What Is Rental Arbitrage? (Critical Errors That Kill Profitability)

5.1 min read

Updated: Dec 21, 2025 - 10:12:16

Rental arbitrage, leasing a property long-term and re-renting it on Airbnb or Vrbo, can generate profits if managed with discipline, but most beginners underestimate costs, legal hurdles, and occupancy volatility. Unlike buying property, startup costs are lower, yet failure rates remain high due to unrealistic assumptions and poor operations. As of 2025, operators face stricter city regulations, higher cleaning and service fees, and average U.S. occupancy rates below 60% (AirDNA), making conservative planning essential. Success depends less on market hype and more on professional execution.

- Regulations first: Many cities (e.g., NYC Local Law 18, LA Home Sharing Ordinance) heavily restrict or ban short-term rentals, violations risk eviction and sunk costs.

- Costs cut margins: Expect $100–$150 per turnover (TurnoverBnB), 3–15% platform fees, $200–$300 utilities, 10–15% lodging taxes, and frequent furniture replacement.

- Optimism kills cash flow: U.S. average occupancy is 56% (AirDNA 2023), not the 80–90% many new hosts project; seasonality can push earnings negative.

- It’s hospitality, not passive income: Hosts spend 10–15 hours weekly on guest communication, cleaning, and maintenance (Hostfully survey).

- Insurance matters: Standard renter policies rarely cover STRs, dedicated short-term rental coverage is critical to avoid liability gaps.

Rental arbitrage is a business model where an individual leases a property long-term, typically six months to a year or more, and then re-rents it on a short-term basis through platforms such as Airbnb or Vrbo. The host’s profit comes from the spread between what they pay in fixed monthly rent and what they earn from nightly bookings.

Unlike traditional real estate investing, rental arbitrage does not require a mortgage or a large down payment. However, it does require upfront capital for furniture, security deposits, insurance, and compliance with local laws. While the barrier to entry may be lower than purchasing property, the risks are high, and the financial outcomes vary dramatically based on market conditions and operational discipline.

How Rental Arbitrage Works (Case Example)

Consider a host who signs a one-year lease for an apartment in Austin, Texas, at $1,900 per month. With an average nightly rate of $160 and 20 booked nights, gross monthly revenue would be $3,200. After deducting rent, utilities, cleaning, platform service fees, and local lodging taxes, the host might net $800–$1,000 during peak months.

Contrast this with a unit in Cleveland leased at $1,500 per month. With an average nightly rate of $110, the revenue potential is far lower, and seasonal dips can push operations into negative territory. According to AirDNA Market Reports, markets with heavy tourism and business travel consistently outperform those with weaker demand, but operators often underestimate how much local dynamics affect profitability.

Why People Try Rental Arbitrage

The appeal of rental arbitrage lies in its perceived flexibility and potential for quick returns:

- It offers a lower barrier to entry than buying property.

- Operators can walk away at the end of a lease instead of being locked into a mortgage.

- In high-demand markets, returns may exceed what traditional landlords achieve through long-term renting.

Yet enthusiasm is tempered by risk. While, research on short-term rental regulations and legal analyses show that many operators struggle due to regulatory restrictions, unrealistic revenue projections, or poor cost management.

Critical Errors That Kill Profitability

Ignoring Local Laws and Lease Agreements

Cities across the U.S. have tightened restrictions on short-term rentals.

-

In New York City, Local Law 18 prohibits rentals under 30 days unless the host is present.

-

In Los Angeles, the Home Sharing Ordinance requires registration and imposes limits on which units qualify.

On top of city ordinances, many landlords explicitly ban subletting in their lease agreements. Violating these terms can lead to eviction and the loss of thousands in upfront investment.

Underestimating Costs and Fees

Margins shrink quickly when hidden expenses are ignored:

-

Cleaning averages $100–$150 per turnover for a one-bedroom, per TurnoverBnB.

-

Airbnb and Vrbo service fees run 3–15%.

-

Utilities and internet add $200–$300 per month.

-

Local lodging taxes can climb as high as 15% depending on the city.

-

Furniture often needs replacement every 2–3 years.

