How Much Does Small Business Hazard Insurance Cost in 2026?

6.7 min read

Updated: Dec 22, 2025 - 09:12:59

Most U.S. small businesses pay about $1,605 per year for hazard (business property) insurance, though actual premiums range widely, from $600 to over $2,000, based on industry risk, location, and property value. This essential coverage protects your building, equipment, and inventory from fire, theft, and certain natural disasters. It’s often required by lenders or landlords, and bundling it into a Business Owner’s Policy (BOP) can lower costs by 10–20%.

- Average cost: About $1,605 annually or $134 per month; many pay between $60–$150 monthly depending on coverage and risk.

- Top cost factors: Industry type, location (e.g., hurricane or wildfire zones), building materials, and claims history.

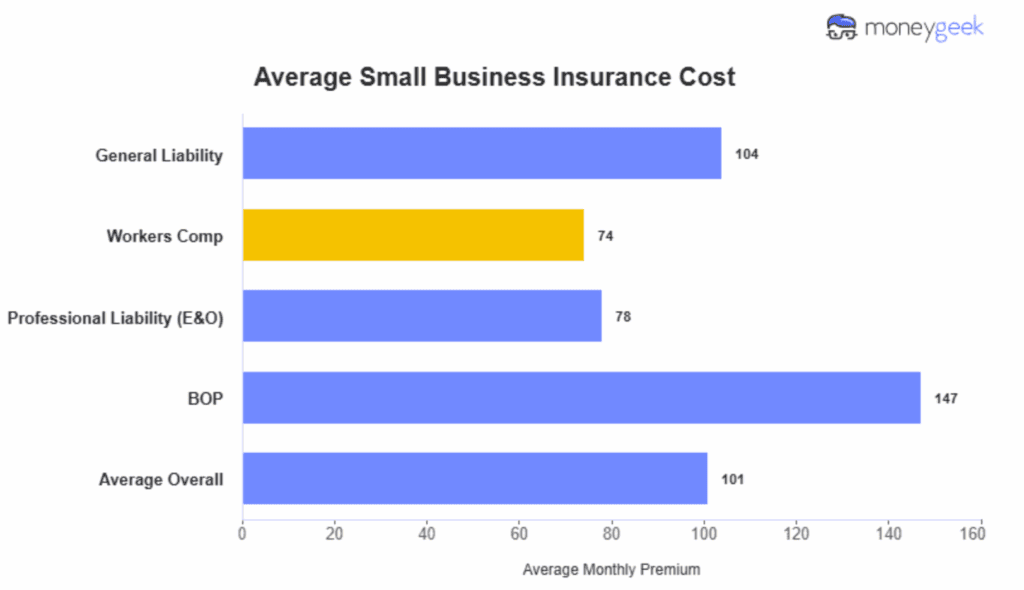

- Bundled coverage: A BOP combining hazard and liability insurance typically costs $80–$200 monthly and saves 10–20%.

- Required coverage: The SBA mandates hazard insurance for loans over $25,000; most landlords require it in leases.

- Smart savings: Install safety systems, raise deductibles, pay annually, and compare at least three quotes for the same limits and exclusions.

Small Business Hazard Insurance (sometimes called business property insurance) covers the physical stuff your business depends on. Your building, equipment, inventory, computers, even important documents. When fire, theft, or a natural disaster strikes, this insurance helps you repair or replace what’s damaged without draining your bank account.

What You’re Actually Paying For

Hazard insurance is straightforward in concept but broad in scope. A typical policy covers your building, whether you own or rent, along with the contents inside. That means furniture, inventory, equipment, computers, and even important business documents are included. Outdoor fixtures such as fences or signage are often covered as well. Most policies protect against events like fire, theft, vandalism, and certain natural disasters.

But there are key exclusions. Flood and earthquake damage are usually not included and require separate policies. Standard hazard insurance also doesn’t cover normal wear and tear, intentional damage, or other excluded risks. Business owners in high-risk zones must weigh whether supplemental coverage is necessary to avoid catastrophic losses.

The Real Numbers

When it comes to actual costs, averages tell an important story. Data from The Hartford shows small business clients pay about $1,605 annually, which equals roughly $134 per month. NerdWallet found that the median premium is $63 per month for policies covering $60,000 with a $1,000 deductible. Industry surveys provide further insight: most small businesses with moderate property values pay between $60 and $150 monthly.

