The Simple Variance Formula That Separates Smart Investors from Gamblers

6 min read

Updated: Dec 28, 2025 - 07:12:42

Most investors chase the highest returns, but variance, the unpredictability of returns, often has a bigger impact on long-term wealth. Even if two investments average the same annual return, the one with steadier performance usually compounds to a higher final value and causes less stress for the investor. Understanding your tolerance for variance helps you choose investments that align with both your financial goals and your peace of mind.

- Variance drag: Large swings in returns reduce compounding; a 50% loss requires a 100% gain to recover.

- Behavioral risk: High-variance assets increase the chance of panic selling during downturns, as behavioral finance research shows.

- Measuring variance: Check beta scores on Yahoo Finance for stocks (beta >1.5 = high volatility, <0.8 = stability) or standard deviation for funds and ETFs.

- Portfolio strategy: A sustainable approach balances 70-80% in diversified, lower-variance funds with 20-30% in selective growth opportunities.

- Warning signs: Daily price swings above 5%, yearly differences over 30%, or hype-driven investments often indicate dangerous volatility.

Most investors spend their energy chasing the highest returns, yet overlook the hidden factor that shapes long-term wealth: variance. Variance represents the degree of unpredictability in an investment’s returns. While high returns look attractive, if they fluctuate dramatically from year to year, the end result is often disappointing compared to a steadier, lower-variance investment.

Think of variance as the smoothness of your financial journey. A consistent, predictable ride often produces better outcomes for your wealth, and for your peace of mind, than a roller coaster of highs and lows.

Understanding Variance Without the Math

Variance sounds complicated because of the formulas attached to it, but the idea is intuitive. Imagine comparing two cities:

-

Phoenix, Arizona has hot, sunny weather almost every day. You know what to expect, low variance.

-

Chicago, Illinois can be warm and sunny one day, snowy and cold the next. That’s high variance.

Your investments behave in the same way. A low-variance stock acts like Phoenix weather, steady and predictable. A high-variance stock resembles Chicago, exciting but hard to plan around.

Source: FTSE Russell

The Bowling Alley Test

Another way to picture variance is by imagining two bowlers. Bowler A consistently knocks down seven pins every frame. It may look dull, but it’s steady. Bowler B scores a strike one frame, a gutter ball the next, then a mix of spares and misses. Both might average seven pins per frame, but one experience is predictable while the other is full of wild swings.

Investments behave the same way. Both a stable dividend stock and a volatile growth stock may average 10% annual returns, but the one with lower variance will give you a steadier ride and protect your compounding over time.

The Variance Formula in Simple Terms

The formula for variance is often written as:

σ² = Σ(Ri – μ)² / N

Stripped of symbols, it means this: look at your returns, find the average, measure how far each return strays from the average, square those differences, then average them. The result tells you how “jumpy” the investment is.

Case Study: Two $10,000 Investments

Here’s a real-world illustration:

| Year | