The Niche Report: Life Extension Companies to Invest In – A Complete Market Guide

10.5 min read

Updated: Dec 20, 2025 - 08:12:19

The longevity sector has moved into mainstream institutional investing, with ~$8.5B in 2024 funding and a projected $600B+ global longevity economy by the late 2020s. Investors increasingly search for how to combine large-cap GLP-1 leaders with clinical-stage biotechs and harder-to-access private moonshots. Below are the core takeaways most relevant for 2025 portfolio construction, assuming U.S. market norms and current regulatory guidance.

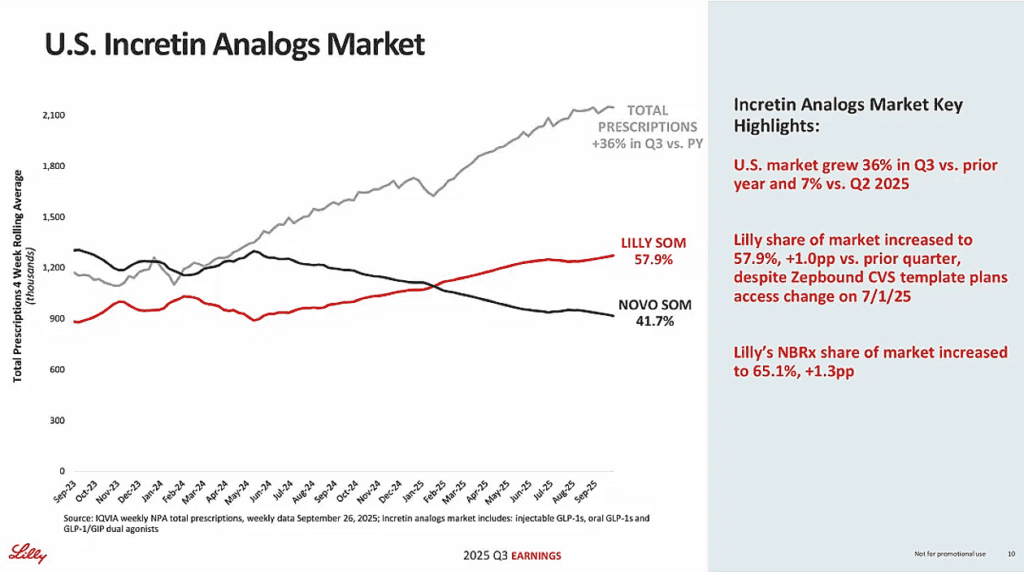

- Eli Lilly’s GLP-1 dominance continues to anchor the public longevity thesis, with 2025 revenue guidance of $58–61B and tirzepatide driving category-leading weight-loss efficacy. Pricing pressure and capacity constraints remain the main risks.

- Novo Nordisk trades at a discounted multiple after 2025 share losses, yet still holds ~63% GLP-1 value share and is advancing a late-stage oral semaglutide obesity pill that could reshape adherence and access.

- Clinical-stage biotechs such as BioAge (BGE-102) and the post-liquidation Unity Biotechnology illustrate typical volatility: NLRP3 programs, senolytics, and aging-mechanism drugs remain high-reward but carry Phase-1–to-approval success odds of only ~10–15%.

- Large-cap stabilizers like AbbVie provide indirect aging exposure through chronic inflammatory pathways, diversified cash flows, and partnerships (e.g., Calico), supporting a balanced longevity allocation.

- Late-stage private companies (Altos Labs, Insilico Medicine, Rubedo, Retro Biosciences) capture the frontier of cellular reprogramming, AI-enabled discovery, and senolytics, accessible mainly to private investors until future IPOs.

- 2025 catalysts include Medicare’s evolving GLP-1 coverage, regulatory limits preventing a formal “aging” indication, and ongoing readouts across senolytic, neurodegenerative, and metabolic pipelines. The TAME metformin trial remains scientifically influential but will not create an FDA aging indication.

- Portfolio construction in longevity favors diversification across mechanisms (metabolic, inflammatory, senolytic, reprogramming), corporate stage, and regulatory pathways given high attrition and long timelines.