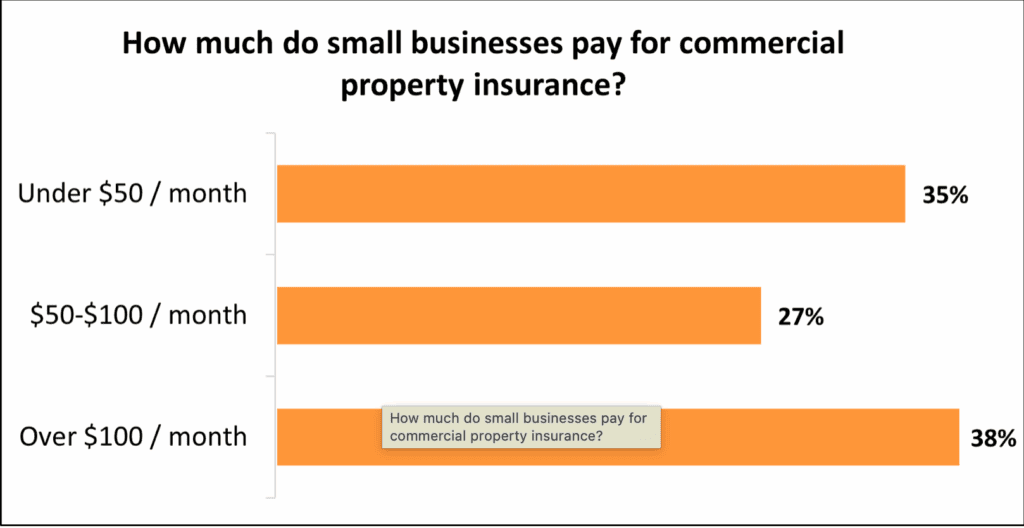

Insureon reports that 35% of their customers pay less than $50 per month, while 27% fall in the $50–$100 range. Interestingly, many businesses choose to bundle hazard insurance with liability into a Business Owner’s Policy (BOP).

Source: Insureon

This bundled coverage typically runs $80 to $200 monthly and saves about 10–20% compared to separate policies. The Hartford notes that its BOP customers average $141 monthly, or $1,687 annually.

Why Your Quote Might Look Different

Your premium isn’t random. Insurance companies weigh specific factors when calculating your rate. Knowing what they look at can help you budget smarter, and sometimes even save money.

