What Venture Capitalists Are Investing In Late 2025 — and What’s on Tap for 2026

5.8 min read

Updated: Dec 20, 2025 - 08:12:08

After two volatile years, global venture funding is rebounding, with $120B invested in Q3 2025. Investors are refocusing on fundamentals, profitable growth, infrastructure, and real-world impact. As 2026 approaches, capital is consolidating around artificial intelligence (AI), deep-tech hardware, healthcare innovation, and sustainability. The era of “growth at any cost” has given way to disciplined, data-backed investing.

- AI infrastructure dominates: Capital is shifting from consumer AI tools to hardware, semiconductors, and data systems that enable scalable intelligence.

- Healthcare meets data: AI-driven drug discovery and diagnostics continue to attract investment as firms like J.P. Morgan spotlight the aging population and biotech automation trends.

- Clean tech revival: Major funds plan to expand climate and sustainability portfolios in 2026, supported by regulatory incentives.

- Defense and deep tech rise: Geopolitical competition is channeling private capital into dual-use and national-security innovations, signaling a new frontier for venture capital.

- Discipline defines winners: Founders with clear profitability paths, durable demand, and operational efficiency will capture the bulk of new funding rounds in 2026.

After several turbulent years marked by high inflation, shifting interest rates, and a slowdown in exit opportunities, late 2025 shows signs of cautious recovery. Global VC funding has started to rebound, with investors gradually putting capital back to work, but this time with a sharper focus on fundamentals, sustainable growth, and clear paths to profitability. As the year draws to a close, attention is already turning to the trends and priorities that are likely to shape the venture investment landscape in 2026.

