What Happens If You Die Without a Will? The Costly Mistake Too Many Mid-Life Adults Are Making

7.3 min read

Updated: Dec 22, 2025 - 09:12:29

Dying without a will, known legally as dying intestate, means state law, not you, decides who inherits your assets, who raises your children, and how long your loved ones wait for closure. More than half of U.S. adults still have no estate plan, yet even a basic will can prevent costly delays, family disputes, and outcomes that defy your wishes. Here’s what really happens if you don’t have one, and why now is the time to act.

- State law controls inheritance: Without a will, assets are distributed by state intestacy laws, often ignoring unmarried partners, stepchildren, or charities. In some cases, the estate may even “escheat” to the state if no relatives are found.

- Courts appoint executors and guardians: A probate judge decides who manages your estate and, if applicable, who raises your minor children. Disputes can leave assets frozen and children in temporary care.

- Costs and delays rise fast: Probate fees often consume 3%–7% of the estate’s value, and disputes can drag on for years. A clear will, or a living trust, minimizes these expenses and speeds up distribution.

- Modern families face special risks: Unmarried or blended families aren’t recognized under intestacy laws, meaning stepchildren and long-term partners could receive nothing without explicit planning.

- Affordable options exist: Simple online wills start around $100–$300, while attorney-drafted plans (typically $300–$1,000) offer tailored protection for more complex estates.

Here’s what really happens when someone dies without a will, and why this is the time to take action. If you’re middle-aged or older, the following scenario is statistically imminent, if it hasn’t happened already. A friend, healthy, active, in their late 40s or early 50s, dies suddenly of a heart attack. Amid the grief, their family is left to navigate not only funeral arrangements but a complex financial and legal maze. For many people in midlife, this scenario hits uncomfortably close to home.

If you’re in your 40s or 50s, own a home, have retirement accounts, or support a family, but don’t have a will, you’re far from alone. Surveys consistently show that more than half of American adults have no estate planning documents in place. But dying without a will (known legally as “dying intestate”) can create complications, legal expenses, family disputes, and outcomes that may be the opposite of what you would have wanted. Here’s what really happens when someone dies without a will, and why now is the time to act.

State Law, Not You, Decides Who Gets What

When a person dies intestate, their assets are distributed according to state intestacy laws. These laws vary, but most follow predictable patterns based on marital status and family structure:

-

Married with children: Assets are divided between the surviving spouse and children. In some states, the spouse gets a fixed share (for example, one-third), and the rest is split among the children.

-

Married without children: The spouse usually inherits everything, but in certain jurisdictions, a portion may still go to surviving parents or siblings.

-

Unmarried with children: The children inherit everything equally. If one child has passed away, their share typically passes to their descendants (grandchildren).

-

No spouse or children: Assets may go to parents, siblings, nieces, nephews, or even distant relatives you might not have known well.

The most important point: you lose control. State laws don’t account for long-term partners, stepchildren, or close friends. They also don’t honor charitable wishes or special gifts. In rare cases where no relatives can be found, your estate “escheats” to the state, meaning the government inherits your property.

The Court Controls the Process

If you die without a will, the probate court must appoint a close relative to handle your estate. Without clear instructions, the process can be slow, costly, and contentious.

Probate often takes months or even years, and financial accounts may be frozen, delaying access to funds. Fees for attorneys, appraisers, and courts typically total 3%–7% of the estate’s value, and can be higher in disputed cases. According to state intestacy laws, assets are divided among relatives by default, which may not align with your wishes.

Unmarried Partners and Blended Families Are Especially at Risk

Modern families are more complex than ever, and intestacy laws haven’t kept pace. For unmarried couples, there are no automatic inheritance rights in most states. A surviving partner could lose their home, bank accounts, or even personal property if it was titled in the deceased’s name alone. Unless you’ve created joint ownership documents or a will, the law will not recognize your shared life together.

Blended families also face major challenges. Stepchildren typically inherit nothing under intestacy laws unless they have been legally adopted. This can create painful divisions, where biological children inherit everything while stepchildren are left with nothing. Even when everyone is on good terms, legal disputes can emerge when emotions run high and expectations differ.

Minor Children Could End Up With a Court-Appointed Guardian

Perhaps the most heartbreaking consequence of dying without a will is what happens to minor children. If both parents die without naming guardians, the court steps in to decide who will raise the children.

Family members can petition for guardianship, but if there’s disagreement, the process can turn into a prolonged and emotionally draining battle. In the meantime, children may be placed temporarily in state-supervised care while the court makes a decision.

Naming a guardian in a will doesn’t just prevent legal chaos, it ensures that the person you trust most is the one who will provide stability and love for your children if the worst happens.

