The Hidden 38%: Benefits Most Government Employees Don’t Know They’re Entitled To

7 min read

Updated: Dec 19, 2025 - 08:12:17

Government workers often underestimate the full value of their pay. In 2025, federal benefits equal about 38% of annual salary, according to the Office of Personnel Management (OPM) and Bureau of Labor Statistics (BLS). That’s roughly $28,500 in added value for someone earning $75,000, through health insurance, retirement contributions, paid leave, and tax-free commuter or childcare benefits. Yet thousands of employees fail to claim all they’re entitled to each year.

- Health Insurance: The federal government covers up to 75% of FEHB premiums, worth about $20,000 per year for family coverage.

- Retirement Savings: Agency TSP matches up to 5% of salary and guarantees a pension under FERS.

- Student Loans: Up to $60,000 in federal loan repayment or Public Service Loan Forgiveness after 120 qualifying payments.

- Paid Leave: At least 37 paid days off annually (vacation, sick leave, and holidays), worth over $11,000 at a $75,000 salary.

- Commuter & Childcare Perks: Up to $7,800 in transit benefits and $5,000 in pre-tax childcare savings through FSAFEDS.

Government workers across the United States may be leaving thousands of dollars on the table every year. While most employees focus on base salary, they often overlook a crucial fact: the federal government’s contribution to employee benefits equals roughly 38% of annual salary, according to the U.S. Department of Agriculture.

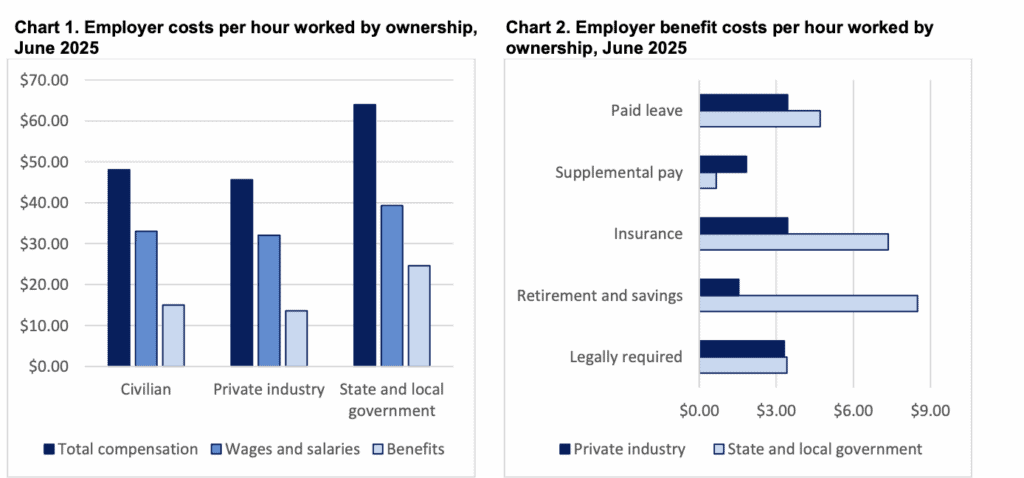

For state and local government employees, total compensation averaged $63.94 per hour in June 2025, including $24.63 per hour in benefits, which accounted for 38.5% of total compensation, per the Bureau of Labor Statistics. That’s substantially higher than the 29.8% share received by private-sector workers, whose average hourly compensation was $45.65, with $13.58 of that going toward benefits.

Source: Bureau of Labor Statistics

Despite these generous contributions, many public employees remain unaware of the full value of their benefits, missing opportunities to maximize their overall compensation package.

THE BIGGEST BENEFITS YOU MAY BE MISSING

1. Health Insurance Subsidies ($8,000–$20,000+ annually)

Federal employees receive coverage through the Federal Employees Health Benefits (FEHB) Program, which offers nearly 200 plan options nationwide, the largest selection of any U.S. workforce.

The government covers up to 75% of total premium costs, averaging 72% of plan premiums. For the 2026 plan year, the maximum biweekly government contribution is $324.76 (Self Only), $711.17 (Self Plus One), and $778.03 (Family), according to OPM’s official rate notice. That equals roughly $20,228 per year for families.

FEHB plans impose no medical exams, waiting periods, or age restrictions, and coverage continues into retirement if enrolled for at least five consecutive years before leaving service.

2. Retirement Benefits ($3,000–$12,000+ annually)

The Federal Employees Retirement System (FERS) includes three major components:

-

Basic Benefit Plan: Agencies contribute 1% of annual salary.

-

Thrift Savings Plan (TSP): Agencies automatically contribute 1% and match up to 5% of employee contributions, up to $7,500 in free matching on a $75,000 salary.

-

Social Security: Standard contributions apply.

Your retirement annuity equals 1% of your “high-3” average salary per year of service, or 1.1% if you serve 20+ years. Employees also earn 13 days of paid sick leave annually with no accrual limit, and unused sick leave converts into additional service credit at retirement, potentially adding months to pension calculations.

3. Student Loan Assistance (Up to $60,000 or Full Forgiveness)

Under the Federal Student Loan Repayment Program, agencies may repay up to $10,000 per year and $60,000 total for eligible employees who agree to at least three years of service. Participation varies by agency but includes many cabinet-level departments.

Additionally, the Public Service Loan Forgiveness (PSLF) Program cancels remaining federal student loan balances after 120 qualifying monthly payments while employed full-time in public service.

