The True Cost of Driving: Breaking Down Insurance, Maintenance, and Hidden Expenses

11.9 min read

Updated: Dec 20, 2025 - 08:12:28

Most car buyers focus on purchase price and monthly payments, but those numbers hide the real financial impact of vehicle ownership. In 2025, the average U.S. driver spends about $11,577 per year to own and operate a new vehicle. Depreciation alone quietly erases thousands in value each year, while insurance, fuel, maintenance, taxes, and financing compound costs far beyond initial expectations. Understanding total cost of ownership is essential for choosing the right vehicle, deciding whether to buy new or used, and avoiding long-term budget strain.

- Depreciation is the biggest cost: New vehicles lose roughly $4,300 in value per year on average, with the steepest drop in the first 1–2 years, making depreciation the largest hidden expense.

- Insurance costs vary dramatically: Full-coverage premiums average about $1,700 annually, but can exceed $3,000–$4,000 depending on state, vehicle type, credit profile, and driver age.

- Fuel and maintenance add steady pressure: Fuel averages roughly $1,950 per year for typical drivers, while maintenance and repairs often run $1,000–$1,200 annually for gas vehicles.

- Financing and fees matter: Interest charges, sales tax, registration, and ongoing vehicle taxes can add thousands of dollars to lifetime ownership costs, especially with long loan terms.

- Vehicle choice changes everything: Smaller sedans, hybrids, and reliable used vehicles consistently deliver lower total ownership costs than large SUVs, pickups, luxury models, or some EVs.

When shopping for a car, most buyers focus on the sticker price and monthly payment. However, the purchase price represents only the beginning of vehicle ownership costs. Insurance, fuel, maintenance, depreciation, taxes, and repair expenses combine to create a total cost of ownership that can significantly exceed initial expectations, often surprising first-time buyers and catching even experienced owners off guard.

The Full Financial Picture

The sticker price is only the starting point of what drivers ultimately pay to own a vehicle. The average cost of owning and operating a new car in 2025 is $11,577 per year, or about $965 per month, reflecting a $719 decline from the previous year. Lower depreciation, easing fuel prices, and a shift toward more affordable vehicles have helped reduce overall ownership costs.

Source: AAA

That average, however, hides substantial variation based on vehicle type. Larger vehicles, particularly pickup trucks and SUVs, carry significantly higher ownership costs per mile than smaller sedans. Higher fuel consumption, insurance premiums, maintenance expenses, and faster depreciation all contribute to the gap.

Over time, these differences can amount to thousands of dollars in additional annual costs. Understanding total cost of ownership, not just the purchase price or monthly payment, is critical when deciding which vehicle to buy, how long to keep it, and whether alternatives such as leasing or shared mobility better fit your financial situation.

Depreciation: The Silent Wealth Eraser

The largest cost of vehicle ownership isn’t insurance or fuel, it’s depreciation. This hidden expense reflects the gap between what you pay for a car and what it’s worth over time. While depreciation doesn’t show up as a monthly bill, it steadily reduces your net worth the entire time you own the vehicle.

On average, new vehicles lost about $4,300 in value over the past year, making depreciation the single biggest ownership expense. Most new cars experience their steepest drop in value early, often losing roughly 15% to 20% in the first year. Depreciation continues in subsequent years, though at a slower pace, gradually compounding the financial impact.

In practical terms, a $30,000 new vehicle may be worth around $24,000 after one year, fall closer to $20,000 after two years, and decline to roughly $16,000 or less within five years. By that point, nearly half of the vehicle’s original value has disappeared, representing money that can’t be recovered when the car is sold or traded.

Not all vehicles depreciate at the same rate. Luxury models and some electric vehicles tend to lose value more quickly, while pickup trucks and high-demand SUVs often retain value better. Understanding depreciation trends before buying can save thousands of dollars over the life of a vehicle and significantly improve the true cost of ownership.

Insurance: The Unavoidable Expense

Auto insurance is typically the second-largest cost of vehicle ownership, trailing only depreciation. The average annual premium for full-coverage auto insurance is around $1,700, but that figure varies widely depending on where you live, your driving history, age, vehicle type, credit profile, and coverage selections.

Young drivers face the steepest premiums. Adding a teenage driver to a family policy can increase costs by $3,000 to $5,000 per year or more, in some cases exceeding the parents’ combined insurance premiums. Rates generally decline as drivers gain experience and maintain clean records, with noticeable reductions often occurring in the mid-20s and again closer to age 30.

Vehicle choice plays a major role in insurance pricing. Sports cars, luxury models, and vehicles with higher theft or repair costs typically carry higher premiums. Before purchasing a specific make or model, obtaining insurance quotes can prevent costly surprises, some vehicles cost nearly twice as much to insure as otherwise similar alternatives.

Location also has a significant impact. Drivers in higher-cost states such as Nevada, Florida, and Michigan often pay $3,000 to $4,000 annually for full coverage, while those in lower-cost states like Vermont, Maine, and New Hampshire frequently pay under $1,500 on average. Even within the same state, urban drivers usually face higher premiums than rural residents due to increased accident frequency and theft risk.

