The $43 Billion Retirement Trap: How to Rescue Your Forgotten 401(k) Money

12.6 min read

Updated: Dec 21, 2025 - 09:12:17

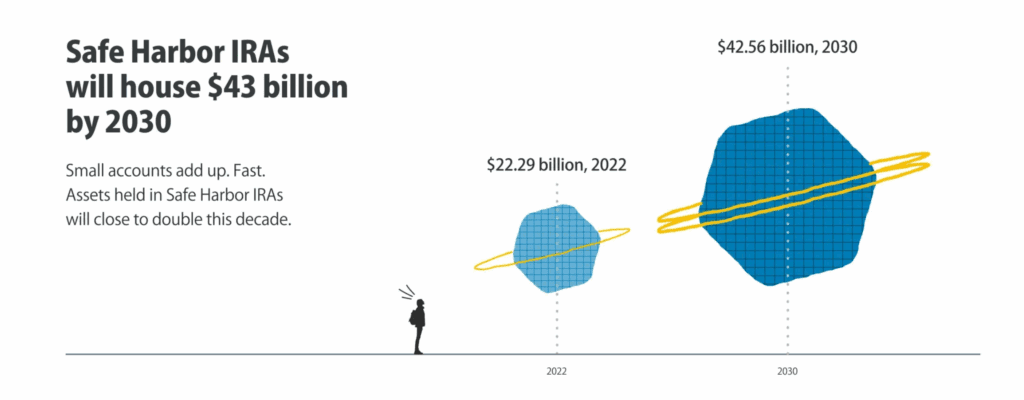

By 2030, more than $43 billion could sit idle in low-yield “Safe Harbor” IRAs, temporary accounts created when workers leave old jobs and forget to roll over small 401(k) balances. These so-called “junk IRAs” often charge high fees, earn below-inflation returns, and quietly erode decades of compounding growth. If you’ve changed jobs multiple times, there’s a strong chance some of your money is trapped in one of these accounts. The good news: new tools under the SECURE 2.0 Act make it easier to locate and reclaim those funds.

- Identify lost accounts: Use the U.S. Department of Labor’s Retirement Savings Lost & Found database (launched Dec. 2024) or contact past employers to trace missing 401(k) plans.

- Understand the risk: Balances under $7,000 are often rolled automatically into Safe Harbor IRAs earning just 0.5%–2%, compared with long-term 401(k) returns of 6%–8%.

- Consolidate for growth: Directly roll over found accounts into your current employer’s 401(k) or a low-cost IRA (Vanguard, Fidelity, Schwab) to restore tax-deferred growth and reduce hidden fees.

- Avoid cash-outs: Withdrawing before age 59½ triggers income tax and a 10% penalty, potentially wiping out years of gains.

- Stay proactive: Before changing jobs, document account details, update contact info, and set rollovers within 60 days to prevent automatic transfer into a junk IRA.

A growing body of research reveals that millions of Americans are unknowingly losing a significant share of their retirement savings to what experts are calling “junk IRAs.” These are poorly performing Safe Harbor IRAs, accounts that were originally designed to protect small 401(k) balances when employees leave their jobs, but have instead become hidden traps draining long-term wealth.

By 2030, an estimated $43 billion could be locked in these underperforming accounts, quietly eroding the financial futures of millions of workers. If you’ve changed jobs multiple times during your career, there’s a strong chance that some of your money is sitting in one of these accounts right now. Here’s what you need to know, and how to recover it before it’s too late.

Understanding the Problem: What Are “Junk IRAs”?

The Origins of Safe Harbor IRAs

In the early 2000s, the Economic Growth and Tax Relief Reconciliation Act (EGTRRA) introduced Safe Harbor IRAs, allowing employers to automatically roll over small 401(k) balances when employees change jobs. The rule helps companies manage accounts under $7,000 and aims to protect workers’ savings. When employees leave without moving their 401(k), employers can transfer those funds into a Safe Harbor IRA, a temporary account designed to preserve retirement money until claimed.

How It Became a Problem

Over time, these accounts have turned from short-term safeguards into costly dead ends. A PensionBee and Employee Benefit Research Institute (EBRI) report reveals that $28.4 billion currently sits in Safe Harbor IRAs, projected to exceed $43 billion by 2030. Around 1–2 million accounts are rolled over annually, with 13 million expected to be stuck by 2030. Nearly one-third of all defined-contribution retirement accounts fall below the $7,000 threshold, making them prone to automatic transfers.

Source: PensionBee

Why Safe Harbor IRAs Hurt Savers

The report outlines four major issues. High fees, monthly charges of $1–$5 and setup costs up to 20%, erode small balances. Low returns, typically 0.5%–2%, lag far behind inflation, while providers pocket most of the spread. Neglected accounts, only 12.8% move within a year, and 75% remain idle after three, leave savers unaware of lost funds. Wealth erosion is the result: a $4,500 balance grows to just $5,507 in a Safe Harbor IRA versus $25,856 in a regular 401(k).

By 2030, millions could lose tens of billions in retirement savings trapped in so-called “junk IRAs.”

Who’s at Risk?

