Building an All-Weather Portfolio: Investing Beyond Seasonal Patterns

13.4 min read

Updated: Dec 28, 2025 - 08:12:14

An effective response to seasonal patterns, election cycles, and fading market anomalies is not tactical trading, but building an all-weather portfolio: a diversified mix of stocks and bonds designed to perform reasonably well across many economic and calendar environments. Because no investor can reliably predict which season, sector, or asset class will lead next, long-term outcomes are driven far more by asset allocation, diversification, and discipline than by timing. Historically, simple diversified portfolios have delivered steadier compounding, smaller drawdowns, and higher risk-adjusted returns than concentrated or frequently rotated strategies, making them especially well-suited for beginner investors.

- Diversification is the core advantage: Combining assets with imperfect correlations reduces risk and improves long-term risk-adjusted returns, a principle grounded in modern portfolio theory.

- Asset allocation matters more than timing: Long-term research shows stocks offer higher returns with deeper drawdowns, bonds offer stability with lower returns, and blended portfolios (e.g., ~60/40) have historically delivered most of the upside with less downside.

- Global exposure improves resilience: Allocating roughly 20%–40% of equities internationally helps hedge against shifting market leadership, currency risk, and region-specific shocks.

- Bonds stabilize and create flexibility: Even with occasional periods of poor correlation, high-quality bonds have historically reduced volatility and supported investor behavior during market stress.

- Simplicity and rebalancing beat complexity: A low-cost three-fund structure (U.S. stocks, international stocks, total bonds), reviewed annually and rebalanced mechanically, has consistently rivaled more complex strategies on a risk-adjusted basis.

After exploring seasonal patterns, market cycles, and the limitations of market timing, beginner investors face a practical question: How should I actually structure my portfolio? If September often shows weakness and November tends to be stronger, if election cycles appear to shape four-year rhythms, and if effects like the January anomaly fade over time, what, if anything, should this mean for asset allocation?

The answer lies in building what investment professionals commonly describe as an all-weather portfolio: a diversified mix of assets designed to hold up across different market environments, economic conditions, and calendar periods. Rather than positioning for specific seasonal tendencies or attempting to rotate between sectors and strategies, an all-weather approach accepts a fundamental reality, you cannot reliably predict which season, sector, or asset class will lead at any given time.

This is not a resignation to mediocre results. It is a recognition that long-term, risk-adjusted returns matter far more than capturing every short-term opportunity or avoiding every temporary drawdown. An all-weather portfolio is unlikely to be the top performer in any single year. Instead, its goal is consistency: delivering reasonable outcomes across many years and allowing compounding to work steadily, regardless of headlines, cycles, or shifting market narratives.

