Foreclosure Sales – Gold Rush or Money Pit? What 322,103 Properties Sales Reveal

8.9 min read

Updated: Dec 21, 2025 - 10:12:21

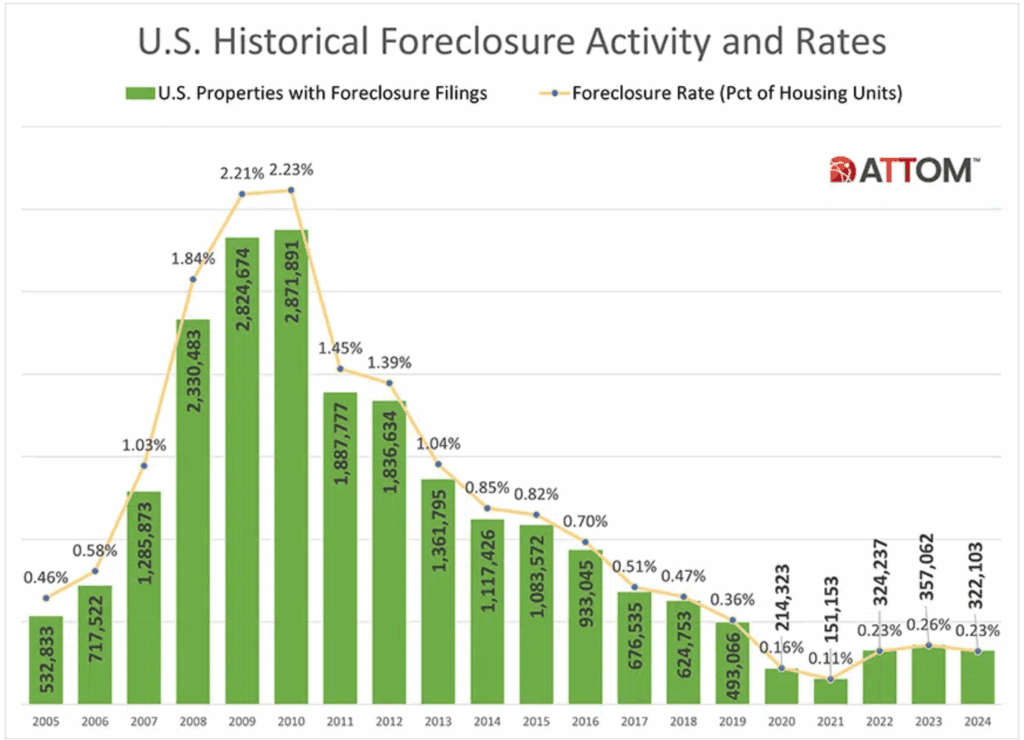

Foreclosure investing in 2024 showed both promise and peril. With filings dropping to just 322,103, down 89% from the 2010 peak, the pool of distressed properties has shrunk, but selective opportunities still deliver profits. Investors reported average revenues of $34,358 from auctions and $40,000 from fix-and-flips. Yet risks remain steep: long foreclosure timelines (762 days on average), hidden repair costs, title complications, liens, and overbidding at auctions. Concentrations in states like Florida, New Jersey, and Nevada create targeted opportunities, while Q1 2025 filings already show a 14% uptick. Success depends less on luck and more on due diligence, capital, and disciplined strategy.

- Opportunities remain selective: Just 0.23% of U.S. homes faced foreclosure in 2024, down sharply from the 2010 peak (ATTOM).

- Profit potential is real: Auctions averaged $34,358 returns; fix-and-flips averaged $40,000 per property.

- Risks are high: Unknown repairs, liens, and 2+ year timelines (762 days average) erode returns in many markets.

- Geography matters: Florida, New Jersey, and Nevada saw the highest foreclosure rates in 2024, with metros like NYC, Chicago, and Houston leading in volume.

- Outlook for 2025: Filings rose 14% in Q1, suggesting gradual increases tied to higher mortgage rates and regional stress.

In 2024, foreclosure investing remained a double-edged sword. While some investors captured solid profits through fix-and-flips, many others saw their portfolios eroded by unexpected repair bills, title complications, and complex local market dynamics.

Data from ATTOM shows that foreclosure auctions can deliver attractive returns, but the opportunities are dwindling. Just 322,103 U.S. properties received foreclosure filings in 2024, down about 89% from the 2010 peak of 2.9 million. This sharp decline highlights the paradox: the deals that remain can be lucrative, but the pool of distressed properties has shrunk to a fraction of its former size.

So is foreclosure investing is a lucrative opportunity or a shrinking minefield? The answer depends on preparation, market knowledge, and risk tolerance.

The 2024 Foreclosure Landscape: What the Data Shows

The market has fundamentally transformed since the housing crisis. Foreclosure filings were reported on 322,103 U.S. properties in 2024, down 10% from 2023 and down 89% from a peak of nearly 2.9 million in 2010. These properties represented just 0.23% of all U.S. housing units, down from 0.25% in 2023 and dramatically lower than the 2010 peak of 2.23%.