The mobile nature of today’s workforce makes this problem especially severe. Each year, roughly 30 to 32 million 401(k) accounts are left behind by workers who change or leave jobs, according to recent estimates from Capitalize. These “orphaned” accounts collectively hold about $2.1 trillion in assets, much of which risks being eroded by high fees and low returns when balances are automatically rolled into Safe Harbor IRAs.

The groups most at risk share one trait, instability. Frequent job changers often accumulate multiple small accounts across employers, while younger workers in their 20s and 30s may be especially vulnerable during early career transitions. Lower-income workers face an added challenge: they’re more likely to have balances under the $7,000 automatic-rollover threshold, leaving them exposed to forced transfers into high-fee, cash-like accounts. Those laid offor dealing with incomplete records can also lose track of old plans amid job disruptions or outdated contact information.

“The likelihood of having at least one of your prior retirement accounts sitting in high-fee, cash-like accounts without your knowledge is strikingly high,” said Romi Savova, CEO of PensionBee. “The impact these junk accounts can have on ultimate retirement wealth is horrific.”

How to Find Your Lost Retirement Money

If you suspect you might have forgotten retirement accounts, here’s how to track them down:

Step 1: Review Your Employment History

Start by listing every employer you’ve worked for, along with approximate employment dates and whether you participated in a 401(k), pension, or other employer-sponsored retirement plan. Keep any benefit statements, pay stubs, or tax forms (like W-2s) that mention retirement contributions. These documents can help you identify where your money might be held.

Step 2: Use the Department of Labor’s Retirement Savings Lost and Found Database

Visit the official Retirement Savings Lost and Found Database created under the SECURE 2.0 Act of 2022. The platform, launched in December 2024, helps workers locate old 401(k) and pension plans. To search, you must verify your identity through Login.gov, providing basic details such as your name, date of birth, and Social Security number.

The database currently includes ERISA-covered employer plans, meaning private-sector 401(k) and defined-benefit pension plans, but does not cover IRAs, Safe Harbor IRAs, or most government and church plans. Plan participation is voluntary, so results may be incomplete. If your plan appears, you’ll see contact details for the plan administrator to help you claim your funds.

Step 3: Contact Former Employers Directly

If the database search doesn’t show results, reach out to former HR or benefits departments. Ask if they still have records of your retirement plan or the plan administrator’s name. If your old company merged or was acquired, contact the successor firm to determine where your plan was transferred.

Step 4: Search State Unclaimed Property Databases

In some cases, unclaimed retirement funds are transferred to state agencies. Use the National Association of Unclaimed Property Administrators (NAUPA) site to search both your current and prior states of residence. Many states list unclaimed 401(k) distributions or pension benefits that were never cashed or rolled over.

Step 5: Review Old Tax and Financial Records

Old tax forms can offer valuable clues. Look for Form 1099-R, which reports retirement distributions, or Form 8955-SSA, which shows vested retirement benefits from former employers. Bank statements or benefits enrollment forms may also reveal if you once contributed to an employer-sponsored account.

What to Do Once You’ve Found Your Accounts

Once you’ve tracked down forgotten 401(k) or pension accounts, the next step is deciding how to manage them. The right move depends on your current job situation, investment goals, and tax considerations.

Rolling Over to Your Current Employer’s 401(k)

If your current employer accepts rollovers, consolidating your accounts can simplify retirement planning and potentially lower fees. Employer-sponsored 401(k) plans are governed by the Employee Retirement Income Security Act (ERISA), which provides strong federal protection against creditors. Rolling your old 401(k) into your current plan can also streamline future required minimum distributions (RMDs) if you remain employed beyond age 73.

However, not all plans allow rollovers, and you’ll be limited to the investment menu chosen by your employer. Be sure to review plan fees and fund performance before transferring.

Rolling Over to an IRA

Moving your funds into an Individual Retirement Account (IRA) gives you more control, broader investment options, and access to low-cost providers like Vanguard, Fidelity, and Charles Schwab.

To keep your money tax-deferred, request a direct rollover, also called a “trustee-to-trustee transfer.” This ensures funds move directly between financial institutions. If the check is made payable to you, federal law requires a 20% tax withholding, and you’ll have just 60 days to redeposit the full amount or face income taxes and possible penalties, according to the IRS rollover rules.

Leaving the Account Where It Is

If your former employer’s plan offers low fees and strong investment options, keeping your money there can make sense, especially if your balance exceeds the $7,000 automatic-rollover threshold set under Department of Labor rules.

The downside? You’ll need to stay vigilant. Former employees often lose track of old accounts, miss plan updates, or fail to rebalance over time. You’ll also have to manage multiple retirement statements and logins.

Cashing Out: The Worst Option

Withdrawing your 401(k) funds may sound tempting, but it’s usually the most costly mistake. Any withdrawal before age 59½ triggers income taxes and a 10% early-withdrawal penalty, unless you qualify for a special exception under IRS rules.

For example, cashing out $10,000 at age 30 could cost about $3,000 in taxes and penalties immediately, and erase more than $150,000 in potential long-term growth if that money stayed invested at a 7% annual return. In short, cashing out sets your retirement savings back decades.

