The Opportunity Cost Of Career Switching: What The Data Shows

9 min read

Updated: Dec 21, 2025 - 10:12:05

Switching careers is one of the most expensive financial decisions a worker can make, costing an average 14% salary cut in year one (about $3,700–$5,000 for U.S. workers), plus lost wages and retraining fees that can push the total hit to $40,000–$50,000. While most career switchers recover within three to five years thanks to nearly 3x faster wage growth compared to job stayers, the payoff depends heavily on industry choice, timing, and age. The 2024 labor market shows a shrinking wage premium for switchers, making strategy more critical than during the “Great Resignation.”

- Immediate cost: Career changers face an average 14% salary drop and up to $50,000 in combined lost wages and retraining costs.

- Recovery window: Most successful switchers break even within 3–5 years; wage growth is 2.9x faster than for stayers.

- Industry matters: Moving into high-demand fields like tech or healthcare accelerates recovery; leaving finance or established tech roles often means permanent pay cuts.

- Timing matters: ADP payroll data shows the job-switching premium fell from 15% in 2022 to 7.2% by mid-2024, narrowing the advantage.

- Long-term view: Workers over 45 take longer to recover, and downturns can extend wage penalties for years.

Career switching is one of the most significant financial and personal decisions a professional can make, and the true cost extends well beyond the headline tuition fees of retraining or the immediate salary drop. Research shows that the first year of switching fields typically comes with a steep cost, about 14% of your salary, translating to $3,700 to $5,000 for most workers. But this figure only scratches the surface.

The Real Cost of Starting Over

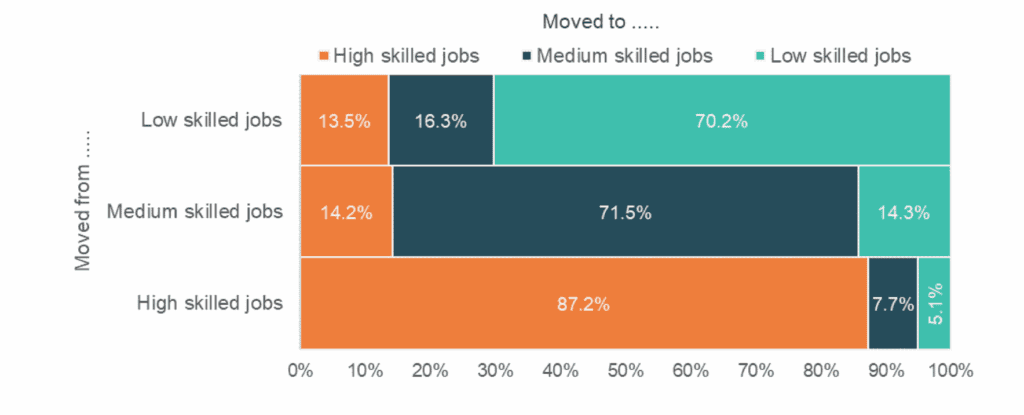

When economists talk about career switching, they mean something specific: moving between industries or occupational fields, not just changing employers. It’s the difference between an accountant moving from one firm to another versus an accountant becoming a software engineer.

According to research from the Learning and Work Institute analyzing thousands of career transitions in the UK labor market, the average full-time worker who switches careers takes an immediate pay cut of £3,731 per year, or about 14% of their salary. The institute’s “New Futures” program, which ran through September 2023, tracked career changers across four UK localities to understand the real costs and barriers.

Source: Learning and Work Institute

American labor market data tells a similar story. During the hot labor market of 2022, when workers were quitting in droves during the “Great Resignation,” job switchers who stayed in their field saw their wages jump by 10% or more according to Pew Research Center analysis. But those who changed industries? Their gains were much smaller, and many actually earned less in their first year.

The size of that initial hit depends enormously on which industries you’re leaving and entering. Bureau of Labor Statistics wage data from May 2024 shows why: computer and information systems managers average $187,990 annually, while elementary school teachers earn $69,790. A teacher moving into tech might see their salary jump eventually, but someone leaving a high-paying finance role to pursue education could face a permanent step down.

The Hidden Price Tag Nobody Mentions

But here’s what makes career switching really expensive: it’s not just about your first paycheck in the new field. It’s about everything given up along the way.

