The Lithium Gold Rush: Investment Guide to the Metal Powering the Future

7.1 min read

Updated: Dec 28, 2025 - 09:12:58

Lithium has become one of the most critical commodities of the 21st century, powering electric vehicles (EVs), renewable energy storage, and advanced electronics. The global market, valued at ~$28 billion in 2024, is projected to grow nearly sixfold to $155.7 billion by 2035, with demand expected to more than double from 1.8 million tonnes in 2025 to 3.7 million tonnes in 2030.

For investors, lithium offers transformative potential but also sharp volatility, environmental risks, and geopolitical uncertainty. Strategic exposure through diversified ETFs like Global X Lithium & Battery Tech ETF (LIT) or established producers such as Albemarle (ALB) and SQM may provide balance, while speculative plays like Lithium Americas (LAC) and Piedmont Lithium (PLL) carry higher risk but growth potential.

- EV demand dominates: In 2025, EVs represent nearly 25% of global passenger car sales, driving 90% of lithium consumption growth.

- Grid-scale storage surges: Installations hit 205 GWh in 2024 and are forecast to triple by 2030, cementing lithium-ion as the technology of choice.

- Regional shifts matter: Australia, Chile, and China now supply 90% of the world’s lithium, but Africa and the U.S. are set to expand output significantly by 2035.

- Volatility and risks: Prices swung from $85,000/tonne in 2022 to $13,000 in 2024; oversupply, environmental pushback, and new chemistries could disrupt forecasts.

- Portfolio allocation: Many analysts suggest capping lithium exposure at 5–10% of a portfolio to balance upside with structural risks.

Lithium has quietly become one of the most critical commodities of the modern era. While much investor attention has often centered on Bitcoin and meme stocks, the real transformation is happening in the battery metal that powers everything from smartphones to electric vehicles.

The global lithium market was valued at about $28 billion in 2024, and forecasts suggest it could surge to as high as $155.7 billion by 2035, representing a compound annual growth rate near 19%. This trajectory reflects powerful megatrends, the rapid adoption of electric vehicles, the expansion of renewable energy storage, and the shift toward electrification across industries.

The Perfect Storm Driving Demand

Three massive forces are converging to create unprecedented lithium demand:

Electric Vehicle Revolution

Electric vehicles (EVs) are the single largest driver of lithium demand. This year global EV sales are projected to exceed 20 million units, which could account for nearly a quarter of all passenger car sales worldwide. The lithium intensity of EV batteries has made the sector dominant in consumption, rising from about 64% of global lithium demand in 2020 to nearly 90% today. With adoption accelerating across China, Europe, and the U.S., lithium use in EVs alone is expected to grow at 12% annually through 2030.

Data Center Energy Storage Boom

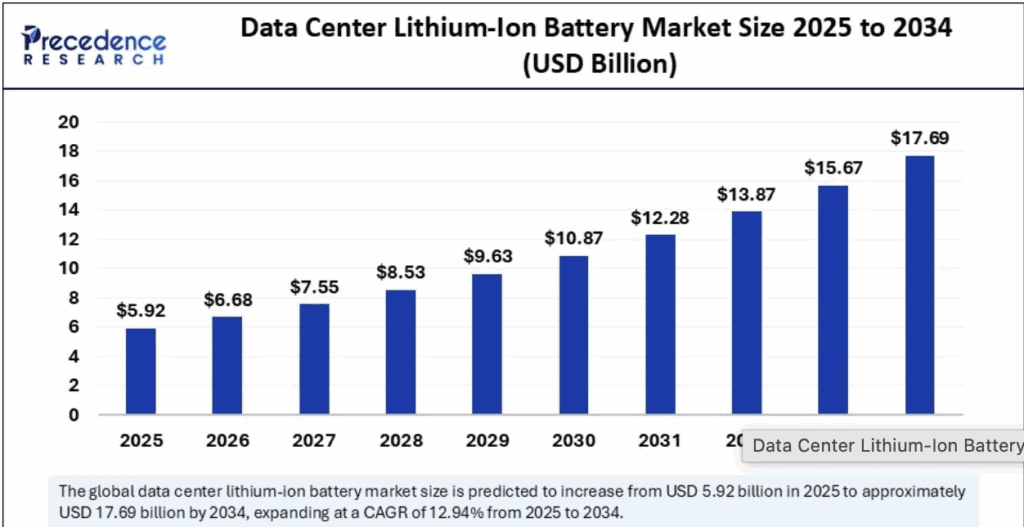

Artificial intelligence is driving rapid data center expansion, but the scale of lithium demand from this sector is often overstated. While data center electricity use is rising quickly, there is no evidence that their battery storage requirements will reach one-third of global demand by 2030. Industry reports instead project the market to grow steadily at around 13% CAGR from 2025 to 2034, far below the claimed 35%. Battery storage will play an important role in smoothing power loads for AI-driven facilities, but EVs and grid-scale deployments will remain the main demand centers for lithium.

