The Real Cost of Property Ownership: Understanding and Managing the $16,000 Annual Burden

9.4 min read

Updated: Dec 20, 2025 - 08:12:08

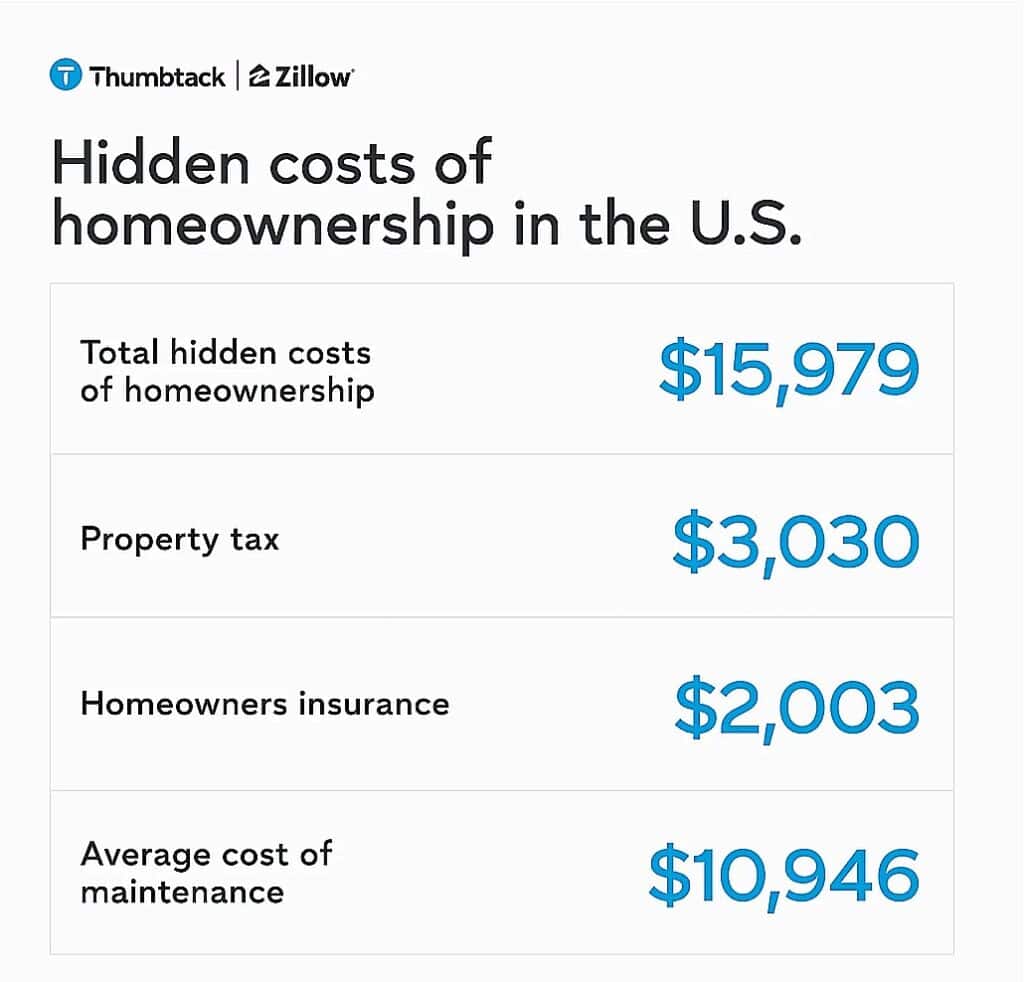

New data from Zillow and Thumbtack shows U.S. homeowners now spend an average of $15,979 per year, about $1,300 per month, on non-mortgage costs like maintenance, insurance, and property taxes. These expenses are rising 4.7% annually, outpacing the 3.8% growth in household income, and they increasingly reshape what “affordable” homeownership means across states and metro areas.

- Maintenance leads costs at $10,946 annually, reflecting essential repairs and routine upkeep required to preserve home value.

- Homeowners insurance has surged 48% since 2020, with markets like Miami seeing 72% premium jumps that act like a second mortgage.

- Property taxes average $3,030 per year and often rise with reassessments; reviewing valuations annually can prevent overpayment.

- Preventive maintenance, guided by ENERGY STAR HVAC recommendations, helps avoid high-cost emergencies.

