The Hidden Asset Protection Rules Most Medicaid Applicants Don’t Know About

11.1 min read

Updated: Dec 20, 2025 - 08:12:19

Medicare does not cover long-term nursing home care, and at roughly $9,000–$10,000 per month, these costs routinely drain middle-class retirement savings. In the U.S., about 70% of adults who reach age 65 will need some form of long-term care, yet Medicaid, not Medicare, is the primary payer for extended nursing home stays. The problem: Medicaid requires applicants to meet extremely low asset limits, often around $2,000. A Medicaid Asset Protection Trust (MAPT), created at least five years in advance to comply with Medicaid’s look-back rules, can legally protect homes and savings while still allowing Medicaid eligibility when care is needed.

- Medicare’s limit is short-term: Medicare generally covers up to 100 days of skilled nursing care per benefit period, not custodial long-term nursing home care.

- Medicaid requires asset spend-downs: In most states, long-term care Medicaid limits countable assets to roughly $2,000, forcing families to exhaust savings unless planning is done in advance.

- MAPTs work only with time: Assets transferred into a properly drafted MAPT more than five years before applying are typically excluded under Medicaid’s 60-month look-back rule.

- Six-figure protection is common: Families who plan early can often preserve $400,000–$600,000+ in home equity and investments that would otherwise be consumed by nursing home costs.

- Cost-benefit is asymmetric: Establishing a MAPT typically costs $2,000–$12,000, compared with annual nursing home costs exceeding $100,000 in many states.

When Jane Martinez’s mother suffered a stroke at 78, the family thought they had planned ahead. They had savings, a paid-off house, and expected Medicare to cover rehabilitation. What they didn’t expect was the harsh reality: Medicare does not cover long-term nursing home care. It generally covers up to 100 days of skilled nursing facility care per benefit period, and only if strict eligibility requirements are met. After that coverage ends, families must pay out of pocket. The median annual cost of a semi-private nursing home room is about $111,000, or roughly $9,200 per month.

Like many Americans, the Martinez family discovered too late that Medicaid, not Medicare, is the primary payer for long-term nursing home care for those who qualify. But there’s a catch: strict asset limits often force families to spend down savings. In most states, the individual Medicaid asset limit for long-term care is typically $2,000 in countable assets, though rules vary by state.

What many don’t realize is that with proper planning, ideally done at least five years in advance to comply with Medicaid’s 60-month look-back rule, families can legally protect significant assets while still qualifying for Medicaid. One commonly used planning tool is a Medicaid Asset Protection Trust (MAPT), an irrevocable trust designed to help preserve assets while meeting Medicaid eligibility requirements.

The Crisis Facing Middle-Class Americans

The numbers are sobering. Recent national cost-of-care surveys show that the median monthly cost of a semi-private nursing home room in the U.S. is about $9,100–$9,300, while private rooms average roughly $10,000–$10,500 per month. In high-cost states, monthly nursing home expenses can exceed $25,000, while in lower-cost states such as Texas, median costs are closer to $5,000–$5,500 per month.

Roughly 70% of Americans who reach age 65 will need some form of long-term care during their lifetime, according to federal health data. For married couples, the risk is compounded, it is highly likely that at least one spouse will require long-term care. Yet most families have no dedicated plan to pay for it beyond personal savings.

Many retirees assume Medicare will cover these expenses. It does not. Medicare pays only for limited, short-term skilled care, not custodial nursing home care. This widespread misunderstanding leaves middle-class families exposed to severe and often irreversible financial strain once long-term care becomes necessary.

The Medicaid Asset Protection Trust: Your Five-Year Shield

A Medicaid Asset Protection Trust (MAPT) is an irrevocable trust used in long-term care planning to help individuals qualify for Medicaid while protecting their assets. When assets are transferred into a properly structured trust that does not allow the Medicaid applicant access to the principal, those assets are generally no longer considered countable for Medicaid eligibility. This is especially important for long-term care programs that commonly impose very low asset limits, often around $2,000 for an individual.

