How Much Life Insurance Do You Actually Need? A Simple Calculator Guide

7.8 min read

Updated: Dec 20, 2025 - 12:12:02

Most U.S. families underestimate how much life insurance they need, and 2024 Barometer Study shows that 42% would face hardship within six months if a primary earner died. Instead of guessing a round number, use a structured, income-based calculation that factors in immediate expenses, long-term goals, and existing resources to avoid leaving a financial gap. The formula below aligns with 2026 planning realities, current funeral and housing costs, and guidance.

- Add immediate obligations such as funeral costs, final bills, and housing payments.

- Replace after-tax income for 5–20 years depending on dependent ages; this remains the largest driver of coverage need.

- Include long-term goals like tuition, university and caregiving needs.

- Subtract existing resources including savings, retirement funds, and employer-provided life insurance.

- Use the full formula: Immediate obligations + Income replacement + Long-term goals – Existing resources. For comparison, see NerdWallet’s calculator or Policygenius’ calculator.

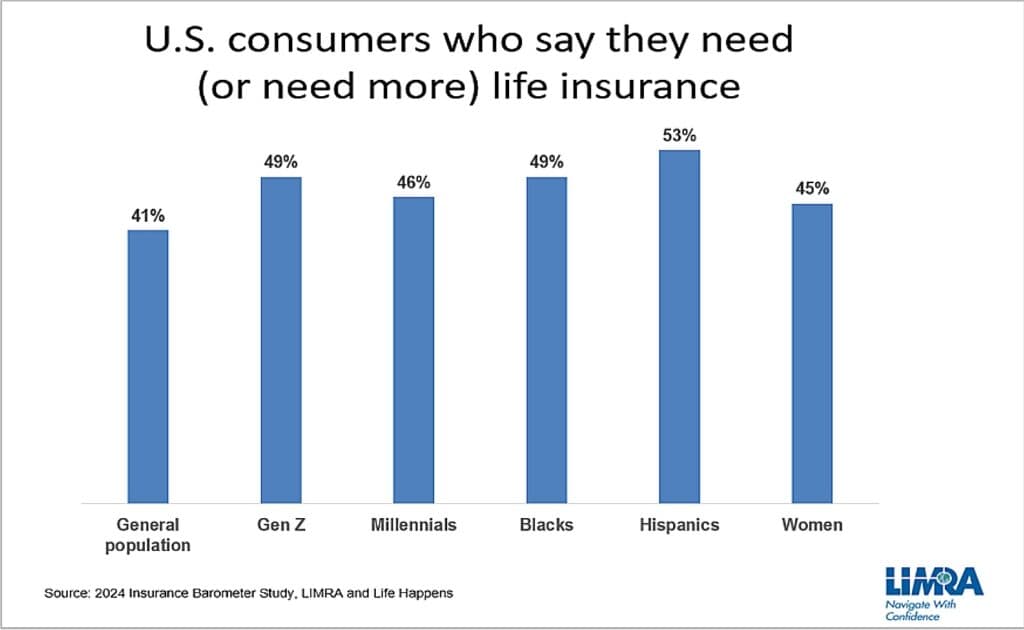

Most people buy life insurance with a guess. They pick a round number, hope it’s enough, and move on. But the data shows that guesswork leaves families exposed. According to the 2024 Insurance Barometer Study from LIMRA and Life Happens, 42% of Americans say they would experience financial hardship within six months of losing their household’s primary earner, and 106 million consumers report that they need more life insurance or need to get coverage for the first time.

Source: LIMRA

In other words, millions of families are underinsured, not because life insurance is complicated, but because most people have never used a structured process to calculate how much coverage they truly need.

This guide lays out a simple, rational, 2026-ready method to determine the correct amount of life insurance for your family. No guesswork, no fear-based sales tactics, just a real calculation based on income, liabilities, and long-term financial goals.

Start With the Real Question: What Financial Gap Would You Leave Behind?

Life insurance isn’t about the cost of death, it’s about the cost of life continuing without you. If your income disappeared tomorrow, your family would still face housing payments, monthly bills, outstanding debt, childcare expenses, education costs, and long-term savings goals.

Financial planners call this “income replacement,” and it remains the strongest indicator of how much coverage a household truly needs. Quick shortcuts like “10× your salary” can be helpful starting points, but they’re still broad averages. To calculate the right amount for your situation, you need a formula grounded in your actual income, obligations, and long-term financial priorities.

Step 1: Add Up Immediate Obligations

When someone dies, surviving family members face a series of costs that arrive quickly, long before income replacement even becomes a factor. These immediate obligations typically include:

-

Debts that remain within the estate

-

Mortgage or rent payments that still need to be made

-

Funeral and burial expenses

-

Medical bills related to the final illness

-

Legal or estate administration fees

Many households underestimate how significant these early expenses can be. According to data from the National Funeral Directors Association, the median cost of a funeral with burial in the U.S. is $8,300, based on its 2023 statistics.

Housing costs add another major burden. U.S. Census Bureau data shows that the median monthly mortgage payment in 2024 was $2,051, while median rent exceeded $1,500, according to the Census Bureau’s Housing Vacancies and Homeownership (HVS) report.

