Who Is Eligible for the 2026 Social Security COLA? A Complete Guide

4.9 min read

Updated: Dec 25, 2025 - 03:12:08

The Social Security Cost-of-Living Adjustment (COLA) ensures your benefits keep pace with inflation, no action required. If you receive retirement, disability (SSDI), survivor, or Supplemental Security Income (SSI) benefits, you’re automatically eligible. The Social Security Administration (SSA) bases annual COLA increases on inflation data from the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), published by the U.S. Bureau of Labor Statistics. The official 2026 COLA increase was announced in October, with a 2.8% payment increase to be reflected from January 2026 checks onwards.

- Automatic adjustment: All Social Security and SSI recipients, about 72.5 million Americans, receive COLA increases automatically; no separate application is required.

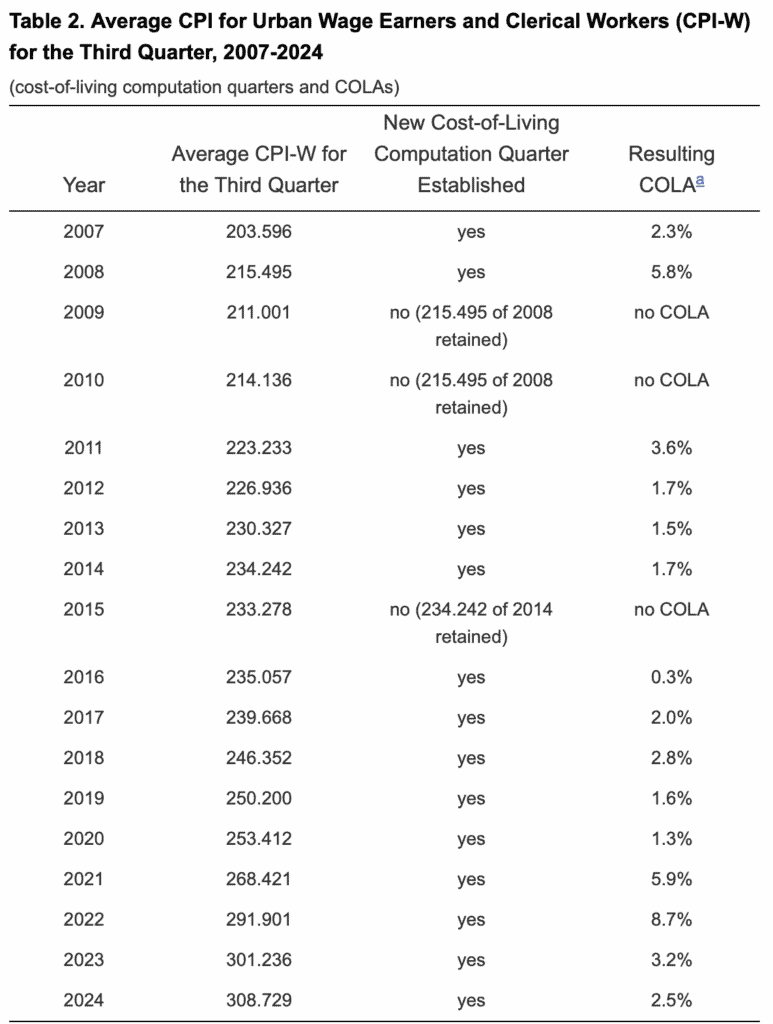

- How it’s calculated: The SSA compares CPI-W averages from Q3 of the current year to the prior year; if inflation rises, benefits increase accordingly.

- Notification timeline: New benefit amounts appear in December notices or your my Social Security account, with payments adjusting in January.

- When no COLA applies: If prices don’t rise, benefits stay level (as in 2009, 2010, and 2015 per Congress.gov), but they never decrease.

- Key considerations: Medicare Part B premiums may offset part of your increase, check Medicare.gov for current rates.

