High Dividend ETFs vs. Growth ETFs: 20-Year Performance Showdown

5.9 min read

Updated: Dec 22, 2025 - 09:12:38

Over the past 20 years, growth-focused ETFs like Invesco QQQ and Vanguard Growth (VUG) vastly outperformed dividend ETFs in wealth creation, thanks to heavy exposure to technology and innovation. Yet dividend ETFs such as Vanguard High Dividend Yield (VYM) and Vanguard Dividend Appreciation (VIG) offered meaningful advantages: steady income, lower volatility, and better downside protection during market stress. The choice depends on investor goals, accumulation versus income, but many benefit from blending both strategies to balance risk and reward.

- Performance gap: QQQ returned 15.55% annually vs. VYM’s 8.89%, turning $10,000 into ~$180,000 vs. ~$50,000 over 20 years (2003–2023).

- Income vs. growth: Dividend ETFs yield 2–3% cash flow annually; growth ETFs typically yield under 1% but compound tax-efficiently.

- Risk profile: VYM’s beta of 0.85 shows less volatility; growth ETFs carry higher risk but deliver outsized long-term gains.

- Dividend growth wins: VIG outperformed high-yield peers like VYM by focusing on consistent dividend raisers, not just yield.

- Investor takeaway: Younger, growth-focused investors may lean 60–70% into growth ETFs, while retirees may prefer 30–40% in dividends for stability and cash flow.

Growth and dividend-focused exchange-traded funds (ETFs) embody two distinct investment philosophies that have shaped investor portfolios for decades. On one side stand growth ETFs, driven by the pursuit of capital appreciation and concentrated exposure to innovation-heavy sectors such as technology. On the other side are high dividend ETFs, designed to generate income and provide stability even when markets turn volatile. A close look at the past 20 years highlights the strengths and weaknesses of each approach and offers important lessons for the future.

The Long-Term Verdict: Growth Takes the Crown

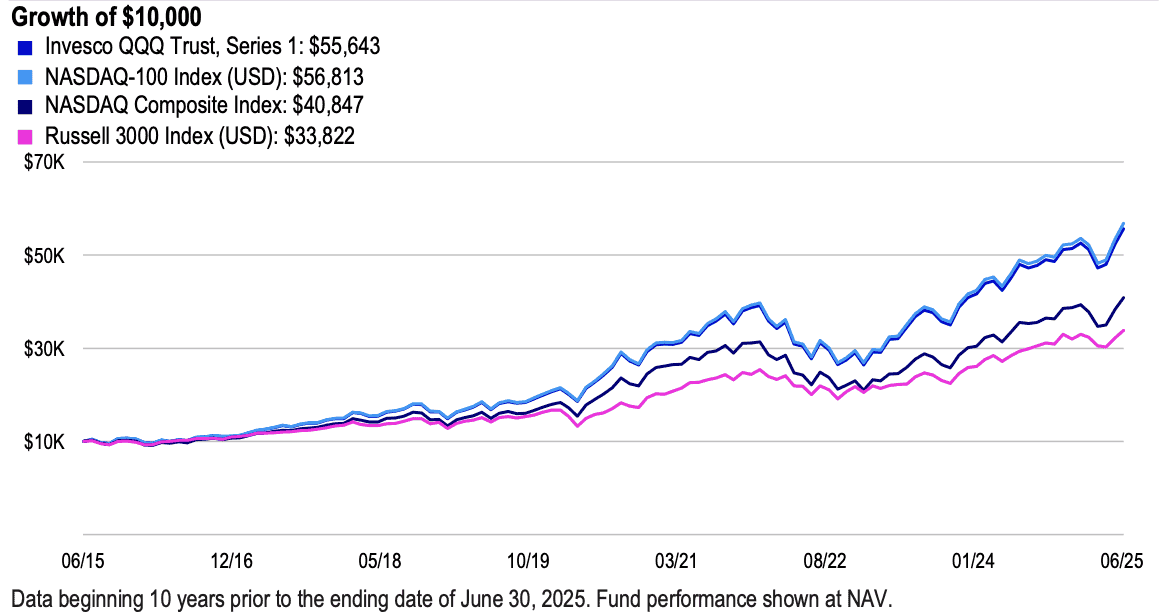

Source: Invesco

Over two decades of performance data leaves little doubt about which strategy delivered superior wealth accumulation. Growth-oriented ETFs, led by the Invesco QQQ, achieved an annualized return of 15.55%, while the Vanguard Growth ETF (VUG) returned 12.78%. In contrast, dividend strategies lagged behind: Vanguard’s High Dividend Yield ETF (VYM) averaged 8.89%, with broader dividend indexes falling in the 8–10% range.

This performance gap is not merely academic. A $10,000 investment in QQQ two decades ago would have grown to nearly $180,000, while the same sum placed in VYM would be closer to $50,000. The compounding effect of high growth, particularly during technology’s explosive expansion, made the difference between moderate growth and transformative wealth.

