Avoid Overpaying the IRS: A Year-Round Tax Game Plan

5.9 min read

Updated: Jan 8, 2026 - 06:01:23

Most U.S. households quietly devote a significant share of their income to taxes, and for some families this amount can rival what they spend on housing, food, or healthcare. In many cases, manageable savings come from basic year-round tax planning rather than last-minute filing decisions. With the 2025 standard deduction at $15,750 (single) and $31,500 (married), increasing again for 2026 under current IRS guidance, families may be able to reduce taxable income through retirement contributions, HSAs, education credits, clean-energy incentives, and commonly missed deductions. The biggest gains often come from shifting your mindset from April “tax prep” to proactive, all-year planning.

- Maximize tax-advantaged accounts: 2025 limits include $23,500 for 401(k)s (plus $7,500 catch-up for eligible participants), $7,000 for IRAs, and $4,300 / $8,550 for HSAs depending on coverage.

- Track deductions in real time: mileage at 70¢ per mile (2025, as announced), home office calculations, equipment, education credits, and charitable contributions.

- Consider timing strategies: accelerating deductions or deferring income based on expected year-to-year changes; reviewing investment losses before December 31.

- Organize a year-round system: dedicated tax folders, receipt-capture apps, and periodic reviews to help avoid underpayment penalties and missed opportunities.

- Hire a professional when complexity increases: equity compensation, rentals, multi-state income, or business ownership often justify CPA-level planning.

Here’s an uncomfortable truth: for many American households, taxes represent one of their largest recurring expenses. A family earning $100,000 might pay $20,000 to $30,000 annually in federal, state, and payroll taxes depending on their circumstances. Yet while people comparison-shop for car insurance or negotiate cable bills to save modest amounts, they often treat taxes as an unchangeable force of nature.

It doesn’t have to be this way. The 2025 standard deduction is $15,750 for single filers and $31,500 for married couples filing jointly, increasing to $16,100 and $32,200 respectively for 2026 under current IRS guidance. Beyond these basics, the tax code includes many lawful provisions that may reduce taxes owed—retirement contributions, health savings accounts, education credits, energy incentives, and business expense deductions. The challenge is that many taxpayers never claim certain benefits, either because they are unaware of them or because they lack systems to track eligible expenses throughout the year.

This guide provides a practical, educational roadmap for approaching your 2026 tax situation. It focuses on well-established, IRS-recognized planning concepts rather than aggressive strategies or questionable “loopholes.” Outcomes depend on individual facts, eligibility rules, and current law.

The Mindset Shift: From Tax Preparation to Tax Planning

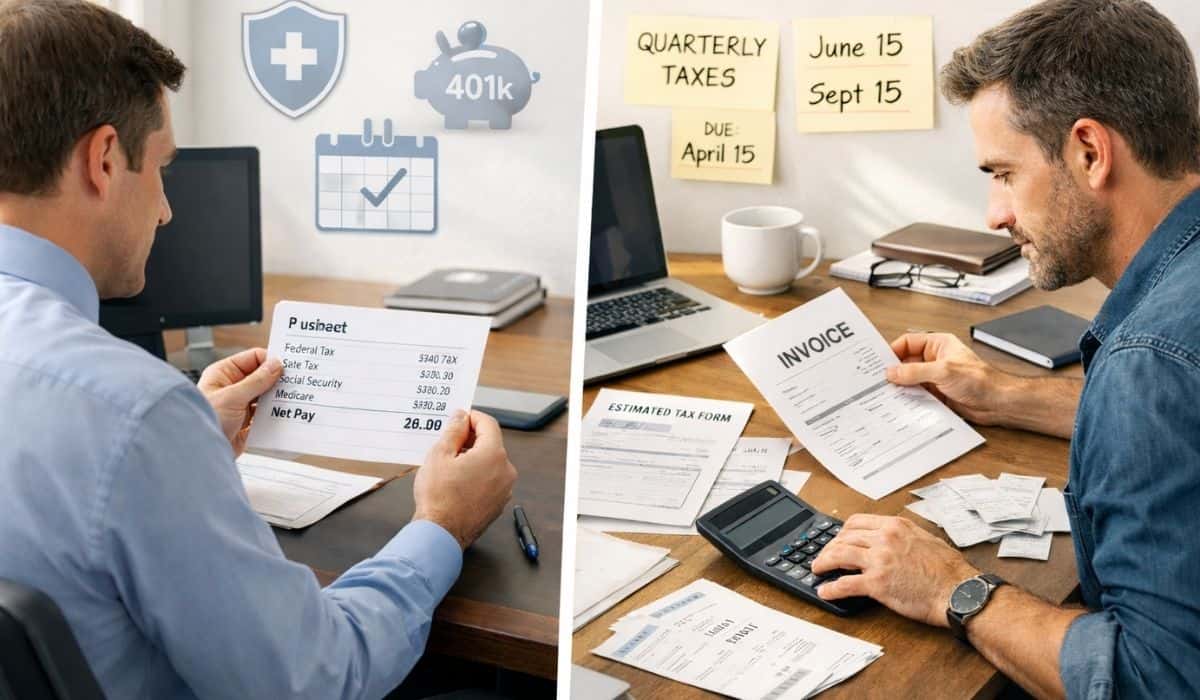

Many people confuse tax preparation—completing forms after the year ends—with tax planning, which happens throughout the year. Tax preparation is retrospective. Tax planning is forward-looking and considers how financial decisions may affect taxes over time.

