Rare Earth Metals: The 17 Billion Investment Opportunity You Only Heard About Last Week

13.2 min read

Updated: Dec 28, 2025 - 09:12:43

China’s 2025 expansion of export restrictions on 12 of the 17 rare earth elements has tightened control over materials critical to electric vehicles, wind turbines, and advanced electronics. These new rules heighten global supply chain risk but open long-term opportunities for investors aligned with Western efforts to rebuild independent production capacity. With the rare earth market projected to grow 6–13% annually through 2030, exposure via diversified ETFs and key producers like MP Materials and Lynas Rare Earths may offer strategic upside amid policy-driven volatility.

- China’s dominance: Controls around 70% of global mining and 90% of refining; new export rules (2025) add licensing and extraterritorial limits on REE-based goods.

- Market growth: Valued at $3.9–$6.7B in 2024, forecast to reach $7.4B by 2030 and potentially $17B by 2032, driven by EVs and renewables.

- Investment access: The VanEck Rare Earth & Strategic Metals ETF (REMX) offers broad exposure; MP Materials and Lynas Rare Earths provide focused plays on Western supply chains.

- Risk profile: Prices remain volatile (30–50% annual swings); policy shifts or recycling advances could cap upside. Recommended exposure: 2–7% of a diversified portfolio.

- Strategic trend: Western reindustrialization and defense initiatives mark rare earths as a national priority sector for the U.S., EU, and Australia through 2035.

China recently expanded its export restrictions on 12 of the 17 rare earth elements, tightening control over materials crucial to high-tech and clean-energy industries. The new rules require export licenses and, in some cases, apply extraterritorially to products made abroad with Chinese materials. These measures, outlined in China’s updated rare earth export policy, have increased global supply chain risks but also opened new investment opportunities.

What Are Rare Earth Metals?

Rare earth elements (REEs) are a group of 17 metallic elements that possess unique magnetic, luminescent, and electrochemical properties. Despite the name, they’re not actually rare in the Earth’s crust. What makes them “rare” is the difficulty and expense of extracting and refining them into usable forms.

The group consists of 15 lanthanides on the periodic table, plus scandium and yttrium. What matters for investors isn’t memorizing the periodic table, but understanding where these materials show up in the real economy.

Source: Britannica

Your smartphone contains at least six different rare earth elements. Neodymium creates the vibration in your phone. Yttrium, europium, and terbium produce the colors on your screen. Lanthanum is in the camera lens. Cerium polishes the glass. Every modern device you own depends on these materials.

Electric vehicles typically use 1–2 kg of neodymium-based magnets per motor, according to the U.S. Department of Energy and Adamas Intelligence, with some designs reaching up to 5 kg. Offshore wind turbines use much more – up to 600 kg of magnets per MW of capacity, as reported by MDPI and ScienceDirect. Without steady supplies of neodymium, praseodymium, and dysprosium, the global transition to electric vehicles and renewable energy would face major disruptions.

Defense applications provide another demand pillar. Modern weapons systems, from missile guidance to fighter jets, rely heavily on rare earth magnets and optical systems. As global defense budgets rise, so does demand for these materials.

