Why We’re Addicted to Checking Our Portfolio – and How to Stop

7.2 min read

Updated: Dec 28, 2025 - 07:12:54

Checking your portfolio multiple times a day might feel responsible, but research shows it’s quietly destroying both your peace of mind and your long-term returns. Behavioral finance studies confirm that frequent monitoring triggers stress, impulsive trades, and poorer performance, the exact opposite of what investors intend. To invest smarter, you must retrain your brain and your habits, not your portfolio.

- Dopamine traps: Each refresh hits the same reward circuits as gambling. Investment apps use red/green colors and pull-to-refresh loops to exploit intermittent reinforcement, the same psychology behind slot machines.

- Myopic loss aversion: Checking daily exposes you to nearly equal odds of seeing gains or losses (53% vs. 47%), increasing stress and risk aversion. Investors who saw fewer updates earned 53% higher profits.

- Illusion of control: Monitoring feels productive but leads to emotional decisions. True investing success comes from patience, diversification, and letting automation handle rebalancing and reinvestment.

- Behavioral reset: Delete or disable app notifications, schedule quarterly reviews, and replace the checking habit with movement or mindfulness. A 30-day “portfolio fast” helps reset dopamine cycles and reduce anxiety.

- Bottom line: Your portfolio doesn’t need hourly supervision, your discipline does. The less you react to short-term noise, the more you gain from long-term compounding.

The first thing you reach for in the morning isn’t coffee, it’s your phone, to check how your investments performed overnight. By noon, you’ve checked again. Three more times before dinner. Once more before bed. On volatile days, the count hits double digits.

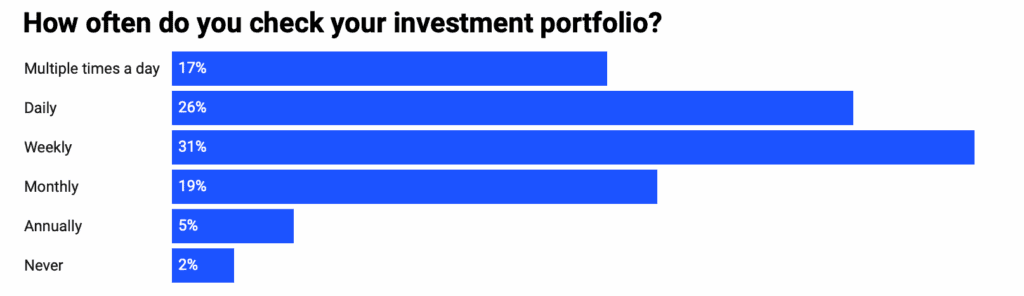

If you’ve ever refreshed your brokerage app for the fifth time in an hour, you’re far from alone. A recent survey shows 43% of investors check their portfolios daily, with 17% doing so multiple times a day.

Source: Sound Mind Investing

This compulsive checking isn’t harmless, research confirms that frequent portfolio monitoring fuels stress and impulsive trading, undermining long-term returns and your overall peace of mind.

The Neuroscience of Portfolio Obsession

Your brain reacts to checking your portfolio much like it does to a slot machine. Each time you open that app, you’re essentially pulling a lever, hoping for a reward. Sometimes you see gains (a dopamine surge), other times losses (a stress response), but it’s the unpredictability that keeps you coming back.

This is known as intermittent reinforcement, the most powerful form of behavioral conditioning. Research shows that uncertainty triggers stronger dopamine responses than predictable rewards, meaning the anticipation of whether your portfolio is up or down can be more stimulating than the result itself.