In most states, insurers also factor in credit history when setting rates. Drivers with poor credit can pay 50% more, or higher, than those with excellent credit for the same coverage. Maintaining strong credit can significantly reduce insurance costs, extending its financial benefits well beyond borrowing rates.

Fuel: The Variable Operating Cost

Fuel is one of the most visible and variable costs of owning a vehicle. Based on 2025 nationwide driving-cost data, the average fuel cost is about 13 cents per mile, using typical gasoline prices and vehicle efficiency. For a driver traveling 15,000 miles per year, this equals roughly $1,950 in annual fuel expenses, making fuel a meaningful but manageable cost for most households.

Fuel expenses vary widely depending on the vehicle. Larger pickup trucks and SUVs consume more fuel and can push annual fuel costs well above the average, while fuel-efficient compact cars and hybrids can reduce fuel spending by 30% to 50% under similar driving conditions. Electric vehicles do not use gasoline, though owners still pay for electricity used in charging.

Source: AAA

Gas prices fluctuate due to crude oil markets, seasonal travel demand, regional supply differences, and geopolitical events. Prices often increase during peak summer driving months and can change quickly during global disruptions. Planning for fuel costs requires flexibility to absorb these fluctuations.

Driving habits also have a significant impact on fuel expenses. Aggressive acceleration, speeding, and excessive idling lower fuel efficiency. In contrast, smoother acceleration, steady speeds, and proper tire inflation can improve fuel economy by up to 10% to 20%, leading to noticeable savings over time.

Maintenance, Repairs, and Tires

Routine maintenance is an unavoidable cost of vehicle ownership. Oil changes, tire rotations, brake service, fluid replacements, and inspections are essential for safe operation and long-term reliability. Average maintenance and repair costs for gas-powered vehicles generally fall between $1,000 and $1,200 per year, depending on vehicle age, type, and driving habits.

Many expenses are predictable. Oil changes are typically required every 5,000 to 7,500 miles, while tire replacement usually occurs every 40,000 to 60,000 miles. Major service intervals at 30,000, 60,000, and 90,000 miles involve more extensive inspections and component replacements, often costing $500 to $1,500 or more.

Unexpected repairs create the biggest financial strain. Problems involving suspension parts, sensors, cooling systems, or transmissions can quickly result in repair bills running into the hundreds or thousands of dollars. Setting aside a vehicle emergency fund helps manage these costs.

Electric vehicles generally require less routine maintenance due to fewer moving parts and no oil changes, while hybrids also benefit from reduced wear on key components. However, when EVs do need repairs, particularly involving batteries or electronic systems, costs can be higher due to limited repair options and specialized labor requirements.

Finance Charges: The Cost of Borrowing

Most Americans finance vehicle purchases rather than paying cash, which adds interest costs to the total cost of ownership. Recent industry data shows average finance charges declined in 2025 compared with 2024, reflecting modestly lower vehicle prices and some easing in borrowing costs. Even so, interest remains a meaningful expense over the life of an auto loan.

Actual borrowing costs vary widely based on credit profile and loan structure. Buyers with excellent credit may qualify for low single-digit promotional rates from manufacturers, while typical prime borrowers often face mid-single-digit interest rates. In contrast, borrowers with weak credit can see rates in the double digits, sometimes well above 10%. On a $30,000 loan, that spread can translate into several thousand dollars in additional interest over a standard five-year term.

Loan duration also plays a major role. Longer terms reduce monthly payments but increase total interest paid. A 72-month loan costs substantially more in interest than a 48-month loan at the same rate, simply because the money is borrowed for longer. Extremely long terms, such as 84 months, also raise the risk of being underwater on the loan for years as the vehicle depreciates faster than the balance declines.

Paying cash eliminates finance charges entirely, though it introduces opportunity cost if those funds could earn returns elsewhere. For buyers offered very low interest rates, keeping cash invested while financing at a low rate can be financially reasonable, depending on risk tolerance and expected returns.

Registration, Taxes, and Fees

State and local governments impose a range of vehicle-related charges that add to the total cost of ownership. According to widely cited transportation cost data, the average U.S. car owner pays about $800 per year for licensing, registration, and vehicle-related taxes. This category covers the ongoing costs required to legally keep a vehicle on the road.

Sales tax at purchase is typically the largest single government expense. With state and local rates commonly ranging from 6% to 8%, buying a $30,000 vehicle results in $1,800 to $2,400 in sales tax upfront. Some states also levy annual personal property taxes based on a vehicle’s assessed value, creating recurring costs that gradually decline as the car depreciates.

Registration fees vary significantly by state and may depend on factors such as vehicle age, weight, value, or fuel type. In some states, annual registration costs remain under $100, while others charge several hundred dollars per year, particularly for newer or higher-value vehicles.

Additional compliance costs can apply depending on location. Emissions testing, safety inspections, and local surcharges add modest but recurring expenses in certain jurisdictions. While these fees are usually smaller than insurance or fuel costs, accounting for them in advance helps prevent unexpected budget disruptions over time.