The Foundational Principle

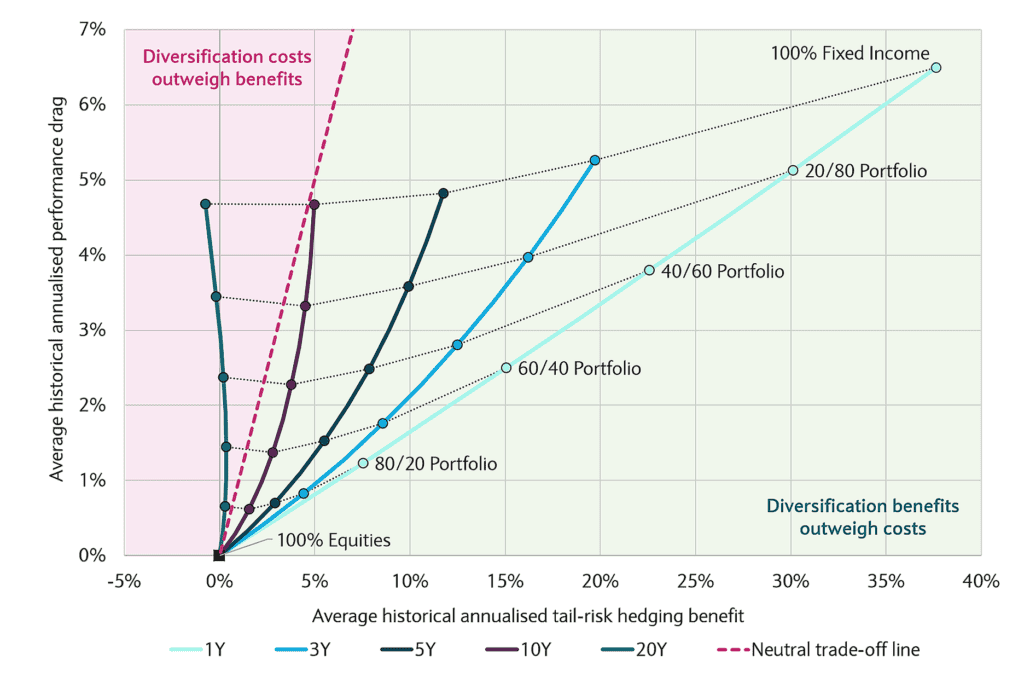

Portfolio diversification represents one of the few widely accepted “free lunches” in investing. Foundational research dating back to Harry Markowitz’s work in the early 1950s demonstrated that combining assets with correlations below 1.0 can reduce overall portfolio risk. In practice, a well-constructed portfolio can achieve stronger risk-adjusted returns than its individual components, even if it does not always maximize raw returns.

Source: Morningstar

The mechanics are straightforward: different assets tend to perform well at different times. When stocks decline, bonds have often held their value or risen. When domestic markets underperform, international markets can sometimes outperform. When growth stocks fall out of favor, value stocks may lead. Holding multiple asset classes that do not move in perfect lockstep helps smooth returns and reduces the severity of drawdowns during periods of market stress.

That said, diversification benefits are not constant. Analysis of rolling 10-year periods since the mid-1970s shows that a traditional 60/40 portfolio has outperformed a 100% equity portfolio on a risk-adjusted basis in the majority of periods, though not all. This reinforces diversification’s long-term value while underscoring an important reality: no portfolio structure dominates in every market environment.

Source: Barclays

The benefits of diversification extend beyond volatility reduction. Long-term historical data covering nearly a century of market cycles shows that diversified portfolios have been more resilient across extended holding periods, particularly during severe market downturns. While diversification does not eliminate losses or prevent temporary underperformance, it has consistently helped preserve capital during extreme market conditions while still allowing investors to participate meaningfully in long-term growth.

Asset Allocation: The Core Decision

Asset allocation, how a portfolio is divided among stocks, bonds, and other asset classes, has a greater influence on long-term investment outcomes than any other single decision. Extensive research shows that asset allocation explains most of the variability in portfolio returns over time, while individual security selection and short-term market timing contribute far less to long-run results.