Why The Supply Situation Creates Investment Opportunity

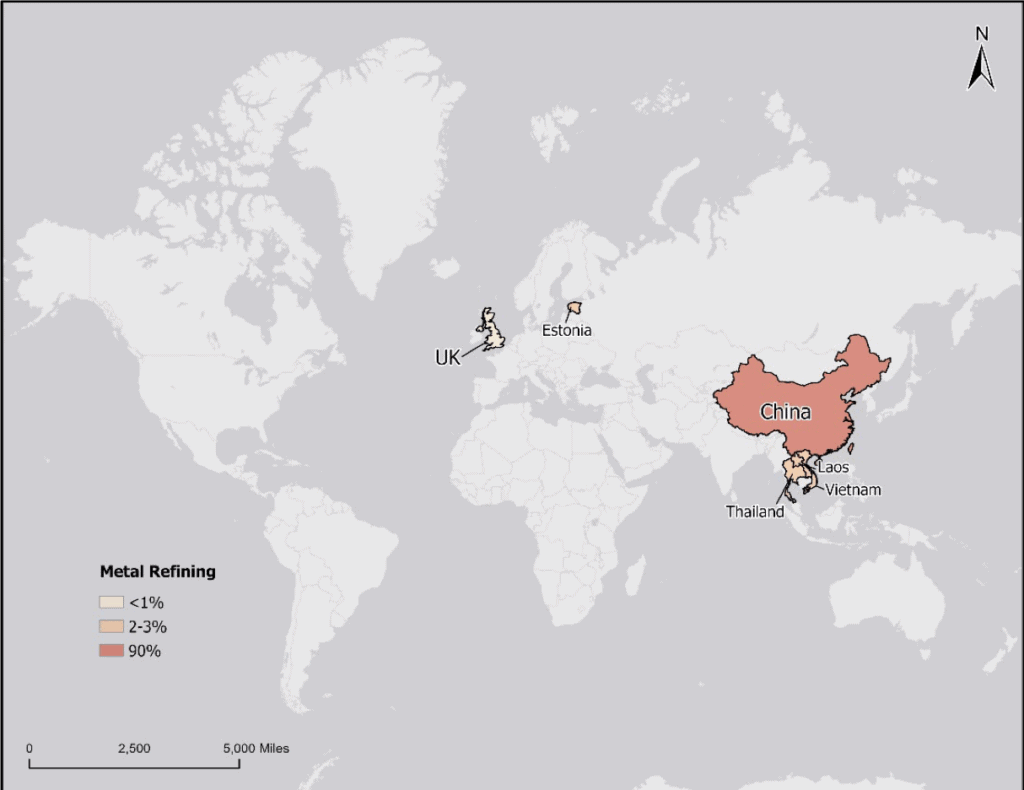

One country currently dominates the rare earth market. China mines roughly 65–70% of global rare earth elements and processes nearly 90% of the world’s supply. Its recent export restrictions have accelerated Western efforts to diversify production, with the United States, European Union, Australia, and Canada investing heavily to build alternative supply chains.

Source: US Department Of Energy

Here’s the investment thesis in one sentence: the Western world is rebuilding rare earth supply chains from the ground up while demand surges, creating opportunities for companies outside China to capture significant long-term value.

The supply constraints aren’t going away soon. Developing new mining and processing capabilities typically takes 7 to 15 years from discovery to full commercial production. Even with massive investment, U.S. production of neodymium-iron-boron magnets is expected to reach only about 1,000 tons annually by late 2025, according to MP Materials. In contrast, China currently produces more than 200,000 tons per year, a gap that remains enormous and will take years to close.

The Demand Explosion: Why Growth Projections Are Conservative

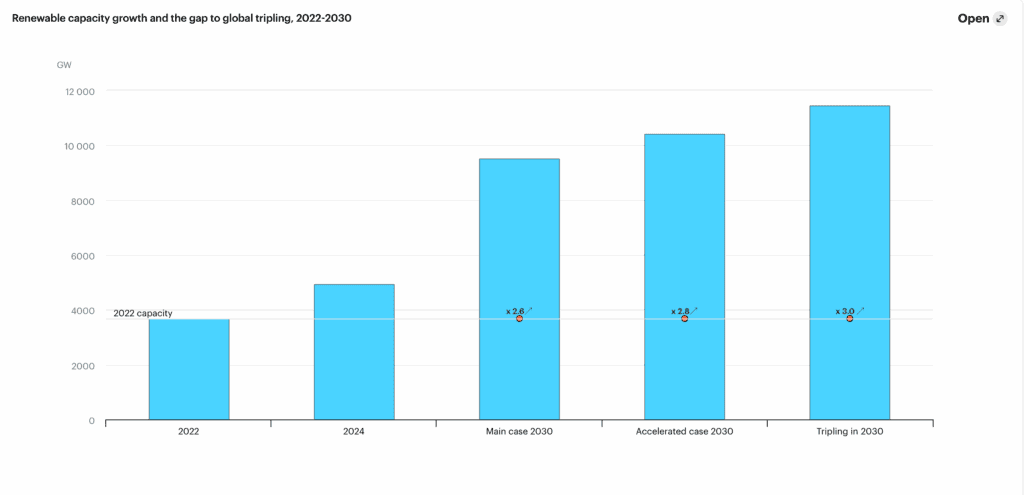

Global electric vehicle (EV) sales topped 17 million in 2024, up about 25% from 2023, according to the International Energy Agency (IEA). The IEA projects sales could reach around 45 million by 2030. Each vehicle uses several kilograms of rare-earth magnets like neodymium and praseodymium, driving demand far beyond today’s capacity.

