Business Tax Deductions Explained: What Counts, What Doesn’t, and Why

13.9 min read

Updated: Jan 8, 2026 - 02:01:55

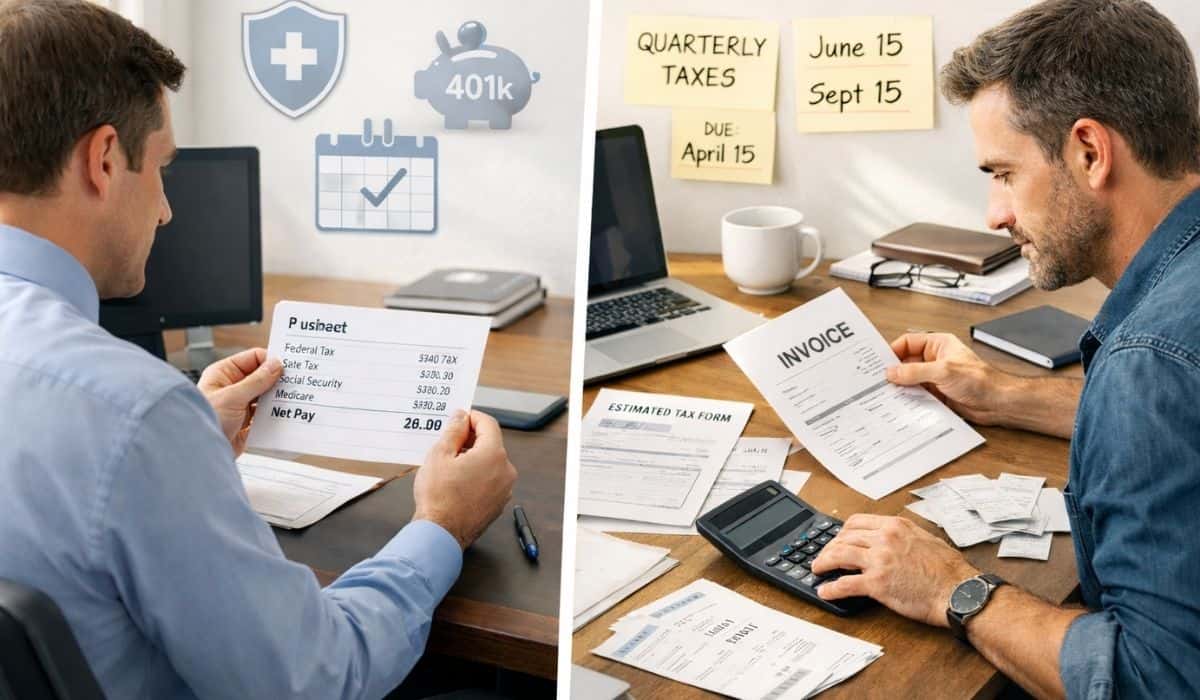

Self-employed individuals can deduct ordinary and necessary business expenses to reduce both income tax and self-employment tax, but only when costs are clearly business-related, properly allocated, and well documented. The key compliance risk is misclassifying personal consumption as business expense, especially for mixed-use items like vehicles, home offices, meals, and technology. IRS rules focus less on creativity and more on substantiation: why the expense was incurred, how it connects to earning income, and whether contemporaneous records support the claim. Legitimate deductions strengthen cash flow; poorly supported ones increase audit and penalty risk.

- Ordinary and necessary is a two-part test: Expenses must be common in your trade and helpful for business, not merely convenient or personal.

- Mixed-use expenses require allocation: Vehicles, internet, phones, and home offices are only deductible to the extent of documented business use.

- Meals are generally 50% deductible; entertainment is not: Business purpose, attendees, and discussion details must be recorded.

- Documentation drives deductibility: Receipts, mileage logs, and contemporaneous notes matter more than estimates or reconstructed records.

- Expense classification affects total tax: Schedule C deductions reduce AGI and self-employment tax, amplifying their value, but also IRS scrutiny.

Self-employed individuals can deduct ordinary and necessary business expenses from gross business income, reducing net business income, which in turn lowers both income tax and self-employment tax. This principle is straightforward in concept but complex in application. The distinction between legitimate business expenses and personal expenses is central to tax compliance and a common source of mistakes, disallowed deductions, and audit risk.