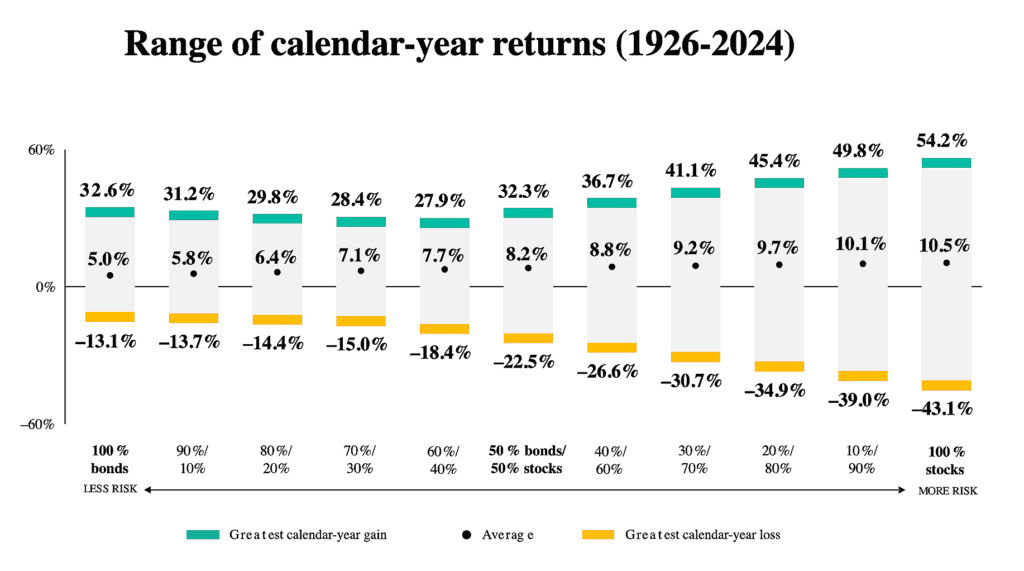

Long-term market data clearly illustrates the trade-offs involved. A portfolio invested entirely in stocks has historically delivered the highest average returns, but it has also suffered the deepest drawdowns, with calendar-year losses exceeding 40% during severe market downturns. A portfolio invested entirely in bonds has shown the opposite pattern, lower long-term returns accompanied by significantly smaller declines during periods of financial stress.

Source: Vanguard

Portfolios that combine stocks and bonds have historically produced more favorable risk-adjusted outcomes than either extreme. A traditional 60% stock / 40% bond allocation has generated roughly 85% to 90% of the long-term returnsof an all-stock portfolio, while experiencing materially smaller drawdowns during major market declines. For many investors, this trade-off, accepting modestly lower upside in exchange for reduced downside risk, supports steadier compounding and improves the ability to remain invested through market cycles.

The appropriate allocation depends on factors specific to each investor, including time horizon, financial goals, risk tolerance, and the capacity to withstand losses without abandoning a long-term plan. A 25-year-old saving for retirement decades in the future can tolerate higher equity exposure and has time to recover from bear markets. By contrast, a 65-year-old approaching retirement generally has less ability to absorb large portfolio declines just before withdrawals begin.

As a general guideline, younger investors tend to emphasize stocks for long-term growth, while older investors gradually increase bond exposure to enhance stability and income. Even so, younger investors often benefit from holding some bonds to reduce volatility, and retirees still need meaningful stock exposure to help protect purchasing power against inflation over potentially multi-decade retirement periods.

Geographic Diversification

U.S. stocks have dominated global markets for much of the past decade, leading some investors to question whether international diversification still matters. The performance gap has been pronounced: from approximately 2015 through 2024, U.S. equities outperformed international developed markets in most years, while emerging markets generally delivered weaker relative results over the period.

This dominance can feel permanent when experienced firsthand. History, however, shows that market leadership rotates. From 2000 through 2009, international stocks significantly outperformed U.S. markets. The 1980s favored U.S. equities, while the 1970s produced stronger results for international markets. Repeatedly, investors who assumed the most recent winner would continue to lead indefinitely were proven wrong.

Early 2025 provided a reminder of this rotation. In the opening months of the year, non-U.S. stocks posted stronger gains while U.S. equities delivered more modest returns, marking a reversal from the pattern seen in recent years. Whether this shift persists remains uncertain, but it illustrates how quickly geographic leadership can change. Investors who abandoned international exposure after years of underperformance would have missed the early stages of this rebound.

Geographic diversification also introduces currency diversification. When the U.S. dollar weakens, international investments denominated in foreign currencies can provide an additional tailwind for U.S. investors. Political, fiscal, or economic risks that pressure U.S. markets may not affect other regions in the same way. Unforeseen events, policy missteps, geopolitical tensions, or structural disruptions, often impact countries and regions unevenly.

As a result, many portfolio frameworks allocate roughly 20% to 40% of equity exposure to international markets. This range offers meaningful diversification benefits without making a portfolio overly dependent on regions that may underperform U.S. stocks for extended periods.

The Bond Allocation Question

Bonds serve several key roles in a diversified portfolio. They provide income through interest payments and generally fluctuate less than stocks, helping reduce overall volatility. In many environments, high-quality bonds have tended to hold their value or rise when stocks fall, offering diversification rather than simply lower variability. Bonds also provide flexibility during market stress, allowing investors to raise cash without selling equities at depressed prices.

Bonds’ stabilizing role, however, depends on the interest-rate environment. When rates rise sharply, bond prices can decline, and in some periods stocks and bonds have fallen together. The market experience of 2022 demonstrated that correlations between asset classes are not fixed and can temporarily weaken diversification benefits.