Source: ATTOM

Where Foreclosures Are Concentrated

The foreclosure market isn’t evenly distributed across America. Florida and New Jersey tied for the highest state foreclosure rates in 2024, with one foreclosure filing for every 267 housing units. Nevada followed closely at one in every 273 housing units, then Illinois at one in every 278, and South Carolina at one in every 304. These five states accounted for a disproportionate share of the nation’s foreclosure activity, creating concentrated opportunities for investors willing to operate in these markets.

Among major metropolitan areas, the numbers are equally striking. New York led with 15,327 foreclosure starts, followed by Chicago with 11,508, Houston with 10,197, Los Angeles with 8,790, and Miami with 8,603. For investors, this geographic concentration means that success often depends on choosing the right market rather than just finding the right property.

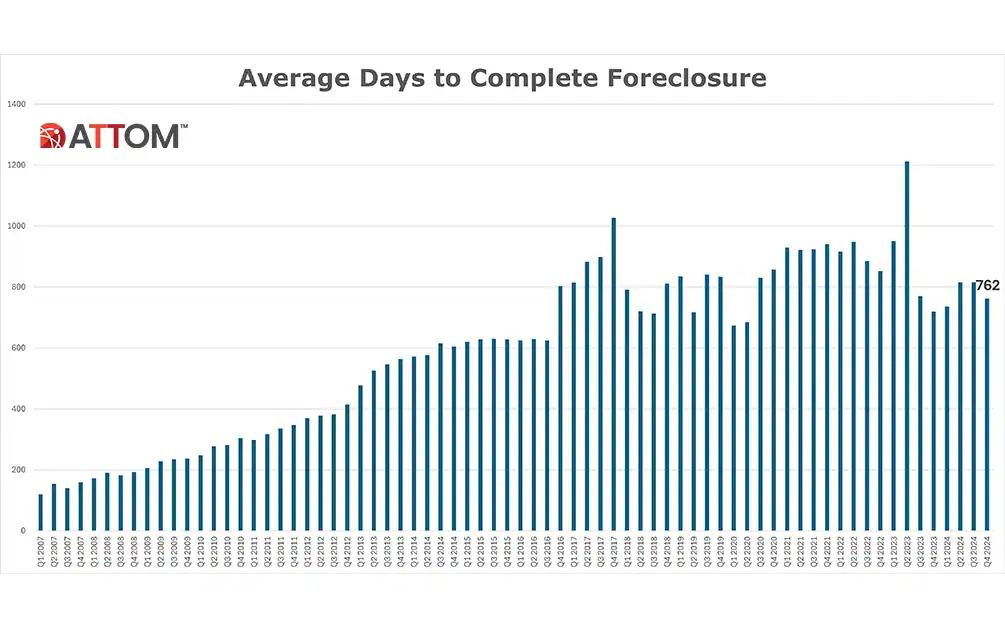

The Timeline Reality

Properties foreclosed in the fourth quarter of 2024 had been in the foreclosure process for an average of 762 days, more than two years from initial default to final resolution. This extended timeline has significant implications for both distressed homeowners and investors attempting to acquire these properties. The longest average foreclosure timelines were in Louisiana at 3,015 days, Hawaii at 2,505 days, and New York at 2,099 days, while faster-moving states completed the process in under a year.

Source: ATTOM

The Profit Potential: Where Investors Actually Make Money

Despite the reduced inventory, foreclosure investing remains profitable for those who know what they’re doing. According to a survey of real estate investors, foreclosure auctions were the best lead source, bringing in an average revenue of $34,358 and outperforming the second-best option, MLS, by $4,497. For fix-and-flip investors specifically, deals yielded average profits of $40,000 per property.

The discounts exist for straightforward reasons. Banks aren’t in the real estate business, they’re in the lending business. Every month a foreclosed property sits on their books costs them money in property taxes, maintenance, insurance, and opportunity cost. Foreclosed homes are often sold at below market value, with sellers sometimes offering additional incentives such as reduced down payments, lower interest rates, or the elimination of appraisal fees and some closing costs.

For rental property investors, the math becomes even more compelling. Because the purchase price is often well below market value, investors can enjoy stronger cash flow. With a smaller mortgage or even an all-cash deal, monthly rental income can provide steady returns and help cover costs faster than traditional real estate investments.

The Hidden Dangers: Why Many Investors Lose Money

The potential for returns is real, but so are the risks. Many buyers mistakenly assume foreclosures are easy paths to profit, only to find themselves in financial trouble.

Property condition is one of the biggest unknowns. Many foreclosed homes sit vacant for years, accumulating mold, pests, plumbing damage, or vandalism. Properties are sold as-is, meaning buyers must absorb all repair costs. In some cases, homeowners strip the property before losing it, leaving bare interiors without appliances or fixtures. Auctions compound this problem since thorough inspections are often not allowed.

Title issues and liens are another major risk. Investors often refer to title problems as the “iceberg,” because unseen liens can sink an entire deal. Some states require liens to be cleared before foreclosure sales; others pass them on to the winning bidder. Misunderstanding this distinction can lead to catastrophic losses. A well-documented case involved a property where a $150,000 SBA loan was senior to $600,000 in mortgages, wiping out the latter entirely. Buyers who skip proper title research risk losing their entire investment.

