Health Insurance Premiums: What Open Enrollment Means for Your Wallet

11.9 min read

Updated: Dec 20, 2025 - 12:12:24

As 2026 approaches, Americans face sharply diverging health-insurance costs. The biggest risk is the scheduled December 31, 2025 expiration of enhanced Affordable Care Act subsidies, which could cause premiums to more than double for millions, far outpacing the more modest Medicare and FEHB increases. Analyses show average subsidized premiums rising 136% nationwide if Congress does not act, with far higher spikes in high-cost states. CMS’ 2026 rules confirm notable but manageable increases to Medicare Part B premiums and deductibles. Federal employees in discontinued FEHB plans could see extreme jumps unless they actively choose a new option during Open Season.

- Enhanced ACA subsidies ending in 2025 would trigger dramatic 2026 premium hikes, over 100% nationally and more than 300% in states like Alaska.

- Low-income, middle-income, older adults, and high-cost states face the steepest affordability cliff as premiums rise across all metal tiers.

- CMS confirms 2026 Medicare Part B premiums rising to $195.70, with deductibles increasing to $283, moderate compared with ACA changes.

- About 32,000 FEHB enrollees in discontinued plans will default into costly GEHA High unless they switch during Open Season.

- Most consumers can still manage costs by shopping plans, checking networks, reviewing drug coverage, and maximizing available assistance.

As November open enrollment begins, Americans are entering a rapidly shifting health-insurance landscape. For those using Affordable Care Act marketplaces, the amount they pay in premiums could more than double in 2026 if the enhanced subsidies enacted under recent federal laws expire at the end of 2025. Medicare beneficiaries are also facing notable cost increases, with monthly Part B premiums and deductibles rising for the upcoming year. These developments make it essential for households to review their coverage options carefully and prepare for potentially higher health-insurance expenses ahead.

The Affordable Care Act Marketplace: A Crisis of Affordability

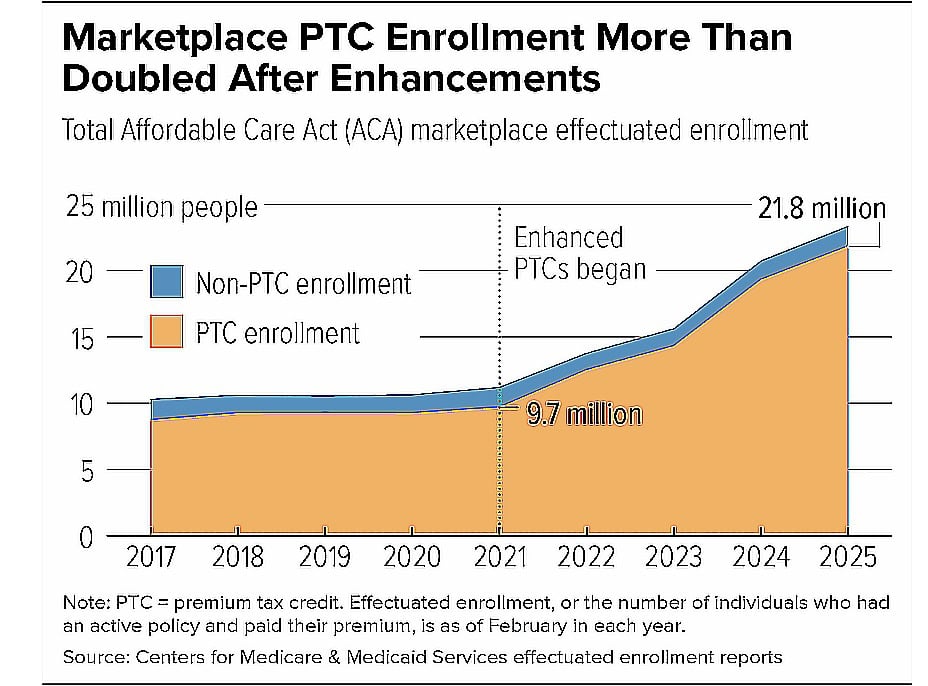

The most significant health-insurance changes affect the 24 million Americans who rely on HealthCare.gov and state marketplaces. These enrollees face a perfect storm in 2026: insurer premium hikes combined with the scheduled expiration of enhanced federal subsidies that have kept coverage affordable since 2021.