Source: Precedence Research.

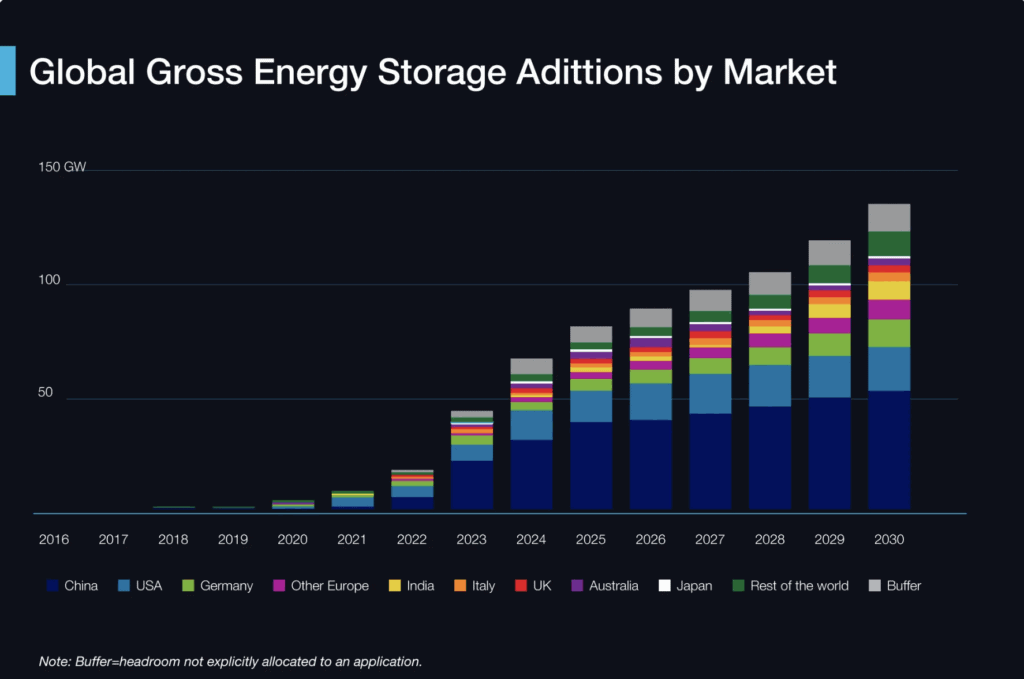

Grid-Scale Energy Storage

The global build-out of renewable energy is creating unprecedented demand for grid-scale storage. In 2024, global battery energy storage deployments surged to 205 GWh, with over 160 GWh installed in the grid market alone. Installations are projected to grow at an annual rate of 21% through 2030, effectively tripling capacity by the end of the decade. Lithium-ion batteries remain the technology of choice thanks to their efficiency, scalability, and cost advantages, cementing lithium’s role in stabilizing renewable-driven power grids.

The result? Global lithium demand is forecast to reach 1.8 million tonnes of lithium carbonate equivalent in 2025, doubling to 3.7 million tonnes by 2030.

The Investment Landscape: Who’s Cashing In

| Company / ETF | Exchange | Nickname | Strengths / Advantages | Key Plans & Metrics | Risks / Considerations |

|---|---|---|---|---|---|

| Albemarle Corporation (ALB) | NYSE | The Warren Buffett of Lithium | – Largest global lithium producer- Vertically integrated operations (mining → purification)- Diversified revenue (bromine, catalysts)- Strong balance sheet | – Reopening Kings Mountain mine (NC) with $90M DoD support– Doubling Silver Peak (NV) production by 2025 | Low bankruptcy risk but tied to global lithium demand cycles |

| Sociedad Química y Minera de Chile (SQM) | NYSE | The Chilean Goldmine | – World’s largest lithium producer by volume- Owns rich Salar de Atacama deposits (1,800–2,700 ppm)- Diversified (fertilizers, iodine, solar salts) | – Partnership with Codelco until 2060– Target: 300,000 tonnes LCE by 2030 | Exposure to Chilean government policy shifts and potential nationalization |

