How to Win Government Contracts: A Practical Guide for Small Businesses & Entrepreneurs

10.6 min read

Updated: Dec 21, 2025 - 09:12:44

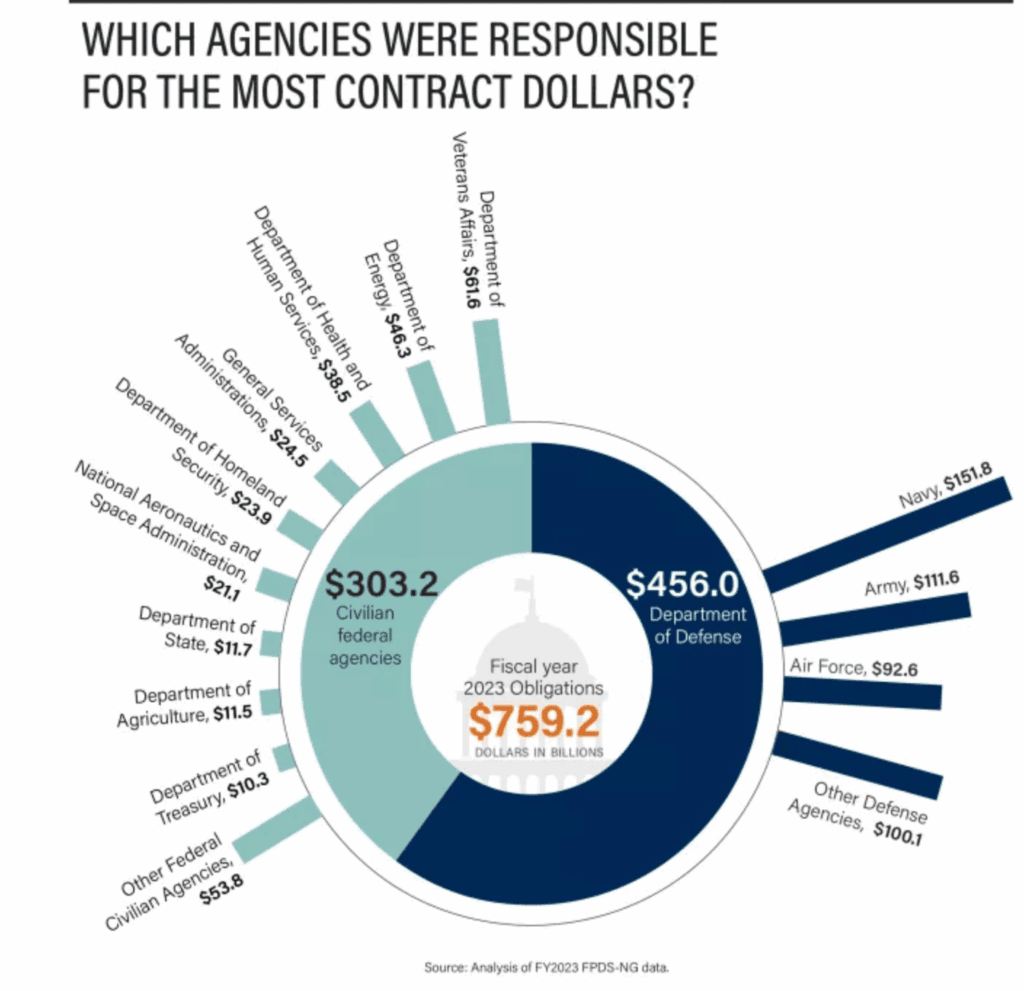

The U.S. government buys over $750 billion in goods and services each year, 23% of which must go to small businesses. Yet many entrepreneurs never compete for these contracts. Success requires understanding the rules, registration, certification, compliance, and smart bidding, but the payoff is stable, long-term revenue and national-scale credibility.

- Start with SAM.gov: Register your business, obtain a Unique Entity ID and CAGE Code, and select your NAICS codes to access federal opportunities worth over $25,000.