- Financial planners recommend saving 1%–3% of home value annually to manage repairs, stabilize budgets, and sustain long-term affordability.

When most people calculate the affordability of buying a home, they focus on the mortgage payment. It’s the biggest number, the most visible cost, and the one that determines whether a bank will approve your loan. But new data from Zillow and Thumbtack shows a sobering reality: the mortgage is just the beginning.

Homeowners across America now spend an average of $15,979 per year on the hidden costs of homeownership, expenses that go well beyond the monthly payment. That’s more than $1,300 every month for maintenance, homeowners insurance, and property taxes. Even more concerning, these costs are rising 4.7% annually, outpacing household income growth of just 3.8%. The gap between what homes cost to maintain and what families can afford is widening, fundamentally reshaping what it means to own property in today’s market.

Source: Zillow

Breaking Down the $16,000 Question

The three major categories driving these rising expenses highlight the real challenges of modern homeownership. Maintenance leads the pack at $10,946 annually, reflecting the ongoing work required to keep a home functional and preserve its long-term value. This includes routine tasks like gutter cleaning and HVAC servicing, seasonal projects such as lawn care, and occasional repairs like fixing a leaky roof or replacing a worn water heater.

Property taxes contribute another $3,030 on average, though this number varies widely by location and often increases as local governments update assessed values and tax rates. Homeowners insurance adds $2,003 annually, a cost that varies significantly across regions and remains one of the fastest-growing expenses owners face.

These aren’t optional expenses that homeowners can simply avoid. They represent the necessary cost of preserving a home’s value, keeping it safe and livable, and protecting the investment from catastrophic loss. Yet many buyers, especially first-time purchasers focused mainly on qualifying for a mortgage, continue to underestimate the size and importance of these ongoing financial commitments.