Insurers have raised premiums by an average of 18% for 2026 due to higher medical costs, increased use of GLP-1 drugs like Ozempic and Wegovy, rising hospital prices driven by workforce shortages and consolidation, and concerns about a sicker risk pool if subsidies expire. For subsidized enrollees, the real shock comes from the potential loss of enhanced premium tax credits.

The Enhanced Subsidy Cliff

Since 2021, enhanced subsidies expanded eligibility above 400% of the federal poverty level, capped premiums at 8.5% of household income, increased support for low-income enrollees, and helped marketplace enrollment grow from 11.2 million in 2021 to 23.4 million by February 2025. These enhancements expire December 31, 2025, creating a sharp affordability cliff for 2026.

Source: CBPP

State-by-State Cost Impact

Urban Institute and Center for American Progress analyses show that subsidized premiums would rise 136% nationally if enhanced subsidies end. The steepest projected increases include 346% in Alaska, 207% in Connecticut, 195% in West Virginia, and 183% in Vermont. Large states also face substantial jumps, including 122% in California, about $1,000 more annually, and 132% in Florida, about $520 more annually. Texas also expects significant increases across major rating regions.

Even the lowest-cost Bronze plan becomes far more expensive. With subsidies in place, the average HealthCare.gov enrollee would pay about $50 per month in 2026, a modest $13 increase from 2025. Without enhanced subsidies, premiums across all metal tiers rise dramatically.

Who Gets Hit Hardest

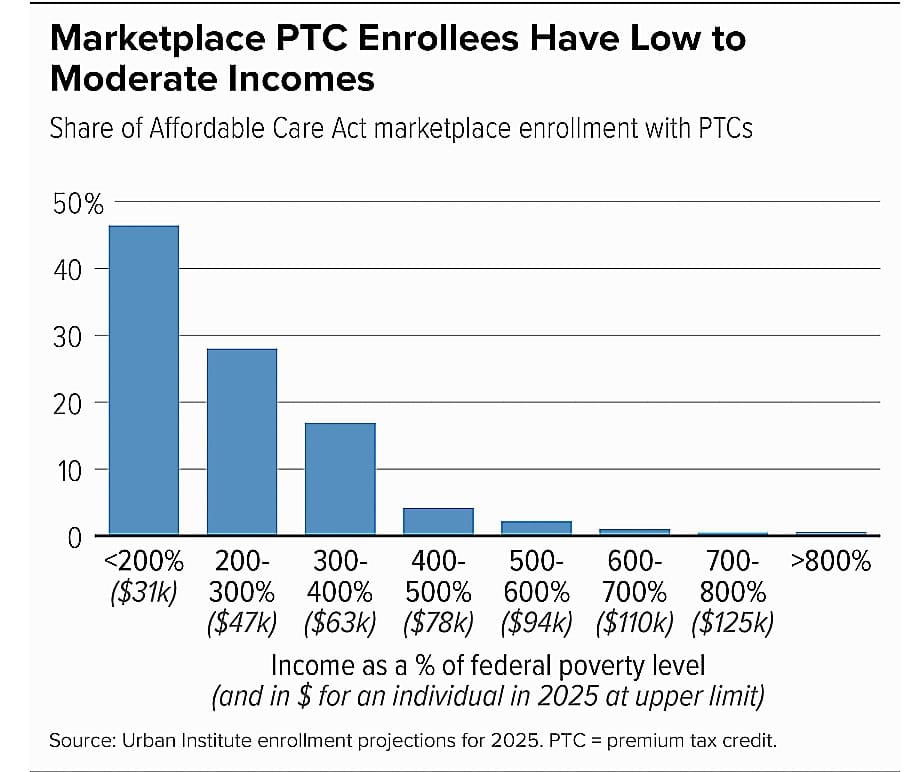

Near-poverty households between 100 and 200% of the federal poverty level, whose enrollment grew 143% since 2021, could see premiums jump from nearly $0 today to hundreds per month. Middle-class enrollees above 400% FPL would lose all subsidy eligibility and face full premiums.

