

- Survival rates favor solo founders: Research by NYU and Wharton analyzing Kickstarter startups found solo founders were 2.6× more likely to still be operating years later than teams of three or more.

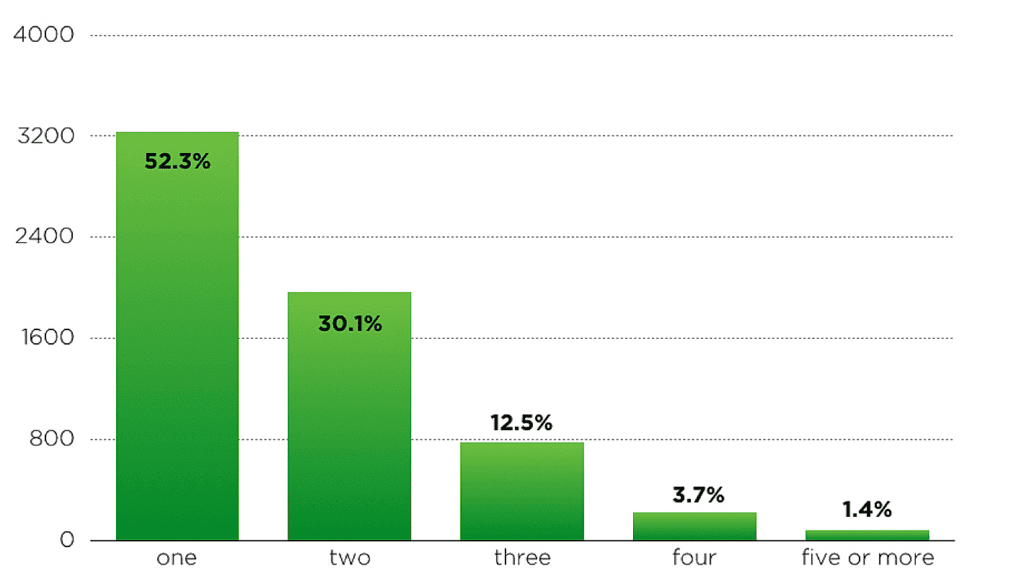

- Exit outcomes challenge VC bias: Crunchbase data shows 52.3% of startups with successful exits were founded by a single founder, despite solo founders representing a minority historically.

- Fundraising trade-offs persist: Solo founders raise seed rounds at valuations 20–30% lower than teams on average, per First Round Capital, reflecting perceived key-person risk rather than execution results.

- Execution advantages can offset capital gaps: Faster decision-making, no founder conflict, and earlier revenue focus often allow solo founders to reach first priced rounds sooner and operate with greater capital discipline.

The conventional wisdom in venture capital has long favored founding teams over solo entrepreneurs. Walk into any pitch meeting with “I’m doing this alone,” and you might sense the room’s energy shift. This bias is well-documented, with solo founders receiving a smaller share of VC funding than multi-founder teams. However, recent research across broader startup datasets suggests that solo founders can perform just as well as teams on measures such as business survival and revenue generation, challenging the assumption that going it alone inherently lowers the odds of success.

The Solo Founder Surge

Something fundamental has changed in the startup landscape. According to Carta’s 2025 Founder Ownership Report, solo-founded companies accounted for about 35% of new startups formed in 2024, up from roughly 17% in the mid-2010s. That represents more than a doubling over the past decade, with the share of solo founders continuing to climb through 2024.

Several structural forces are driving this shift. AI-powered tools now give individual founders leverage that previously required small teams, while cloud infrastructure and software-as-a-service platforms have significantly reduced the cost of launching and operating a startup. As a result, building and validating a company has become increasingly feasible for a single founder, even though venture capital funding still tends to favor multi-founder teams.

The Success Data May Surprise You

Here’s where it gets interesting. Research by NYU’s Jason Greenberg and Wharton’s Ethan Mollick, analyzing more than 3,500 Kickstarter-launched businesses, found that solo founders were 2.6 times more likely to still be running an active, for-profit venture than teams of three or more founders. The study showed that while multi-founder teams tended to raise more initial capital, solo-founded companies were significantly more likely to remain operational years later, indicating stronger long-term survival rather than early fundraising advantage.