Taxes and Costs Can Eat Into Your Estate

While a will doesn’t eliminate taxes, intestate estates often face higher legal and administrative costs because of delays and disputes. These expenses can reduce the total amount that eventually goes to your heirs. A clear, legally valid will can minimize these costs by streamlining the process and making your intentions clear.

Dying intestate doesn’t automatically increase taxes, but it often amplifies costs and inefficiencies. Without clear documentation, legal fees rise as courts determine heirs and property ownership. Executors and attorneys must identify and value every asset, from vehicles to digital accounts, and verify debts, taxes, and beneficiaries. Disputes can delay closure for years.

A simple will, by contrast, speeds up probate and ensures that your estate is distributed according to your wishes. You can also pair your will with a revocable living trust, which allows certain assets to bypass probate altogether, saving thousands in fees and months of delay.

Why People Put It Off, and Why That’s Dangerous

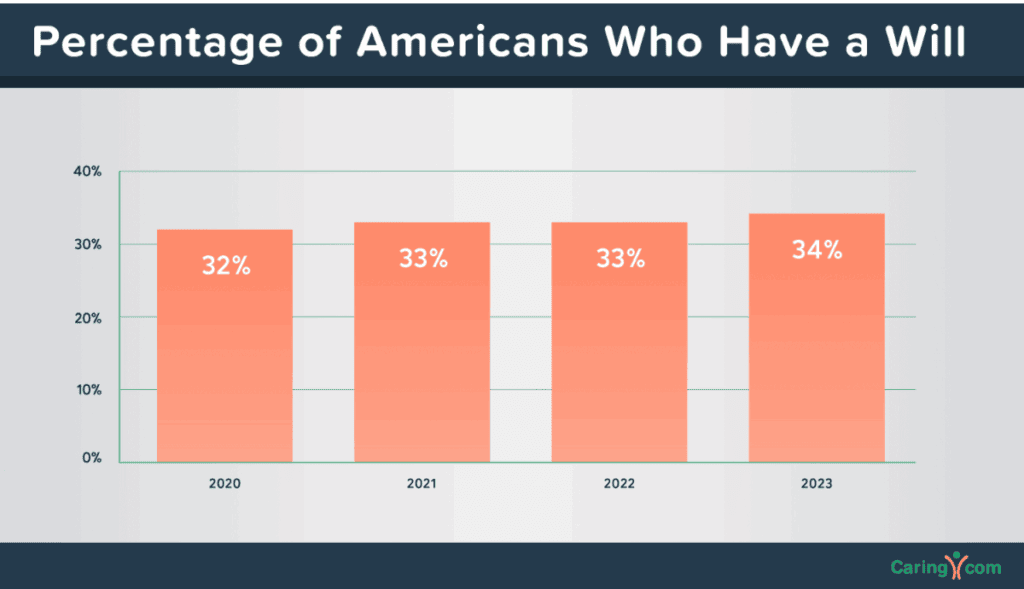

Procrastination is the enemy of estate planning. Many people assume they’re too young, too healthy, or don’t own “enough” to need a will. Yet, sudden illness or accidents can happen at any age. In Caring.com’s 2023 Wills and Estate Planning Survey, nearly half of U.S. adults admitted they have no estate plan at all.

Source: Caring.com

Among those who hadn’t created one, the leading reasons were that they “just haven’t gotten around to it” (42%) and “don’t have enough assets to leave anyone” (35%). These findings highlight that procrastination and misconceptions about wealth level remain the biggest barriers to preparing even a simple will.

Source: Caring.com

The truth is, a will isn’t just for the wealthy. It can cover everything from your home and retirement accounts to digital assets, family heirlooms, or even pets. You can also leave instructions for funeral arrangements, charitable donations, or guardianship for children. Writing a will gives you, and your family, peace of mind. It eliminates guesswork, prevents family disputes, and provides legal clarity when your loved ones need it most.

The Bottom Line

If you don’t have a will, you’re leaving one of life’s most important financial decisions to state law and the courts. Creating a will can be relatively straightforward and affordable for most people. A basic will in the United States typically costs between $300 and $1,000 when prepared by an estate attorney, depending on location and complexity.

Those looking for more affordable options can turn to reputable online services such as Trust & Will or LegalZoom, where basic wills often range from about $100 to $300. These platforms are ideal for straightforward estates but may not fully address complex financial or family situations.

For estates involving real estate in multiple states, business ownership, or significant assets, a customized legal plan is essential. Working with an experienced estate planning attorney ensures that your property is protected, your beneficiaries are clearly defined, and your assets are distributed according to your wishes, minimizing potential disputes and delays in probate court.