The Learning and Work Institute calculated that a worker taking a one-year full-time course to retrain faces a combined hit of up to £40,000 (approximately $50,000). That’s £30,000 in lost wages during the training year, plus course fees, plus that 14% pay cut when starting in the new field.

And that’s just the money that can be counted. What about the 401(k) matching schedule that resets? The three weeks of vacation time earned that just dropped to one? The professional network built over a decade that’s suddenly less relevant? The pension benefits that were about to vest?

When adding it all up, the true opportunity cost of switching careers can feel overwhelming. This is probably why the Learning and Work Institute research found that fewer people are switching sectors now than before the 2008 financial crisis, despite all the talk about people seeking more meaningful work.

When the Gamble Pays Off

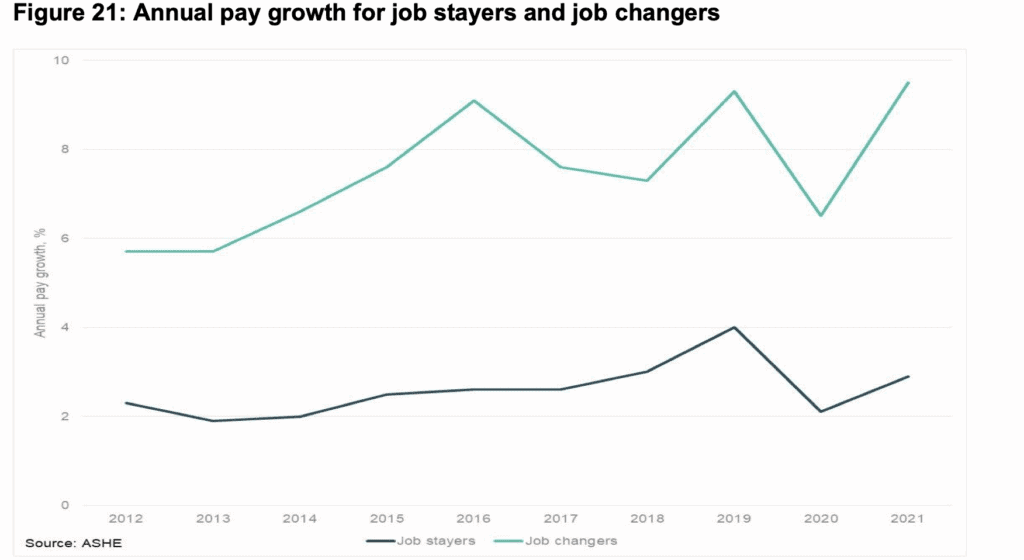

Here’s where the story gets interesting. Because while the immediate cost is real, career switchers don’t stay behind forever. The data shows something remarkable: after taking that initial hit, career changers see their wages grow 2.9 times faster than people who stay in the same job. Not 2.9% faster, nearly three times faster.

Source: Learning and Work Institute

Let’s watch how this plays out in real numbers using BLS occupational wage data. Imagine a teacher earning the national average of $68,130 who switches to become a software developer, where the average salary is $144,570.

In year zero, they’re out about $70,000 between lost teaching salary and bootcamp costs. But in year one, landing an entry-level development job at $85,000 means earning $16,000 more than they would have as a teacher, even while below the average developer salary. By years two and three, as skills grow and strategic job moves happen, they’re pushing toward $110,000. By year four, they’re at or above the average developer salary, having completely recovered their initial investment.

The break-even point for most successful career switchers falls somewhere between three and five years. Research from the Swiss Journal of Economics and Statistics tracking long-term career interruptions found that wage penalties typically vanish completely after five to six years.

When It Doesn’t Work

Of course, not every career switch follows this optimistic trajectory. The data reveals some sobering patterns. Older workers face a steeper climb. According to the American Institute for Economic Research, 82% of workers over age 45 who attempt a career change do succeed, but their recovery period is longer. They are often competing for entry-level positions against younger candidates, and age bias in hiring remains a persistent challenge.

Workers switching to lower-paid fields face permanent salary reductions. That finance manager who leaves to start a nonprofit might never recover their former earning power, no matter how fast wages grow in the new sector. When growing from a lower base, there is always catching up to do.

