Breaking: New Law Could Let YOU Invest Like the Ultra-Wealthy (Even on a Teacher’s Salary)

7.5 min read

Updated: Dec 21, 2025 - 10:12:31

The House just passed the Equal Opportunity for All Investors Act of 2025, a landmark bill that could open private market investments, like pre-IPO shares, private equity, and real estate syndications, to everyday investors. Instead of needing a $200,000 income or $1 million net worth, individuals could qualify as accredited investors by passing an SEC-administered knowledge test. If the Senate approves, this could mark the most significant democratization of investing since online brokerages, though risks, high minimums, and limited liquidity remain.

- New Pathway: Pass an SEC test on financial literacy and risks, no income or net worth thresholds required.

- Private Market Access: Opportunities include pre-IPO startups, private credit with yields of 8–15%, and commercial real estate syndications starting around $1,000–$5,000.

- Wealth Gap Impact: Private equity has historically outperformed public markets by 3–6 percentage points annually (Vanguard, CAIA, KKR), helping the wealthy compound gains.

- Risks & Limits: High minimums ($25K+ typical), long lockups, high fees (2% + 20%), and complex due diligence still favor wealthier investors.

- Action Step: Strengthen personal finances and build literacy now, if the law passes, being prepared for the SEC test could open life-changing opportunities.

For decades, America’s investment system has operated like an exclusive country club. If you didn’t earn at least $200,000 a year or have a net worth over $1 million, you were locked out of some of the most lucrative investment opportunities available. But that could all change thanks to groundbreaking legislation that just passed the House of Representatives.

The Equal Opportunity for All Investors Act of 2025 has the potential to democratize investing in ways not seen since the creation of online brokerages. Here’s everything you need to know about how this could transform your financial future, even if you’re earning a middle-class salary.

The “Rich Only” Investment Club You’ve Been Excluded From

Right now, there’s a two-tiered investment system in America. Regular investors (that’s probably you), can buy stocks, bonds, mutual funds, and ETFs that trade on public exchanges. But there’s a whole other world of investments that have been off-limits: the private markets.

These “accredited investor only” opportunities include:

- Pre-IPO company shares (think buying Uber or Airbnb before they went public)

- Private equity funds that buy and improve entire companies

- Venture capital funds that invest in the next Facebook or Google

- Hedge funds with sophisticated trading strategies

- Private credit opportunities offering potentially higher yields

- Real estate syndications for large commercial properties

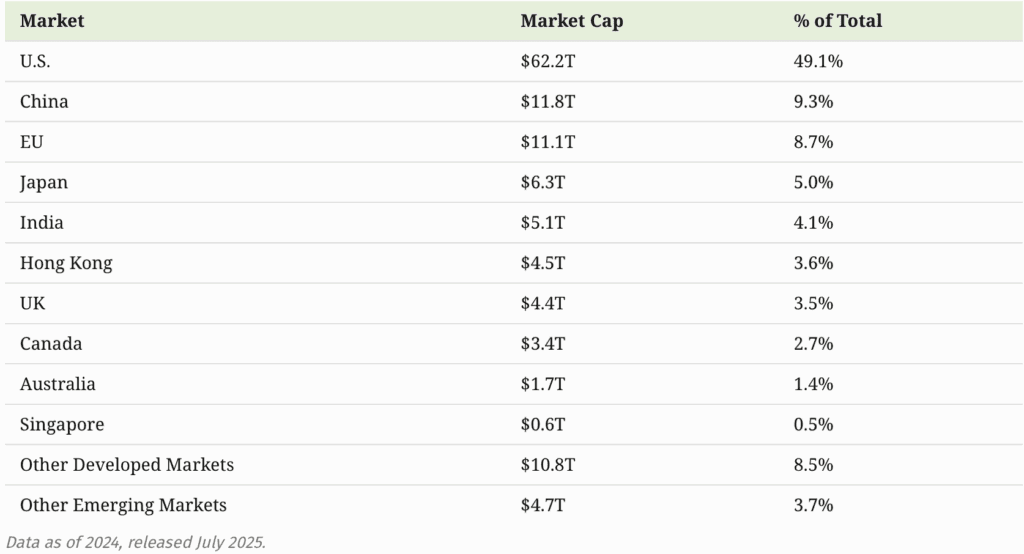

The numbers are staggering. As of 2025, public stock markets worldwide are valued at over $125 trillion, while private markets account for roughly $13–15 trillion and continue to grow rapidly. This huge pool of ‘premium’ opportunities has historically been reserved for institutions and the wealthy.

Source: Visual Capitalist

How the Wealthy Have Been Getting Wealthier

The current system hasn’t just excluded regular investors, it has also deepened wealth inequality.

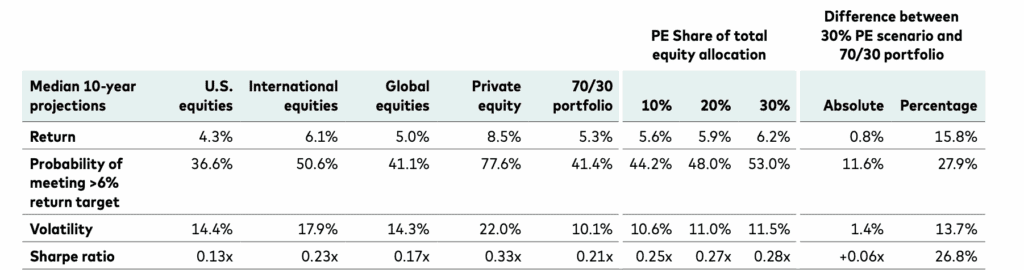

Private equity has often outperformed public equities over the long term, with Vanguard projecting 10-year median returns of 8.5% vs 5.0% for public markets. Historical studies, including CAIA and KKR, confirm PE’s long-run premium of 3–6 percentage points annually. However, in strong bull markets, public equities have outpaced private funds. Accredited investors may access pre-IPO companies to capture early growth, but these opportunities involve higher risk, illiquidity, and limited access.

Source: Vanguard

Beyond performance, private investments provide meaningful diversification. They often move independently of public markets, helping investors manage risk more effectively. Many are also less correlated with market crashes, offering relative stability during downturns.

For the average worker, like a teacher earning $50,000 a year, these advantages have been entirely out of reach. Meanwhile, a wealthier neighbor earning $250,000 could access superior opportunities, compounding gains over time. The result is the existing system that systematically favors those who are already wealthy.

The Game-Changing New Law

The Equal Opportunity for All Investors Act of 2025 would blow up this exclusive system by creating a knowledge-based pathway to accredited investor status. Instead of needing a high income or substantial net worth, you could take an SEC-administered test to prove you understand the risks and complexities of private investments.

What the Test Would Cover:

- Understanding different types of securities and their risks

- Reading and interpreting financial statements

- Recognizing the unique challenges of private investments (limited liquidity, subjective valuations, longer investment horizons)

- Understanding disclosure requirements and investor protections

The test is designed to be challenging enough to ensure investor sophistication but not so difficult that intelligent, motivated investors can’t pass it with proper preparation.

Current Requirements vs. New Pathway:

Current System:

- Annual income of $200,000+ (individual) or $300,000+ (married)

- OR net worth over $1 million (excluding primary residence)

- OR hold certain financial licenses (Series 7, 65, or 82)

New Pathway:

- Pass an SEC-administered knowledge test

- No income or wealth requirements

What This Could Mean for Your Portfolio

For beginning investors, this represents a potential paradigm shift. Here are the key opportunities:

Startup Investment Access: You could invest in the next Amazon or Tesla before they become household names. Early employees and accredited investors in companies like Facebook and Google became millionaires from pre-IPO investments.

Higher Yield Opportunities: Private credit often offers yields of 8-15% or more, compared to current savings rates under 5%. This could significantly accelerate wealth building for younger investors with longer time horizons.

Real Estate Syndications: Instead of needing hundreds of thousands to buy rental property, you might access commercial real estate deals with investments as low as $1,000-$5,000.

Venture Capital Exposure: Participate in funds that invest across multiple startups, spreading risk while gaining exposure to potentially explosive growth.

The Reality Check: It’s Not All Upside

Before planning a private equity strategy, it’s crucial to note the drawbacks: Minimum investments are often high, typically $25,000 to $100,000, making meaningful participation still difficult for many. These markets also carry higher risks: they are less liquid, harder to value, and more volatile than public stocks.

Fees are another concern, with common structures charging 2% management plus 20% of profits, which cuts into returns. Liquidity is limited since funds are usually locked up for years, leaving little flexibility in emergencies.

Lastly, private equity demands rigorous due diligence. Unlike index funds, these investments require advanced analysis, and many new investors may not have the expertise or time to evaluate them properly.

What Critics Are Saying

Not everyone is celebrating this potential change:

Consumer Protection Advocates argue that wealth requirements, while imperfect, do provide a buffer against catastrophic losses. They worry that a test alone might not adequately protect unsophisticated investors from making poor decisions.

Some Financial Advisors point out that the current system, while excluding many people, does ensure that only those who can afford to lose money are risking it in volatile private markets.

Industry Insiders note that simply having legal access doesn’t mean having practical access, since minimum investment amounts and due diligence requirements will still favor wealthier investors.

The Bigger Picture: Still Not Completely Level

Even if the Act passes, the system will not become fully level. Wealthy investors will retain structural advantages that extend beyond accreditation. They have the capital to diversify across multiple private opportunities, reducing concentration risk. They have networks that provide access to better deals earlier. They can afford professional advisors, attorneys, and accountants to conduct detailed due diligence. And most importantly, they have the capacity to withstand losses without threatening their financial security.

However, for the motivated middle class, the new law could represent a turning point. It offers the chance to participate in the engines of growth that have historically generated outsized returns for the wealthy. By shifting the definition of accreditation from a measure of wealth to a measure of knowledge, the Act has the potential to empower individuals who are willing to educate themselves and prepare.

How to Prepare (If the Law Passes)

If the Equal Opportunity for All Investors Act of 2025 becomes law, individuals should begin laying the groundwork now. Building financial literacy through structured study, courses, and real-world practice will be essential. Strengthening personal finances, maintaining an emergency fund, contributing to retirement accounts, and paying down high-interest debt, will provide a foundation for taking on higher-risk, illiquid investments. Practicing analysis on public markets can also help sharpen the skills needed to evaluate more opaque private opportunities.

The test itself is only the beginning. Passing will unlock access, but success will depend on an investor’s discipline, strategy, and ability to manage risk responsibly. For many, this will mean starting with smaller commitments, gaining experience, and gradually expanding exposure to private markets.

The Bottom Line

The Equal Opportunity for All Investors Act represents the most significant democratization of investment access in decades. For the first time, your knowledge, not just your wealth, could determine your investment opportunities.

The law still needs to pass the Senate and be signed by the President, so this opportunity isn’t guaranteed. But if it becomes reality, it could mark the beginning of a new era where your financial knowledge, not your paycheck, determines your investment ceiling.

For a teacher, nurse, or engineer earning a middle-class salary, that could make all the difference in building long-term wealth.