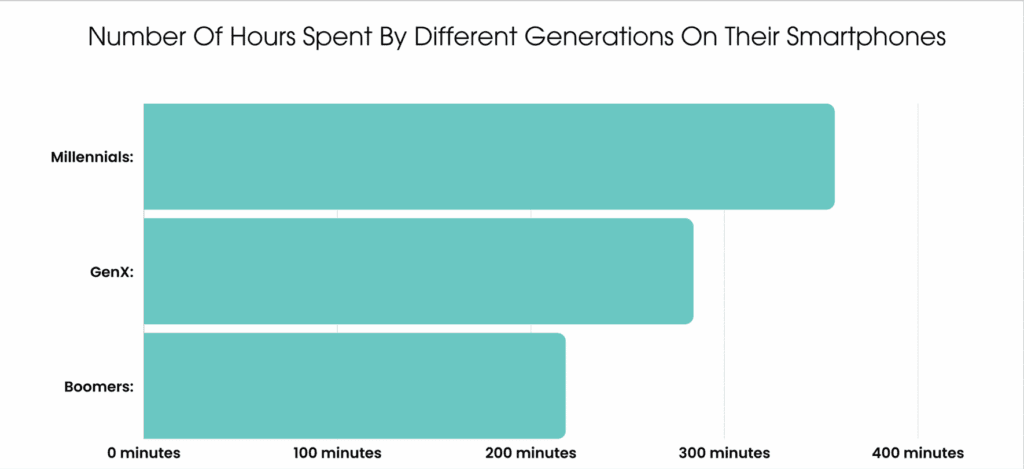

Investment apps are built to exploit this neurological loop. Their interfaces, pull-to-refresh gestures, red and green color schemes, and instant updates, mimic the same addictive feedback systems found in social media and gambling platforms. The average person checks their phone about 58 times a day, and portfolio apps tap into those same reward pathways, turning investing into a cycle of compulsive checking.

Source: Demandsage

The Hidden Cost of Constant Monitoring

The more often you check your portfolio, the more likely you are to hurt your returns. Behavioral economists call this myopic loss aversion, a cognitive bias where frequent monitoring makes investing feel riskier, leading to overly cautious and lower-performing choices.

Here’s why: historical S&P 500 data shows roughly 53% of trading days end higher and 47% lower. Check daily, and you’ll see plenty of losses. Check quarterly, and the odds of viewing a loss drop sharply, reducing emotional reactions that drive impulsive trades.

A landmark NBER field experiment found that traders who received infrequent price updates invested 33% more in risky assets and earned 53% higher profits than those with constant information access. Simply put, less checking led to smarter investing.

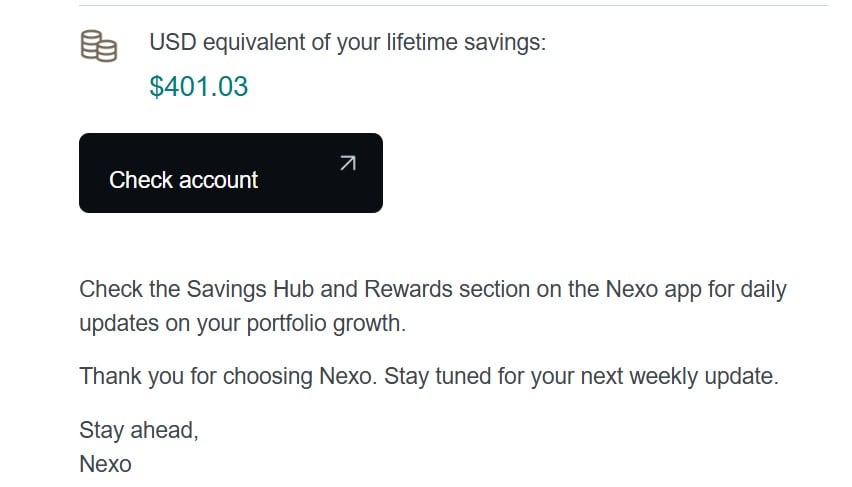

The Nexo email to savings account holders urges users to check “for daily updates on your portfolio growth”. Source: Nexo

Losses hurt about twice as much as equivalent gains feel good, according to research summarized by BehavioralEconomics.com. Constant monitoring exposes investors to more short-term pain, amplifying stress and prompting bad timing decisions. Over time, that emotional volatility quietly erodes long-term performance, making restraint, not obsession, the smarter investment habit.