The life-extension sector has shifted from fringe speculation to a legitimate institutional investment category. In 2024, longevity-focused companies attracted approximately $8.5 billion in funding, according to multiple biotech investment trackers, reflecting one of the strongest capital inflows the sector has seen, though the “220% increase” figure varies by dataset and typically refers to growth over multi-year baselines rather than a single-year jump.

Broader market forecasts remain bullish: the global longevity economy is projected to exceed $600 billion by the late 2020s, with narrower estimates for the longevity biotech market ranging from $30–$40 billion today to more than $100–$120 billion by 2030, depending on methodology.”

This guide organizes the sector from accessible public companies to higher-risk clinical biotechs and private, pre-IPO moonshots.

Eli Lilly (NYSE: LLY) Market Cap: $1 Trillion

Eli Lilly became the first healthcare/pharmaceutical company to reach a $1 trillion market capitalization in November 2025, driven by surging demand for its GLP-1 diabetes and obesity drugs.

By late 2025, tirzepatide (Mounjaro and Zepbound) generated about $24.8 billion in revenue over the first three quarters, and on a quarterly basis the franchise surpassed Merck’s Keytruda as the world’s top-selling drug, with $10.1 billion in Q3 2025 vs. Keytruda’s $8.1 billion.

Source: Lilly

In Q1 2025, Lilly reported $12.73 billion in revenue, up 45% year-over-year, and maintained 2025 revenue guidance of $58–61 billion, implying strong double-digit growth versus 2024.

For longevity, Lilly’s importance comes from its broad metabolic, cardiovascular, and neurological programs. In a head-to-head obesity trial, tirzepatide (Zepbound) achieved about 20.2% average weight loss versus roughly 13.7% with semaglutide (Wegovy) over 72 weeks, a sizable efficacy advantage.

Main risks include growing political and regulatory pressure to cut drug prices, early Medicare negotiations have produced discounts of roughly 38–79% versus list prices for selected drugs, alongside capacity constraints for GLP-1 manufacturing and patent expirations in older, non-GLP-1 franchises such as Trulicity later this decade.

Novo Nordisk (NYSE: NVO) Market Cap: $225 Billion

Novo Nordisk’s U.S.-listed shares have fallen by roughly the mid-40% range in 2025 as growth in GLP-1 drugs has slowed and competition has intensified, yet the company still controls a dominant position in the category. Management recently reported a GLP-1 value market share of about 63% in 2024, and Ozempic plus Wegovy together generated around $26 billion in revenue that year. The stock now trades at a meaningfully lower earnings multiple than during its 2021–2023 peak, offering some valuation relief versus its own history.

A key potential catalyst is Novo’s push into oral obesity and metabolic treatments, including a once-daily “Wegovy pill” in late-stage development that could attract patients who prefer pills to injections. The company is also building on semaglutide’s cardiovascular profile: in 2024 Wegovy gained approval in both the U.S. and EU for reducing cardiovascular risk in people with obesity and established cardiovascular disease. By contrast, a recent Phase 3 Alzheimer’s trial using semaglutide failed to meet its primary endpoint, which has tempered expectations for near-term neurodegenerative indications.

For 2025, Novo initially guided for mid-teens to mid-20s percentage sales growth at constant exchange rates, but has since cut its outlook several times and now expects high-single- to low-double-digit growth as competition, pricing pressure, and market saturation weigh on the GLP-1 franchise. The market currently prices in continued share losses to Eli Lilly, yet that assumption could prove overstated if rivals face regulatory, pricing, or manufacturing constraints and Novo successfully broadens access to its semaglutide-based portfolio.

BioAge Labs (NASDAQ: BIOA) Market Cap: $200M–$500M

BioAge Labs became publicly traded in September 2024 through an IPO that raised approximately $198 million at $18 per share. Its former lead candidate, azelaprag, an oral apelin receptor agonist, had shown short-term preservation of muscle mass in early studies. However, the phase 2 program, including the combination trial with tirzepatide, was discontinued in late 2024 after elevations in liver enzymes were observed, and azelaprag is no longer advancing.

The company’s focus has shifted to BGE-102, an oral, brain-penetrant NLRP3 inhibitor now in phase 1 clinical testing, with additional safety and dose-escalation data expected through late 2025. Current Wall Street targets imply a price objective of roughly $11.33 per share, assuming clean progression of BGE-102. As with all clinical-stage biotechs, negative trial outcomes could eliminate much of the company’s market value.