- Certify strategically: Programs like 8(a), WOSB/EDWOSB, HUBZone, and VOSB/SDVOSB offer exclusive access to set-aside contracts and mentoring under federal law.

- Bid wisely: Understand solicitation types (RFP, RFQ, IFB) and avoid underbidding, agencies often award on “best value,” not lowest price.

- Manage cash flow: Payments under the Prompt Payment Act can take 30–90 days; maintain a credit line or invoice financing for stability.

- Think long-term: Compliance and persistence pay off, once you win your first federal or state contract, your past performance opens the door to multi-year, recurring work.

The U.S. federal government is the single largest buyer of goods and services in the world. In fiscal year 2023, it awarded nearly $759 billion in contracts, according to the U.S. Government Accountability Office (GAO). Despite this enormous figure, many small business owners never explore these opportunities.

Source: GAO.gov

The truth is, government contracting isn’t limited to large corporations or defense giants. Federal law requires that 23% of all eligible prime contract dollars, more than $170 billion annually, be awarded to small businesses, according to the U.S. Small Business Administration (SBA). In FY 2023, agencies exceeded this goal, directing about $178.6 billion to small firms.

When state and local procurement is included, total public-sector contracting exceeds $1 trillion annually, reflecting the combined purchasing power of governments nationwide. For small businesses, federal contracts offer stability, visibility, and long-term revenue, but success depends on mastering the process.

From registering on SAM.gov to meeting compliance requirements, crafting competitive proposals, and managing payments, understanding how the system works is essential to turning government contracts into lasting business growth.

Understanding the Government Contracting Landscape

Government contracting operates across three tiers: federal, state, and local. Federal contracts are the largest and most regulated, governed by the Federal Acquisition Regulation (FAR), which standardizes procurement procedures across all agencies. State and local governments, by contrast, offer smaller contracts with faster turnaround times and generally simpler procurement rules, though they still maintain their own oversight requirements.

The federal government also prioritizes a portion of contracts for specific business categories. The 8(a) Business Development Program supports small disadvantaged businesses. The Women-Owned Small Business (WOSB/EDWOSB) program promotes opportunities for women entrepreneurs. The Veteran-Owned and Service-Disabled Veteran-Owned (VOSB/SDVOSB) programs assist military veterans, while the HUBZone Program supports firms in historically underutilized business zones.

Each program offers advantages such as exclusive bidding, mentoring, and reduced competition. These are not optional incentives but legally supported programs that help agencies meet annual small business contracting goals. Federal law sets government-wide targets, like 23% of prime contract dollars to small businesses and specific percentages for each socio-economic group, under SBA contracting goals.

Contract types vary in structure and risk. Fixed-price contracts offer higher profit potential but hold the contractor responsible for cost overruns. Cost-reimbursement contracts provide more security but require detailed expense tracking. Time-and-materials contracts pay based on labor hours and materials used, offering flexibility for evolving projects.

Small businesses often thrive in service-based fields like IT, construction, janitorial work, consulting, and logistics—areas requiring expertise rather than large capital investments. Another entry point is subcontracting, as large prime contractors are often required to allocate portions of their work to small businesses, creating valuable opportunities for experience and credibility.

Registration Requirements: The Bureaucratic Gauntlet

Before bidding on federal contracts, you must complete several mandatory registrations and certifications, a process that can take weeks.

The first step is registering on SAM.gov, the official System for Award Management portal. This free platform is your gateway to federal contracting. During registration, you’ll obtain a Unique Entity ID (UEI), which replaced the DUNS number in April 2022, and select NAICS codes (North American Industry Classification System) to define your business activity. Once approved, your business is assigned a CAGE Code (Commercial and Government Entity Code), used by federal agencies to identify and track contractors.

State and local governments run their own procurement systems. For instance, California uses Cal eProcure, Texas operates the Centralized Master Bidders List (CMBL), and New York manages the NYS Contract System. Each platform requires separate vendor registration before bidding.