Overpaying at auction is another frequent pitfall. Competitive bidding can cause investors to chase properties beyond fair value. Once repair costs, taxes, and holding expenses are added, these deals often turn negative.

Financing is also a challenge. Most auctions require full cash payments, and banks are cautious about issuing loans for foreclosures. Even bank-owned REOs usually come with stricter lending conditions, making it harder for undercapitalized investors to participate.

Finally, unexpected occupants add another layer of complexity. Many foreclosures still house tenants, previous owners, or squatters. Evictions take months and cost thousands in legal fees, delaying both renovations and cash flow

Understanding the Three Stages of Foreclosure

Opportunities exist at different points in the foreclosure process, each with unique risks and rewards.

Pre-foreclosure properties are in default but not yet repossessed. Banks file a “lis pendens” to notify the court, and investors can sometimes negotiate directly with homeowners. These deals may involve short sales, where the bank accepts less than the mortgage owed (CFPB).

Auction properties are sold publicly, often at courthouses. They provide the steepest discounts but also carry the highest risks, especially since titles may come with liens and inspections are limited. Many inexperienced buyers make costly mistakes here, such as bidding on junior liens without realizing senior mortgages still apply.

REO (Real Estate Owned) properties are those that fail to sell at auction and return to the lender’s ownership. These are often safer for investors since titles are clearer and inspections are permitted, but discounts are smaller. In 2024, lenders repossessed 36,505 REO properties, a 13% decline from the prior year, according to the ATTOM Report.

Strategies That Separate Success from Failure

-

Buy-and-Hold Rentals: Ideal in strong rental markets, leveraging lower purchase prices for better cash flow and long-term appreciation.

-

Fix-and-Flip: Profitable when done with accurate renovation cost estimates, trusted contractors, and disciplined exit timelines.

-

Wholesale/Assignment: Lower-capital strategy where investors sell contracts rather than properties, relying heavily on market knowledge and networks.

The most successful investors analyze dozens of properties before buying one, maintain 20–30% cost buffers, and diversify their exit strategies.

Resources for Investors

Those seeking opportunities can begin with HUD Homes, Fannie Mae HomePath, and Freddie Mac HomeSteps. Local county recorder filings for lis pendens notices are also critical for early detection of pre-foreclosure properties.

The Due Diligence That Separates Winners from Losers

The difference between profitable foreclosure investing and losing money comes down to preparation and thorough research before making any commitments.

Before making an offer, successful investors research comparable sales in the area, calculating their maximum allowable offer based on after-repair value minus renovation costs minus desired profit. They conduct title research to identify all liens and encumbrances, drive by the property at minimum to assess exterior condition and neighborhood quality, and research permit history to identify any unpermitted work or code violations that could create future problems.

For auction properties specifically, investors inspect properties before auction if allowed, set a maximum bid and stick to it regardless of competitive pressure, have financing arranged in advance with either cash or proof of funds, understand the auction rules for their specific venue, and research the auctioneer’s reputation and past sales to understand typical outcomes.

For REO properties, the due diligence becomes even more comprehensive. Investors conduct full home inspections covering structural, electrical, plumbing, HVAC, and roof systems. They get multiple contractor bids for required repairs rather than relying on a single estimate, verify property taxes are current to avoid unexpected liens, check for homeowners association liens or violations that could add costs, and review all seller disclosures carefully while understanding that “as-is” sales still carry some disclosure obligations.

The Market Outlook: What The Future Holds

Foreclosure activity began ticking upward in late 2024. October filings rose 4% month-over-month, with 30,784 properties affected, while Q1 2025 foreclosure starts rose 14% from the prior quarter.

Key trends shaping the outlook include:

-

Rising mortgage rates, pushing adjustable-rate borrowers into default.

-

Regional economic stress, particularly in states with high foreclosure rates.

-

Potential government interventions, such as moratoriums if conditions worsen.

-

Growing commercial real estate pressures, especially in the office sector.

These factors suggest that while foreclosure volumes remain historically low, 2025 may bring gradual increases in distressed property opportunities.

The Verdict: Gold Rush or Money Pit?

Foreclosure investing in 2024 and beyond is neither universally a jackpot nor a dead end, it is a specialized field requiring expertise, capital, and patience.

For well-capitalized investors with reliable teams and disciplined strategies, the 322,103 foreclosures of 2024 represented a lucrative, if selective, gold rush. For underfunded buyers chasing quick profits, those same properties became money pits, draining resources and exposing hidden liabilities.

In essence, foreclosure investing rewards those who treat it as a business, not a gamble, anchored in research, due diligence, and long-term planning. The promise of $34,358 in average revenues and $40,000 fix-and-flip profits is real, but only for those prepared to manage every risk lurking beneath the surface.

Related: This article is part of our broader Investing Hub, where you’ll find guides on market behavior, ETF research, asset allocation, and long-term wealth planning.