Car Insurance Comparison Shopping 101: How to Save $500+ Annually

13.8 min read

Updated: Dec 20, 2025 - 08:12:20

Most U.S. drivers overpay for car insurance simply because they don’t compare quotes often enough. Pricing varies widely between insurers due to different risk models, meaning identical coverage can cost hundreds, or even thousands, more per year depending on the carrier. Industry quote analyses consistently show that drivers who compare at least three insurers can save $700–$900 annually, with switchers often seeing around $1,000 per year in savings without reducing coverage. Because insurers weigh factors like credit, ZIP code, and driving history differently, there is no universally “best” insurer, only the best one for your profile at a given time. Regular comparison shopping, especially at renewal or after life changes, is one of the highest-return financial habits for lowering the true cost of vehicle ownership.

- Premiums can differ by $2,000+ per year for the same driver and coverage due to insurer-specific pricing models.

- Drivers who actively shop often save $700–$1,000 annually by switching carriers after comparing multiple quotes.

- Shopping is underutilized: while ~14% of drivers compared rates in early 2025, only ~4% actually switched, leaving savings unclaimed.

- Best timing: start comparing 30–45 days before renewal or after rate hikes, moves, vehicle changes, or credit improvements.

- Focus on value, not just price: compare identical coverage and check claims satisfaction and financial strength via J.D. Power and AM Best.

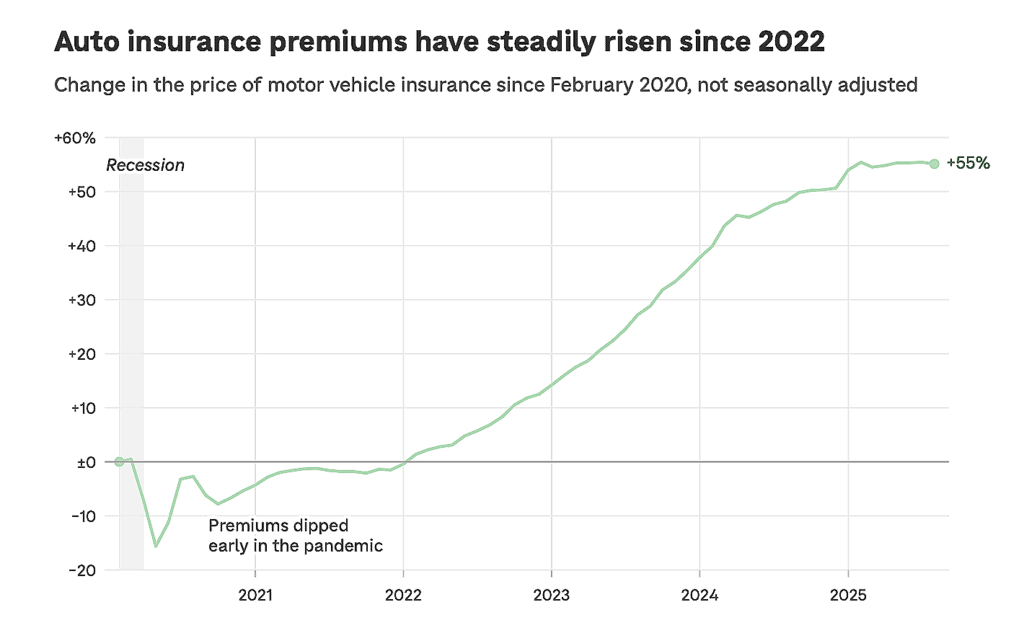

Car insurance is one of those unavoidable necessities: in nearly every state, drivers are legally required to carry at least minimum liability coverage or demonstrate financial responsibility. Yet it often feels like paying for protection you hope never to use. The good news is that many drivers pay more than necessary simply because they haven’t compared quotes in years, or ever.

Insurance premiums can vary dramatically between companies for the same coverage, sometimes by thousands of dollars annually. Strategic comparison shopping allows drivers to lower costs without reducing coverage, making it one of the simplest ways to improve the true cost of vehicle ownership.

The Comparison Shopping Opportunity

The auto insurance market rewards active shoppers. Industry pricing studies show that annual premiums can vary by $2,000 or more between insurers for the same driver and identical coverage, depending on location and risk profile. That difference is meaningful, it can fund travel, reduce debt, or strengthen savings without changing coverage levels.