Unity Biotechnology (NASDAQ: UBX) Market Cap: $3 Million

Unity Biotechnology was one of the first public companies focused on senolytic therapies designed to eliminate senescent cells. Its lead candidate, UBX1325 (foselutoclax), showed clinically meaningful and durable vision gains in diabetic macular edema patients in phase 2 studies, with NEJM Evidence reporting improvements that persisted for many months after a single injection. Despite this, historical trial setbacks, shareholder dilution, and failed or discontinued programs have driven its valuation down to the low-single-digit-million range.

Top-line phase 2b ASPIRE results were released in March 2025, with full 36-week data in May 2025 showing vision outcomes broadly non-inferior to aflibercept but not meeting all pre-specified primary endpoints. Following these mixed results and continued cash constraints, Unity laid off nearly all employees, was delisted from Nasdaq, and stockholders later approved a plan of liquidation and dissolution. The shares now trade over-the-counter and represent an extremely speculative, highly volatile remnant rather than an ongoing operating longevity company.

AbbVie (NYSE: ABBV) Market Cap: $400 Billion

AbbVie gives investors indirect exposure to aging biology through its large immunology and chronic-disease franchises, which target inflammatory and immune pathways closely linked to age-related conditions. The company generated about $56 billion in revenue in 2024 and, as of late 2025, offers a dividend yield of roughly 3 percent, combining growth potential with regular income.

Historically, AbbVie has invested in aging science via major collaborations such as its long-running partnership with Calico, an Alphabet-backed research venture focused on age-related disease, even as that alliance is now being wound down. More broadly, AbbVie’s use of partnerships, acquisitions, and licensing deals to expand its pipeline allows it to participate in emerging therapies for age-related conditions while maintaining the diversified cash flows of a mature pharmaceutical leader, making it a relatively stable anchor within a longevity-focused allocation.

Late-Stage Private Companies: The Pre-IPO Tier

Altos Labs Estimated Valuation: $6–$7 Billion

Altos Labs is one of the most heavily funded private longevity companies, launched in 2022 with backing from Jeff Bezos and several major investors. The company focuses on cellular rejuvenation through reprogramming technologies and has recruited leading scientists, including Nobel laureate Shinya Yamanaka, as senior fellows.

Altos has no human trials underway and remains entirely preclinical, meaning public-market investors cannot access it until a future IPO or listing. Its valuation already reflects expectations for breakthroughs in regenerative biology, making it one of the sector’s most closely watched private science platforms.

Insilico Medicine Total Funding: $500–$550 Million

Insilico Medicine is an AI-driven drug discovery company focused on identifying aging-related targets and designing novel compounds using generative platforms. The company has raised over $500 million to date, including a major Series E round in 2025, and several internally developed assets have advanced into clinical trials.

Insilico generates revenue through partnerships with large pharmaceutical companies, allowing progress without relying on approved drugs. A future IPO remains possible, with valuation dependent on continued clinical success and commercial traction.

Rubedo Life Sciences Series A: $40 Million

Rubedo focuses on systemically delivered senolytics, aiming to remove senescent cells across multiple organs. Its 2024 Series A round included leading longevity investors and positions the company to advance toward later-stage trials and broader therapeutic programs.

Retro Biosciences Funding: $180 Million from Sam Altman

Retro Biosciences is a privately funded longevity company backed by $180 million from Sam Altman, focused on extending healthy lifespan through cellular reprogramming, autophagy-based therapies, and plasma-based interventions. The company has stated plans to begin its first human clinical trial in 2025, marking the transition from preclinical programs to early-stage testing.

With significant capital but long development timelines, Retro remains a high-risk, high-potential venture accessible only to private-market investors until any future public offering.