Source: MIT

Additional analysis drawing on Crunchbase data has shown that approximately 52.3% of startups that achieved successful exits were founded by a single founder, even though solo founders historically represented a smaller share of the overall startup population. This suggests that while solo founders often face disadvantages in fundraising, those constraints may be offset by advantages in execution, decision-making speed, and long-term business durability.

Source: Crunchbase

The Fundraising Reality Check

The data isn’t uniformly positive for solo founders. While solo-founded companies account for roughly one-third of newly formed startups in recent years, they represent a much smaller share of companies raising venture capital in their founding year, commonly estimated in the mid-teens to low-20% range across major datasets. Venture investors continue to show a preference for multi-founder teams, with three- to five-person founding teams consistently overrepresented among funded startups.

Solo founders also tend to face lower initial valuations. Research published by First Round Capital found that solo-founded companies raised seed rounds at valuations roughly 20–30% lower than those of founding teams, a gap attributed to perceived key-person risk and the absence of complementary skill coverage at the earliest stage.

That said, the fundraising gap may be narrowing on certain dimensions. Solo-founded companies now raise billions of dollars in aggregate each year, and multiple longitudinal datasets show that solo founders often reach their first priced equity round faster than co-founded startups across cohorts from the late 2010s into the mid-2020s. Without extended pre-seed runways, solo founders are more likely to pursue rapid validation and revenue milestones early, a constraint that can enforce capital discipline rather than hinder progress.