Understanding what qualifies as a business expense is not about finding creative ways to write off personal spending. It is about correctly identifying costs that have a clear business purpose, are directly connected to earning income, and are properly documented in accordance with IRS requirements. These rules exist to distinguish true costs of operating a business from personal consumption, including expenses that may occur while running a business but do not qualify as deductible business expenses.

Ordinary and Necessary: The Core Standard

The IRS uses a two-part test for business expense deductibility that appears simple but requires judgment in application. Under IRS Publication 535, business expenses must be both “ordinary” and “necessary.”

Ordinary expenses are those that are common and accepted in your trade or business. They are costs that businesses in a similar line of work typically incur. For a freelance writer, computer equipment and internet service are ordinary expenses. For a construction contractor, tools and work vehicles are ordinary. An expense does not need to be universal across all businesses in the field, but it should be recognizable as a normal cost of operating that type of business.

Necessary expenses are those that are helpful and appropriate for carrying on your business. They do not need to be indispensable, very few expenses meet that standard, but they must serve a legitimate business purpose. An expense can be necessary without being strictly required, as long as it contributes to business operations.

This standard creates gray areas. A meal with a client where business is discussed can qualify as an ordinary and necessary business expense, though under current tax law such meals are generally only 50% deductible. By contrast, the same meal consumed during a personal outing is personal consumption, even if no formal business activity occurs.

In practice, the distinction often turns on why the expense was incurred and whether it can be substantiated as business-related. If a cost would exist regardless of business activity, it is generally personal and not fully deductible. However, expenses that have both personal and business components, such as internet service or a vehicle, may be partially deductible if the business portion can be reasonably allocated and properly documented.

Personal Versus Business: Where Lines Get Drawn

The clearest expense categories are fully business or fully personal. Office rent paid for space used exclusively for business is deductible. Groceries for family meals are personal. But many expenses fall into mixed-use categories that require allocation between business and personal portions.

Home Office Expenses

Home office deductions are available when a portion of your home is used regularly and exclusively for business as your principal place of business. According to the IRS home office guidelines, the space must be used only for business, a spare bedroom that serves as an office qualifies, but a corner of your living room where you sometimes work doesn’t meet the exclusive use requirement.

If you qualify, you can deduct a proportionate share of home expenses: mortgage interest or rent, utilities, insurance, repairs, and depreciation. The proportion is typically calculated based on square footage, if your home office is 200 square feet in a 2,000 square foot home, you can deduct 10% of qualifying home expenses.

The simplified method allows a deduction of $5 per square foot of office space, up to 300 square feet, without requiring detailed expense calculations. This provides a $1,500 maximum deduction and eliminates the need to track and allocate actual expenses, though it may provide a smaller deduction than the actual expense method for those with significant home costs.

Vehicle Expenses

Vehicles used for business can be deducted using either actual expenses (gas, maintenance, insurance, depreciation) allocated to business use, or the standard mileage rate set annually by the IRS (67 cents per mile for 2024). According to IRS guidance on vehicle expenses, commuting from home to a regular workplace isn’t deductible, it’s personal, but travel between business locations, to meet clients, or to business-related appointments qualifies.

Detailed mileage logs documenting date, destination, business purpose, and miles driven are required to substantiate deductions. The IRS expects contemporaneous records, not reconstructed logs created at tax time. Many self-employed individuals use mileage tracking apps that automatically log trips, simplifying this documentation requirement.

Someone using a vehicle 60% for business and 40% personally can deduct 60% of actual expenses, or can claim the standard mileage rate for business miles only. The personal use portion is never deductible regardless of method chosen.

Meals and Entertainment

Business meal deductions are generally limited to 50% of the actual cost. Meals while traveling for business overnight, meals with clients or business associates where business is discussed, and meals provided to employees all can qualify for the 50% deduction. The Tax Cuts and Jobs Act eliminated deductions for entertainment expenses entirely, tickets to sporting events, theater, golf outings, and similar activities aren’t deductible even if they involve clients.

The distinction between deductible meals and non-deductible entertainment can be subtle. A business dinner where work matters are discussed is 50% deductible. Adding tickets to a show afterward makes those tickets non-deductible. Documenting the business purpose, who attended, and what was discussed helps substantiate that meals weren’t simply personal dining disguised as business expenses.

Technology and Equipment

Computers, software, phones, and other technology expenses are deductible if used for business. For equipment used partially for personal purposes, only the business-use percentage is deductible. A computer used 80% for business allows deduction of 80% of the cost.