Certifications are equally critical. Key federal programs include the 8(a) Business Development Program, Women-Owned Small Business (WOSB/EDWOSB), and HUBZone Program. These certifications qualify businesses for exclusive set-aside contracts and enhance visibility in federal databases.

Common registration mistakes can derail your progress. Errors such as incorrect tax information, mismatched banking details, or expired registrations can cause delays or disqualification. Because SAM.gov requires annual renewal, keeping records current and setting reminders ensures uninterrupted eligibility for federal contracts.

Finding and Evaluating Contract Opportunities

Federal opportunities are centralized on SAM.gov Contract Opportunities, which replaced the former FedBizOpps system. This free portal lists most open solicitations across federal agencies for contract actions over $25,000 and allows filtering by agency, NAICS code, set-aside type, and other key criteria. You can also save searches and set alerts to receive notifications when new opportunities matching your profile appear.

At the state and local levels, procurement systems vary widely. Some states offer advanced search portals with keyword and category filters, while others still post bid documents as downloadable PDFs. It’s often necessary to monitor multiple sources, including city or county procurement websites, to stay updated on new bids.

Understanding solicitation types is critical. An RFP (Request for Proposal) requires detailed technical and cost responses and is typically used for complex services or consulting projects. An RFQ (Request for Quote) focuses mainly on pricing for clearly defined goods or services. An IFB (Invitation for Bid), often called a sealed bid, is generally awarded to the lowest responsible bidder who meets all technical requirements.

Evaluating each solicitation goes beyond checking deadlines. Carefully review all attachments to understand technical specifications, evaluation criteria, and submission formats. Some solicitations may also disclose incumbent contractors or budget ceilings, valuable insights for shaping competitive proposals.

Finally, attending industry days and matchmaking events hosted by federal agencies or the Small Business Administration (SBA) is an effective way to discover opportunities. These events provide direct access to contracting officers and prime contractors seeking small business partners.

The Bidding Process: Preparing a Winning Proposal

Winning a government contract requires meticulous preparation, not just competitive pricing. Many solicitations span dozens or even hundreds of pages, outlining strict formatting, submission, and compliance rules. A single mistake, like using the wrong file type or exceeding a page limit, can make your proposal nonresponsive before it’s even reviewed.

Federal agencies evaluate proposals based on criteria set in each solicitation, typically focusing on technical capability, past performance, and cost or price. While the lowest bid might seem appealing, most awards follow a “best value” approach, balancing quality, reliability, and cost realism. Underbidding can create cash flow strain and delivery issues, so explain your pricing logic clearly, emphasizing value and efficiency.

For businesses without prior federal experience, private-sector projects can serve as comparable evidence of capability. Highlight measurable results, client references, and relevant performance data to build credibility. A strong proposal also shows a clear understanding of the agency’s mission, goals, and requirements. Avoid vague marketing language—demonstrate how your process, personnel, and resources directly meet the contract’s objectives.

Finally, consider teaming through the SBA Mentor-Protégé Program. This initiative enables small firms to partner with experienced contractors, share resources, and pursue larger opportunities together, accelerating growth and federal contracting experience.

Contract Management and Payment Realities

Winning the contract is only half the battle, managing it effectively determines your long-term success.

Federal agencies must follow the Prompt Payment Act, which requires payment within 30 days after a proper invoice or acceptance of work. In practice, payments may take 60–90 days, so planning for cash flow is essential. Many small contractors use progress payments or short-term credit lines to bridge delays.