Wind power adds more pressure. Global capacity is expected to nearly double by 2030, and each modern turbine can require hundreds of kilograms of rare-earth magnets. Alongside consumer electronics and defense applications, this creates a steady demand floor that’s largely immune to economic slowdowns.

Source: IEA

The rare-earth market is forecast to grow 6–10% annually through 2030, with neodymium up ~9%, praseodymium ~10%, and dysprosium and terbium prices likely to climb in double digits amid tight supply. Without major new mining and refining projects, EV production could outstrip neodymium and praseodymium supply by 2036, reinforcing a structural shortage and sustained long-term pricing strength.

Investment Options: From Simple To Complex

Exchange-Traded Funds: The Foundation

For most investors, ETFs offer balanced exposure and risk management. The VanEck Rare Earth and Strategic Metals ETF (REMX) is the most established option, managing about $1.34 billion in assets as of October 2025. It holds around 30 companies deriving at least 50% of revenue from rare earths, with an expense ratio of 0.58% and major exposure to Australia, the U.S., and China. The fund has shown roughly 87% five-year gains, though with significant volatility.

The Sprott Critical Materials ETF (SETM) launched in 2023 and carries a 0.65% expense ratio, offering broader exposure to lithium, cobalt, and other critical metals. While newer, it has performed well since inception. For most investors, REMX provides focused, liquid exposure, while SETM adds diversification across the critical materials supply chain.

Major Producers: Concentrated Exposure

MP Materials (NYSE: MP) represents America’s key rare earth investment. The company operates the Mountain Pass mine in California, the only large-scale rare earth production site in the U.S. In July 2025, the Department of Defense invested $400 million in equity and established a 10-year price floor of $110/kg for neodymium-praseodymium products, alongside a $150 million loan to expand heavy rare earth processing.

MP produced about 1,300 tons of NdPr oxide in 2024 and is developing a fully integrated U.S. supply chain from mining through magnet manufacturing. Risks include ramp-up challenges, exposure to Chinese pricing, and reliance on government support, but the scale of federal backing highlights its role as strategic infrastructure.

Lynas Rare Earths (ASX: LYC, OTC: LYSCF) leads rare earth production outside China. The company mines at Mt Weld and processes material in Malaysia and at its new Kalgoorlie facility, which began operations in November 2024. In 2023, a Japan–Australia joint venture invested A$200 million to expand output. NdPr production rose 22% year-over-year in early 2025. While Lynas faces regulatory challenges in Malaysia and strict environmental standards in Australia, its scale and established supply relationships secure its position as the leading non-Chinese rare earth producer.

Junior Miners: High Risk, High Reward

USA Rare Earth (NASDAQ: USAR) is developing the Round Top deposit in Texas. In January 2025, the company produced its first dysprosium oxide sample refined to 99.1% purity, a notable step toward domestic rare earth production. However, moving from lab samples to commercial scale remains a major challenge.

This highlights the risk–reward profile of junior miners. They provide early exposure to potential world-class deposits but face long timelines, heavy capital needs, and high failure rates. The typical path from discovery to production can take 7–15 years.

Key Factors to Evaluate:

-

Geological reports and resource estimates

-

Processing complexity and costs

-

Management track record

-

Capital needs and dilution risk

-

Realistic timeline to production

For risk-tolerant investors, a small allocation, about 1–2% of a rare earth position, can offer asymmetric upside, but exposure should stay limited within a broader portfolio.

Diversified Miners: Lower Risk Exposure

Major mining companies are adding rare earth exposure to their portfolios. Rio Tinto (NYSE: RIO) is developing rare earth separation capabilities as part of its critical minerals strategy. Iluka Resources has committed about A$1.2 billion to build the Eneabba Rare Earths Refinery in Western Australia, dedicated to rare earth oxide production.

The advantage is gaining rare earth exposure alongside copper, iron ore, and aluminum, supported by strong balance sheets and experienced management. The drawback is diluted exposure, rare earths form a small part of total revenue, so price gains have limited stock impact. This approach fits conservative investors seeking moderate rare earth exposure without the volatility of pure-play companies.