Section 179 expensing and bonus depreciation allow many businesses to deduct the full cost of equipment in the year purchased rather than depreciating it over multiple years. These provisions encourage business investment and simplify accounting, though they involve elections and limitations that require attention to specific rules.

Documentation and Substantiation: Why Records Matter

The IRS requires taxpayers to substantiate deductions with adequate records. The level of documentation needed varies by expense type, but the general principle is consistent: you must be able to prove the expense occurred, that you paid it, that it was business-related, and (for some categories) additional details about business purpose.

Receipt and Payment Documentation

Basic documentation includes receipts or invoices showing the amount paid, to whom the payment was made, the date, and the nature of the expense. Bank statements and credit card statements provide proof of payment but are not sufficient on their own because they show that money was spent, not what was purchased or whether it was business-related. The receipt or invoice documenting the actual expense is required to establish the nature and purpose of the cost.

For certain expenses under $75, the IRS generally does not require a receipt if other records adequately substantiate the expense. This exception does not apply to lodging and does not eliminate the need to document business purpose. In practice, many tax professionals recommend retaining receipts for all business expenses regardless of amount to reduce audit risk and avoid disputes.

Specialized Documentation Requirements

Certain expense categories require additional documentation:

- Travel expenses need records of dates, destinations, and business purpose. Lodging receipts, transportation costs, and daily meal expenses should be documented. The IRS provides detailed travel expense substantiation requirements in Publication 463.

- Vehicle expenses require mileage logs showing date, destination, business purpose, and miles driven for each trip. Odometer readings at year-end support total annual mileage claims.

- Gifts to clients or business associates are deductible up to $25 per recipient per year. Records must show recipient, date, cost, and business purpose.

- Listed property, computers, vehicles, and certain other equipment, requires detailed records of business use percentage, particularly when used partially for personal purposes.

The recurring theme is contemporaneous documentation created when expenses occur, not reconstructed later. Notes, calendar entries, emails, and project files that establish business purpose at the time of expense provide stronger substantiation than memory-based reconstructions months or years later.

Why Expense Classification Matters

Beyond simple deductibility, how expenses are classified affects multiple aspects of tax calculations and business accounting.

Above-the-Line Versus Itemized Deductions

Business expenses for self-employed individuals operating as sole proprietors or single-member LLCs are reported on Schedule C and reduce adjusted gross income. These are “above-the-line” deductions available regardless of whether a taxpayer itemizes personal deductions.

This distinction matters because adjusted gross income determines eligibility for many credits, deductions, and phase-outs. Business expenses that reduce AGI generally provide broader tax benefits than itemized deductions, which only reduce taxable income for taxpayers who exceed the standard deduction threshold.

Capitalization Versus Immediate Expensing

Some business expenditures create assets with multi-year useful lives and must be capitalized and recovered over time through depreciation rather than fully deducted in the year incurred. Buildings, major equipment, and certain improvements typically fall into this category, while routine operating expenses are generally deductible immediately.

This distinction affects both cash flow and tax planning. Immediate expensing produces larger current-year deductions, while capitalization spreads deductions across future years. Provisions such as Section 179 and bonus depreciation allow immediate expensing for many qualifying assets that would otherwise require depreciation, subject to specific eligibility rules and limitations.

Self-Employment Tax Impact

Business expenses reduce net self-employment income, which lowers both income tax and self-employment tax. Self-employment tax is imposed at a combined rate of 15.3% on 92.35% of net earnings for taxpayers whose income is fully subject to the tax. For someone in the 24% marginal income tax bracket, a $1,000 legitimate business expense typically reduces total federal taxes by approximately $380 to $385, depending on individual circumstances.

The same $1,000 spent on personal consumption provides no tax benefit. This creates a strong incentive to properly identify and document legitimate business expenses, but it also encourages improper classification of personal costs as business expenses. The IRS is aware of this risk, which is why substantiation requirements exist and why business expense deductions receive close scrutiny.

Audit Risk and Compliance Awareness

Certain types of business expenses and patterns of expense reporting receive closer IRS scrutiny than others. Understanding these risk factors doesn’t mean avoiding legitimate deductions, it means ensuring that claimed deductions are properly documented, accurately calculated, and genuinely business-related.

High-Risk Expense Categories

Some expense categories consistently require heightened substantiation because of the potential for personal use or frequent taxpayer error:

- Vehicle expenses are closely reviewed because business and personal use are often mixed and the substantiation rules are detailed. Taxpayers must be able to document mileage, business purpose, and dates. Claims of 100% business use are difficult to support unless the facts clearly demonstrate exclusive business use.

