The Multi-Millionaire Blueprint: How Comfortable Wealth is Built

5.6 min read

Updated: Dec 21, 2025 - 10:12:53

America’s $10–20 million net worth households aren’t billionaires on magazine covers, they’re disciplined business owners and investors who spent decades building equity, balancing real estate, and compounding returns. Credit Suisse reports this group grew 5.2% in 2024, and their wealth-building formula is surprisingly consistent: own businesses, diversify into equities and real estate, live below their means, and let time do the compounding. Contrary to myth, most are self-made, with only ~16% inheriting wealth.

- Business ownership drives wealth: 47% of millionaires are entrepreneurs; equity provides scalability and outsized compounding.

- Real estate stabilizes portfolios: Typical allocations 17–25%, delivering income, tax benefits, and steady 3.7% annual appreciation since 1991.

- Balanced allocation: $10–20M portfolios hold ~40% equities, 15–30% private companies, 17–25% real estate, and modest bonds/cash.

- Self-made majority: Over two-thirds built fortunes themselves; average entry into $10M+ takes 15–30 years of discipline and savings.

- Frugality is common: Despite wealth, many avoid luxury spending, reinvesting savings into equity growth and diversified assets.

The Truth About $10-20 Million Net Worth Individuals

They don’t make magazine covers or trend on social media. They aren’t billionaires buying sports teams or reshaping industries. Yet across the U.S., hundreds of thousands of individuals have quietly accumulated between $10 million and $20 million in net worth, a group that grew by 5.2% in 2024 according to Credit Suisse Global Wealth Report. Their path to wealth reveals a story less about luck or inheritance and more about discipline, ownership, and decades of execution.

The Primary Wealth Driver: Business Ownership

The data on wealth creation is remarkably consistent: business ownership is the single most powerful engine for building multi-millionaire status. Research from Spectrem Group and Thomas Stanley’s The Millionaire Next Door shows that 88% of millionaires have built their wealth through business ownership.

Among self-made millionaires, entrepreneurs reached an average of $7.4 million in 12 years, compared with “saver-investors” who needed 32 years to accumulate $3.3 million through salaries and investing. Nearly half (47%) of all millionaires are business owners.

The difference lies in scalability. While billionaires like those in Bloomberg’s Billionaires Index typically hold nearly 90% of their wealth in companies they built, individuals in the $10–20 million range hold a more balanced mix, but business equity still makes up 30–50% of their portfolios during their wealth-building years.

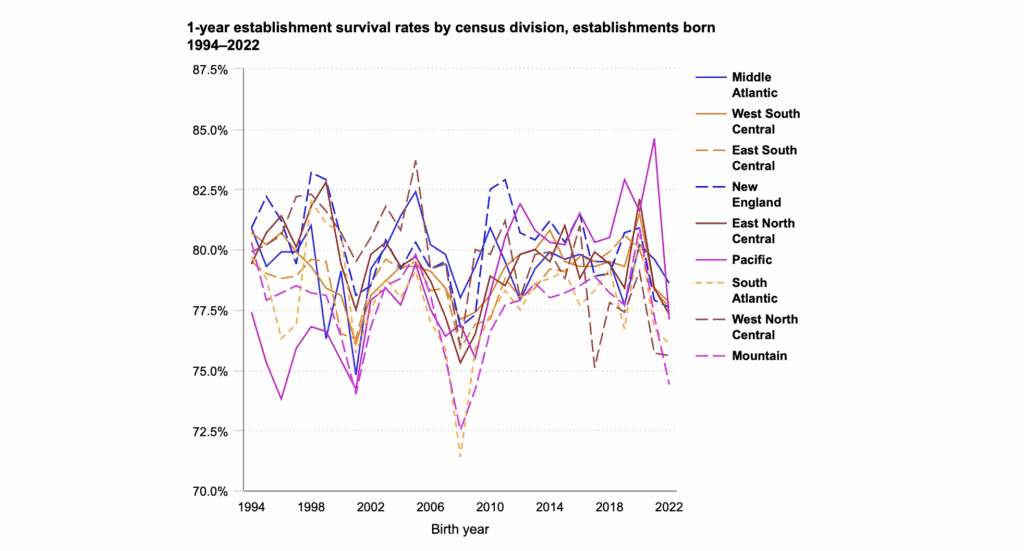

Entrepreneurship carries risk, U.S. Bureau of Labor Statistics data shows that around 50% of small businesses fail within five years. Even so, for those who succeed, equity growth combined with income creates compounding wealth that salary alone cannot match.

Source: U.S. Bureau of Labor Statistics

The Supporting Asset: Real Estate

While entrepreneurship accelerates wealth, real estate provides stability. In 2025, direct real estate ownership accounted for about 22.5 % of a typical family office’s portfolio, according to Knight Frank’s Wealth Report 2025. Among ultra-wealthy investors (over $30 million in net worth), real estate allocations rise to about 32% in residential and 21% in commercial properties.