Geographic and Sector Snapshot

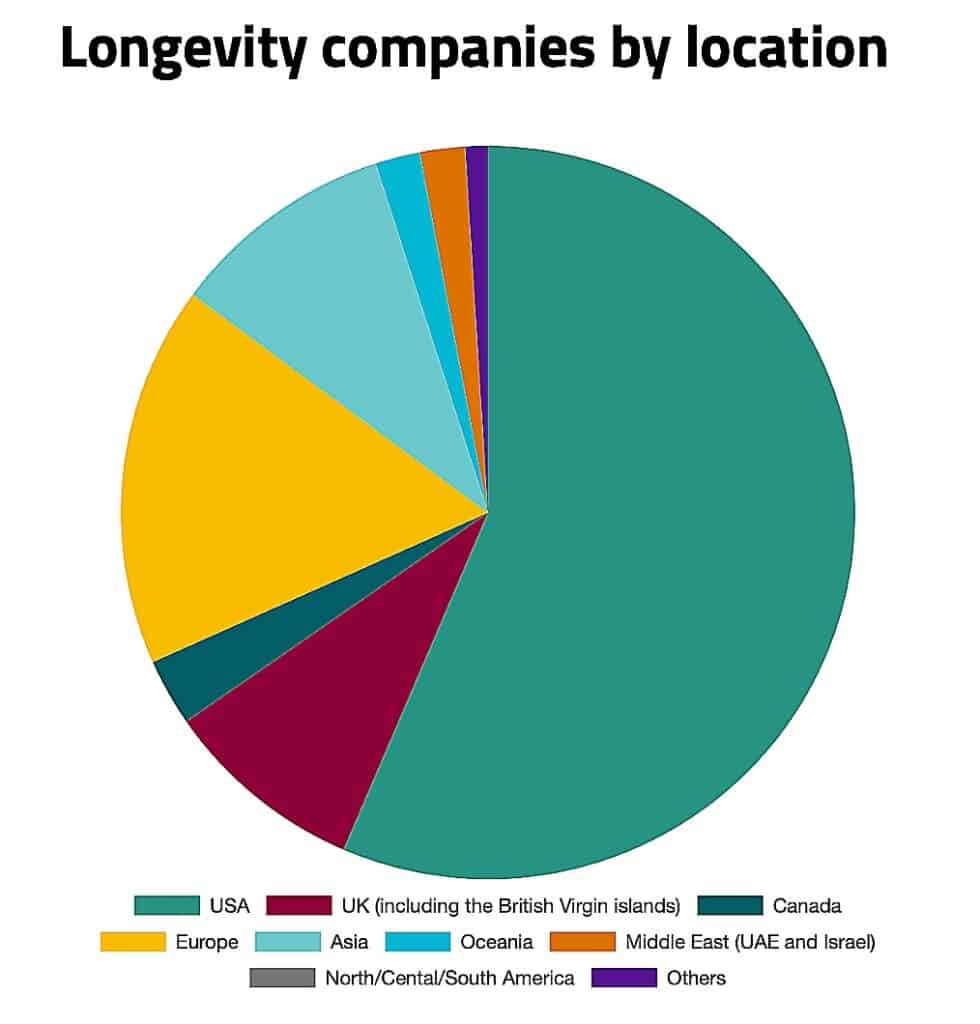

North America remains the dominant hub for longevity investment, with the United States alone accounting for more than half of global longevity companies and approximately 84% of global deal volume, according to the 2024 Annual Longevity Investment Report. Europe contributes a smaller but meaningful share, supported by strong activity in regenerative medicine and early-stage therapeutics. Asia-Pacific continues to expand, led by Singapore, Japan, and South Korea, though it represents a significantly smaller portion of global deal flow compared with North America.

Source: Longevity Technology

Sector funding in 2024 was led by AI-enabled discovery platforms, which raised approximately $2.65 billion, making it the highest-funded category of the year. Neurodegeneration and cellular-rejuvenation programs together attracted multiple billions globally, though not in equal or uniform bands. Consumer diagnostics and biomarker platforms also saw strong multi-hundred-million to multi-billion global inflows. Traditional supplements and general wellness products continued to receive minimal institutional capital, reflecting investor preference for regulated, technology-driven therapeutic innovation.

The 2025 Outlook

Three developments are set to influence the sector in 2025: clinical readouts from senolytic and aging-biology pipelines (e.g., Unity’s UBX1325 in ophthalmology), ongoing federal moves that could broaden Medicare coverage for GLP-1–based obesity treatments, and regulatory guidance that continues to treat aging as a risk factor rather than an approved indication, limiting pathways to disease-based endpoints.