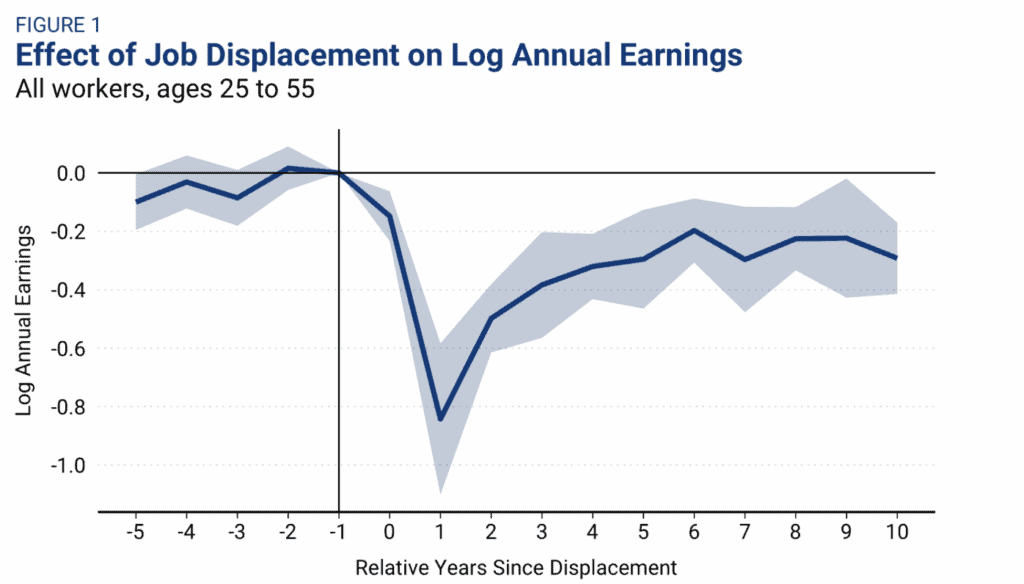

Economic timing matters enormously. Research on job displacement highlights that poor timing can echo through earnings for years. A Brookings analysis found that displaced workers often earn 15–25% less even a decade laterthan peers who remained employed.

Source: Bookings

Earlier studies from the National Bureau of Economic Research (NBER) similarly show that six years after displacement, wages remained about 10% below expected levels, underscoring how macroeconomic conditions at the time of a switch can have lasting financial consequences.