The distinction matters because many tax-related opportunities require action before year-end. The 401k contribution limit is $23,500 in 2025, with a $7,500 catch-up contribution for those aged 50 and over. Decisions about retirement contributions, deductible expenses, or investment losses generally must be made during the tax year, not after it closes.

Tax planning also helps clarify the difference between marginal and effective tax rates. The seven federal tax rates range from 10% to 37%. Only income above each threshold is taxed at the higher rate, not all income. Understanding this distinction can help avoid common misconceptions about raises or additional income.

Viewing taxes as something you actively manage—within the law—often changes behavior. You may start asking how purchases affect taxable income, whether income should be deferred or accelerated, and which expenses might qualify for deductions or credits. Over time, these considerations can compound.

Structuring Your Financial Life for Tax Efficiency

The foundation of tax-aware planning involves understanding tax-advantaged accounts. Traditional IRA contribution limits remain $7,000 in 2025, plus a $1,000 catch-up contribution for eligible taxpayers. HSA contribution limits are $4,300 for self-only coverage and $8,550 for family coverage, with an additional $1,000 catch-up for those 55 and older.

For W-2 employees, contributing enough to capture an employer 401(k) match is often a starting point. Beyond that, the choice between traditional and Roth contributions depends on income level, time horizon, and expectations about future tax rates. There is no universal answer.

HSAs offer tax advantages when used for qualified medical expenses, but eligibility requires enrollment in a qualifying high-deductible health plan. While funds can roll over, contribution and withdrawal rules apply.

Side-hustlers and freelancers face additional considerations. Income and expenses generally flow through Schedule C. Forming an LLC may provide legal benefits, but it does not automatically change federal tax treatment. Clear separation of business and personal finances and thorough documentation remain essential.

Home office deductions are available only when strict IRS requirements are met, including regular and exclusive business use. Taxpayers can choose between the simplified method or actual expense allocation depending on their records.

Other commonly missed items may include equipment, software, professional education, and business mileage at 70 cents per mile for 2025. Credits such as the Earned Income Tax Credit can be valuable, but eligibility and amounts vary by income, filing status, and family size. The IRS has reported that some eligible taxpayers do not claim the credit according to the IRS. For 2025, eligible filers with three or more children may claim a maximum of $8,046, subject to eligibility rules.

Education expenses can generate tax benefits. The American Opportunity Tax Credit provides up to $2,500 annually for the first four years of college, while the Lifetime Learning Credit offers up to $2,000 for qualifying education. Student loan interest up to $2,500 may be deductible, subject to annual income limits.

Clean energy investments may qualify for incentives under current law. These credits are subject to documentation requirements and may change over time.

Charitable deductions are available to taxpayers who itemize and maintain proper records. Smaller donations, donated goods, and charitable mileage are often overlooked.

Timing strategies can sometimes shift income or deductions across years. Whether this is beneficial depends on expected income changes, tax brackets, and other factors.

When Professional Help Pays for Itself

Straightforward tax situations can often be handled with tax software. More complex scenarios—such as equity compensation, real estate activity, multi-state income, or business ownership—may benefit from guidance by a CPA or enrolled agent.

Professional fees vary. While savings are not guaranteed, advice can help clarify obligations, identify issues, and reduce the risk of costly reporting errors.

Building a Year-Round Tax System

Reducing filing-season stress often starts with basic organization. Maintaining folders—digital or physical—for income, expenses, investments, and property records can simplify year-end review.

Periodic check-ins throughout the year allow you to review withholding, estimated payments, and contribution progress before deadlines pass.

Your 30-Day Action Plan

Over the next month, consider taking a few practical steps to improve visibility into your tax situation.

- Create your tax organization system and begin filing documents as they arrive.

- Review withholding and retirement contributions to see whether they align with your expectations.

- Evaluate tax-advantaged accounts such as HSAs or IRAs, if eligible.

- Begin mileage and receipt tracking if you have deductible activity.

- Consider professional guidance if your situation is complex.

Taxes are a major financial obligation, but they are governed by defined rules and long-standing provisions. Thoughtful planning, accurate records, and timely decisions may help reduce unnecessary overpayment while remaining fully compliant. This article is for general educational purposes only and is not tax or legal advice.