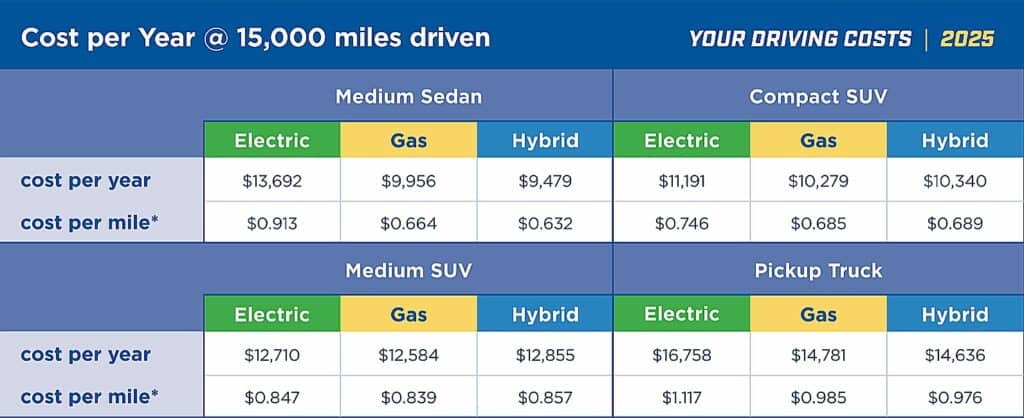

Electric vs. Gas: The Ownership Cost Comparison

Electric vehicles (EVs) have gained traction as alternatives to gas-powered cars, but total ownership costs remain nuanced. Comprehensive cost studies show that fuel prices are the primary driver of cost differences between electric and gasoline vehicles.

EVs benefit from lower operating costs, mainly due to cheaper electricity and reduced maintenance. Electricity typically costs less than half as much per mile as gasoline, and fewer moving parts eliminate expenses like oil changes and exhaust repairs, lowering long-term maintenance costs.

However, EVs continue to face higher ownership costs, including depreciation, insurance, fees, and financing. Higher purchase prices increase depreciation exposure and loan costs, while insurance premiums are often elevated due to expensive battery and electronic repairs. As a result, total cost of ownership for many EVs still exceeds comparable gas vehicles, though the gap has narrowed in recent years.

Hybrid vehicles offer a compelling middle ground. They deliver fuel savings close to EVs, maintain low maintenance costs, and avoid many of the higher ownership expenses associated with fully electric models. For drivers seeking efficiency without full reliance on charging infrastructure, hybrids often present the most balanced cost profile.

Strategies for Reducing Total Ownership Costs

Reducing total vehicle ownership costs starts with understanding where your money goes over time. While purchase price matters, long-term expenses such as depreciation, insurance, fuel, maintenance, and repairs have a far greater impact on what a car actually costs to own.

- Buy the right vehicle from the start: Models with strong reliability records, lower insurance premiums, and high resale values consistently deliver lower total cost of ownership. Ownership-cost comparisons show that choosing the right vehicle can save thousands of dollars over its lifespan, even among similar models.

- Buy used to limit depreciation losses: New cars lose the most value in their first few years. Purchasing a vehicle that is about three years old allows buyers to avoid the steepest depreciation while still benefiting from modern safety features and dependable performance. A professional inspection helps prevent costly surprises after purchase.

- Maintain the vehicle properly: Routine maintenance such as oil changes, brake service, tire care, and scheduled inspections reduces the likelihood of major repairs. Addressing small issues early extends vehicle life and lowers long-term maintenance and repair costs.

- Keep vehicles longer to lower annual costs: Once a car loan is paid off, monthly ownership costs drop significantly. Driving a paid-off vehicle for several additional years avoids new depreciation cycles and financing expenses, resulting in a much lower average cost per year.

- Optimize insurance coverage: Insurance should be reviewed annually as vehicle value declines. Dropping unnecessary coverage, increasing deductibles, or adjusting policy limits on older vehicles can reduce premiums without meaningfully increasing financial risk.

- Reduce fuel expenses through efficient driving: Fuel costs vary widely based on driving habits and vehicle choice. Smooth acceleration, proper maintenance, trip planning, and using the most fuel-efficient vehicle for daily driving all help lower ongoing fuel expenses.

The Value of Understanding True Costs

Vehicle ownership is one of the largest ongoing expenses for many households, often ranking just behind housing in total annual cost. While the sticker price receives the most attention, it represents only the starting point. Insurance, fuel, maintenance, financing, fees, and depreciation combine to create long-term expenses that frequently surpass the original purchase price over a typical ownership period.

Understanding the full cost of ownership allows buyers to make smarter financial decisions, choosing the right vehicle, selecting appropriate financing terms, deciding whether to buy new or used, and determining how long to keep a car. These decisions affect household budgets for years, making total ownership cost analysis one of the most important steps in responsible vehicle financial planning.