The 2024 Reality Check

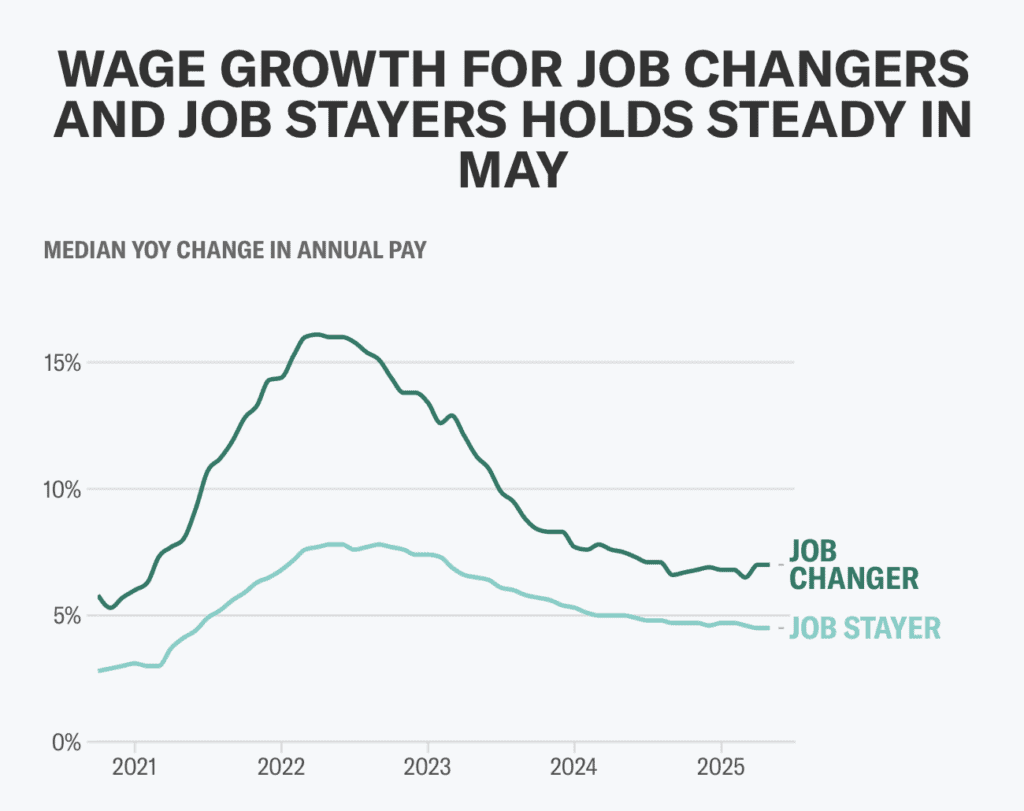

The labor market in 2024 looks very different from the pandemic hiring frenzy. According to ADP’s payroll data tracking millions of American workers, the wage premium for job switching has collapsed. Back in April 2022, job switchers were seeing their pay jump by 15% while people who stayed put got raises of just 7%. That 8-point gap made switching a no-brainer for anyone confident they could land something new.

Source: Yahoo Finance

By March 2024, that gap had narrowed to less than 5 percentage points. Switchers were getting 10% raises, stayers were getting 5%. Still an advantage, but smaller. By July 2024, it had shrunk further: 7.2% for switchers versus 4.8% for stayers.

The message is clear: the golden window for career switching has closed somewhat. It can still be done, but requires more strategic thinking about when and how.

Running Your Own Numbers

How should someone think about this decision?

The framework isn’t complicated, but requires honest accounting. First, map out what happens by staying. Someone making $72,000 now with typical annual raises of 3-5% will be at about $83,000 in five years and $96,000 in ten. Ten-year total earnings: roughly $850,000.

Now map the switch. Three months of bootcamp costs $18,000 in tuition plus $18,000 in lost salary. Landing an entry-level developer job at $85,000 in year one, then hitting $110,000 by year three and $140,000 by year five with typical tech wage growth. Ten-year total earnings: roughly $1,150,000.

The career switch would put someone ahead by about $300,000 over ten years. But that calculation assumes success, staying in tech, and not getting laid off in a downturn.

The intangibles matter too, though they’re harder to quantify. What’s it worth to wake up excited about work instead of dreading another day? What’s the dollar value of better work-life balance, interesting problems, or avoiding slow crushing boredom? These aren’t just feel-good questions, they’re real factors in the opportunity cost calculation.

What The Data Actually Tells Us

After reviewing BLS wage data across more than 800 occupations, Pew Research Center labor market analysis tracking thousands of job transitions, and recent ADP payroll data on wage growth patterns, several clear patterns emerge.

Career switching has real, measurable costs that hit immediately. Looking at a 14% pay cut on average, and potentially $40,000 to $50,000 in total transition costs when factoring in lost wages and retraining. This isn’t theoretical, it shows up in bank accounts in year one.

But for those who stick with it, the recovery is also real and measurable. The 2.9x faster wage growth means most successful switchers break even within three to five years and come out ahead over a career. The emphasis is on “successful”, the data shows that younger workers, those switching into growing fields, and people with higher education levels have much better odds.

Industry selection matters more than almost anything else. Sectors with labor shortages, healthcare, technology, specialized trades, offer faster wage growth and easier entry according to industry-specific wage data. Switching out of high-wage sectors like finance or established tech roles is expensive. Switching into them can be lucrative if getting a foot in the door.

Timing matters in ways that are hard to predict. Making a switch during an economic expansion, or into a field that’s currently hot, dramatically improves odds. Switching during a recession, or into a field about to be disrupted, can leave someone worse off for years.

The Question Nobody Asks

Many who eventually make career switches find that almost nobody helped them think through the actual numbers. The blogs and career coaches offered inspiration but not calculation.

The research shows that in an economy where 50-year careers are becoming normal and entire industries face disruption from AI and automation, the ability to successfully switch careers isn’t a one-time decision, it’s a skill needed multiple times. Most people now expect to have 12 different jobs across their working lives, and many involve switching fields entirely.

So the real question isn’t whether someone can afford to switch careers. It’s whether they can afford not to develop the capability to do so. The data suggests that career switchers, despite taking an initial hit, end up with more control over their earning trajectory and career satisfaction than people who stay put out of fear. Just make sure to run the numbers first.