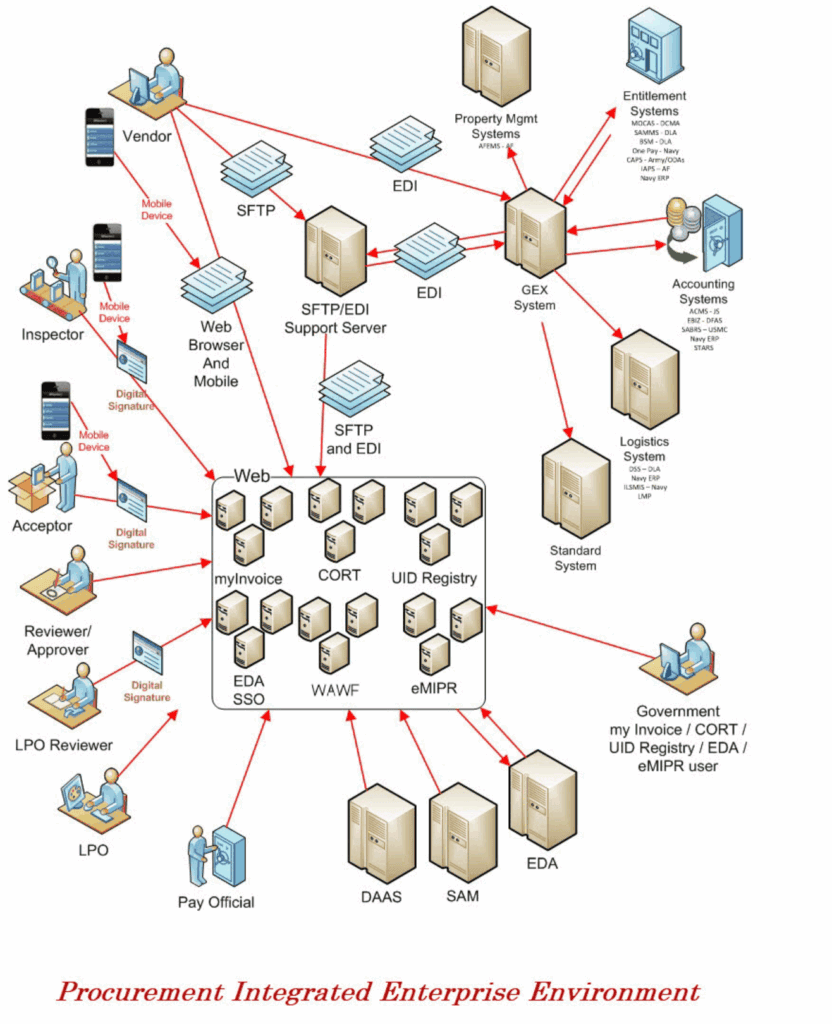

Invoices must be accurate and submitted through systems like the Wide Area Workflow (WAWF) for Department of Defense contracts. Errors or missing documents can restart the payment clock.

Source: PIEE

Contract clauses demand attention. The Termination for Convenience clause allows agencies to cancel contracts at any time, paying only for completed work. Construction contracts may include retainage, typically 5–10% withheld until final acceptance.

Change orders are another challenge. All modifications must be documented and approved under the Changes clause (FAR 52.243). Performing extra work without written approval risks nonpayment.

