Borrowing Beyond Borders: How US Business Owners Can Tap Global Lenders in 2025

8.5 min read

Updated: Dec 20, 2025 - 08:12:40

U.S. businesses expanding internationally can borrow from overseas lenders, but access depends on the type of global capital channel they use. While there’s no single cross-border small-business loan, American companies with foreign sales, subsidiaries, or project investments increasingly qualify for financing through development finance institutions, marketplace lending programs, revenue-based financing models, and regional fintech lenders.

- DFIs such as the U.S. International Development Finance Corporation fund U.S.-led overseas projects using long-term loans, guarantees, and risk-mitigation tools.

- Marketplace lenders like Amazon Lending, Shopify Capital, PayPal Working Capital, and Stripe Capital use global sales data to underwrite U.S. businesses across borders.

- International revenue-based financing providers, including Wayflyer, Uncapped, Clearco, and Capchase, fund U.S. companies based on real-time Stripe, Shopify, Amazon, and PayPal data.

- Regional fintech lenders can finance locally registered foreign subsidiaries of U.S. companies operating in markets like Mexico, Brazil, or Southeast Asia.

- Cross-border borrowing adds complexity, currency exposure, governing law, data-access requirements, and licensing checks all matter before signing an international loan agreement.

For most U.S. small business owners, borrowing money from a lender outside the United States still feels unfamiliar. Traditionally, companies have relied on domestic options such as banks, SBA-backed loans, online lenders, and business credit cards. But by 2025, American businesses are increasingly global. Many sell internationally through ecommerce platforms, maintain overseas supply chains, or explore foreign retail expansion.

This shift raises an important question: Can a U.S. business borrow from a lender based overseas, and are there international lenders that serve American companies?

The answer is yes, but access varies. There is no single global bank that lends universally across borders. However, U.S. companies can access funding through a growing mix of channels, including development finance institutions, cross-border marketplace lending platforms, revenue-based financing models, and regional fintechs that operate internationally.

For American businesses entering new markets or building global revenue streams, these emerging lending pathways can offer meaningful and sometimes strategically valuable sources of capital.

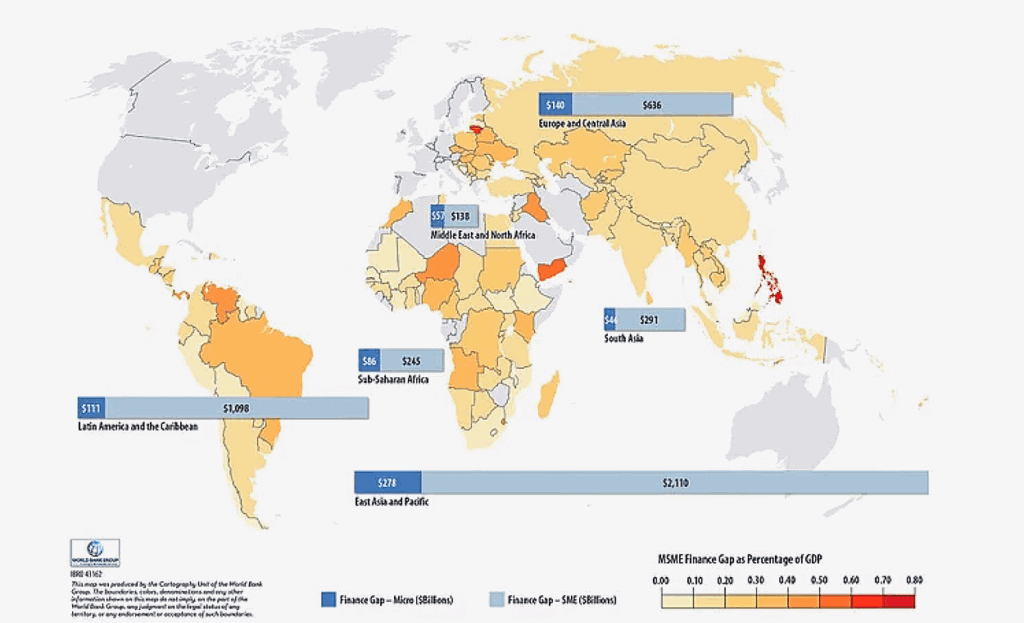

The Global SME Financing Landscape

Small and mid-sized businesses worldwide face a significant financing gap, as documented by global institutions. Traditional banks remain cautious, especially when evaluating SMEs with limited collateral, short credit histories, or exposure to cross-border risk. As a result, two major groups increasingly fill this space:

- Government-backed development finance institutions (DFIs): DFIs provide credit lines, guarantees, and risk-sharing programs that help expand lending to SMEs, particularly in international or emerging-market contexts.

- Fintech lenders using real-time business performance data: These lenders analyze transaction flows, receivables, and digital sales activity rather than relying solely on traditional collateral, enabling faster and more flexible underwriting.

US businesses are not always the primary audience for these global financing channels. However, American companies with international operations, such as export activity or overseas customers, often qualify for the cross-border lending models outlined in broader global analyses of SME finance.

Source: World Bank Group

1. Development Finance Institutions: Global Capital for US Led Overseas Projects

For U.S. companies planning to expand or invest outside the United States, development finance institutions (DFIs) offer some of the most reliable and impactful sources of international financing. These organizations specialize in supporting private-sector growth in emerging markets, where traditional banks often hesitate due to risk, regulation, or political uncertainty.

What They Are

Development finance institutions are government-backed or multilateral organizations that provide long-term capital, guarantees, and risk-mitigation tools to private businesses operating abroad. Their mission is to promote economic development, stabilize markets, and encourage responsible investment.

Key DFIs include:

-

The U.S. International Development Finance Corporation, which provides long-term loans, guarantees, equity, and political risk insurance through its official program offerings.

-

A global private-sector development institution that finances companies in emerging markets, detailed on its private-sector financing page.

-

A regional development institution that supports private-sector growth across Latin America and the Caribbean through its private-sector financing portal.

-

A major Asia-focused institution that funds infrastructure, energy, and technology projects via its private-sector operations page.

These organizations are designed to support projects with measurable development impact, such as job creation, sustainability improvements, and infrastructure expansion.

What They Fund

DFIs commonly support sectors that promote long-term economic value. Typical project categories include:

-

Manufacturing and industrial facilities

-

Renewable energy and clean-power infrastructure

-

Technology, telecom, and data center development

-

Healthcare facilities and medical production

-

Retail and consumer expansion in emerging markets

-

Logistics hubs, warehousing, and supply chain upgrades

Their financing tools typically include:

-

Long-term loans for project development and expansion

-

Loan guarantees to help businesses secure additional funding

-

Equity investments in high-impact ventures

-

Political risk insurance, available through dedicated risk-mitigation programs

These offerings help U.S. businesses operate confidently in higher-risk international markets.

Limitations

While DFIs are powerful partners, they follow strict rules:

-

They do not provide general working capital for U.S.-only operations.

-

Funding is reserved for overseas projects with clear development impact.

-

Businesses must meet environmental, social, and governance standards that exceed typical commercial banking requirements.

-

Projects must demonstrate long-term commercial viability.

In short, DFIs are best suited for U.S. companies expanding internationally, not for domestic cash-flow needs.

2. Marketplace Financing: When Global Platforms Become the Lender

One of the most accessible forms of cross-border financing now comes from ecommerce and payments platforms. Programs such as Amazon Lending, Shopify Capital , PayPal Working Capital, and Stripe Capital rely on sales performance instead of traditional bank underwriting.

Because these platforms operate internationally, the funding behind their lending programs often comes from global capital providers. As a result, a U.S. business may receive financing sourced from a partner lender based in another country, even while selling through a U.S. storefront.

This matters because:

-

Your financing follows your sales data, not your location

-

Marketplaces enable cross-border underwriting

-

Expanding into international marketplaces can automatically unlock additional funding programs

For U.S. owners entering foreign Amazon marketplaces or operating global Shopify storefronts, marketplace financing is often the simplest first step toward accessing international capital.