These expenses form the baseline of your life insurance calculation, the bills your family would need to cover immediately and predictably if your income disappeared.

Step 2: Calculate Income Replacement

Income replacement is the single largest component of life insurance planning. Your income is what sustains your family’s ongoing lifestyle, groceries, utilities, transportation, healthcare, childcare, education, and every recurring expense that keeps the household running.

Most financial planners recommend replacing income until the youngest dependent can reasonably support themselves. In practice, this often means:

-

20 years for families with young children

-

10 years for households with older children

-

5 years if a partner is nearing retirement

The commonly cited industry rule of 7× to 10× annual income is based on these realities. This guideline appears widely across consumer education resources, including the Insurance Information Institute’s guidance on how much life insurance you need.

But to calculate your actual requirement, a simple formula brings more accuracy:

Income replacement need = your after-tax annual income × number of years your family will rely on it

Using after-tax income matters because it reflects the real cash flow that disappears if you are no longer here, the money your family genuinely uses to live their everyday life.

Step 3: Add Long-Term Goals

Life insurance isn’t only about covering bills, it’s also about protecting the long-term opportunities and stability your family would otherwise lose. These goals often include:

-

University tuition

-

Childcare or long-term caregiving needs

-

Maintaining homeownership and preventing forced moves

-

Preserving your family’s current standard of living

-

Providing the surviving spouse time to adjust financially and emotionally

Education expenses alone can represent one of the largest long-term commitments. According to the College Board, the average annual cost of tuition, fees, room, and board at a four-year public university now exceeds $23,000, while private colleges average more than $54,000 per year.

When multiplied over four years, and especially for multiple children, these numbers escalate quickly. Including long-term goals ensures your family can pursue the same future plans, even if your income is no longer there to support them.

Step 4: Subtract Existing Resources

Once you know your obligations, income replacement needs, and long-term goals, the next step is determining how much of that burden is already covered. Many families already have some financial resources in place, including:

-

Personal savings

-

Retirement accounts (401(k), IRA)

-

Employer-provided life insurance

-

Investment accounts

-

529 college savings plans

-

Existing private life insurance policies

These assets reduce the size of the financial gap your life insurance must fill.

A common example is employer-provided coverage. Most companies offer basic group life insurance equal to 1× or 2× annual salary. While this amount is far below what most households require for true protection, it still offsets part of the need, and must be subtracted to calculate your actual coverage requirement.

The Simple 2026 Formula

Once you’ve identified each part of your family’s financial picture, you can calculate your total coverage need with a single clear equation:

Life insurance needed = Immediate obligations + Income replacement + Long-term goals – Existing resources

This framework reflects the same methodology used by the leading consumer calculators on the market today. If you want to compare your results or test different scenarios, you can use tools like:

-

NerdWallet’s life insurance calculator

-

Policygenius life insurance calculator

Both tools follow the same principles: quantify the financial gap your family would face, then size your coverage to fill it. This approach ensures that your policy isn’t based on guesswork, it’s based on your real financial life.

Why Stay-at-Home Parents Need Coverage Too

One of the most common mistakes in life insurance planning is assuming that non-earning parents need only minimal coverage. In reality, the economic value of a stay-at-home parent is substantial. Their work covers childcare, transportation, household management, meal preparation, scheduling, and emotional labor, services that become expensive to replace.

Childcare alone illustrates the scale of this cost. According to Care.com’s national survey, average childcare expenses range from $226 to $800 per week, depending on the child’s age, the type of care, and the family’s location.

If a stay-at-home parent were suddenly absent, the surviving partner would often need to hire multiple services, part-time childcare, housekeeping, transportation support, or after-school care, all of which add significant monthly expenses.

In other words, even without an income, a stay-at-home parent contributes economic value that must be protected. Appropriate life insurance ensures that the family’s stability does not disappear along with that essential support.

Why Term Length Matters Just As Much As Dollar Amount

Choosing the right life insurance policy isn’t only about how much coverage you buy, it’s also about how long that coverage needs to last. Term length determines how many years your family is protected at your current age and health rating.

Buying a term that’s too short can become an expensive mistake. When a policy expires, you’re forced to reapply at an older age, and potentially in worse health, both of which drive premiums sharply higher.

Industry data illustrates how steep the increases can be. According to analysis from Policygenius, life insurance premiums typically rise 9% to 12% for every additional year of age once applicants reach their 40s and 50s.

This means renewing later often costs far more than securing a longer term today. For families with young children, long mortgages, or multi-year financial goals, locking in a longer term at a younger age usually delivers the best long-term value.

The Bottom Line

People don’t fail to buy life insurance because the math is complicated, they fail because no one shows them a clear, rational method for calculating what they actually need. When you total your immediate expenses, replace income for the right number of years, account for long-term goals, and subtract existing resources, the real number emerges. And it’s often very different from the quick guesses most people rely on.

Life insurance can’t erase loss, but it can prevent financial freefall at the worst possible time. A proper, data-driven calculation ensures your family inherits stability, not uncertainty, and gives them the financial space to grieve, recover, and rebuild without fear.