Industry Risk

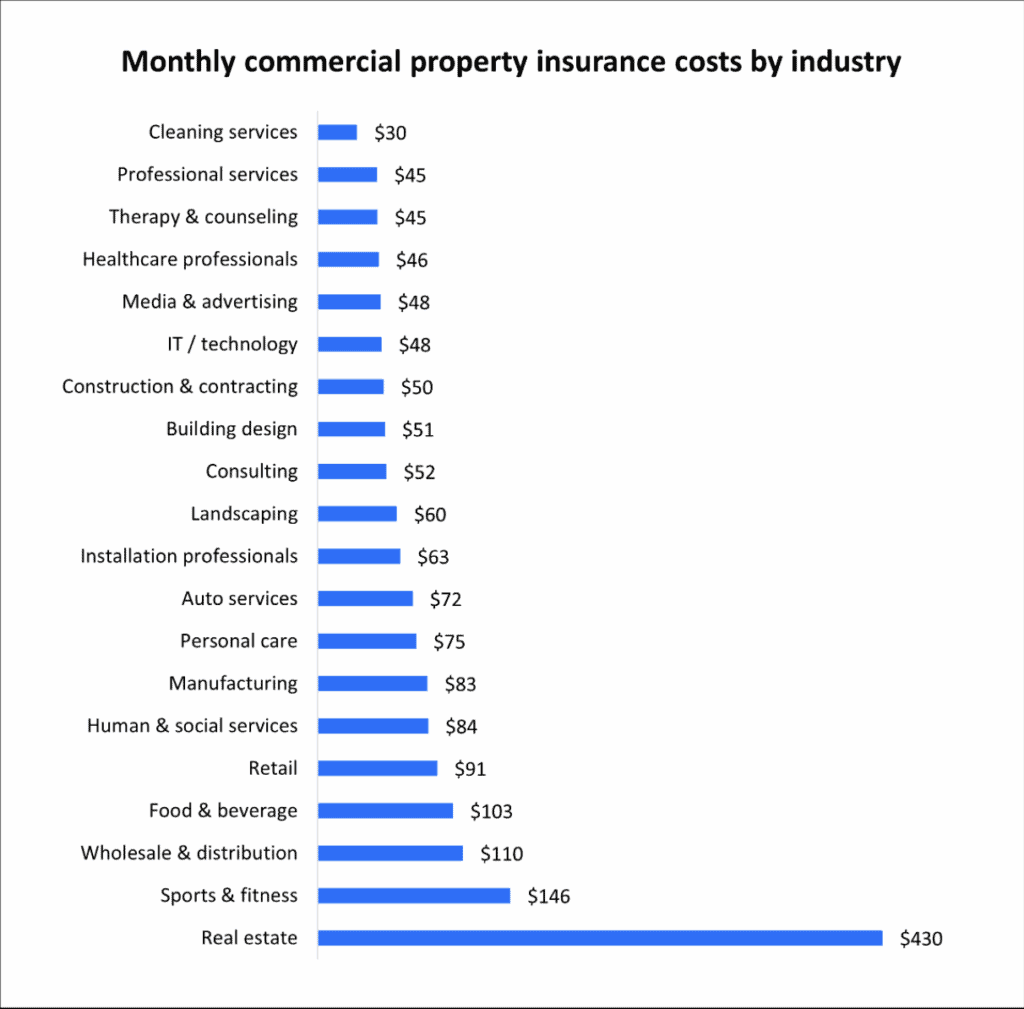

Your line of work matters more than you might think. According to The Hartford, the type of business you run is one of the biggest cost drivers. A manufacturing company carries far greater risk than a home-based technology consultant. Research shows that commercial landlords consistently pay much higher premiums than IT consultants for the same coverage limits.

Source:Insureon

For example, a busy restaurant might pay $1,500 or more per year, while a consultant with no storefront could pay as little as $400. That’s nearly a 4x difference, just based on industry.

Location

Your address is more than a dot on a map, it directly influences your premium. Operating in a hurricane zone, wildfire region, or earthquake-prone area drives costs higher. Similarly, urban areas with higher crime rates usually see more expensive premiums compared to suburban or rural areas.

Building Characteristics

The building itself tells insurers a lot. They consider:

-

Age and materials: Fire-resistant structures generally cost less to insure than older wooden buildings.

-

Size and usage: Square footage and how you use the space affect your risk profile.

-

Value inside: High-value equipment, inventory, or records increase the premium.

Ownership vs. Renting

If you own your building, your policy must cover the entire structure, driving costs higher. Renting usually means you only need coverage for business contents and improvements, which lowers the premium.

Claims History

Your track record matters. Insurers carefully review past claims. Multiple claims raise a red flag, signaling higher risk, and result in higher premiums. On the flip side, a clean history often translates to lower costs.

Coverage Limits and Deductibles

Two factors you can control have a big impact on your premium:

-

Coverage limits: Higher limits equal higher premiums.

-

Deductibles: Choosing a higher deductible lowers your monthly cost but increases your out-of-pocket responsibility if you need to file a claim.

When It’s Not Optional

In many cases, hazard insurance isn’t legally required by states, but it can still be effectively mandatory. The Small Business Administration (SBA) requires hazard insurance for loans over $25,000 when property is used as collateral. Landlords almost always insist on proof of coverage as part of a lease agreement. Some industries also require active policies in order to issue or maintain business licenses.

Even when it’s not legally required, skipping coverage is a gamble with your business’s survival. One fire, burglary, or natural disaster could eliminate your assets and end your business permanently.

Smart Ways to Lower Your Cost

While you can’t control every factor that influences your premium, you can take steps to manage it more effectively. Installing smoke detectors, sprinkler systems, and security features reduces risk and often qualifies for discounts.

Deductible choices also matter: raising your deductible lowers monthly payments, but only if your business can handle the higher upfront cost in the event of a claim. Paying annually rather than monthly often eliminates processing fees, providing modest savings.

Shopping around is another powerful strategy, quotes can vary widely between providers, from $69 to $178 per month for similar coverage. Finally, be strategic about claims. Filing small claims can drive up future premiums, so sometimes paying out of pocket makes more financial sense.

Source: Moneygeek

What Doesn’t Get Covered

Business owners must pay attention to exclusions in their policies. Floods and earthquakes almost never fall under standard hazard insurance, requiring separate policies. Normal wear and tear is considered maintenance, not an insurable event.

Exclusions also include intentional damage, government seizure, and nuclear hazards. In certain states, such as Florida or California, purchasing additional flood or earthquake coverage isn’t optional, it’s essential for real protection.

Getting an Accurate Quote

When you request quotes, having this information ready will get you more accurate estimates:

Create a detailed inventory of your equipment, inventory, and any building improvements you’ve made. Note your building’s construction type, square footage, age, and any safety features you’ve installed. Think about replacement cost, not just what things are worth now. Decide what deductible makes sense for your cash flow situation.

Then get quotes from at least three different insurers, making sure you’re comparing identical coverage amounts and deductibles. Read the fine print carefully. Understand what’s covered, what’s excluded, and any special conditions that might apply to your business.

The Bottom Line

Hazard insurance isn’t optional if you want long-term stability. On average, small businesses pay around $1,605 annually, though your actual cost depends on your industry, location, building type, and claims history. The protection it provides far outweighs the risk of going without it. A single fire or theft could permanently close your doors, while a well-structured policy keeps your business running.

The goal isn’t to chase the cheapest premium but to find a balance between comprehensive coverage and affordability. By understanding what drives your costs, preparing thoroughly for quotes, and exploring smart cost-saving strategies, you can secure a policy that protects your assets and provides peace of mind. In the end, hazard insurance is less about paying a monthly bill and more about ensuring that your business survives whatever challenges come its way.