Understanding The Risks

Price Volatility and Market Manipulation

Rare earth prices can swing 30–50% within a year. In 2022, prices spiked due to supply concerns, while by 2024 they fell 17–30% as Chinese overproduction created a supply glut. This volatility is inherent to the market’s structure. China has a history of using its market power to manipulate supply, after the 2010 export restrictions, it later flooded the market with low-cost material, causing several Western producers to collapse. Investors should recognize that Chinese policy shifts can depress prices regardless of global demand.

Current disruptions have created what many call a “rare earth value gap” for long-term investors. However, repeated export restrictions are accelerating supply chain diversification, with Western nations racing to build capacity before China adjusts policy again.

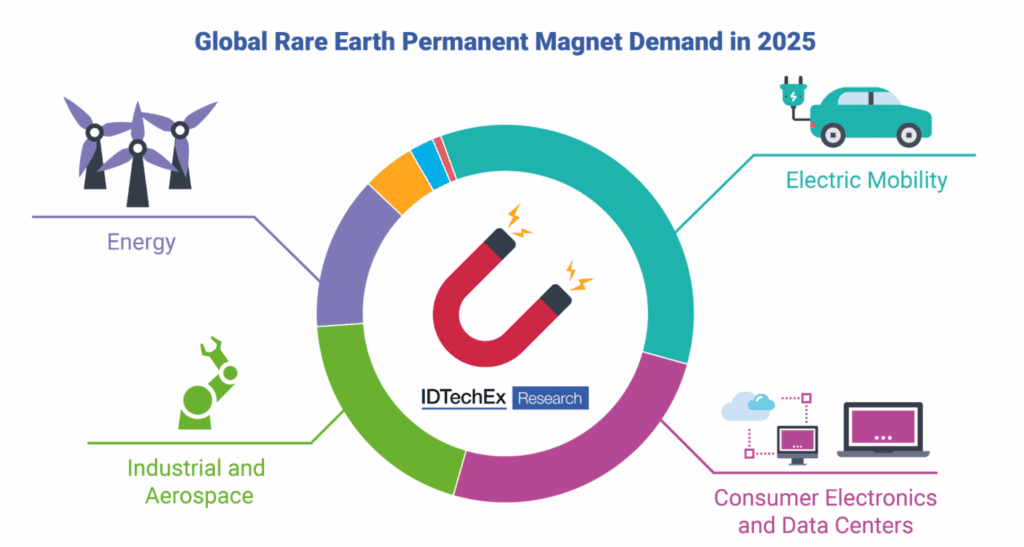

Technology and Substitution Risk

Companies like Toyota are developing rare-earth-free motor technologies. While not yet commercially viable, successful designs could cut neodymium demand by 10–15% by 2035. Recycling efforts in Europe and North America are also advancing, with IDTechEx projecting recycling could supply up to 10% of total demand by 2030. These aren’t immediate threats, but they represent long-term headwinds to the current rare earth demand model.

Source: IDTechEx

Environmental and Regulatory Risk

Rare earth mining is environmentally intensive. The extraction and refining processes generate toxic waste and face strict oversight. Lynas has faced years of regulatory battles over its Malaysian processing facility. In Western nations, new projects typically face 7–10 years of permitting hurdles, with environmental opposition capable of delaying or stopping operations entirely, especially for junior miners without political leverage.

Capital Intensity and Dilution

Building rare earth processing facilities costs hundreds of millions to billions of dollars. Most companies rely on continuous capital raises, diluting early shareholders long before profitability. MP Materials remains an exception due to massive U.S. government support, including direct defense investment and price floor guarantees. Few others enjoy similar backing, leaving most miners dependent on capital markets and exposed to financing dilution.

The Expertise Spectrum: What You Actually Need To Know

Beginner Investors (Less Than 3 Years Experience)

If you’re new to investing, rare earths can fit in your portfolio but with strict limits. Keep exposure to 2–3% and use only the VanEck Rare Earth and Strategic Metals ETF (REMX). Avoid individual stocks and focus on a 5–10 year horizon.

What you need to know: rare earths are volatile commodities, demand is growing from EVs and renewables, supply is dominated by China, and Western nations are building new supply chains. That’s enough to make an informed ETF choice.

What you don’t need: deep knowledge of metallurgy, mining economics, or trading strategies. The ETF provides broad exposure and risk management.