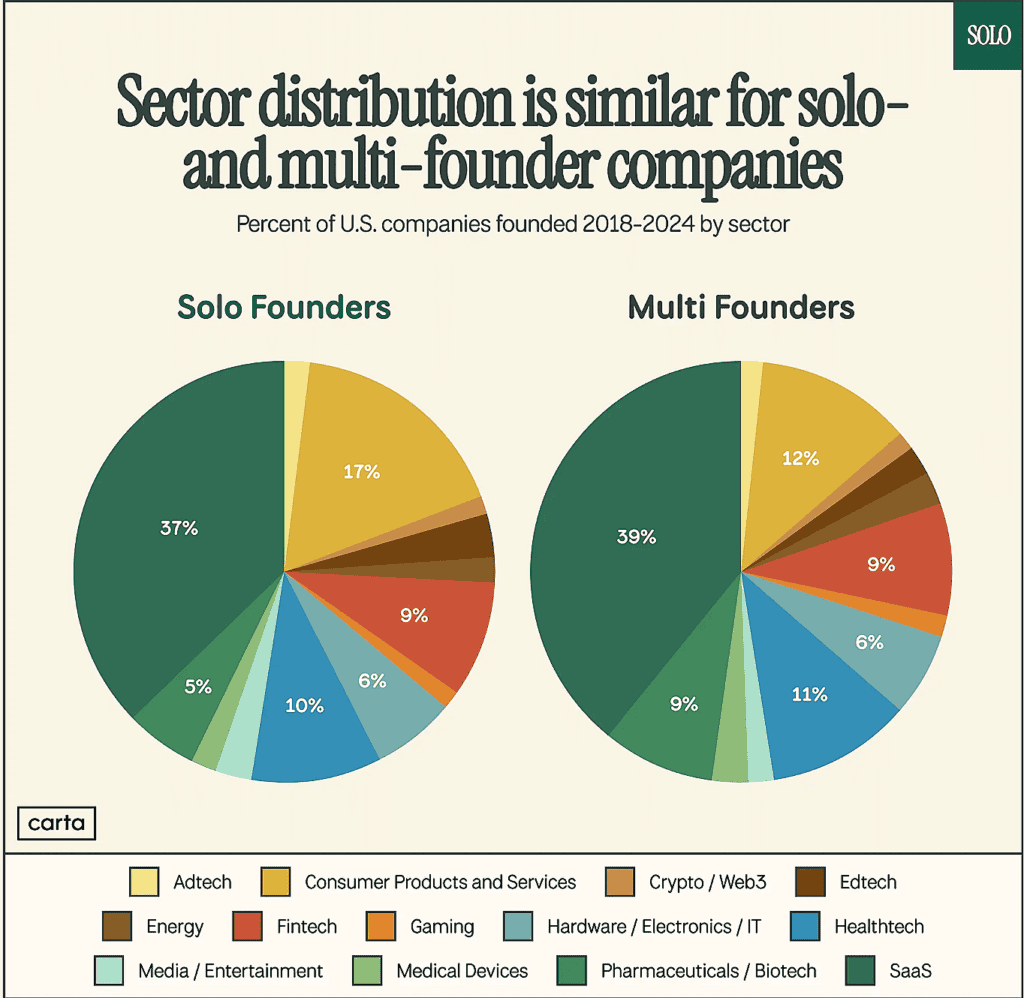

Source: Carta

The Hidden Advantages of Going Alone

Decision velocity is one of the most practical advantages of being a solo founder. Without the need for consensus, decisions move directly from insight to action. In fast-moving markets, this speed can make the difference between capturing an opportunity and missing it entirely.

Solo founders also avoid a common source of startup failure: internal founder conflict. Disagreements, stress, and misaligned incentives are frequent challenges in founding teams and can stall execution or permanently damage a company. Operating alone removes the risk of equity disputes, strategic deadlocks, or founder breakups that derail progress at critical stages.

Risk dynamics differ as well. Choosing to build a company alone often reflects a willingness to accept greater personal responsibility and uncertainty. While this does not guarantee better outcomes, it can enable faster, more decisive strategic moves when conditions demand it.

These advantages don’t eliminate the challenges of solo founding, but they help explain why many single-founder companies are able to compete, and sometimes outperform, larger founding teams despite structural disadvantages.

The Co-Creator Model

The most effective solo founders aren’t truly alone. Instead of formal co-founders, they build a network of co-creators, advisors, early hires, contractors, and strategic partners who provide key capabilities without permanent founding commitments.

This model offers flexibility that traditional co-founder structures often lack. Technical expertise can be added through contractors, strategic input can come from advisors with modest equity, and ownership can reflect real contributions rather than assumptions made at day one. As the business evolves, the team can change with it, without the friction or risk of restructuring a founding team.

Making the Decision

The choice between solo and co-founding isn’t binary, but it does involve clear trade-offs that show up consistently in startup research and investor behavior.

Choose solo founding if you have a clear, well-defined vision that you can both articulate and execute independently; you’re willing to accept potentially slower or more selective early fundraising in exchange for higher equity retention and full control; you can recognize gaps in your expertise and realistically fill them through early hires, contractors, or advisors; you thrive on autonomy and fast decision-making without the need for consensus; or you’ve explored potential co-founder relationships but none align with your long-term working style or strategic priorities.

Seek a co-founder if you’re entering a domain where you lack essential expertise that would materially slow execution and is difficult to outsource effectively; you value shared emotional load and decision support during prolonged uncertainty and high-stress periods; you’ve identified a partner with genuinely complementary skills and a proven track record of working productively with you; or you’re targeting institutional venture capital early, where a preference for multi-founder teams, especially at the seed stage, still exists in many firms due to concerns around execution risk and founder redundancy.

The New Normal

The venture capital industry’s long-standing preference for founding teams may increasingly reflect an inherited heuristic rather than a universally valid rule. As industry analyses have observed, an ecosystem built around identifying exceptions and outliers can appear inconsistent when it applies a broad assumption about team size as a proxy for execution quality.

Data emerging from 2024 and into 2025 suggests a meaningful shift in founder behavior and market acceptance. Solo founding is becoming more normalized, particularly at the earliest stages, rather than treated as a structural disadvantage by default. Advances in AI-driven tools and cloud infrastructure now allow individual founders to perform functions that previously required multiple specialized roles, reducing coordination costs and increasing execution speed.

The question, then, is no longer whether a company can succeed with a single founder, ample evidence shows that it can. The more relevant question is whether solo founding represents the optimal structure for a given venture, based on the founder’s skills, risk tolerance, and the complexity of the problem being addressed.

For founders with a clear vision, strong execution discipline, and the ability to strategically supplement gaps through hires or advisors, the answer may increasingly be yes.