Avoiding the Safe Harbor IRA Trap in the Future

To prevent your retirement savings from being swept into a Safe Harbor IRA, plan ahead before changing jobs. Document all your accounts, decide where your funds will go next, and keep your contact information current with every plan administrator.

Understanding the $7,000 threshold under the SECURE 2.0 Act is crucial. Employers can automatically transfer balances between $1,000 and $7,000 into a Safe Harbor IRA if you leave your job and take no action. Smaller balances, typically under $1,000, may be cashed out automatically depending on the plan’s rules. Amounts over $7,000 generally cannot be rolled over without your consent and remain in the plan unless you choose otherwise.

To stay protected, review your retirement accounts each year, ensure your contact details are up to date, and request a direct rollover to your new employer’s plan or a low-cost IRA provider like Vanguard, Fidelity, or Schwab. Acting early prevents your money from being locked in a high-fee, low-yield account and keeps your savings compounding toward retirement.

What Financial Advisors Recommend

Financial professionals emphasize that the best defense against this problem is consolidation and active management.

“Small balances are easy to overlook, but when left in cash for years, the lost compounding can erode considerable wealth,” said Romi Savova, CEO of PensionBee, in an interview with Financial Planning. “For advisors working with plan sponsors, automatic rollovers are happening on autopilot at your clients’ companies, and most plan sponsors have no idea where participants’ money is going or what’s happening to it once it leaves the plan.”

John Power, a financial advisor at Power Plans in Walpole, Massachusetts, said he makes tracking down old accounts a standard part of his client onboarding process. “I always suggest they roll over to their own IRA in the case of smaller holdings, so they can be lumped together and managed effectively as part of a financial plan,” Power said. “A proper financial plan looks at all resources, the way they are invested, and how they fit into the retirement scheme.”

Josh Brooks, founder of Exponential Advisors in Weatherford, Texas, emphasizes the importance of making decisions before accounts go dormant. “While Safe Harbor IRAs are better than having stranded 401(k)s lost forever, they’re rarely optimal due to a conservative investment mix and sometimes steep fees,” Brooks said. “They’re intended as a stopgap, not a long-term solution.”

The Bigger Picture: Why This Matters

The Safe Harbor IRA issue highlights deeper problems within America’s retirement system. With frequent job changes, many workers leave small balances scattered across old plans, creating fragmented savings that are often forgotten or lost. This system makes it easy for retirement funds to become stranded, eroding long-term growth and reducing retirement security.

The SECURE 2.0 Act of 2022 aims to fix this by requiring the Department of Labor to create a Retirement Savings Lost and Found database that helps individuals locate forgotten accounts. It also supports the development of auto-portability programs, which automatically transfer small balances to new employer plans when workers change jobs. These provisions mark progress toward reducing lost savings and improving plan accountability.

Private companies are also stepping in with technology-driven solutions. Emerging auto-portability networks and consolidation platforms help workers locate and merge accounts more efficiently, while modern recordkeeping systems track participants across career moves. These tools show strong potential, but widespread adoption and coordination across the retirement industry will take time.

Take Action Today

Don’t let your retirement savings become part of the $43 billion trapped in underperforming Safe Harbor IRAs. Here’s how to take control of your accounts before they go dormant.

Immediate Steps

Start by creating a record of every employer you’ve worked for. Use the Department of Labor’s Retirement Savings Lost and Found database to locate missing 401(k) and pension accounts. If necessary, contact each former HR department directly and check your state’s unclaimed-property database for any transferred funds. Reviewing old tax returns for Form 1099-R can also help identify prior distributions.

Once You Locate Accounts

Compare fees and investment options among your available plans. Decide whether to consolidate into an IRA or roll into your current 401(k) to streamline management. Always execute a direct rollover so funds move from one plan to another without triggering taxes or the IRS 60-day redeposit rule. Choose diversified investments that match your age and risk tolerance, and set up a tracking system for all accounts.

For Future Job Changes

Document your retirement balances before leaving any job. Make rollover decisions within 60 days of separation and keep contact information current with plan administrators. Maintain detailed records of every plan and review accounts annually to ensure they remain active, invested, and performing as expected.

Conclusion

The $43 billion retirement trap is real, but it doesn’t have to claim your savings. With workers changing jobs more often than ever, keeping track of old 401(k) and IRA accounts requires awareness and proactive planning.

The good news: forgotten retirement money can be found and restored. The Department of Labor’s Retirement Savings Lost & Found tool offers a simple way to locate missing accounts. By pairing this with direct outreach to former employers and careful documentation, most people can recover their lost funds.

After locating these accounts, consolidating into a low-fee IRA or your current employer’s 401(k) can unlock stronger long-term growth. The gap between a Safe Harbor IRA earning less than 1% and a diversified account earning average market returns can equal hundreds of thousands of dollars over time.

Don’t let your money sit idle in a “junk IRA.” Act now to find, consolidate, and reinvest your retirement savings for real growth. Each account you recover today is future wealth compounding for decades. What’s at stake isn’t just today’s balance, but the financial security of your future. Start your search today, your missing retirement savings are out there, ready to grow again.