Large-scale quote analyses also highlight the value of comparison shopping. Reviews based on millions of insurance quotes show that drivers who compare prices from at least three insurers often save several hundred dollars per year, with average savings commonly falling in the $700 to $900 range. For many households, that equates to roughly an extra monthly car payment recovered simply by switching providers.

These price differences exist because insurers assess risk differently. Each company uses its own proprietary pricing models, weighing factors such as credit history, driving record, vehicle type, ZIP code, and local claims costs in distinct ways. One insurer may emphasize credit-based scoring, while another focuses more on accident trends or repair costs.

As a result, insurance pricing is highly individualized. The insurer offering your neighbor the lowest rate may quote you a premium 30% to 40% higher, even with similar characteristics. There is no universally “best” insurer, only the one that best matches your specific risk profile.

This pricing complexity makes one reality clear: the only reliable way to find the lowest rate is to compare quotes directly. Without shopping regularly, many drivers continue overpaying year after year for identical protection.

The Shopping Behavior Gap

Despite clear opportunities to save, most drivers still fail to shop for auto insurance regularly. Survey data shows that roughly four in ten drivers have never switched insurance providers, while nearly three-quarters do not compare rates at every renewal, even though regular shopping is widely recommended within the industry.

Source: Motley Fool Money

This inertia is understandable. Switching insurers feels inconvenient, collecting policy details, entering personal information across multiple websites, and comparing coverage options can seem time-consuming and confusing. As a result, many drivers simply renew their existing policies automatically, assuming the effort outweighs the potential savings.

That behavior has begun to shift. Recent consumer research indicates that about 14% of drivers actively shopped for new auto insurance in early 2025, approaching historically high levels. Shopping activity has increased steadily as rising premiums push more households to search for lower rates.

However, a notable gap remains between shopping and switching. While around 14% of drivers compared rates, only about 4% actually changed insurers. Other survey data shows that over 40% of drivers considered switching in the past year, yet only a fraction followed through. This disconnect suggests millions of drivers continue leaving meaningful savings on the table simply by not completing the final step of the process.

How Much Can You Really Save?

Savings vary by driver, but the data consistently points to meaningful upside. Industry research shows that drivers who switch auto insurance providers often save around $1,000 per year on average over a 12-month period. In many cases, savings are even higher, depending on location, credit profile, and coverage needs.

Real-world examples highlight this potential. One widely reported case involved a Washington State driver who reduced her premium from about $500 per month to roughly $190 after comparing quotes from multiple insurers, an annual savings of more than $3,700. While not every driver will see results that dramatic, the example underscores how wide pricing differences can be for identical coverage.

Source: NPR

Even smaller reductions compound over time. Cutting insurance costs by just $50 per month translates to $600 annually, or $3,000 over five years. Redirected toward savings or long-term investing, those dollars can grow substantially, turning a short comparison exercise into a strong return on time spent.

Savings potential is often highest during periods of change. Drivers who recently experienced rate hikes may find better offers elsewhere, since insurers adjust pricing at different times and by varying amounts. Similarly, improvements in credit, a clean driving history, or a vehicle that has significantly depreciated can all unlock lower premiums, benefits that may not appear unless drivers actively shop and compare.

The Comparison Shopping Process

Effective comparison shopping works best when approached systematically. Most insurers recommend beginning 30 to 45 days before your auto insurance policy renewal date, allowing enough time to gather quotes, compare coverage options, and complete a carrier switch without risking a lapse in coverage. Starting early also reduces pressure to accept unfavorable terms at renewal.

Before requesting quotes, gather all required information to ensure accuracy. This includes driver’s license numbers for all listed drivers, Vehicle Identification Numbers (VINs) for each vehicle, current coverage limits and deductibles, and recent driving history. Having this information prepared enables true apples-to-apples comparisons and helps prevent pricing changes after initial quotes are issued.

Determine your coverage needs in advance. Vehicles that are leased or financed typically require comprehensive and collision coverage under lender agreements. For older, fully paid-off vehicles with limited market value, some drivers choose liability-only coverage, since comprehensive and collision claims are capped at the vehicle’s actual cash value.