Intermediate Investors (3–7 Years Experience)

With some commodity knowledge, you can raise allocation to 5–7% and add individual stocks. A balanced mix could be 60% REMX, 25% MP Materials for U.S. exposure, and 15% Lynas Rare Earths for Australian exposure.

You should understand basic mining economics, production updates, light vs heavy rare earths, and how policy affects prices. Track price trends on MetalMiner and monitor quarterly reports and regulatory developments.

Advanced Investors (7+ Years Experience)

Experienced investors can allocate up to 10% and include select junior miners. A practical mix: 40% REMX, 30% MP Materials, 20% Lynas, and 10% split among juniors with near-term catalysts.

You should understand geological data, permitting timelines, financing structures, and processing challenges. At this level, you’re doing full due diligence and must accept high volatility, and potential total loss, on junior miner positions in exchange for high upside potential.

Practical Investment Framework

Portfolio Allocation Guidelines

Conservative investors (retirees, risk-averse) should limit rare earth exposure to 0–2% of their total portfolio. Moderate investors with a balanced approach and 10+ year horizon can allocate 3–5%. Aggressive investors focused on growth and comfortable with high volatility can allocate up to 5–10%, but never exceed 10%, regardless of conviction level.

These limits are justified by the sector’s speculative nature and extreme volatility. Rare earth prices have historically seen 30–50% drawdowns, so allocations must be small enough to withstand those swings without panic selling.

Three Strategy Templates

Simple Approach (90% of investors): Invest 100% of your rare earth allocation in the VanEck Rare Earth & Strategic Metals ETF (REMX). Rebalance annually if it exceeds your target. Hold for 5–10 years for diversified exposure across miners, refiners, and recyclers, with professional management and geographic balance.

Balanced Approach (experienced investors): Allocate 60% REMX, 30% MP Materials, and 10% Lynas Rare Earths. This mix provides core ETF diversification plus direct exposure to the two leading non-Chinese producers, capturing Western production growth while mitigating single-stock risk.

Aggressive Approach (advanced investors): Allocate 40% REMX, 30% MP Materials, 20% Lynas, and 10% to a carefully chosen junior miner with a near-term production catalyst. The junior position is speculative and could go to zero, but other holdings offer downside stability.

What to Monitor

Quarterly Checklist:

-

Production updates from individual holdings

-

Rare earth price trends, especially neodymium-praseodymium

-

Global EV sales data as a proxy for demand growth

-

Government policies or subsidies affecting rare earths

-

Portfolio allocation vs. targets (rebalance as needed)

Quarterly reviews are sufficient. Only junior miners require closer tracking of financing rounds and project milestones.

Exit Signals

Reduce position if: Your rare earth exposure grows beyond target due to price gains. Rebalance down, this is discipline, not bearishness.

Reassess thesis if:

-

China floods the market and prices collapse 40%+.

-

Substitution technologies achieve commercial scale.

-

Recycling meets 15%+ of global demand earlier than expected.

-

Your time horizon drops below three years.

Exit completely if: You find the sector’s volatility exceeds your comfort or expertise level. Recognizing a poor fit early is smarter than panic-selling later.

The Bottom Line: Is This Investment Right For You?

The rare earth opportunity is real. Western nations are rebuilding supply chains to reduce dependence on China, which controls about 70% of global mining and 90% of processing capacity. Demand is growing 6–10% annually, driven by EVs, wind power, and defense industries. Companies positioned in this transition could generate strong returns, but risks remain high.

This is not a beginner investment theme. Rare earth prices swing 30–50% a year, projects take 7–15 years to reach production, and many juniors fail. Chinese policy shifts can crush prices regardless of demand.

Invest only if you understand commodity cycles, can handle volatility, and have a 5–10-year horizon. Keep allocation below 10%. Start with the VanEck Rare Earth and Strategic Metals ETF (REMX) for diversified exposure, and consider adding MP Materials or Lynas Rare Earths later.

Avoid if you need short-term liquidity or prefer stable income. The sector is volatile but backed by long-term megatrends in electrification and energy transition, patient investors can benefit if they size positions carefully.

This article belongs to Mooloo’s Asset Classes series, which examines how different assets behave over time and how they are used together to build resilient portfolios. View the full Asset Classes overview to see how each asset fits within a broader investment structure.