Operators who budget only for rent and expect everything else to “work itself out” often end up operating at a loss.

Overestimating Occupancy and Nightly Rates

Market optimism is a common pitfall. While some hosts plan on 80–90% occupancy, AirDNA’s 2023 U.S. Short-Term Rental Report shows a nationwide average of just 56%. Off-peak seasons often drop below 40%, creating cash flow shortfalls. Unrealistic income projections are one of the leading reasons operators abandon the business within a year.

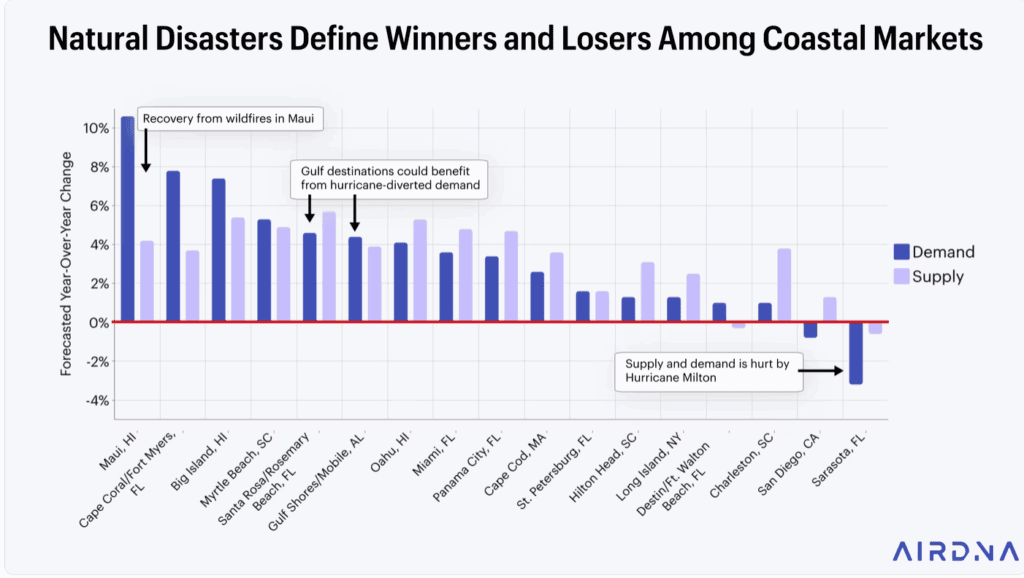

Source: AirDNA

Failing to Manage Operations Professionally

Running a short-term rental is closer to hospitality than traditional landlording. A Hostfully survey in 2022 revealed that managing one property consumes 10–15 hours per week, covering messaging, turnovers, maintenance, and troubleshooting. Without systems such as smart locks, automated messaging, and reliable cleaning contracts, hosts risk poor reviews, lower rankings on booking platforms, and declining revenue.

Neglecting Insurance and Liability Risks

Many renters assume their standard insurance policy covers short-term rental activity, but this is rarely the case. Airbnb’s Host Guarantee offers limited protection, but it is not a substitute for specialized coverage. Guest injuries, theft, or property damage can leave hosts exposed to five-figure liabilities. Providers now offer short-term rental insurance tailored to this market, but failing to secure it can lead to devastating losses.

Best Practices to Avoid Mistakes

To succeed in rental arbitrage, discipline and preparation are non-negotiable:

-

Research city regulations and lease terms before signing.

-

Use conservative financial models, budgeting at 50–60% occupancy while including all hidden costs.

-

Build reliable operations with professional cleaners, guest screening, and automation tools.

-

Purchase specialized insurance policies for short-term rental coverage.

-

Diversify locations and avoid overreliance on a single property in a volatile market.

Bottom Line

Rental arbitrage can be a viable path to profits in the short-term rental market, but it is not the quick, low-effort hustle that social media often portrays. It is a hospitality business requiring constant attention, regulatory awareness, and conservative financial planning. Those who treat it as a serious venture, with realistic projections, strong operational systems, and legal compliance, stand a chance of building sustainable income. Those who cut corners risk eviction, lawsuits, and rapid financial loss.