The annual Cost-of-Living Adjustment (COLA) ensures the purchasing power of millions of Americans. While COLA may sound complicated, the reality is far simpler: most recipients are automatically eligible, and the adjustment requires no additional action. Understanding who qualifies, how it’s calculated, and what to expect each year can help you better plan your finances in retirement or while receiving disability or survivor benefits.

Who Qualifies for Social Security COLA?

COLA eligibility is straightforward. If you’re among the more than 72.5 million Americans receiving Social Security benefits, including nearly 68 million Social Security beneficiaries and approximately 7.5 million Supplemental Security Income (SSI) recipients, you automatically qualify for the Cost-of-Living Adjustment.

- Social Security retirement benefits: Whether you claimed at 62, waited until your full retirement age, or delayed until 70, you’ll receive COLA increases. Your monthly payment adjusts each year to reflect changes in the cost of living.

- Social Security Disability Insurance (SSDI): If you’re approved for disability benefits through Social Security, you’re eligible for COLA. Your payments increase at the same rate as everyone else’s.

- Survivor benefits: Widows, widowers, and dependent children receiving benefits based on a deceased worker’s record all qualify for COLA adjustments.

- Supplemental Security Income (SSI): Though technically separate from Social Security, SSI recipients also receive annual COLA increases. If you receive SSI due to age, blindness, or disability, your payments will adjust accordingly.

How COLA Is Calculated

The Social Security Administration (SSA) calculates COLA using the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), a measure provided by the U.S. Bureau of Labor Statistics (BLS). The formula is straightforward:

-

The SSA compares the average CPI-W for July, August, and September of the current year with the same period from the prior year.

-

If the index has increased, the percentage difference becomes the COLA for the following year.

-

If the index has not increased, no COLA is applied.

For example, if inflation pushes the CPI-W higher, retirees see larger increases, as in 2023 when COLA reached 8.7%, one of the highest in decades due to surging inflation.

How You’ll Know Your New Amount

The SSA announces the COLA percentage adjustment each October, based on inflation data from the U.S. Bureau of Labor Statistics. You’ll receive a notice in December showing your new benefit amount, either by mail or through the Message Center of your my Social Security account. This notice explains exactly how much your payment will increase. You can also log in to your account online to view the updated amount once COLA takes effect.

When COLA Doesn’t Apply

If there’s no increase in the CPI-W from one year to the next, there can be no COLA, this has happened three times since automatic COLAs began in 1975: in 2009, 2010, and 2015.

Source: Congress.gov

However, your benefits will never decrease. The Social Security COLA can never be negative, and benefit levels are not reduced, even during times of a declining price index. If there’s no COLA, your payment simply stays the same as the previous year.

Special Situations

While COLA applies broadly, a few additional scenarios are worth noting:

-

Working while receiving benefits: If you’re employed and under full retirement age, your benefits may be reduced if your earnings exceed annual limits. However, COLA adjustments still apply regardless of employment status.

-

Medicare premiums: Most beneficiaries have Medicare Part B premiums deducted directly from Social Security payments. If premiums increase, your net monthly payment may not rise by the full COLA percentage. You can review details at Medicare.gov.

Why COLA Matters

COLA is critical to ensuring that Social Security keeps pace with rising costs. Without it, inflation would gradually erode the real value of benefits, leaving seniors, the disabled, and survivors vulnerable to financial hardship. By linking adjustments to inflation data, the SSA provides a safeguard that helps maintain stability in retirement and disability income.

The Bottom Line

If you’re receiving Social Security retirement, disability, or survivor benefits, or if you’re getting SSI, you’re eligible for COLA. You don’t need to do anything to claim it. The increase happens automatically each January, and you’ll be notified in December through mail or your my Social Security account.

COLA ensures that the purchasing power of Social Security and SSI benefits isn’t eroded by inflation. It’s automatic, guaranteed for eligible recipients, and requires zero action on your part. For the most current updates, visit the official SSA COLA page or log in to your my Social Security account to view personalized benefit information.

For a full overview of Social Security benefits, rules, and common questions, see our Social Security Explained guide.