Source: Source: CBPP

Older adults, who can be charged three times more than younger enrollees, would experience the largest dollar-amount increases. High-cost states such as Alaska, Connecticut, Vermont, and West Virginia face the steepest spikes. Racial and ethnic minorities, whose enrollment surged under enhanced subsidies, up 186% for Black enrollees and 158% for Latino enrollees, would be disproportionately affected.

Real Stories, Real Consequences

The impact is already visible. Texas resident Elizabeth Wick saw her premium rise from $862 to $1,380 per month without enhanced subsidies. Chris and Donna Vetter dropped coverage entirely because they cannot afford 2026 premiums. Cancer survivor Kimberly Montgomery saw her premium jump to $1,758 per month, putting essential follow-up scans and treatment at risk.

This is the affordability crisis the ACA marketplace faces if enhanced subsidies are allowed to expire.

Medicare: More Modest but Meaningful Increases

Medicare beneficiaries will see modest but meaningful cost increases in 2026. According to the Centers for Medicare & Medicaid Services, the standard Part B premium will be $195.70 in 2026, up $10.70 from 2025, and the Part B deductible will rise from $257 to $283. CMS notes that the increase reflects normal trends in medical prices and utilization.

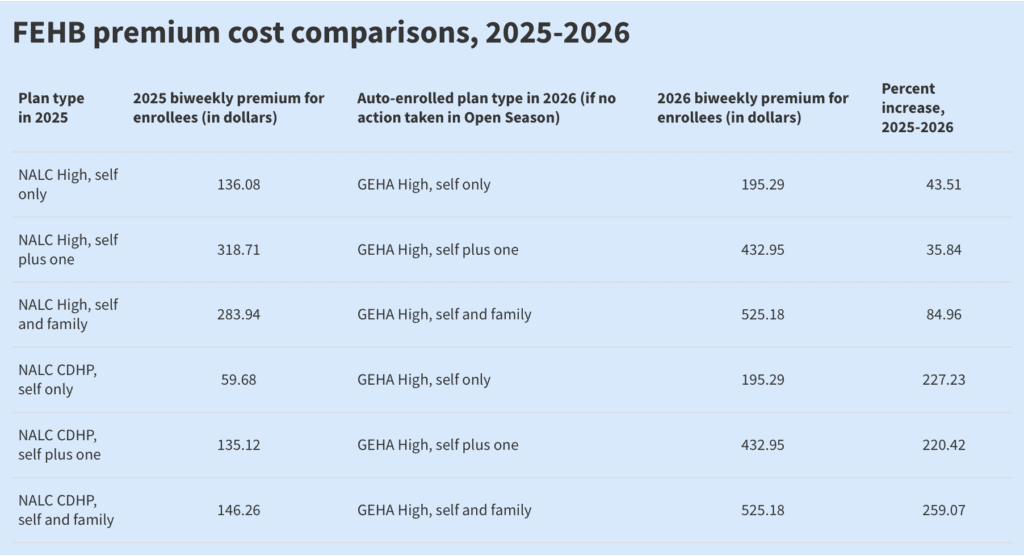

More than 30,000 federal employees in the Federal Employees Health Benefits (FEHB) program face sharp premium increases in 2026, but only if they are enrolled in a discontinued plan and take no action during Open Season. Eight plan options across six carriers are leaving the program next year, affecting roughly 32,000 enrollees. Most of those impacted are currently in the National Association of Letter Carriers (NALC) High and NALC CDHP plans, both of which are being discontinued.

For 2026, the Office of Personnel Management has changed its long-standing default rule. Instead of automatically moving affected members into the lowest-cost nationwide plan, OPM will now shift all enrollees from discontinued plans into GEHA High Option if they do not choose a replacement.