Why We Can’t Look Away

Beyond the dopamine mechanics, several psychological factors drive portfolio checking addiction:

Fear of missing out (FOMO): What if something major happens and you’re not aware? What if you miss the perfect moment to buy or sell? This anxiety is particularly acute during market volatility – precisely when checking most frequently causes the most damage.

Illusion of control: Monitoring feels like doing something productive about your finances. In reality, for long-term investors, it’s counterproductive theater. You’re not piloting a plane that requires constant adjustments; you’re on a cruise ship where micro-managing the rudder just creates turbulence.

Social comparison: Investment apps often include social features, leaderboards, or community feeds that trigger competitive impulses. You’re no longer just managing your money – you’re competing with strangers on the internet.

Boredom and habit: You’ve trained your brain to fill idle moments with portfolio checking. Waiting in line? Check the portfolio. Commercial break? Portfolio. The behavior has become reflexive, disconnected from any actual investment decision-making need.

The Breaking Point

Stopping portfolio-checking addiction isn’t about willpower, it’s about strategy. Behavioral finance research shows that constant monitoring triggers dopamine cycles and impulsive decisions, while structured routines restore control.

Delete the app: It’s drastic but effective. Logging in through a desktop adds friction that breaks the habit loop. If this idea makes you anxious, that’s proof of how deeply conditioned the behavior has become. Investors managed portfolios long before smartphone apps, you can too.

Schedule fixed check-ins: Experts suggest that reviewing once a quarter or less is ideal for long-term investors. More frequent checking adds anxiety, not insight. Set a recurring 90-day reminder and ignore daily noise.

Turn off notifications: Every alert is engineered to spike dopamine and lure you back. Disable all price, news, and portfolio updates. If a real crisis hits, you’ll hear about it elsewhere.

Automate everything: Set up automatic rebalancing, dollar-cost averaging, and dividend reinvestment. Automation removes decision fatigue and keeps emotions out of the equation.

Replace the habit: When the urge to check hits, redirect it: take a walk, stretch, meditate, or text a friend. You’re retraining your brain’s trigger-reward loop to seek healthier dopamine hits.

Use blockers if needed: Apps like Freedom or Cold Turkey help enforce digital boundaries by restricting access to brokerage sites during work hours.

Try a “portfolio fast”: Go 30 days without checking. Behavioral experts note that discomfort peaks in week one but fades as your brain resets. By week three, you’ll feel calmer and more focused on long-term growth, where real wealth is built.

The Uncomfortable Truth

Here’s what nobody wants to hear: if you’re a long-term investor with a properly diversified portfolio aligned to your risk tolerance and time horizon, daily price movements are meaningless noise. Checking them doesn’t make you a more engaged investor – it makes you a worse one.

The best investors aren’t the ones constantly monitoring. They’re the ones who set up their portfolios correctly and then have the discipline to leave them alone. Legendary investor John Bogle advised: “Don’t peek. Don’t look at your account. Throw the 401(k) statement in the trash when it comes.”

Your phone wants your attention. Investment apps want your engagement metrics. Your amygdala wants to protect you from losses by staying hypervigilant. None of these forces care about your actual investment returns.

The Bottom Line

Compulsive portfolio checking is a modern behavioral addiction, driven by technology and reinforced by your brain’s reward system. It feels productive but often leads to worse financial outcomes. The habit creates an illusion of control while quietly reducing both your discipline and long-term returns.

Breaking this cycle takes more than willpower. You need to remove triggers, add friction, and replace impulsive checking with structured investing habits. Progress matters more than perfection, if you check your portfolio ten times a day and cut that to once a week, you’ve already boosted your chances of long-term success.

Your investments don’t need constant supervision, but your behavior does need boundaries. The less you monitor short-term noise, the more you’ll appreciate the real signal years later, when patience and compound growth, not constant vigilance, have built your wealth.

About this topic

This article forms part of Mooloo’s investing education series, which explains how markets work, how risk and returns are generated, and how investors can make better long-term decisions.

Learn more in our How Investing Works guide.