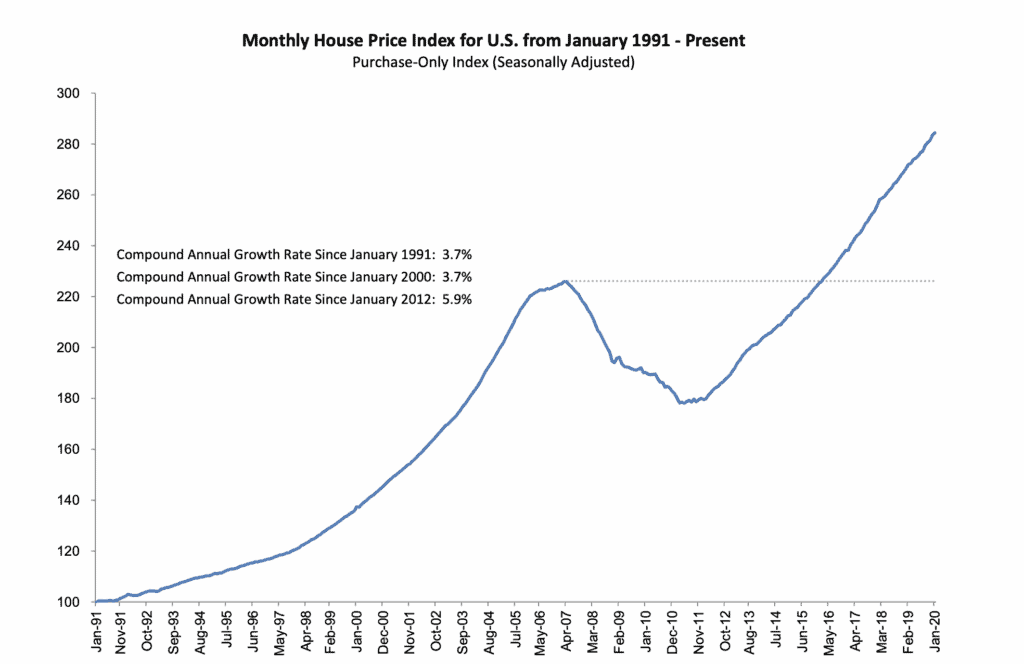

The appeal is simple: predictable rental income, tax advantages, leverage, and long-term appreciation. According to the Federal Housing Finance Agency, U.S. home prices have appreciated by 3.7% annually since 1991, proving real estate’s role as a steady compounding force.

Source: Federal Housing Finance Agency

The Balanced Portfolio: Where the Money Actually Sits

By the time individuals reach $10–20 million, their portfolios reflect both growth and preservation priorities:

-

Public Equities: 38–47%: Equities remain the largest slice, offering liquidity and exposure to economic growth.

-

Private Companies/Business Equity: 15–30: Business ownership remains central, with wealthier portfolios tilting higher.

-

Real Estate: 17–25%: A stabilizing and cash-generating allocation.

-

Cash & Bonds: 8–15%: Liquidity dominates over fixed income, as bonds remain under 10% even among conservative investors.

-

Alternatives: 5–10%: Hedge funds, private credit, collectibles, or venture allocations fill the rest.

This mix highlights a key truth: even conservative multi-millionaires prioritize equities and cash flexibility over heavy fixed-income positions.

The Path: How They Got There

The journey follows recognizable patterns. Contrary to myth, most millionaires aren’t inheritors. Wealth-X data shows that only about 16% inherited their fortunes, while 68% are self-made. Many started businesses with less than $25,000 in capital.

During the build phase, habits matter:

-

Hard work: 84% of entrepreneurs put in more than 40 hours weekly.

-

Multiple streams of income: Millionaires typically develop 3–7 revenue sources.

-

Frugality: 95% own their homes, but 50% report never spending more than $399 on a suit.

-

High savings rates: Nearly 30% save more than half their post-tax income.

-

Leverage: Strategic mortgages and business loans amplify growth.

The average millionaire in America is around 61 years old, according to analyses of Federal Reserve Survey of Consumer Finances (SCF) data. For households headed by someone in their 50s, the Federal Reserve’s 2022 SCF reports an average net worth of about $975,800 for ages 45–54 and $1.56 million for ages 55–64, figures far below the $10 million tier. This underscores that reaching eight-figure wealth typically takes decades of disciplined effort, compounded returns, and in many cases business ownership or equity stakes.

The Surprising Truths

They Don’t Look Wealthy: In The Millionaire Next Door, researchers described renting a Manhattan penthouse stocked with pâté, caviar and wine, where millionaires felt out of place, ate only crackers, and one said he drank only free beer or Budweiser. 50% had never paid over $399 for a suit, and 10% had never paid over $195.

They’re Largely Self-Made: 67.7% of the world’s ultra-high-net-worth population is self-made, 8.5% inherited, and 23.7% a mix. In the U.S., 79% of millionaires say their wealth is self-made and 11% inherited. Earlier Forbes data suggested ~32% came from wealthy families in 2011, down from ~60% in 1982.

They Work Different, Not Harder: Claims that 80% of self-made millionaires set long-term goals and that 93% credit mentors for success appear in success literature, though they are not from peer-reviewed studies.

The Bottom Line

The formula for reaching $10-20 million in net worth isn’t mysterious, but it is demanding:

Own equity (preferably in businesses you control) + Invest in real estate (for stability and cash flow) + Diversify into public markets (for liquidity and growth) + Live below your means (to compound aggressively) + Time (usually 15-30 years) = Multi-millionaire status

Business ownership remains the primary wealth creator, providing both income and equity value that can compound or be sold for significant sums. Real estate serves as the stabilizing force, generating passive income and appreciating steadily. Public equities provide liquidity and exposure to broader economic growth. The combination, managed prudently over decades, creates the comfortable wealth that $10-20 million represents.

The path is clear from the data: entrepreneurship offers the fastest path to wealth for those who adopt disciplined habits including goal-setting, continuous learning, frugal living, networking, calculated risk-taking, and maintaining positivity and health. Combined with strategic real estate investments and diversified public market exposure, this approach has created hundreds of thousands of multi-millionaires, individuals who’ve achieved financial freedom not through lottery tickets or inheritance, but through ownership, patience, and consistent execution over decades.