Despite these periods, bonds have remained effective long-term portfolio components. Over extended time horizons, Treasury bonds have delivered meaningfully higher real returns than Treasury bills, while corporate bonds have produced stronger long-run growth than government debt in exchange for added credit risk. Even with periodic drawdowns, bonds have contributed materially to portfolio stability and outcomes.

Appropriate bond allocation depends on time horizon and risk tolerance. Conservative investors often allocate 40% to 60% to bonds. Moderate investors typically hold 30% to 40%. More aggressive or younger investors may hold 10% to 20%, accepting greater volatility for higher expected returns.

Diversification within bonds also matters. Government bonds offer safety, corporate bonds provide higher yields with added risk, inflation-protected bonds defend purchasing power, and international bonds can add diversification despite currency exposure. A mix across these categories is generally more resilient than relying on any single type.

Beyond Stocks and Bonds

Many investors wonder whether alternative assets, such as real estate, commodities, gold, or cryptocurrency, belong in an all-weather portfolio. The evidence offers a mixed and often less compelling case than theory suggests.

Real estate investment trusts (REITs) provide exposure to property markets without the challenges of direct ownership. However, over time REIT returns have shown a relatively high correlation with U.S. equities, particularly during market downturns. This reduces their effectiveness as true diversifiers precisely when diversification matters most.

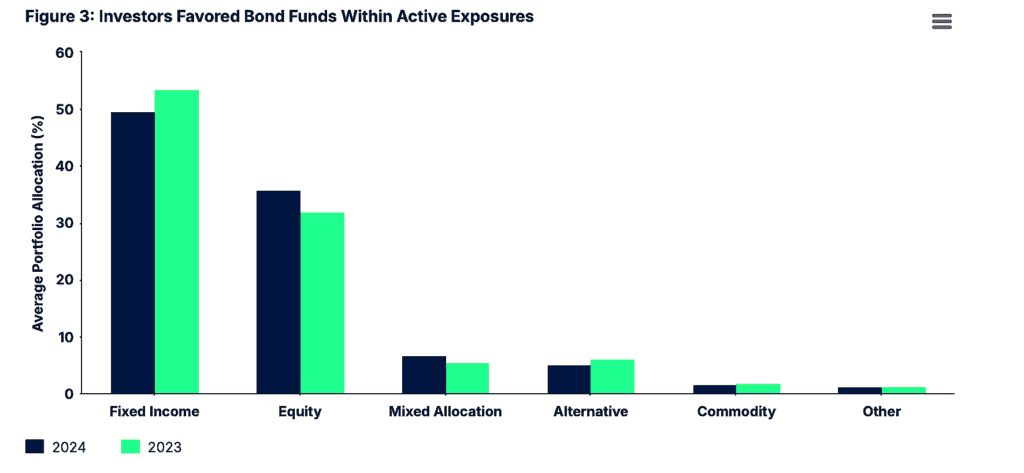

Commodities and gold are often promoted as inflation hedges and crisis protections. In practice, their performance has been inconsistent and highly cyclical. Recent investor allocation data shows that only a relatively small share of portfolios include commodities or gold, and participation declined compared with the prior year. Professional investors have also reduced exposure as long-term diversification benefits proved less reliable than expected.

Source: State Street

For most beginner investors, a globally diversified mix of stocks and bonds provides sufficient risk reduction and return potential. Alternative assets tend to add complexity, higher costs, and tax complications while offering uncertain diversification benefits. The priority should be building a solid core portfolio before considering alternatives.

The Rebalancing Discipline

Market movements inevitably push portfolios away from target allocations. A strong stock market rally increases equity exposure above your target. A bond market decline reduces fixed income below desired levels. Without intervention, your portfolio drifts toward whatever has performed best recently, precisely the opposite of buying low and selling high.

Rebalancing means periodically selling portions of assets that have grown beyond their target allocation and buying assets that have fallen below target. This forces you to take profits from winners and add to positions that have lagged. Financial advisors recommend reviewing portfolios annually and rebalancing when an asset class drifts more than 5% to 10% from its target.

The psychological difficulty of rebalancing shouldn’t be underestimated. Selling your best performers feels wrong. Buying assets that have declined or underperformed feels risky. Your instinct screams to do the opposite, add to winners and abandon losers. Rebalancing requires overriding these instincts in service of maintaining your strategic allocation.