Where VC dollars are flowing now

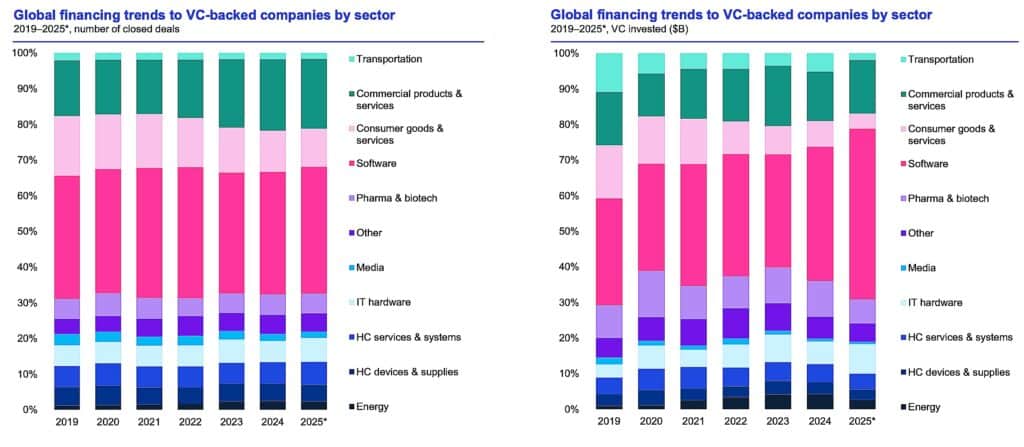

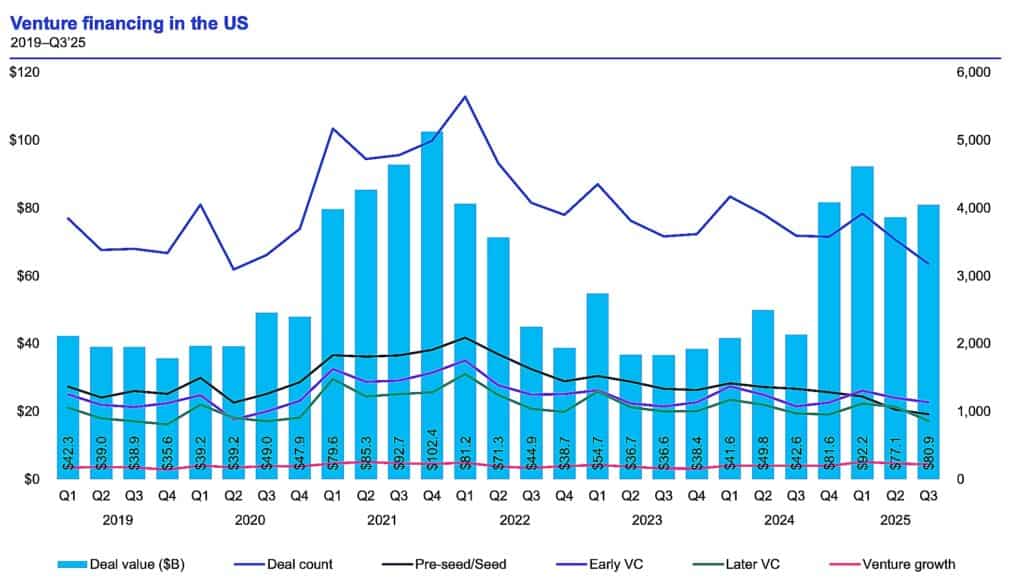

Global venture funding reached roughly $120 billion in the third quarter of 2025, marking a strong rebound from earlier quarters, according to KPMG’s Q3 2025 Venture Pulse. Despite the recovery, the market remains uneven, deals are fewer, rounds are larger, and capital is concentrating around proven teams and scalable technologies. Late-stage rounds have become more competitive, while early-stage and seed companies continue to face higher barriers to funding.

Much of the capital is flowing into artificial intelligence (AI) and related infrastructure. A significant share of global VC investment in Q3 2025 went to AI-focused companies, including those developing foundational models, generative platforms, and AI-enabled tools. Investors are prioritizing real-world adoption and revenue traction over speculative growth. Hardware supporting AI, such as semiconductors, data centers, and edge-compute systems, has also drawn renewed interest as investors back the infrastructure behind the AI boom.

Source:KPMG

Healthcare and biotechnology are emerging as additional areas of focus. Startups combining AI with life sciences, from drug discovery to diagnostics, are attracting capital as machine learning shortens research timelines and reduces costs. While consumer tech and fintech remain active, investors are more selective, favoring companies with clear profitability paths and differentiated products.

Regionally, the United States remained the epicenter of global venture funding, accounting for more than half of total capital deployed in Q3 2025. Asia and Europe are recovering more slowly but continue to strengthen their innovation ecosystems, drawing early-stage activity in sustainability, deep tech, and mobility. Improved exit activity through mergers, acquisitions, and secondary sales has also provided a modest but important boost to investor confidence heading into 2026.

