Treasury Bonds vs Notes vs Bills vs I-Bonds vs TIPS: What’s the Difference?

11.1 min read

Updated: Dec 19, 2025 - 08:12:59

All U.S. Treasury securities are government-backed and virtually risk-free, but they differ mainly by time horizon and inflation protection. If you’re unsure which to buy on TreasuryDirect.gov, the key is matching your investment timeline and tax situation to the right product. Here’s how they stack up in 2025.

- Treasury Bills (T-Bills) — Mature in 4 to 52 weeks; sold at a discount with no regular interest. Best for emergency funds or cash you’ll need within a year. Minimum $100.

- Treasury Notes (T-Notes) — Mature in 2–10 years and pay semiannual interest. Ideal for medium-term goals and stable returns in retirement portfolios. Minimum $100.

- Treasury Bonds (T-Bonds) — Mature in 20–30 years and offer higher yields but greater sensitivity to interest rate changes. Best for long-term income or estate planning.

- I Bonds — Combine a fixed rate with inflation adjustments every six months; limit $10,000 per person per year. Interest compounds tax-deferred until redemption. Great for smaller, inflation-protected savings.

- TIPS (Treasury Inflation-Protected Securities) — Adjust the principal for inflation; interest paid every six months. No purchase limits. Best held in IRAs/401(k)s to avoid “phantom income.”

You visit TreasuryDirect.gov, ready to invest in safe, government-backed securities, only to be greeted by a confusing menu of options: bonds, notes, bills, I Bonds, and TIPS. They’re all issued by the U.S. Treasury and backed by the full faith and credit of the government, yet the differences between them aren’t immediately clear. Which one should you actually buy? Let’s cut through the confusion.

The Simple Answer: It’s Mostly About Time

The simplest way to understand the difference between Treasury bills, notes, and bonds is to look at one key factor, time. Each represents a loan to the U.S. government, but they differ in how long it takes before you get your money back. Treasury bills (T-bills) are short-term securities that mature in one year or less. Treasury notes (T-notes) are medium-term, typically maturing in two to ten years. Treasury bonds (T-bonds) are the long-term option, with maturities of 20 or 30 years.

You can think of it like choosing between a short-term rental, a medium-term lease, or buying a home. All serve the same basic purpose, providing a place to live, but they come with very different time commitments and levels of stability. Similarly, all three Treasuries are backed by the U.S. government, but the duration determines how long your money is tied up and how much interest you earn along the way.

Treasury Bills (T-Bills): The Short-Term Option

Treasury Bills have maturities of 4, 8, 13, 17, 26, or 52 weeks. Unlike other bonds, you don’t receive regular interest payments. Instead, you buy them at a discount and receive the full face value when they mature. The difference between what you pay and what you receive is your interest.

For example, you might buy a $1,000 T-Bill for $980. When it matures in 26 weeks, you get $1,000. Your $20 profit is the interest you earned. T-Bills work well for emergency funds, money you’ll need within a year, or as an alternative to high-yield savings accounts. You can buy them at TreasuryDirect.gov or through any brokerage, with a minimum purchase of $100.

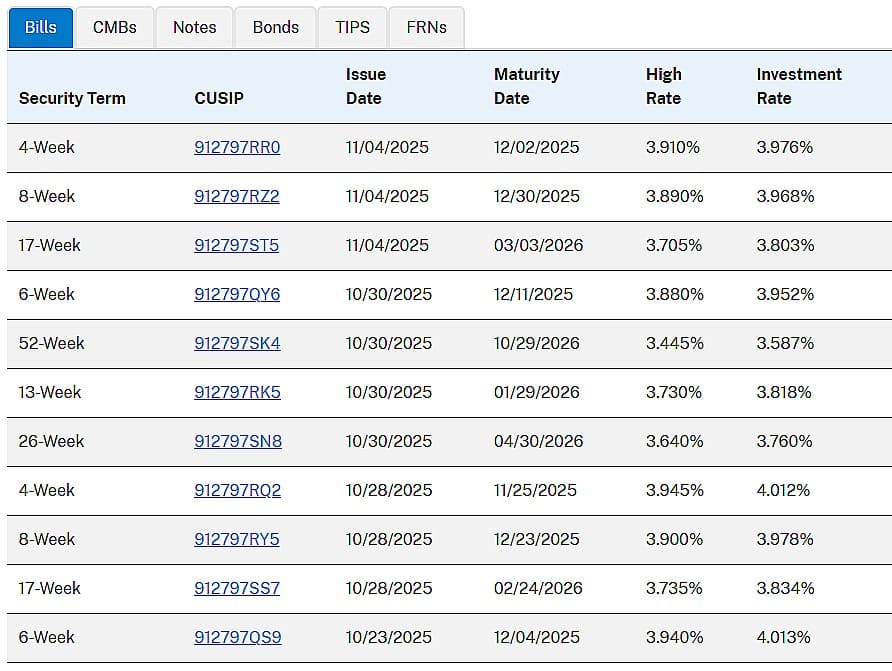

Current rates for T-Bills, Bonds, TIPS and other government backed investment options are all available at Treasury Direct.gov