Evidence supports this discipline. Studies examining rebalancing strategies show that portfolios rebalanced annually or when allocations drift significantly have delivered better risk-adjusted returns than portfolios left to drift over time. The benefit comes not from market timing but from systematically enforcing the buy-low, sell-high principle through mechanical rules.

Sector Diversification Within Equities

Within stock allocations, diversification across sectors and company sizes adds another layer of protection. Technology stocks behave differently than healthcare. Large-cap companies move differently than small-caps. Growth and value stocks also tend to alternate leadership over multi-year cycles rather than moving together.

Recent investor data shows a continued shift toward exchange-traded funds and broad index products. This move reflects growing awareness that consistently identifying winning sectors or individual stocks is extremely difficult over time. Broad-based and total market index funds automatically hold all sectors according to market capitalization, providing built-in sector diversification without requiring active rotation or forecasting.

For investors who prefer modest sector tilts, history offers a clear lesson: sector leadership is cyclical. Technology dominated much of the 2010s and early 2020s. Energy led during the inflationary 1970s. Financials outperformed in the 1990s. Healthcare has led during various defensive and demographic-driven periods. No sector remains dominant indefinitely, and sectors that lag for extended periods often lead future recoveries.

The all-weather approach to sector allocation is straightforward: own them all. Allow market-cap weighting to determine sector exposure over time. This ensures participation in whichever sectors lead while reducing the concentration risk that comes from heavy bets on any single industry.

The Simplicity Advantage

-

Portfolio research consistently shows that simpler portfolios often perform as well as, or better than, more complex ones on a risk-adjusted basis.

-

In many historical periods, a basic 60/40 mix of U.S. stocks and bonds has competed favorably with portfolios spread across numerous asset classes.

-

Adding more assets does not automatically improve results and can increase costs, tracking error, and behavioral mistakes.

-

For beginner investors, sophisticated multi-asset strategies are not required to build a resilient portfolio.

-

Low-cost stock and bond index funds, properly allocated and periodically rebalanced, have historically delivered strong long-term outcomes.

-

Long-term data shows that conservative portfolios with high bond allocations have overwhelmingly produced positive real returns over rolling 20-year periods.

-

Time in the market and consistency have mattered far more than portfolio complexity.

-

A simple three-fund structure, total U.S. stock market, total international stock market, and total bond market, provides broad diversification with minimal complexity.

-

Additional complexity can be added later, deliberately and purposefully, rather than as a response to short-term market noise.

Living With Your Portfolio Through All Seasons

The true test of an all-weather portfolio isn’t how it performs during bull markets, almost every strategy looks good when markets are rising. The real test comes during September slumps, election-year uncertainty, bear markets, corrections, and other periods when investing feels uncomfortable.

An all-weather portfolio is designed to endure these periods without requiring constant action. When stocks decline, bond allocations often help cushion losses. When specific sectors suffer sharp drawdowns, broad diversification limits the overall damage. When emotions run high during market stress, exposure to more stable assets can make it easier to remain invested rather than react impulsively.

This doesn’t mean losses or anxiety disappear. Diversification reduces risk; it does not eliminate it. Even well-diversified portfolios can decline during broad bear markets. The key difference is magnitude and recovery: diversified portfolios have historically experienced smaller drawdowns and more consistent recoveries than concentrated portfolios, making it psychologically easier for investors to stay invested through difficult periods.

The seasonal patterns discussed throughout this series, September weakness, November strength, January effects, and presidential cycles, exist within the broader structure of an all-weather portfolio. You acknowledge these tendencies without trading them. You recognize sector leadership rotates without trying to predict or chase it. You understand markets move through bull and bear phases without attempting to time those transitions.

An all-weather portfolio is not optimized for any single season, cycle, or pattern. It is optimized for something more durable: helping you reach long-term financial goals across a wide range of market conditions. That is the real measure of investment success, and seasonal knowledge is most valuable when it reinforces, not disrupts, your commitment to that objective.

About Portfolio Strategy

Portfolio construction sits at the core of long-term investing. It determines how risk is balanced, how returns are captured, and how portfolios survive periods of volatility, drawdowns, and changing market conditions.

Explore the full framework in our Portfolio Strategy guide.