The TAME (Targeting Aging with Metformin) trial remains an important long-term project. It is designed, per AFAR disclosures and FDA consultation, to test whether metformin can delay multiple age-related diseases through a composite endpoint. If successful, it would strengthen support for aging-mechanism interventions but would not itself create an FDA aging indication.

Valuations remain disciplined. BioAge trades at levels typical for a clinical-stage biotech with multiple assets, including its Phase 1 NLRP3 inhibitor. Unity’s valuation reflects significant execution and funding risk following layoffs despite earlier UBX1325 data. Larger companies such as Eli Lilly, Novo Nordisk, and AbbVie remain the most stable ways to gain exposure to longevity-related mechanisms through approved metabolic and inflammatory franchises.

Constructing a Longevity-Focused Portfolio

A longevity-focused portfolio typically combines large pharmaceutical companies with selective exposure to clinical-stage biotechs and, where available, late-stage private opportunities. This structure reflects the reality of drug-development risk: industry data consistently shows that only about 10–15% of drugs entering Phase I ultimately reach approval. Because early-stage programs frequently fail due to toxicity, lack of efficacy, or funding constraints, diversification across biological mechanisms, regulatory pathways, and development stages is critical.

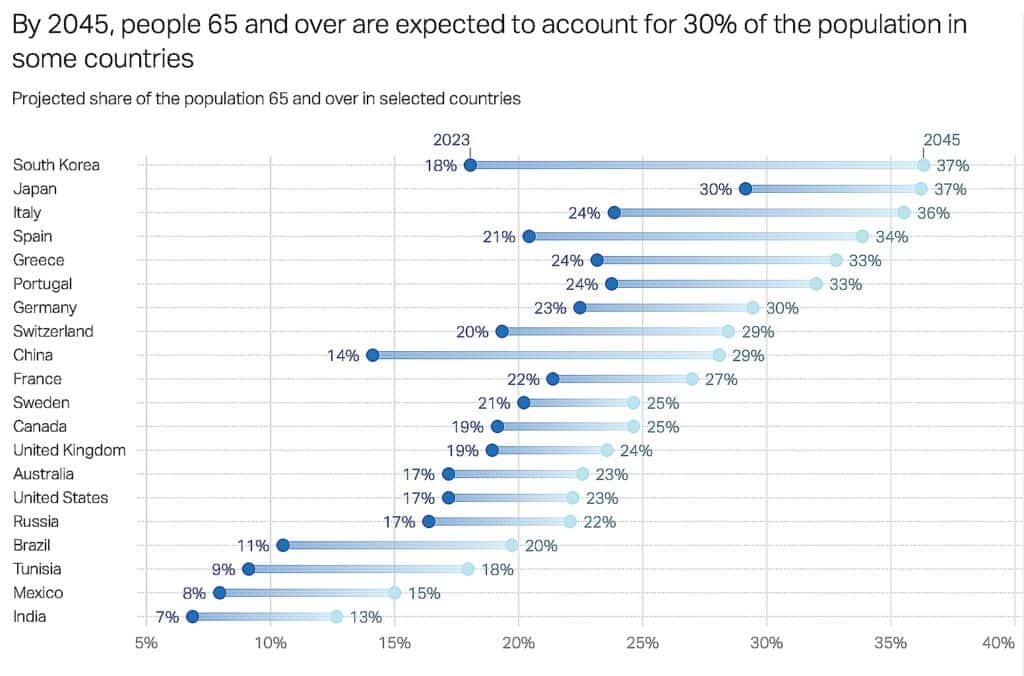

Long-term demand for healthspan-extending therapies is set to rise for decades as global populations age. Forecasts from major demographic research bodies project the number of adults over 60 and 65 to nearly double by 2050, dramatically increasing the prevalence of metabolic disease, neurodegeneration, frailty, and other aging-linked conditions. Within this backdrop, the companies advancing metabolic therapies, senolytics, partial reprogramming approaches, and next-generation diagnostics are positioned to shape one of the most important medical and investment narratives of the coming era.

Source: SwissInfo

The central challenge for investors is determining which technologies will translate into safe, scalable, commercially viable treatments. Many platforms show early biological promise but never reach late-stage validation. A disciplined, diversified approach remains essential as the field moves from speculative concepts toward measurable healthspan outcomes.