Carrying coverage above state minimums is widely recommended. While minimum limits meet legal requirements, they often fall short in real-world accidents. Common minimum limits such as 25/50/25—$25,000 per person for bodily injury, $50,000 per accident, and $25,000 for property damage, can be quickly exhausted in multi-vehicle crashes or incidents involving serious injuries, potentially leaving drivers personally responsible for uncovered costs.

Where to Get Quotes

Drivers have several reliable options for obtaining auto insurance quotes, each with distinct advantages and tradeoffs. Direct insurer websites allow you to request quotes straight from major national carriers such as State Farm, Progressive, GEICO, and Allstate. This method provides full control over coverage selections but requires entering the same information separately for each company, making the process more time-consuming.

Online comparison platforms simplify shopping by letting you submit your information once and receive multiple quotes at the same time. Tools like The Zebra, Insurify, and Experian’s insurance marketplace work with numerous insurers to present side-by-side pricing comparisons. However, participation varies by carrier, so some insurers may still require direct quotes outside these platforms.

Independent insurance agents offer another effective option. Unlike captive agents who sell policies for only one insurer, independent agents represent multiple companies. They can generate quotes from several carriers simultaneously, help tailor coverage decisions, and manage paperwork throughout the process. For many drivers, this personalized assistance offsets any modest difference in cost.

Caution is warranted with lead-generation websites that advertise quotes but primarily sell consumer information to insurers or agents. These sites often result in persistent calls, emails, and sales outreach without delivering immediate pricing. Focus on tools and agents that provide actual quotes rather than simply collecting contact details.

Use Consistent Coverage Levels

Accurate price comparisons require requesting identical coverage levels from every insurer. Differences in liability limits, deductibles, or optional coverages make side-by-side comparisons unreliable. A lower premium may appear attractive until you realize one quote reflects minimal coverage while others include stronger financial protection.

Set your coverage parameters before requesting quotes. Common liability limit options include 50/100/50, 100/300/100, or 250/500/100 (bodily injury per person / bodily injury per accident / property damage). Select collision and comprehensive deductibles, which are commonly set at $500, $1,000, or $2,000, based on your risk tolerance and budget. Also decide whether to include optional coverages such as rental reimbursement, roadside assistance, or gap coverage.

Insurers may suggest different coverage levels based on their underwriting models or perceived risk. While these recommendations can be helpful, maintain consistent coverage when comparing prices. Once you’ve identified the most cost-effective carrier, you can fine-tune coverage levels to better match your needs.

Evaluate Total Value, Not Just Price

The cheapest quote isn’t always the best choice. Customer service quality, claims handling efficiency, and financial stability all matter when selecting an insurer. Getting a great price from a company that makes filing claims nightmarishly difficult or delays payments represents false economy.

J.D. Power’s 2025 Auto Insurance Study reveals that 38% of customers fell into the lowest satisfaction segment, higher dissatisfaction than in previous years. This suggests that as insurers have focused on profitability and rate adequacy, some have allowed customer experience to slip.

Research customer satisfaction ratings and complaint ratios before committing. J.D. Power, Consumer Reports, and state insurance departments publish this information. Companies with consistently poor ratings or high complaint ratios may not be worth choosing even if their prices seem attractive.

Check insurers’ financial strength ratings from agencies like AM Best, Moody’s, or Standard & Poor’s. These ratings indicate whether an insurer has adequate reserves to pay claims even after major catastrophic events. An A-rated insurer provides more security than a B or C-rated company, even if the latter offers lower premiums.

Discount Opportunities

Auto insurance discounts vary widely by insurer, making them an important part of comparison shopping. Common discount categories include multi-policy bundling, where combining auto insurance with home or renters coverage often reduces premiums by roughly 5–10%, as well as multi-vehicle discounts, good student discounts for young drivers maintaining strong academic performance, and safe driver discounts for maintaining a clean driving record over a defined period.

Low-mileage discounts can meaningfully reduce costs for drivers who work remotely or have short commutes. Some insurers also offer pay-per-mile or usage-based pricing for drivers who log relatively few annual miles, which can be particularly cost-effective for households driving well below average mileage.

Completing an approved defensive driving course may also qualify for premium reductions, especially for older drivers or those seeking to offset minor violations. In many states, these courses can also help with ticket dismissal or point reduction, creating both financial and practical benefits.

Always ask insurers or agents to review all available discounts. Not every qualifying discount is automatically applied during online quoting. Memberships in professional organizations, alumni associations, employers, or affinity groups may unlock additional savings. Military service often qualifies drivers for specialized programs or lower rates through insurers that focus on military households.