This decision creates unusually steep cost increases: NALC High enrollees in the Self & Family tier will see premiums rise from $283.94 biweekly in 2025 to $525.18 in 2026, an 85% increase. NALC CDHP enrollees face an even more dramatic jump, with Self & Family premiums rising from $146.26 to $525.18, a 259% surge. These figures are consistent with OPM’s 2026 FEHB premium tables and official discontinuation notices.

Source: Federal News Network

To avoid these spikes, affected federal employees must actively select a new plan during Open Season (November 10–December 8, 2025). Choosing a different option prevents default enrollment into the high-cost GEHA High plan. Importantly, the average FEHB premium increase across all plans in 2026 is 12.3%, far lower than the jumps triggered by automatic enrollment.

Does This Affect All States Equally?

Marketplace premium changes do not affect all states equally because each state’s insurance market operates differently. Premiums depend on competition among insurers, underlying medical costs, and population health. States with multiple carriers generally experience smaller increases, while states with high healthcare costs, such as Alaska, see more pronounced impacts.

Differences also exist between states using HealthCare.gov and the 17 states plus Washington, D.C., that run their own marketplaces, which set separate pricing rules and plan structures. State regulations and rate-review laws further influence how sharply premiums rise.

Medicare is more uniform. Part A and Part B premiums are federally standardized and increase evenly across all states. Part D is the exception because prescription drug plans vary by region, creating geographic differences in premiums.

Other coverage types, including employer-sponsored insurance, Medicaid, TRICARE, and VA health care, operate under separate systems. As a result, they are not directly affected by ACA marketplace premium changes or Medicare adjustments.

It’s Not Just the Affordable Care Act

While marketplace enrollees face the most dramatic changes, premium increases are occurring across the broader private insurance market as well. A December 2024 analysis from ValuePenguin found that the average monthly premium for a Silver-tier private health insurance plan will reach $621 in 2025, or $7,452 annually, reflecting a 7% increase from 2024. This marks the fourth straight year of rising costs, with premiums climbing 15% since 2022 as medical prices, prescription drug spending, and hospital costs continue to rise nationwide.

Premium trends also vary widely by geography. According to ValuePenguin’s state-level review, 42 states are seeing higher marketplace premiums in 2025, driven by elevated healthcare utilization and insurer pricing adjustments. However, a small group of states will see modest relief. Iowa, South Dakota, and Alabama are among the six states experiencing slight decreases, with average reductions ranging from 3% to 7% depending on the plan.

When Do Premium Changes Take Effect?

Premium changes take effect at the start of the 2026 coverage year, aligned with each program’s open enrollment period. For Healthcare.gov and state marketplaces, open enrollment runs from November 1, 2025, to January 15, 2026, with coverage beginning January 1, 2026, for anyone who enrolls by December 15, 2025.

Medicare’s annual enrollment window runs from October 15 to December 7, 2025, with all changes becoming effective on January 1, 2026. The Federal Employees Health Benefits (FEHB) Open Season runs from November 10 to December 8, 2025, also for January 2026 coverage.

New premiums hit consumers with the first payment for January 2026 coverage. Marketplace enrollees typically make their initial payment in late December 2025 or early January 2026. For Medicare, updated Part B premiums are automatically deducted from January 2026 Social Security checks. FEHB participants see new premiums deducted from their first federal pay period in January 2026.

Are There Workarounds or Ways to Lower Premiums?

Despite premium increases, several strategies can help reduce costs. For Marketplace enrollees, always shop during Open Enrollment rather than auto-renewing. Most consumers now have six to seven insurers available, and 95% have at least three, so comparing options is essential.

Moving from a Gold or Platinum plan to a Silver or Bronze tier can sharply cut premiums, though out-of-pocket costs rise. Starting in 2026, all Bronze and catastrophic plans become HSA-eligible, creating new tax advantages. Make sure your reported income is accurate so you maximize subsidies, and update it immediately if it decreases.