Treasury Notes (T-Notes): The Medium-Term Option

Treasury Notes, or T-Notes, are U.S. government securities that mature in 2, 3, 5, 7, or 10 years. Unlike Treasury Bills, which are sold at a discount and pay no periodic interest, T-Notes provide investors with fixed interest payments every six months. At the end of the term, you also receive the full principal amount you initially invested.

For example, if you buy a $10,000 Treasury Note with a 4% annual interest rate and a 5-year maturity, you’ll receive $200 every six months, half of the annual interest. Over 5 years, that adds up to $2,000 in total interest payments, and when the note matures, you’ll get your $10,000 principal back.

Treasury Notes are ideal for medium-term savings goals and for investors who want steady income with low risk. They’re commonly used in retirement portfolios to provide stability and predictable returns. You can purchase them directly through TreasuryDirect.gov or via any brokerage, with a minimum purchase of $100.

Treasury Bonds (T-Bonds): The Long-Term Option

Treasury Bonds (T-Bonds) function almost identically to Treasury Notes (T-Notes), but with much longer maturities, typically 20 or 30 years. They pay fixed interest every six months and return the full principal at maturity.

For example, if you buy a $10,000 T-Bond with a 4.5% annual interest rate and a 30-year term, you’ll receive $225 every six months (half of 4.5% of $10,000). Over 30 years, that totals $13,500 in interest payments, plus your $10,000 principal back at maturity.

T-Bonds generally offer higher yields than shorter-term Treasury securities to compensate for the longer commitment. They are ideal for long-term income planning, pension-style cash flow, and estate planning. However, they are also the most sensitive to interest rate changes, when rates rise, T-Bond prices fall more sharply than those of shorter-term securities because of their longer duration.

Quick Comparison: Bills vs Notes vs Bonds

| Feature | T-Bills | T-Notes | T-Bonds |

|---|---|---|---|

| Maturity | 4-52 weeks | 2-10 years | 20-30 years |

| Interest Payments | None (discount pricing) | Every 6 months | Every 6 months |

| Price Volatility | Very low | Moderate | Higher |

| Typical Yield | Lowest | Middle | Highest |

| Best Use | Cash parking | Medium-term goals | Long-term income |

Now the Special Cases: I-Bonds and TIPS

The three securities above are straightforward. But the Treasury offers two inflation-protected options that work differently.

Series I Savings Bonds (I-Bonds): Inflation Protection with Limits

I-Bonds combine a fixed rate (set when you buy) with a variable rate that adjusts every six months based on inflation. The fixed rate stays the same for the bond’s 30-year life, while the inflation component changes with the Consumer Price Index. Interest compounds twice a year but isn’t paid until you cash the bond, which you can do after holding it for at least 12 months.

Here’s an example: You buy a $10,000 I-Bond when the fixed rate is 1.1% and inflation rate is 2.88% (giving you 3.98% total). If inflation rises to 4% in six months, your new rate becomes 5.1% (1.1% + 4%). If inflation falls to 1%, your rate drops to 2.1% (1.1% + 1%).

The main limitation is the $10,000 per person per year purchase limit. Previously, you could buy an additional $5,000 in paper bonds using your tax refund, but that option ended January 1, 2025.

If you cash I-Bonds before five years, you forfeit the last three months of interest. After five years, there’s no penalty. You can only buy them at TreasuryDirect.gov with a $25 minimum purchase.

I-Bonds work particularly well for forced savings (since you can’t touch them for a year), inflation protection up to the annual limit, and people in high-tax states since they’re exempt from state and local taxes. You can defer federal taxes until redemption or maturity.

TIPS (Treasury Inflation-Protected Securities): Professional-Grade Inflation Protection

TIPS work differently than I-Bonds. Instead of adjusting the interest rate for inflation, TIPS adjust the principal. They’re issued with maturities of 5, 10, or 30 years and pay a fixed interest rate. But that rate is applied to an inflation-adjusted principal that changes every six months based on the Consumer Price Index.

Let’s walk through an example: You buy $10,000 in TIPS with a 1% interest rate. Inflation runs at 3% for the year. Your principal adjusts to $10,300, so your interest payment is now 1% of $10,300 = $103 (instead of $100). The next year, if inflation is 3% again, your principal becomes $10,609 and your interest payment rises to $106.09. At maturity, you get back at least your original $10,000, but likely much more due to inflation adjustments.