- Home office deductions are legitimate when the space is used regularly and exclusively for a qualified business purpose. The IRS focuses on verifying exclusive use, eligibility, and proper calculation rather than discouraging the deduction itself. Taxpayers claiming a home office should ensure they meet all requirements and maintain supporting records.

- Meals and travel expenses are another common area of error. Business meals are generally limited to a 50% deduction, and travel expenses must be primarily for business purposes. Taxpayers must be able to separate business costs from personal expenses and document the business purpose of the travel.

- Cash expenses without adequate documentation are difficult to verify and may be disallowed if substantiation is insufficient. Businesses that operate primarily in cash face additional scrutiny because cash transactions lack the automatic records created by electronic payments.

Red Flags and Disproportionate Deductions

Expenses that appear disproportionate to reported business income may raise questions about accuracy and profit motive. For example, a business reporting $30,000 in gross receipts and $28,000 in expenses may be reviewed to determine whether it is a legitimate for-profit activity or a hobby.

The IRS distinguishes between businesses operated for profit and activities not engaged in for profit under the hobby loss rules. While profit motive is evaluated using multiple factors, such as businesslike operations, taxpayer expertise, time devoted, and reliance on income, repeated losses year after year can weaken a profit motive claim. An activity is presumed to be for profit if it shows a profit in at least three of the last five tax years.

For tax years 2018 through 2025, hobby expenses are generally not deductible, even though hobby income must still be reported. As a result, misclassification can significantly increase taxable income.

Finally, round-number expenses and unusually consistent percentages of income are not formal audit triggers, but they may raise credibility concerns if they appear to be estimates rather than amounts supported by receipts, logs, and invoices.

What Doesn’t Qualify: Common Misconceptions

Some expenses are frequently claimed as business deductions even though they do not meet IRS requirements. Misunderstanding these rules can increase audit risk and lead to disallowed deductions.

Commuting expenses from home to a regular or primary work location are generally not deductible, even for self-employed individuals. The IRS treats commuting as personal transportation. However, if a home qualifies as the taxpayer’s principal place of business, travel from that home office to other business locations is considered business travel and may be deducted.

Clothing is deductible only when it is required for work, not suitable for everyday wear, and not worn outside of work. Uniforms, protective gear, and specialized work apparel may qualify. Business suits, professional attire, and other clothing that could be worn outside work are not deductible, even if used exclusively for business.

Education expenses are deductible only when they maintain or improve skills required in the taxpayer’s current trade or business. Education that qualifies a taxpayer for a new trade or business, or that is required to meet minimum educational requirements, does not qualify for a deduction.

Fines and penalties paid for violations of law are not deductible, even when incurred in the course of business. This includes traffic tickets, regulatory penalties, and tax-related penalties, all of which must be paid without reducing taxable income.

The Conservative Approach to Compliance

A conservative, documentation-focused approach is the most appropriate stance when claiming business expense deductions. Legitimate business expenses should be deducted, they are legal deductions allowed under the tax code, but only when they clearly meet the IRS “ordinary and necessary” standard and can be substantiated with proper records. Expenses that lack a clear business purpose or adequate documentation should not be claimed.

This approach strengthens audit defensibility. When every deduction is clearly business-related and supported by receipts, invoices, and records, responding to IRS inquiries becomes far more straightforward. Proper documentation allows taxpayers to demonstrate that expenses were incurred for business purposes and paid during the tax year, reducing disputes during examinations.

A conservative compliance strategy also reduces the risk of accuracy-related penalties. While disallowed deductions do not automatically trigger penalties, the IRS may assess a 20% accuracy-related penalty if underpayments result from negligence or disregard of rules. Maintaining thorough records and making a good-faith effort to follow IRS guidance can support penalty relief when deductions are questioned but claimed reasonably.

Separating personal and business expenses is critical for long-term credibility. Businesses that consistently blur this line face higher audit risk and weaker positions during examinations. Accurate reporting reflects responsible financial management and helps preserve professional credibility with tax authorities, lenders, and other stakeholders.

The objective is not to minimize deductions or avoid legitimate write-offs. The goal is to ensure that every claimed expense represents a true business cost, is properly documented, and can withstand scrutiny if reviewed. Business expense rules exist to distinguish business activity from personal consumption, and following them correctly protects both tax compliance and long-term business stability.