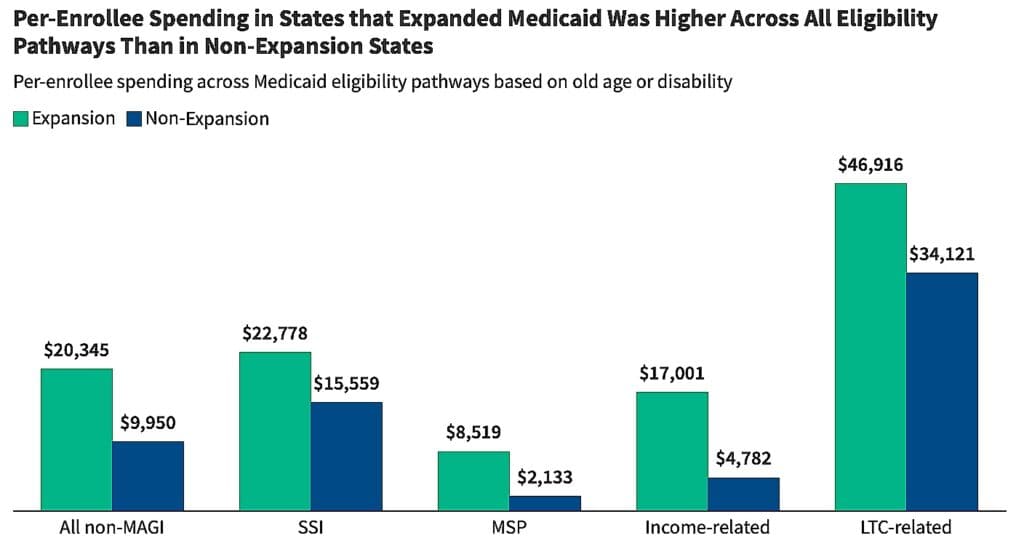

Source: KFF

Timing is the most critical factor. Medicaid applies a five-year lookback period for long-term care coverage. During this period, any assets transferred for less than fair market value can result in a penalty period during which Medicaid will not pay for nursing home or long-term care services.

This is where a Medicaid Asset Protection Trust becomes effective. Assets transferred into the trust more than five years before applying for Medicaid are typically outside the lookback window. When the trust is drafted correctly and the timing rules are met, the transfer can avoid penalties, preserve family wealth, and still allow the individual to qualify for Medicaid coverage when long-term care is needed.

What Assets Can Be Protected?

A Medicaid Asset Protection Trust (MAPT) can hold many types of assets, allowing individuals to reduce countable resources for Medicaid long-term care eligibility when the trust is structured correctly and funded outside the five-year lookback period.

- Real estate is commonly transferred into a MAPT. This includes a primary residence, vacation home, or investment property. Properly drafted trusts allow the grantor to retain the right to live in the home while removing it from their Medicaid estate.

- Financial accounts such as savings accounts, certificates of deposit, and taxable brokerage accounts can also be placed into a MAPT. These non-retirement assets are among the most frequently protected.

- Personal property including jewelry, artwork, antiques, and collectibles may be transferred into the trust, though high-value items should be properly documented.

- Business interests, such as ownership in closely held businesses, partnerships, or LLCs, can be transferred to a MAPT, provided operating agreements and valuation rules are carefully reviewed.

- Life insurance policies with cash value, including whole and universal life policies, are generally transferable into a MAPT.

Important exception: Qualified retirement accounts like IRAs and 401(k)s are typically not transferred into MAPTs. Moving these assets would trigger immediate income taxation and potentially significant penalties, making transfers financially impractical in most situations.

The Income Advantage Few Discuss

Medicaid Asset Protection Trusts (MAPTs) can be structured as income-only trusts, allowing the grantor to continue receiving income generated by trust assets while protecting the underlying principal from Medicaid spend-down rules.

When income-producing assets, such as rental real estate, interest-bearing accounts, or dividend-paying investments, are transferred into a properly drafted MAPT, the income they generate may still flow back to the grantor. The principal, however, remains shielded from Medicaid asset calculations once the five-year lookback period has passed.

This strategy requires careful planning due to Medicaid income limits. In 2025, many income-cap states impose a monthly income limit of $2,901 for Medicaid long-term care applicants. If income received from trust assets causes an applicant to exceed this threshold, they may need to establish a Qualified Income Trust (QIT), also known as a Miller Trust, to remain eligible.

The key advantage is balance: income can support day-to-day living expenses while assets remain protected for a spouse, heirs, or long-term planning goals. However, improper structuring can unintentionally jeopardize eligibility, making professional drafting essential.

Real-World Protection: The Numbers

Consider a common Medicaid planning scenario. A married couple owns a $400,000 home and holds $250,000 in savings and investments. The husband requires nursing home care costing $9,000 per month.

Without a Medicaid Asset Protection Trust

Without prior planning, the couple must spend down assets to Medicaid’s Community Spouse Resource Allowance (CSRA). In 2025, the maximum CSRA is $157,920 for the spouse remaining at home, plus $2,000 allowed for the Medicaid applicant.

This means the couple must reduce countable assets from $650,000 down to $159,920, resulting in a required spend-down of approximately $490,000 before Medicaid coverage begins.

With a Medicaid Asset Protection Trust Established Five Years Earlier

If the couple had established a Medicaid Asset Protection Trust (MAPT) at least five years earlier, the outcome changes dramatically. The $400,000 home and $200,000 of investments are transferred into the trust and are fully protected from Medicaid asset calculations.

Only $50,000 remains outside the trust. Those remaining assets are spent down quickly to Medicaid’s allowable limits, allowing eligibility within months rather than years. As a result, the family preserves approximately $600,000 in assets that would otherwise have been consumed by long-term care costs.