3. Revenue Based Financing: A Borderless Model That Follows Your Revenue

Revenue-based financing (RBF) has become one of the most globally accessible funding options for U.S. companies expanding across borders. Instead of relying on collateral, personal guarantees, or domestic banking rules, RBF providers supply capital in exchange for a fixed percentage of future revenue. This makes underwriting dependent on actual performance, not location.

Leading international RBF providers include:

-

Wayflyer — growth capital for ecommerce brands

-

Uncapped — non-dilutive funding for online businesses

-

Clearco — revenue-linked financing for ecommerce and DTC companies

-

Capchase — recurring-revenue financing for SaaS companies

Many of these companies are headquartered outside the U.S. yet actively lend to American businesses, giving U.S. owners access to global capital without traditional banking barriers.

Why RBF Works Across Borders

RBF providers underwrite companies based on real-time, platform-verified data. These lenders connect directly to systems such as:

-

Stripe

-

Shopify

-

Amazon

-

PayPal

-

Subscription billing platforms (e.g., Chargebee, Recurly, Paddle)

-

Cloud accounting tools (e.g., QuickBooks, Xero)

Because this data is globally standardized and independently verifiable, RBF lenders can assess risk regardless of borders. This makes the model especially attractive for ecommerce sellers, cross-border marketplace brands, and SaaS companies with international revenue streams.

Limitations

Revenue-based financing is best suited for companies with:

-

Predictable recurring or monthly revenue

-

Steady transaction volume

-

Sufficient margins to support revenue-share repayments

Businesses with irregular sales cycles, seasonality issues, or thin margins may not qualify or may receive smaller offers.

4. Cross Border Fintech Lenders: Useful if You Operate Local Entities Abroad

In many emerging markets, fintech lenders have become a major source of financing for small and mid-sized businesses. These platforms are often backed by global investment firms from the U.S. or Europe, enabling them to offer fast, data-driven credit to local SMEs.

While these lenders generally do not lend directly to U.S.-based companies, they can fund the locally registered subsidiaries of American businesses. If a U.S. owner establishes a legal entity in markets such as Mexico, Brazil, the Philippines, or Vietnam, that local entity may qualify for financing through regional fintech lenders that specialize in supporting SMEs operating inside those economies.

This isn’t a global lending solution for the U.S. parent company itself, but it becomes strategically valuable when American businesses set up on-the-ground operations overseas. By using a properly registered foreign entity, U.S. owners can tap into local fintech credit lines, revenue-based financing, and digital SME loan programs that would otherwise be inaccessible.

Important Considerations When Borrowing Across Borders

International borrowing can create meaningful opportunities for U.S. business owners, but it also introduces additional layers of financial, legal, and operational complexity. Before accepting any cross-border financing, companies should evaluate the following risks:

Currency risk: Borrowing in euros, pounds, or other foreign currencies can expose your business to exchange-rate fluctuations. If the dollar weakens, your repayment costs may rise.

Governing law: Many international loan agreements are governed by English law or EU commercial law. Understanding which jurisdiction applies, and how disputes are resolved, is essential before signing a contract.

Data access requirements: Marketplace lenders and revenue-based financing providers often require ongoing access to your bank transactions, sales dashboards, payment processors, or ecommerce platforms. Expect continuous data sharing as part of the underwriting and repayment process.

Licensing and compliance: Verify that the lender is properly licensed in its home country. Also confirm whether your U.S. entity, or any foreign subsidiary, triggers reporting requirements under U.S. or local regulatory frameworks.

These considerations do not diminish the value of cross-border financing, but assessing them carefully helps ensure that international borrowing supports long-term stability rather than adding avoidable risk.

The Bottom Line for US Business Owners

Most U.S. companies will still rely on domestic lenders for everyday financing. But for businesses expanding abroad, global capital is now more accessible than ever. Development finance institutions, marketplace lending programs, revenue-based financing, and regional fintech lenders each offer pathways that support international growth.

There’s no universal global small business loan, but the world’s capital markets are far more open to U.S. entrepreneurs than in the past. For any business entering new countries or building global revenue streams, understanding these cross-border lending options is increasingly essential.