Source: KPMG

What investors are preparing for in 2026

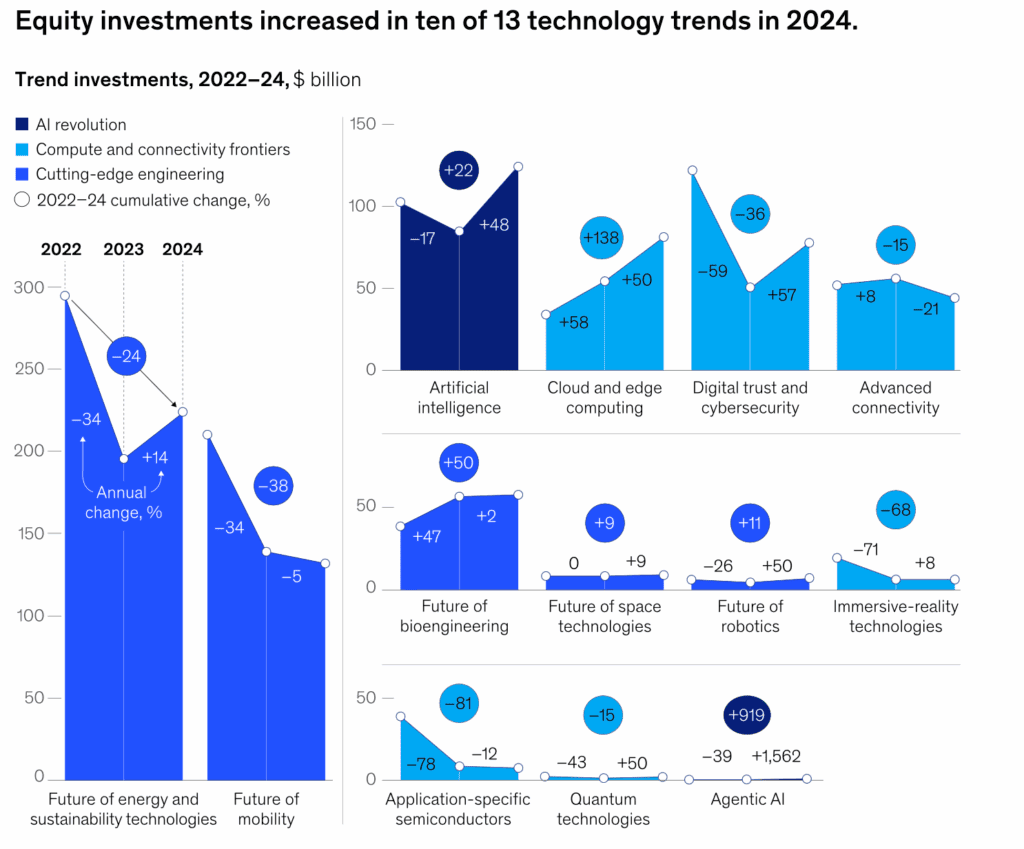

Looking ahead, the strongest signals point toward a market that values infrastructure, convergence, and discipline. The strong enthusiasm for artificial intelligence (AI) in 2025 has set the stage for a more refined focus in the coming year. Investors are expected to pivot from consumer-facing AI applications toward the systems that power them, data management, computing infrastructure, and applied industrial uses.

A key area of emphasis is deep-tech infrastructure. Reports highlight that scaling AI will demand advances in hardware, chip design, and energy-efficient data processing. Startups building new compute architectures, quantum components, or optimized data centers are likely to attract growing interest in 2026. These ventures are capital-intensive but essential to the long-term AI economy, according to McKinsey’s report.

Source: McKinsey

Another expanding theme is the intersection of healthcare and technology. Following 2025’s progress in AI-assisted drug discovery and diagnostics, investors are positioning for platforms that merge biology, data, and automation. Analyses from J.P. Morgan on healthcare innovation suggest that this combination of aging demographics and accelerating AI capabilities could define one of 2026’s most active investment arenas.

There is also cautious optimism for select consumer technology. After a funding slowdown in 2024, the spread of AI into productivity, wellness, and content tools is reviving investor interest. The focus is on startups that enhance personal services or automate repetitive tasks, targeted innovation rather than broad consumer bets.

Climate and sustainability technologies remain a long-term priority. Several major funds plan to expand allocations to clean energy, carbon measurement, and circular-economy solutions in 2026, supported by regulatory incentives and decarbonization mandates, as highlighted in the Roland Berger Infrastructure Investment Outlook.

Finally, defense, space, and dual-use technologies are drawing new attention. Rising geopolitical tensions and semiconductor competition are attracting private capital into national-security-linked innovation. Venture firms that once avoided the sector are building specialized funds or partnering with public-private programs, signaling a broader convergence of innovation and resilience heading into 2026.

A disciplined approach to growth

Across sectors, 2026 is expected to reinforce a shift toward capital efficiency and sustainable growth. Venture investors are prioritizing profitability and sound business models over pure scale. Startups demonstrating positive unit economics, durable customer demand, and measured expansion are best positioned to secure follow-on funding. Growth remains valuable, but profitability and operational resilience have become defining metrics.

For founders, the funding landscape now rewards clarity and execution. Clearly defining the market problem, proving real traction, and presenting data-driven growth strategies are more persuasive than broad visions. Investors are demanding concrete paths to profitability and transparent capital use, even at early stages. Fewer overall deals are expected in 2026, but those meeting higher performance standards may attract larger average rounds.

For investors, balance and selectivity will be essential. Capital continues to cluster in sectors such as artificial intelligence (AI), deep-tech, and applied healthtech, but diversification across industrial automation and regional innovation hubs remains critical. While top-tier funds dominate mega-rounds, specialized mid-sized firms can thrive by focusing on niche opportunities. Liquidity prospects show tentative improvement, with modest rebounds in IPO and M&A activity gradually recycling capital into new deals.

The outlook for venture capital

Late 2025 has marked a reset period. The market has stabilized after two challenging years, but the exuberance of past cycles has been replaced by a more disciplined and data-driven approach. As 2026 begins, venture capital is expected to concentrate around a few dominant technologies, particularly those that combine scientific depth with clear commercial potential.

In practical terms, the next wave of VC interest will likely focus less on speculative consumer apps and more on infrastructure, science, and sustainability sectors that define the next decade of innovation. Founders who align their products with these themes, while demonstrating solid business fundamentals, will stand the strongest chance of securing investment in the year ahead.