The “phantom income” problem is the biggest drawback of TIPS. The increase in principal is taxable each year, even though you don’t receive the money until maturity. This means you might owe taxes on income you haven’t actually received yet. The solution is to hold TIPS in tax-advantaged accounts like IRAs or 401(k)s.

TIPS have no annual purchase limits, making them suitable for large inflation-protection investments. You can buy them at TreasuryDirect.gov or through any brokerage with a $100 minimum.

I-Bonds vs TIPS: Which Inflation Protection Should You Choose?

| Feature | I-Bonds | TIPS |

|---|---|---|

| Purchase limit | $10,000/year | Unlimited |

| What adjusts | Interest rate | Principal |

| When you get paid | At redemption | Every 6 months |

| Minimum holding | 1 year | None |

| Penalty period | 5 years (3 months interest) | None |

| Tax timing | Defer until redemption | Taxed annually (phantom income) |

| Deflation protection | Rate won’t go below 0% | Get original principal back at maturity |

| Best for | Smaller investors, forced savings | Larger amounts, retirement accounts |

The practical approach is to max out I-Bonds first ($10,000 per year), then buy TIPS if you need more inflation protection. Always hold TIPS in tax-advantaged accounts if possible to avoid the phantom income tax issue.

The Tax Situation: What You Need to Know

Where to Buy: Your Options

You can buy U.S. Treasury securities in three main ways, each offering a different balance of cost, convenience, and flexibility. TreasuryDirect.gov allows you to purchase securities directly from the U.S. government with no fees or commissions. It’s the only platform where you can buy electronic Series I Savings Bonds (I-Bonds), making it ideal for long-term, buy-and-hold investors. However, the website is notoriously outdated, and selling securities before maturity can be cumbersome.

Brokerage accounts at firms like Fidelity, Schwab, or Vanguard provide a more user-friendly experience. These platforms make it easy to buy and sell Treasuries both at auction and on the secondary market. Many charge no commissions for new issues and only a small spread on secondary trades. This option is especially convenient for investors who might need to sell before maturity or prefer to manage their holdings alongside other investments.

Finally, bond funds and ETFs offer instant diversification and high liquidity without the need to manage individual securities. While they don’t have set maturity dates, meaning their prices fluctuate with interest rates, they provide broad exposure to the Treasury market. This makes them a good choice for investors who want consistent bond exposure without worrying about reinvestment or redemption timing.

Non-U.S. citizen living abroad without a U.S. address or Social Security Number can not buy Treasury securities through TreasuryDirect.gov, but they can purchase through U.S. brokerages that accept foreign clients such as Interactive Brokers – though policies vary.

Practical Scenarios: Which Should You Buy?

Let’s say you need money in 6-12 months for an emergency fund. Treasury Bills with 4-26 week maturities are your best option. For a down payment fund you’ll need in 3 years, consider Treasury Notes with 2-3 year maturities or a ladder of T-Bills.

If you’re planning to retire in 10 years and want stable income, build a ladder of Treasury Notes across 2, 3, 5, 7, and 10-year maturities. With $5,000 to invest and you want inflation protection, max out I-Bonds first. If you have $50,000, put $10,000 in I-Bonds and $40,000 in TIPS held in an IRA.

For someone 70 years old needing predictable income for 20+ years, Treasury Bonds or TIPS work well. If you’re parking $100,000 for just 3 months, use 13-week Treasury Bills and roll them over as needed.

Common Misconceptions

Many people think Treasury bonds are completely risk-free. While they have no default risk, you can lose money if you sell before maturity when interest rates have risen.

I-Bonds aren’t always better than TIPS. If you need more than $10,000 in inflation protection or want regular income payments, TIPS make more sense.

Longer maturities don’t always pay more. During an “inverted yield curve,” short-term rates can actually exceed long-term rates. And TIPS don’t only make sense when inflation is high. They make sense when inflation will be higher than the market currently expects.

The Bottom Line

Here’s the simplest way to think about Treasury securities. Need your money soon? Buy T-Bills. Need it in 2-10 years? Buy T-Notes. Need income for decades? Buy T-Bonds. Worried about inflation with small amounts? Buy I-Bonds. Worried about inflation with large amounts? Buy TIPS.

All are backed by the US government. All are as safe as investments get. The only question is which time horizon and inflation protection matches your needs.

And remember, you don’t have to choose just one. Many investors use a mix. T-Bills for emergency funds, I-Bonds for inflation protection, and T-Notes for medium-term goals. It’s not an either-or decision. Now you can confidently navigate TreasuryDirect.gov and know exactly what you’re buying.

This article is part of Mooloo’s Retirement & Long-Term Planning Hub, covering retirement income, Social Security decisions, investment risk, healthcare costs, and long-term financial security.