| Lithium Americas Corp (LAC) | NYSE | The American Dream Play | – Focused on U.S. lithium independence- Largest known resource (Thacker Pass, NV)- GM joint venture | – JV ownership: 62% LAC, 38% GM– Phase 1 completion expected late 2027– Production: 40,000 tonnes/year battery-grade lithium- Secured $250M fundingfrom Orion | No current revenue, highly speculative |

| Livent Corporation (LTHM) | NYSE | The Technology Leader | – Specialty applications (energy storage, polymers)- Financially strong (0.7 equity-to-asset ratio)- Innovation leader | – 3-year revenue growth: 15%– 3-year EBITDA growth: ~50%– Forward P/E: 10.42 | Exposure to lithium price volatility |

| Piedmont Lithium Inc (PLL) | NASDAQ | The Carolina Wildcatter | – U.S.-focused, in NC’s Tin-Spodumene Belt- Tesla supply agreement (amended 2023)- Located in mining-friendly region | – Plans: 60,000 tonnes/year lithium hydroxide capacity- Recently completed multiple funding rounds | Pre-revenue, early-stage speculative play |

| Global X Lithium & Battery Tech ETF (LIT) | NASDAQ | The Diversified Play | – Diversified across supply chain- Reduces single-stock risk | – Top holdings: Albemarle, SQM, Tesla, TDK- Geographic split: 43.1% China, 18.4% U.S., 11.4% South Korea– Net assets: $1.08B– Expense ratio: 0.75% | Lower upside vs. single stocks, but safer |

The 10-Year Outlook: What the Data Shows

The numbers paint a compelling picture for long-term lithium investors. Demand is set to grow rapidly, with projections showing 1.8 million tonnes of lithium carbonate equivalent (LCE) needed this year, a figure that could more than double to 3.7 million tonnes by 2030. By 2035, if new mining and processing projects face delays, the market could encounter significant supply deficits.

Current lithium prices remain depressed, hovering between USD 8,000 and 13,000 per tonne, well below the incentive price required to stimulate new production. However, analysts see a clear recovery path. By 2026, the market is expected to rebalance as excess supply contracts. From 2027 to 2030, looming deficits may begin pushing prices upward, and the period from 2030 to 2035 could see structural undersupply as demand outpaces the development of fresh projects.

Shifts in geographic supply are also reshaping the industry. Today, Australia, Chile, and China dominate, accounting for nearly 90% of global production. Over the next decade, Africa’s lithium output is forecast to surge by ~170% between 2025 and 2035. Meanwhile, the United States is ramping up domestic production to strengthen strategic security and reduce dependence on foreign supply.

Source: Metal Hub

The Risks Investors Cannot Ignore

Lithium may offer immense upside, but it comes with substantial risks. Prices are notoriously volatile, having swung from over $85,000 per tonne in late 2022 to around $13,000 per tonne by 2024. Alternative battery chemistries such as solid-state or sodium-ion could eventually reduce reliance on lithium.

Environmental challenges are also intensifying, as mining in water-scarce regions like the Atacama Desert faces opposition over ecological damage and Indigenous rights concerns. Oversupply remains another risk, as seen in 2024 when a glut of about 150,000 tonnes briefly flooded the market.

The Bottom Line for Investors

Lithium is more than just another commodity; it has become a cornerstone of the 21st-century clean energy economy. Global demand is projected to grow two to four times by 2030, driven primarily by electric vehicles and large-scale energy storage. While estimates vary, most industry forecasts agree that the lithium market will expand significantly over the next decade, though precise valuations such as a $155 billion target by 2035 should be treated as directional rather than definitive.

For investors, a conservative approach emphasizes diversified exposure through vehicles like LIT and established producers such as ALB and SQM. A higher-risk, growth-oriented strategy may include speculative developers like LAC and PLL, which are still building out production capacity. In either case, it is generally wise to limit lithium exposure to 5–10% of a portfolio, balancing the sector’s transformative potential with its inherent volatility.

The energy transition remains a structural trend, and lithium is central to today’s battery technologies. The real uncertainty is not whether demand will rise, but which companies and regions will successfully capture the value created in this new electric era.

This article belongs to Mooloo’s Asset Classes series, which examines how different assets behave over time and how they are used together to build resilient portfolios. View the full Asset Classes overview to see how each asset fits within a broader investment structure.