Telematics or usage-based insurance programs offer another potential source of savings. These programs track driving behavior through smartphone apps or plug-in devices, rewarding habits such as smooth braking, steady speeds, and limited high-risk driving times. While participation requires sharing driving data, safe drivers can earn meaningful premium reductions over time.

Credit Score Considerations

In most U.S. states, insurers are permitted to use credit-based insurance scores when setting auto insurance rates. Currently, 46 states allow this practice, while California, Hawaii, Massachusetts, and Michigan restrict or prohibit the use of credit information in auto insurance pricing. Insurers argue that credit-based insurance scores correlate with claim frequency and loss severity, a relationship supported by long-standing industry studies, even though the reasons behind the correlation remain debated.

For drivers in states where credit scoring is allowed, the impact can be substantial. Drivers with poor credit often pay significantly higher premiums, sometimes 50% or more, compared to drivers with excellent credit for the same coverage. In contrast, drivers with strong credit profiles typically qualify for lower rates, making credit one of the most influential non-driving factors in insurance pricing.

Improving credit can therefore lead directly to lower insurance costs. Practical steps include paying bills on time, reducing credit card balances, correcting errors on credit reports, and limiting new credit applications within short timeframes. These actions not only help reduce insurance premiums but also lower borrowing costs for auto loans, mortgages, and other forms of credit, improving overall financial health.

When to Shop

At a minimum, drivers should shop for auto insurance at every renewal, even if they ultimately remain with their current insurer. Pricing changes frequently as insurers adjust rates, roll out new discounts, or shift their appetite for specific risk profiles. A competitive quote provides leverage and helps confirm whether your existing policy remains competitively priced.

Major life changes also create strong shopping opportunities. Moving to a new address, getting married, adding a teenage driver, purchasing a different vehicle, or changing jobs can all materially affect insurance premiums. These transitions often alter risk factors or eligibility for discounts, making it a natural time to reassess coverage and compare options.

Shopping is especially important after accidents or traffic violations, when rate increases are common. Insurers apply surcharges differently, meaning the lowest-cost carrier before an incident may no longer be the most affordable afterward. Industry analysis shows that following events such as speeding tickets or at-fault accidents, the identity of the lowest-priced insurer often changes, allowing some drivers to partially offset premium increases by switching companies rather than accepting higher renewal rates.

Making the Switch

After selecting a new auto insurance policy, timing is critical to avoid coverage gaps. Schedule your new policy to begin on the same day your current policy expires, ensuring uninterrupted coverage. Most insurers allow future-dated start times, making it easy to coordinate a smooth transition.

Do not cancel your existing policy until your new coverage is fully active. Even a brief lapse in insurance can result in license or registration penalties in some states, higher future premiums, and increased difficulty obtaining affordable coverage. Insurers often treat lapses as higher risk, even when the gap is unintentional.

When your new policy documents arrive, review them carefully. Verify that coverage limits, deductibles, listed vehicles, and named drivers match what you requested. Administrative errors can occur during policy issuance, and correcting them early helps prevent claim disputes later.

Most insurers refund unused premiums when a policy is canceled before the end of the term, though some may charge a small cancellation or short-rate fee. Confirm your current insurer’s refund policy in advance to avoid unexpected charges during the switch.

The Shopping Mindset

View insurance comparison shopping as a recurring financial practice, not a one-time task. Adding it to your annual routine, alongside reviewing investments, retirement contributions, and other insurance policies, helps keep household costs under control.

Auto insurance pricing changes frequently as insurers adjust risk models, pricing strategies, and discounts. The company offering the best rate today may not remain the cheapest at your next renewal, making regular shopping essential to capturing ongoing savings.

Industry data shows that nearly half of active auto insurance policies are shopped at least once each year, signaling that comparison shopping is becoming standard behavior rather than an exception.

Insurance loyalty rarely pays. Unlike other industries, insurers often reserve their best pricing for new customers, while long-tenured policyholders see gradual increases. Treating insurers as competing vendors, and switching when better value appears, is usually the most effective approach.

The time required is minimal. One to two hours of comparison shopping can deliver meaningful annual savings, making it one of the highest-impact, lowest-effort financial decisions households can make.