Where the Hidden Costs Hit Hardest

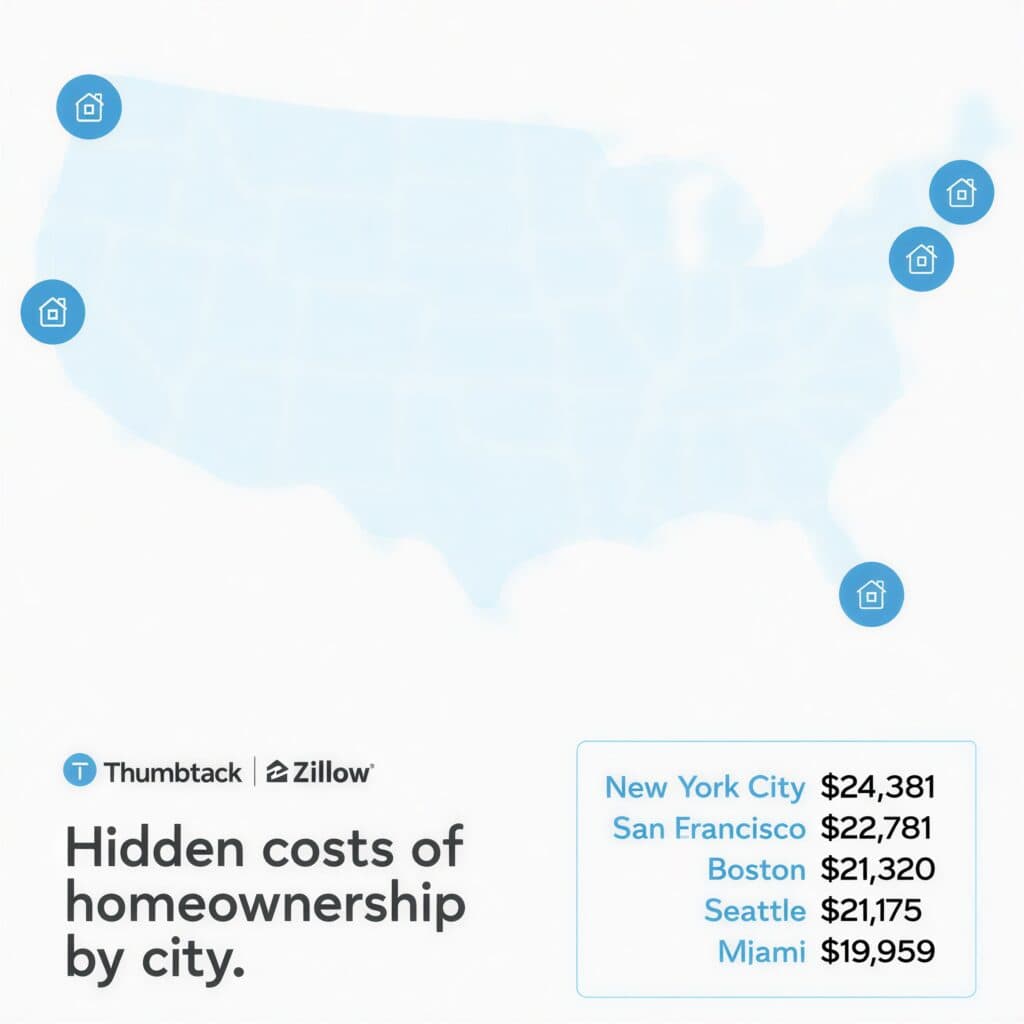

Geography plays an enormous role in determining your total hidden costs. In already expensive coastal markets, these expenses compound existing affordability challenges. New York City homeowners face the highest burden at $24,381 per year, followed by San Francisco at $22,781 and Boston at $21,320. These figures come on top of some of the nation’s highest mortgage payments, creating a double squeeze that makes homeownership increasingly difficult to sustain.

The insurance component deserves special attention because it has become a crisis within the broader affordability picture. Nationwide, premiums have surged 48% since February 2020, as noted in the Zillow report. But certain markets have seen increases so steep they threaten to price homeowners out of coverage entirely. Miami homeowners now pay an average of $4,607 annually, a 72% jump over the past five years. Similar spikes have occurred across Florida: 72% in Jacksonville, 69% in Tampa, and 68% in Orlando.

Source: Zillow

Outside Florida, the insurance squeeze continues. New Orleans has seen premiums climb 79%, Sacramento 59%, Atlanta 58%, and Riverside, California 56%. These increases stem from a mix of more frequent and severe weather events, rising construction costs, and insurers reassessing risk in climate-vulnerable areas. For homeowners in these markets, the insurance bill alone can resemble a second mortgage.

The Maintenance Money Pit: Understanding What You’re Really Paying For

The $10,946 average annual maintenance cost, reflects a wide range of essential work required to keep a home safe, functional, and in good condition. While individual expenses vary, common industry estimates help illustrate how this total takes shape. HVAC maintenance typically runs $300 to $500 annually for routine servicing of heating and cooling systems. Roof upkeep, including inspections and minor repairs, can average $400 to $800 per year when spread across the roof’s lifespan.

Lawn care and landscaping services often cost $1,200 to $2,400 annually, depending on property size and climate. Gutter cleaning and tree trimming add another $400 to $600. Appliance repairs and occasional replacements contribute as well, along with less frequent but higher-cost projects such as exterior painting, deck maintenance, plumbing fixes, and electrical work. While homeowners may not spend this exact amount every year, these expenses tend to average out over time. One year may involve only routine upkeep, while another brings a new water heater, storm-related roof repairs, or a failed air conditioner.

Strategies to Lower Your Hidden Homeownership Costs

While you can’t eliminate these costs entirely, smart maintenance can meaningfully reduce them. Preventive upkeep is the most effective approach, small fixes now prevent expensive emergencies later. A typical roof inspection costing $150–$300 can catch early shingle damage and help avoid major repairs. Regular HVAC servicing also extends system life and reduces the risk of peak-season breakdowns with premium emergency fees.

A Thumbtack homeowner survey found that 65% of homeowners said their issues could have been prevented with proactive maintenance. Following a schedule helps: inspect HVAC systems twice a year using ENERGY STAR’s HVAC maintenance guidance, clean gutters in spring and fall, check the roof after storms, service the water heater annually, and complete seasonal tasks like disconnecting hoses before winter.

Basic DIY maintenance, painting, landscaping, gutter cleaning, replacing air filters, caulking, and minor plumbing, can save significant labor costs. But major plumbing, electrical work, roofing, and structural repairs should be handled by licensed professionals, as failed DIY attempts often cost more to fix than hiring a pro initially.

Smart Shopping for Professional Help

When you need to hire professionals, building long-term relationships with reliable contractors can lead to better pricing and service. Contractors who know you as a repeat customer may offer discounts, prioritize your projects, or provide advice that helps prevent future problems. Always get multiple quotes for major work, but don’t automatically choose the lowest bid. Licensed and insured professionals with solid references may cost more upfront but often deliver durable work and provide recourse if issues arise.

