Federal No Tax on Tips Deduction: Complete Worker’s Guide to the Tax Break

10.6 min read

Updated: Jan 8, 2026 - 06:01:17

The federal “no tax on tips” rule is a temporary 2025–2028 federal income-tax deduction (not a full exemption) that lets eligible tipped workers deduct up to $25,000 of qualified, voluntarily paid tips from federal taxable income. You’ll still owe Social Security and Medicare taxes, and many states will continue taxing tips. The deduction applies whether you take the standard deduction or itemize, begins to phase out above $150,000 MAGI for single filers, and is first claimed on a 2025 tax return filed in early 2026.

- Deduction covers up to $25,000 in qualified tips (cash, card, pooled tips) reported on Form W-2, 1099, or Form 4137; mandatory service charges don’t qualify.

- Eligible occupations must have “customarily and regularly received tips” before 12/31/24 per Treasury/IRS guidance; certain specified service fields may be limited or excluded under the law’s definitions.

- Phaseout starts at $150,000 MAGI (single) / $300,000 (married filing jointly); the allowed deduction generally decreases as income rises.

- Lower withholding may begin in 2026 as the IRS updates withholding guidance and forms; 2025 benefits are generally claimed after filing.

- State treatment varies: some states conform to federal law, many continue taxing tips, and states with no income tax see only federal benefits.

For millions of Americans working in restaurants, salons, hotels, and other service industries, tips aren’t just extra income—they’re essential to making ends meet. On July 4, 2025, the One Big Beautiful Bill Act became law, creating a new federal deduction designed to reduce federal income taxes for eligible tipped workers. But despite the slogan, the “no tax on tips” provision does not eliminate taxes entirely. Instead, it offers a capped, above-the-line deduction for qualifying tip income, and understanding how it works is crucial for anyone who relies on gratuities.

What the “No Tax on Tips” Policy Actually Means

The provision creates a new federal income tax deduction of up to $25,000 per year for qualified tip income, allowing eligible workers to subtract those tips from their taxable income. This can lower federal income tax, but it does not eliminate other taxes: workers will still owe Social Security and Medicare payroll taxes on tips, and many states will continue taxing tips as regular income.

The deduction is available whether you take the standard deduction or itemize, and applies only to qualified, voluntarily given tips that are properly reported. The policy is temporary, applying to tax years 2025 through 2028, with income-based phaseouts for higher-earning taxpayers.

Who Qualifies for the Tips Deduction?

Occupation Requirements

To qualify for the tips deduction, you must work in an occupation that “customarily and regularly received tips” on or before December 31, 2024. Treasury and the IRS released guidance identifying eligible occupations in 2025, including many roles in food service, hospitality, personal services, transportation, and entertainment. See the list of occupations referenced in reporting for examples.

The law also limits eligibility for certain “specified service trades or businesses.” Depending on how IRS/Treasury guidance applies, some higher-earning creative or professional activities may be excluded from treating payments as qualified tip income.

Income Limitations

The deduction begins phasing out once modified adjusted gross income (MAGI) exceeds $150,000 for single filers or $300,000 for married couples filing jointly. The phaseout mechanics are technical, and the amount you can deduct generally decreases as income rises.

Workers with low taxable income may already owe little or no federal income tax after the standard deduction and other credits. In those cases, the tips deduction may provide limited additional federal income-tax benefit—but payroll taxes can still apply to tip income.

What Tips Qualify?

Only “qualified tips” count toward the deduction. Eligible amounts generally include cash tips received directly from customers, tips added to card transactions, and tips distributed through pooling or sharing arrangements—so long as they are voluntarily paid. Non-eligible payments include automatic service charges (such as an 18% automatic gratuity) and other mandatory charges. To be deductible, qualifying tips must be properly reported, including through Form W-2, Form 1099, or Form 4137, depending on how the tips are received and reported.

How the Deduction Works: Payment and Refund Timelines

Understanding when this deduction actually reduces your tax bill is essential for planning. For the 2025 tax year, many workers won’t see lower withholding immediately. Instead, you’ll generally claim the deduction when filing your 2025 federal return in early 2026. The IRS confirmed transition guidance for 2025, meaning employers generally won’t be penalized for not immediately updating payroll systems.

When you file, you’ll report your total qualified tips and claim the deduction of up to $25,000 (subject to eligibility and phaseouts). If federal income tax was withheld from those tips during the year, you may receive a refund for any overpayment. For example, a worker with $20,000 in qualified tips could reduce taxable income by up to that amount, which may lower federal income tax depending on the worker’s bracket and overall return.