The Dividend Strategy Advantage: Stability and Income

While growth ETFs dominated in total returns, dividend-focused strategies offered distinct advantages:

Income Generation

High dividend ETFs provide immediate cash flow that growth ETFs simply cannot match:

Lower Volatility

VYM has a beta value of 0.85, indicating it’s less volatile than the overall market. High dividend strategies often exhibit lower volatility, providing more stable investment experiences during market stress.

Downside Protection

VYM suffered a maximum drawdown that was generally less severe than growth-focused funds during major market crashes, though all equity investments face significant risks during severe bear markets.

Performance Across Different Market Environments

The 20-year period encompassed multiple market cycles, revealing how each strategy performed under different conditions. Market cycles revealed distinct strengths for each strategy. In rising rate environments, dividend growth strategies such as those represented by the S&P 500 Dividend Aristocrats Index provided a balanced combination of growth and income, making them more resilient than pure high-yield plays.

During long bull markets, however, growth ETFs dominated, particularly benefiting from the technology boom of the 2010s and 2020s. When markets faltered, dividend ETFs offered relative protection, as their focus on established, profitable companies limited the depth of their losses compared to high-growth funds.

The Quality Factor: Dividend Growth vs. High Yield

An important distinction emerged between dividend growth strategies and pure high-yield approaches:

Dividend Growth ETFs (VIG, DGRO):

- VIG wins the battle in the long run with higher 10-year returns compared to VYM

- Focus on companies with consistent dividend increases

- Better long-term performance than high-yield strategies

High Dividend Yield ETFs (VYM, DVY):

- Higher immediate income

- More defensive positioning

- Potential risks from distressed high-yield stocks

Expense Ratios: A Close Call

Both strategies offer low-cost options from quality providers:

The cost advantage goes to the Vanguard funds, with growth and dividend options both offering institutional-quality pricing.

Risk-Adjusted Returns: Beyond Raw Numbers

Absolute performance is only part of the story. When considering risk-adjusted returns, dividend ETFs often appeal to more conservative investors.

-

Growth ETFs: Higher volatility, higher upside, but bumpier ride.

-

Dividend ETFs: Lower volatility, smoother returns, but less total wealth.

This distinction is vital for retirees or investors who prioritize capital preservation and steady income over maximum upside.

Sector Allocation: The Driver of Performance Differences

The performance gap largely stems from sector allocation differences. Growth ETFs maintained heavy technology weightings that dominated 20-year performance, benefiting significantly from digital transformation trends but creating higher concentration risk. In contrast, high dividend ETFs focused on defensive sectors with more diversification across utilities, financials, and other established industries. While this approach provided better stability, it meant missing out on the explosive growth in technology sectors.

Practical Implications for Investors

Choosing between growth and dividend ETFs depends on investor goals, time horizon, and risk tolerance.

-

Growth ETFs: Suited for investors with long horizons (15+ years), higher volatility tolerance, and no need for immediate income. Ideal for wealth accumulation during early and middle career stages.

-

High Dividend ETFs: Best for investors who need cash flow, prefer lower volatility, or are nearing retirement. They provide income and defensive exposure.

-

Blended Approach: Many investors benefit from mixing strategies, allocating 60–70% to growth ETFs for capital appreciation and 30–40% to dividend ETFs for income and stability. This balanced structure can be adjusted as markets evolve and personal circumstances change.

The Tax Consideration

Tax treatment further distinguishes these strategies. Dividend ETFs distribute taxable income annually, reducing tax efficiency in non-retirement accounts. Growth ETFs, by contrast, allow earnings to compound tax-deferred until shares are sold. For investors in higher tax brackets or those investing outside of tax-advantaged accounts, this efficiency can significantly boost after-tax returns.

Looking Ahead: Will This Pattern Continue?

While growth ETFs dominated the past two decades, the future may look different. Technology valuations remain elevated, and potential regulation or slowing innovation could weigh on performance. Dividend ETFs may benefit from demographic shifts, such as an aging population seeking more income-oriented investments.

They could also find tailwinds in a market rotation toward value stocks, as well as increased spending on infrastructure and utilities. Both strategies remain valid, but their relative appeal may shift as macroeconomic conditions evolve.

Key Takeaways

The evidence is clear: growth ETFs created far more wealth, but dividend ETFs provided essential stability and income. Dividend growth strategies outperformed high-yield peers, showing that quality is more important than raw yield. Sector allocation proved decisive, with technology exposure driving growth dominance. For most investors, the best approach is not to choose between the two but to combine them thoughtfully, aligning allocations with individual goals, risk tolerance, and life stage. Growth wins the long-term performance crown, but dividends deliver the steadying influence that makes portfolios sustainable.