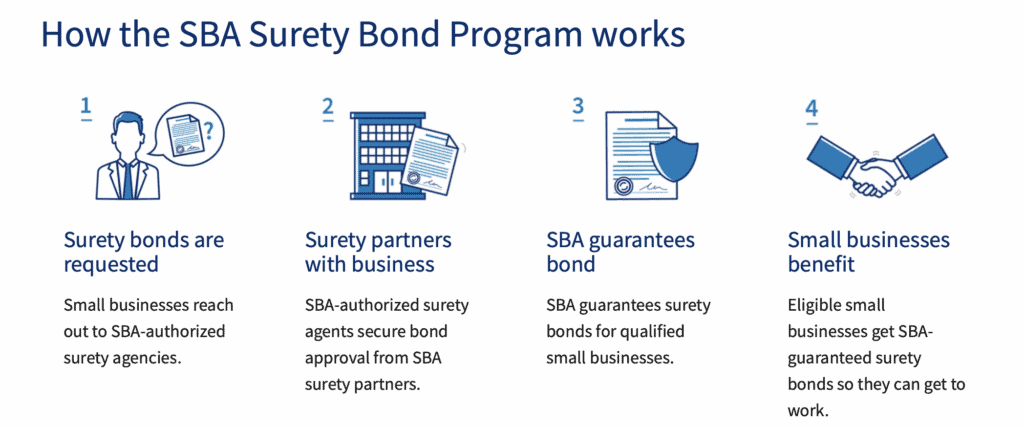

Finally, insurance and bonding requirements can strain small firms. Many contracts require performance bonds or liability coverage near the contract value. The SBA Surety Bond Guarantee Program helps small businesses obtain required bonding for contracts up to $14 million.

Source: SBA

Common Pitfalls and Compliance Risks

Underbidding is a leading cause of small contractor failure. Winning an unprofitable contract often leads to financial strain and reputational damage. Compliance errors, such as late reports, false certifications, or labor violations, can result in penalties or debarment under FAR Subpart 9.4, restricting future eligibility for up to three years.

The Davis-Bacon Act requires federal construction contractors to pay prevailing local wages and submit certified payrolls. Violations can bring heavy fines or contract termination. Likewise, Buy American rules under FAR Part 25 limit foreign materials unless a waiver applies.

Security clearance requirements also pose delays. Contracts involving sensitive data may require clearances taking months to process through the Defense Counterintelligence and Security Agency (DCSA).

Finally, administrative overload is common. Federal contracts demand extensive documentation, audits, and compliance reporting. Without dedicated administrative capacity, businesses risk falling behind. Establish organized record-keeping and plan for contract management early.

Is Government Contracting Worth It?

The rewards of government contracting can be substantial. Once established, contractors gain access to stable revenue streams and predictable, multi-year growth opportunities. The federal government is widely regarded as a reliable customer—it consistently pays approved invoices and often renews contracts when performance is strong. Long-term success can also enhance a firm’s reputation, leading to new opportunities in both the public and private sectors.

However, challenges are real. Procurement cycles can be lengthy, federal solicitations often take six months or more from release to award. Compliance obligations under the Federal Acquisition Regulation (FAR) are rigorous, requiring strict reporting, documentation, and labor standards. Payment timelines, governed by the Prompt Payment Act, can still stretch to 60–90 days in practice, straining cash reserves for smaller firms. Profit margins also tend to be lower than in commercial work, especially in highly competitive industries.

The firms best positioned to thrive are those that view government contracting as a strategic, long-term investment, not a quick revenue fix. They build administrative discipline, maintain strong financial systems, and recognize that early persistence often leads to significant long-term rewards.

Taking the First Steps

Getting started doesn’t require a large budget, but it does demand planning and patience. Begin by registering on SAM.gov and ensuring your UEI, NAICS, and CAGE Code details are accurate. Next, identify certification programs, such as 8(a) Business Development or HUBZone, that align with your business profile.

Start small with local or state contracts, or by subcontracting under a prime contractor to build past performance experience. Attend SBA networking events and agency industry days to meet contracting officers and primes. Once you’ve built a track record, target higher-value federal opportunities on SAM.gov Contract Opportunities.

Before bidding, establish reliable financing and accounting systems. Government contracts can significantly boost revenue, but cash flow delays are common during the 30–90-day payment cycles governed by the Prompt Payment Act. Having a line of credit or invoice financing in place helps maintain stability.

Above all, stay persistent. The first award is often the hardest to secure, but once you win one, it builds the credibility needed to expand into larger, long-term opportunities.

Conclusion

Government contracting is not a shortcut to success, it’s a disciplined, strategic process that rewards preparation, patience, and professionalism. For small businesses that master it, the payoff is immense: stable clients, recurring revenue, and access to opportunities few private markets can match.

The bureaucracy may be intimidating, but every regulation exists to ensure fairness and transparency. Those who learn the system gain a lasting competitive advantage. With accurate registration, smart partnerships, and consistent compliance, small businesses can transform the federal marketplace into their most dependable growth engine.