For the 2026–2028 tax years, the IRS expects updated withholding guidance so eligible workers can see reduced federal withholding during the year rather than waiting for a refund. To ensure accurate withholding, workers may need to update Form W-4 once the IRS finalizes the revised 2026 version and related instructions.

State Tax Considerations: A Patchwork of Policies

State tax treatment of tips remains inconsistent, which means your overall result will depend in part on where you live. While the new federal deduction applies nationwide for federal income tax, states retain authority over how they tax tip income.

States Following Federal Law

A number of states automatically conform to federal tax code updates, so they may adopt the new federal tips deduction unless lawmakers choose to “decouple” from it. Conformity rules vary widely, and states can opt out of specific federal provisions, meaning adoption is not guaranteed.

States Maintaining Tip Taxation

Several states have signaled they will continue taxing tips as ordinary income. California, for example, requires employees to report tip earnings as taxable for state income tax regardless of federal deductions. Colorado has also taken action to decouple certain state tax rules from federal tip/overtime-related provisions, meaning state treatment may differ even when federal treatment changes.

States Considering Their Own Relief

Throughout 2025, multiple states introduced legislation to reduce or eliminate state taxes on gratuities. These proposals included Illinois (HB 1750) as well as bills in Arizona, Kentucky, Kansas, Maryland, Nebraska, New Jersey, New York, North Carolina, Oregon, South Carolina, and Virginia. However, many proposals were still pending as of late 2025, leaving state-level tip taxation unchanged in many places.

States Without Income Tax

Workers in states with no income tax—Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming—do not owe state income tax on tips in the first place. For these workers, the federal tips deduction generally represents the primary income-tax change.

Common Complaints and Concerns

Despite broad support for the tips deduction, workers and tax professionals have raised concerns about reporting and documentation. Information reporting rules can change over time, and some workers may not receive certain forms even though income is still reportable. Regardless of which forms you receive, you are responsible for accurately reporting tip income and keeping support for your return.

Fairness concerns are also common. A worker who doesn’t receive tips pays federal income tax under the usual rules, while a tipped worker with similar total earnings may deduct qualifying tips. Critics also warn that the policy could encourage more tipping in roles where it wasn’t customary, potentially increasing income volatility for workers.

Another concern is that automatic gratuities don’t qualify. Mandatory service charges, even though they can resemble tips, are treated differently under the rules. The deduction can also offer limited benefit to lower earners whose federal income tax is already low after the standard deduction and credits.

Skepticism remains common. Longtime workers have noted that new tax breaks can come with compliance details that affect how helpful they are in practice. Separately, tipping behavior can shift over time: Square has reported that average tipping on food and beverage transactions dipped below 15% in Q2 2025, and survey research has found many consumers believe tipping culture has “gotten out of control,” which could affect future tip income in some settings.

How to Maximize Your Benefit and Avoid Pitfalls

- Document Everything: Keeping accurate tip records is essential for compliance and for claiming the federal tips deduction. Maintain daily logs, credit-card tip receipts, cash tip notes, and any documentation from tip-pooling arrangements. Even if your employer reports tips on your W-2, keeping your own records can help you reconcile discrepancies.

- Report Tips Promptly to Your Employer: Federal rules require workers to report cash and non-cash tips totaling more than $20 per month to their employer. Correct reporting helps ensure your tip income is reflected on your tax forms and can reduce underreporting issues.

- Update Your W-4 for 2026: After the IRS releases the 2026 Form W-4 and instructions, consider adjusting your withholding to reflect the tips deduction. Updating your W-4 may reduce excess withholding throughout the year, though your best setting depends on your full return.

- Use Tax Software or a Professional: The tips deduction is expected to be integrated into major tax software for 2025 returns. Many workers can use software, but if you have multiple jobs, mixed tip sources, or income near phaseout levels, consulting a qualified tax professional can help with accurate reporting.

- Understand State Obligations: Federal relief does not guarantee state relief. Many states continue to tax tips as regular income and may not conform to the federal deduction. Review your state’s rules to avoid surprises.

- Monitor IRS Guidance: The IRS continues to release updates on how the tips deduction is implemented. For accurate information, check IRS.gov or subscribe to official IRS updates for new rules, forms, and clarifications.

What This Means for Job Decisions

If you’re considering a tips-based job, the new federal tips deduction can increase after-tax income for some workers, but it shouldn’t be the only factor guiding your decision. Start by estimating your annual income, including tips, and consider how much the deduction could reduce taxable income given your bracket and overall return. A worker in the 22% federal bracket with $20,000 in qualified tips could see a meaningful reduction in federal income tax, but actual results depend on the full tax picture, eligibility, and other items on the return.