Bundling maintenance tasks can also lower costs. Instead of calling someone for each small repair, make a list and complete several items in one visit to reduce trip charges. Some homeowners coordinate with neighbors, bringing a contractor to multiple homes on the same day to secure volume pricing. Timing matters too, HVAC companies usually offer lower rates during off-season maintenance periods, and roofing contractors may be more flexible with pricing during slower winter months.

Tackling Insurance and Property Tax Costs

Insurance premiums operate on risk-based pricing, but homeowners still have practical ways to manage what they pay. Shopping around once a year is essential because insurers adjust rates differently, and your current provider may not offer the most competitive price. Bundling home and auto policies can typically reduce costs by 10%–25%, and raising your deductible, from $500 to $1,000 or $2,500, can lower premiums if you have the savings to cover a higher out-of-pocket expense.

Risk-reducing upgrades can also make a measurable difference. Impact-resistant roofing, storm shutters, updated wiring or plumbing, and monitored security systems signal lower risk to insurers and often qualify for targeted discounts. In states where private insurance has become too expensive or unavailable, state-backed insurance pools may serve as a last-resort option, though they generally offer less comprehensive coverage.

Property taxes require regular review as well. Comparing your assessed value with similar homes can reveal errors that inflate your bill. If the valuation seems high, filing an appeal with recent sales data or documentation of property issues can lead to a successful reduction. Many jurisdictions also offer exemptions for seniors, veterans, or primary residences that help lower the tax burden.

The Investment Mindset: Planning and Budgeting for Reality

Smart homeowners treat hidden homeownership costs as long-term investments in their property’s value and livability rather than unexpected emergencies. Financial experts commonly recommend setting aside 1% to 3% of a home’s value each year for maintenance and repairs. For a property valued at $300,000, this translates to $3,000 to $9,000 annually. Broken down monthly, that equals $250 to $750 per month, which provides a realistic benchmark for planning.

Creating a dedicated maintenance and repair fund helps you manage these expenses without disrupting your regular budget. It covers routine upkeep, provides a safety cushion when unexpected issues arise, such as a broken water heater or storm damage, and ensures you can address problems promptly before they become more costly.

Building this fund takes consistency, especially in the early years of homeownership, but it transforms unpredictable repairs into manageable, planned-for costs. Over time, this approach not only protects your finances but also helps preserve your home’s long-term value and livability.

Special Considerations for Rental Property Owners

Rental property owners face the same hidden costs as homeowners, along with added responsibilities. Tenant turnover often brings cleaning, repairs, and updates to keep the unit marketable. Regular inspections help catch problems early, and clearly outlining basic maintenance expectations in the lease can reduce preventable damage. Still, landlords cannot delay essential repairs without risking tenant complaints, habitability issues, code violations, or legal consequences.

Many experienced landlords budget 15%–20% of rental income for maintenance, repairs, and periodic improvements, recognizing that well-kept properties attract stronger tenants and support higher rents. Building reliable relationships with contractors is especially important since landlords often need quick, quality service to maintain tenant satisfaction. Some owners rely on property-management companies to coordinate repairs, though this adds another cost. The goal is to view maintenance as necessary for protecting the property’s income-producing value, not as an optional expense.

Looking Forward: Making Homeownership Sustainable

The new Zillow and Thumbtack data shows that the mortgage payment is only one part of the true cost of owning a home. Homeowners now spend an average of $15,979 per year, about $1,300 a month, on maintenance, homeowners insurance, and property taxes. These costs are rising 4.7% annually, faster than the 3.8% growth in household income. This widening gap is making it more important than ever to budget for the full cost of owning a home.

Prospective buyers should factor these expenses into affordability calculations rather than focusing only on the mortgage. Adding the $1,300 monthly average to the estimated payment provides a clearer picture of what owning a home realistically costs. Current homeowners can reduce financial strain by reviewing their spending, prioritizing preventive maintenance, and building emergency reserves to handle repairs before they become major issues.

These expenses aren’t truly hidden, they’re just often ignored until they show up as urgent and unavoidable. Understanding what they include and how quickly they’re increasing allows both buyers and owners to plan more effectively. A home may build long-term value, but maintaining it requires consistent investment. Planning for these costs, rather than being surprised by them, is the key to sustainable homeownership in today’s market.