4. Paid Leave Package ($4,000–$11,000+ annually)

Federal employees enjoy a robust paid leave structure:

-

Annual Leave: 13 paid vacation days (increasing to 26 with tenure)

-

Sick Leave: 13 days per year with unlimited accrual

-

Federal Holidays: 11 paid days

That’s a minimum of 37 paid days off per year for new employees. At a $75,000 salary, this equals about $11,300 in paid time off, based on OPM’s annual and sick leave fact sheets.

5. Commuter Benefits (Up to $7,800 annually)

Federal agencies may cover or pre-tax-deduct commuting costs under the Mass Transportation Benefit Program.

The IRS monthly limit for 2025 is $325 for transit and $325 for parking, totaling $7,800 per year (IRS Notice 2025-1). Employees can save roughly $1,700 annually in federal taxes if they’re in the 22% tax bracket.

6. Childcare Subsidies ($3,000–$15,000+ annually)

Agencies may help lower-income employees with dependent care through the Federal Child Care Subsidy Program.

Employees can also use the Dependent Care Flexible Spending Account (FSAFEDS) to set aside up to $5,000 in pre-tax funds annually for childcare expenses, reducing taxable income.

The General Services Administration (GSA) manages more than 100 child care centers across federal facilities, providing priority access for federal employees.

VALUABLE LIFESTYLE BENEFITS

Flexible Work Arrangements

Many agencies offer compressed workweeks, nine-hour days with three-day weekends biweekly, or four 10-hour days weekly, under OPM’s Alternative Work Schedules program, helping employees save up to several thousand dollars annually in commuting costs.

Employee Assistance Programs ($500–$2,000+ value)

All agencies provide free Employee Assistance Programs offering counseling, financial planning, legal services, and 24/7 crisis support. Most include 6–8 free counseling sessions ($600–$1,200 value), legal consultations ($300–$500), and financial planning ($200–$400). Services extend to family members.

Insurance Benefits

The Federal Employees Dental and Vision Insurance Program (FEDVIP) offers separate family coverage through pre-tax payroll deductions. The Federal Employees’ Group Life Insurance (FEGLI) program covers over 4 million people with options from one to six times annual salary.

CONSUMER DISCOUNTS ($500-$2,000+ annually)

Major tech brands give solid perks to federal employees. Through the Microsoft Workplace Discount Program, eligible workers can snag up to 30% off Microsoft 365, though that old “Office for under $10” deal is gone. Samsung’s Government Program hooks up to 30% off electronics and home gear.

Hotels, airlines, and car rentals still roll out 5–20% government rates, depending on the company. AT&T gives up to $10 off per line monthly, and GEICO offers its Eagle Discount worth roughly up to 12% off, saving many folks $100–$500 a year.

ID.me Shop dishes out verified exclusive deals across hundreds of retailers. The Washington Post’s free digital access perk for feds is gone, but some promo discounts pop up now and then. Through the OPM Federal Academic Alliance, workers and families can grab 10–25% off tuition at partner colleges.

JOB SECURITY & GUARANTEES

During economic downturns, federal employment remains one of the most stable sectors in the U.S. Government operations continue through recessions, and employees can often transfer between agencies or departments under established merit promotion and transfer rules.

Unlike private-sector 401(k) plans, the Federal Employees Retirement System (FERS) provides a guaranteed lifetime pension based on years of service and highest average salary. Once vested, this defined-benefit annuity ensures secure, predictable retirement income for life.

HOW TO CLAIM YOUR BENEFITS

Immediate Actions:

- Contact your HR department for a full benefits briefing.

- Confirm eligibility for student loan repayment, child care subsidies, transit benefits, and flexible work programs.

- Register for exclusive discounts using your .gov email through ID.me and GovX.

- During Open Season (November 10–December 8, 2025), review and adjust your health, dental, vision, and FSA elections.

- Keep documentation for all benefits, loan agreements, childcare applications, transit enrollments, and sick leave balances, for verification and recordkeeping.

Long-Term:

- Use OPM’s retirement calculators to estimate lifetime benefit values.

- Verify Public Service Loan Forgiveness (PSLF) eligibility and ensure your employer qualifies.

- Calculate the financial impact before leaving a federal position, considering lost benefits.

- Accumulate and track sick leave, each unused day adds to your retirement annuity calculation.

THE BOTTOM LINE

For a federal employee earning $75,000 annually, total compensation extends far beyond base pay. According to the Office of Personnel Management (OPM), federal benefits typically equal about 38% of annual salary, roughly $28,500 in additional value. This includes comprehensive health insurance, agency retirement contributions, generous paid leave, and optional transit subsidies, which can reach up to $1,500 annually depending on location.

Many employees also qualify for the federal Student Loan Repayment Program, which can cover up to $10,000 per year in eligible repayments, along with smaller lifestyle and insurance benefits. Collectively, these programs represent tens of thousands of dollars in total value each year, significantly enhancing long-term financial security.

The question isn’t whether these benefits exist but whether workers fully claim what they’ve already earned. Many leave thousands unclaimed simply because they’re unaware of available programs. Understanding your full compensation package helps guide smarter decisions about career planning, retirement savings, and overall financial stability.

About This Investigation: Based on official data from the Office of Personnel Management, Bureau of Labor Statistics, and verified government sources. Figures reflect federal employee guidelines as of late 2025. For personalized details, contact your agency’s benefits coordinator or HR department.