Cost Versus Benefit

The cost to establish a MAPT typically ranges from $2,000 to $12,000, depending on complexity and location. Compared to the hundreds of thousands of dollars preserved, the planning cost is minimal relative to the financial protection achieved.

State-by-State Variations Create Planning Opportunities

Medicaid Asset Protection Trust rules vary widely by state, creating important planning opportunities. California eliminated its Medicaid asset limit on January 1, 2024, but state law provides for the return of an asset limit on January 1, 2026, making advance planning relevant again.

New York currently has no lookback period for Community Medicaid, though the state has authorized a 30-month lookback that is expected to take effect in 2025 or later. Illinois follows the federal Community Spouse Resource Allowance, which is $157,920 in 2025, allowing the at-home spouse to retain a portion of countable assets.

Florida, Texas, and most other states enforce the standard 60-month Medicaid lookback period, making early trust planning essential. Because Medicaid rules are state-administered, understanding your specific state’s policies is critical to maximizing asset protection.

Critical Considerations Before Creating a MAPT

Before creating a Medicaid Asset Protection Trust, it is important to understand the tradeoffs. A MAPT is an irrevocable trust, meaning assets transferred into it are permanently removed from your ownership and control. Once funded, the trust generally cannot be revoked or changed to allow access to the principal. This loss of access is what allows assets to be excluded from Medicaid eligibility after the lookback period, but it also means you cannot use those assets if your financial situation changes.

To remain effective, neither you nor your spouse can retain control over trust assets. Serving as trustee or holding powers that allow access to principal can cause Medicaid to treat the trust as an available resource. For this reason, trustees are typically adult children, trusted relatives, or professional fiduciaries.

When properly structured and funded outside the lookback period, a MAPT generally protects assets from Medicaid estate recovery, as trust assets are not part of the probate estate. However, estate recovery rules vary by state.

Placing a home into a MAPT does not eliminate Medicaid home equity limits for long-term care eligibility. In 2025, most states apply home equity caps ranging from $730,000 to $1,097,000, depending on state policy.

The Catastrophic Cost of Waiting

Waiting to create a Medicaid Asset Protection Trust can be financially devastating. MAPTs require advance planning and are not effective as crisis tools. If assets are transferred after long-term care is needed or during Medicaid’s lookback period, the transfer triggers a penalty period during which Medicaid will not pay for care.

The penalty is calculated by dividing the value of the transferred assets by the state’s average monthly nursing home cost. For example, transferring $200,000 in a state with a $10,000 monthly nursing home rate results in a 20-month period of Medicaid ineligibility.

Because of this risk, elder law attorneys typically recommend establishing a MAPT in your 60s or early 70s, well before long-term care is anticipated.

Beyond MAPTs: Complementary Strategies

Sophisticated Medicaid planning often extends beyond Medicaid Asset Protection Trusts and relies on a combination of complementary legal strategies. These may include strategic gifting to reduce countable assets while managing penalty exposure, spousal transfers that use spousal impoverishment protections to preserve income and resources for the healthy spouse, and exempt transfers such as those made to a spouse, disabled child, or certain caregiver children.

Properly structured caregiver agreements are also commonly used to compensate family members for providing care, converting otherwise penalized transfers into legitimate expenses when drafted and documented correctly.

The Professional Planning Imperative

Medicaid planning requires professional guidance because the rules are complex and vary by state. A poorly structured Medicaid Asset Protection Trust can trigger penalty periods, delay eligibility, or fail to protect assets altogether.

While nursing home social workers often assist with Medicaid applications, they generally focus on eligibility paperwork rather than asset protection strategies. Specialized elder law attorneys understand state-specific Medicaid rules and ensure MAPTs and related planning techniques are structured correctly to avoid costly mistakes.

Taking Action: Your Next Steps

-

Assess your current assets and state rules.

-

Consult with an elder law attorney.

-

Factor in the five-year timeline.

-

Coordinate your MAPT with your estate plan.

-

Educate your family members.

-

Review your plan regularly.

The Bottom Line

Medicaid Asset Protection Trusts are powerful planning tools that can legally preserve substantial assets while still allowing access to Medicaid-funded long-term care. Their effectiveness, however, depends on one critical factor many families lack during a crisis: time.

The five-year lookback period is not a loophole to work around but a planning window that must be respected. Families who understand this and plan in advance can protect their savings for a spouse and heirs. Those who wait until care is needed often see their assets rapidly consumed by nursing home costs that commonly range from $9,000 to $10,000 per month, or well over $100,000 annually.

The decision is simple but consequential. Planning early allows families to protect assets and maintain financial stability. Waiting until a crisis leaves few options and little protection, turning a lifetime of savings into short-term care expenses rather than a lasting legacy.