It’s also important to consider industry trends. Tipping patterns can change as consumers react to tip prompts and prices, which may affect the stability of tip income in your occupation. Beyond tips, compare the overall compensation package: base wages, health benefits, paid time off, and scheduling flexibility all influence long-term financial stability.

Finally, remember that the deduction is temporary and scheduled to expire after 2028 unless Congress acts to extend it. Major career decisions should be based on long-term factors rather than a short-lived tax benefit.

Looking Ahead: The Future of the Tips Deduction

Looking ahead, the future of the tips deduction remains uncertain. The provision was created as part of a temporary federal tax package and will automatically expire after the 2028 tax year unless Congress extends it. The IRS has estimated that about 6 million workers report tipped wages, and future policy debate may affect whether the deduction is extended, changed, or allowed to sunset.

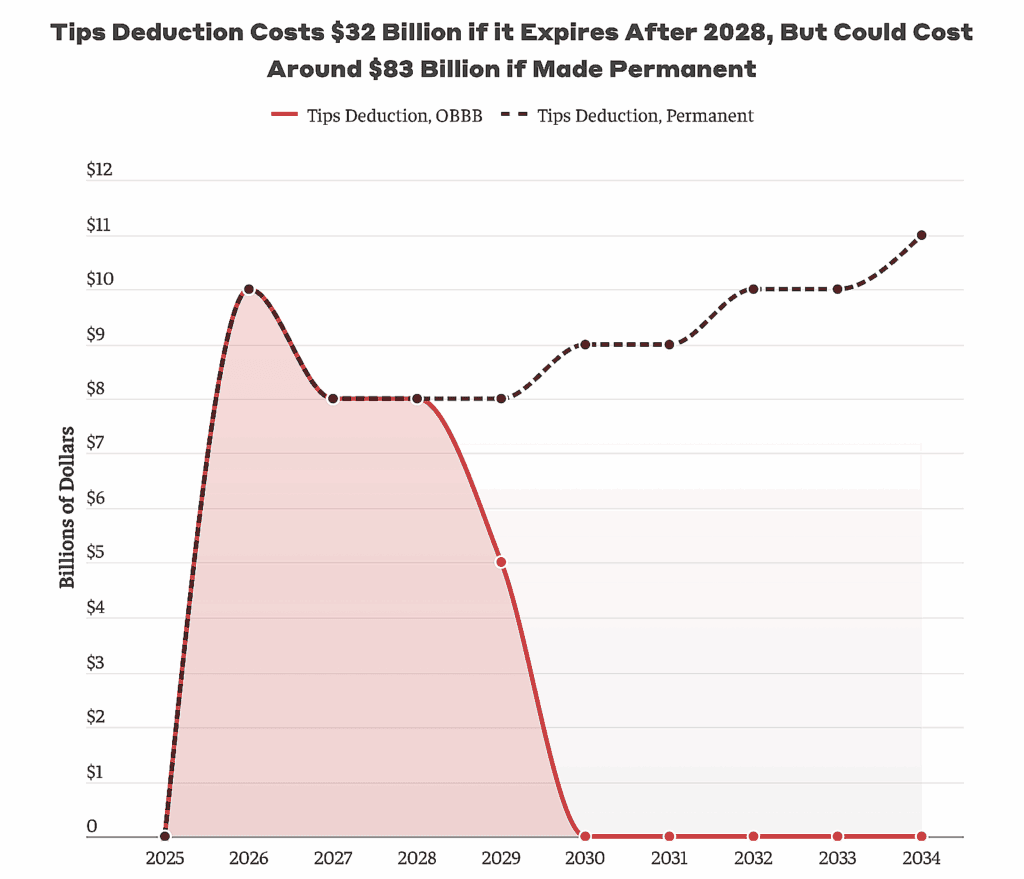

Budget impact is also part of that debate. Public estimates have projected the tips deduction at roughly $32 billion over 10 years under current law assumptions, and higher if made permanent, though estimates vary by methodology and assumptions.

Source: Bipartisan Policy Center

Key Takeaways

The “no tax on tips” policy can provide relief for many tipped workers, but it isn’t as simple as the slogan suggests. It’s a deduction, not a full exemption, which means you’ll still owe Social Security and Medicare taxes, and many states will continue taxing tips. The maximum deduction is $25,000 per year, which may reduce federal income tax, though actual savings depend on eligibility, income, and your overall tax return.