If you experience a qualifying life event, such as marriage, birth, job loss, or moving, you may get a Special Enrollment Period to switch plans. In some cases, joining a spouse’s employer-sponsored plan offers better value. Those choosing high-deductible coverage should use Health Savings Accounts to lower taxable income and cover medical expenses tax-free.

For Medicare beneficiaries, comparing Medicare Advantage plans each year can reveal lower-premium or $0-premium options, though checking provider networks is crucial. Review Part D plans annually using Medicare’s Plan Finder because formularies and prices change.

Low-income beneficiaries may qualify for Medicare Savings Programs (QMB, SLMB, QI) or Extra Help, which reduce premiums and cost-sharing. If you’re newly eligible, take advantage of the six-month Medigap Open Enrollment Period, which provides guaranteed issue rights without medical underwriting.

For federal employees, take action during Open Season to avoid being auto-enrolled into a more expensive default plan. Use OPM’s comparison tool to assess premiums, deductibles, and expected annual costs. Postal Service employees should also compare FEHB options with the new Postal Service Health Benefits (PSHB) program launched in 2025.

Who’s Safe from Premium Increases?

Some groups are more insulated from the premium increases expected in 2026. Veterans enrolled in VA healthcare are not affected by marketplace, Medicare, or private insurance premium changes, though those with supplemental coverage may still see higher costs. Medicaid recipients generally do not pay premiums and are shielded from these increases, even as overall Medicaid enrollment has declined after the end of pandemic-era protections.

Americans with employer-sponsored insurance, about 160 million people, are not directly impacted by marketplace subsidy changes or Medicare premium adjustments, though employer plan costs continue to rise. High-income Medicare beneficiaries who pay IRMAA already face higher baseline premiums, so annual increases have a smaller proportional effect on their overall costs.

The Political Battle: What Happens Next?

The expiration of enhanced marketplace subsidies sits at the center of an unprecedented political fight. Congressional Democrats have demanded that any government funding bill extend the subsidies, while Republicans have opposed this approach, contributing to the longest government shutdown in U.S. history.

Key factors in this debate:

- Cost: Extending enhanced subsidies through 2035 would cost the federal government billions. Fiscal hawks cite deficit concerns.

- Coverage Loss: Analysis suggests 3.8 million more people would be uninsured by 2035 without the enhancements, creating pressure to find a compromise.

- Political Stakes: Both parties recognize the political risk of allowing dramatic premium increases for millions of Americans, many in swing states that supported President Trump in 2024.

- Timing: If Congress waits until late December to act, 1.5 million more people will be uninsured in 2026 compared to earlier extension, as uncertainty causes people to forgo coverage.

What You Should Do Now

| Category | What to Do |

|---|---|

| Immediate Actions | Mark deadlines (Dec 15 & Jan 15). Gather income documents. List medications and doctors. Review 2025 healthcare use. Log in to HealthCare.gov, Medicare.gov, or OPM.gov. |

| Research & Compare | Run plan scenarios by metal tier. Calculate total annual cost (not just premiums). Check provider networks. Verify drug formularies. Review telehealth and extra benefits. |

| Get Help | Use free navigators/assisters. Contact HR if FEHB plan is ending. Call 1-800-MEDICARE for guidance. Consult a broker for complex situations. |

| Stay Informed | Track subsidy legislation. Sign up for marketplace or Medicare alerts. Recheck Medicaid/CHIP eligibility. Look into state assistance programs. |

The Bottom Line

Open enrollment in November 2025 comes at a high-stakes moment. If enhanced marketplace subsidies expire on December 31, 2025, millions of Americans could face premium increases that more than double in 2026, far outpacing the more moderate cost growth seen in Medicare and FEHB. Low-income households, older adults, and people with chronic conditions would experience the greatest financial pressure.

The best protection is proactive action. Compare plans early, check networks and drug coverage, calculate total annual costs, and enroll before deadlines. While Congress debates the future of subsidies, individuals must focus on what they can control: evaluating all available options, maximizing financial assistance, and choosing the most cost-effective coverage.

Staying informed and acting decisively during open enrollment is the strongest way to manage rising healthcare costs and secure reliable coverage for 2026.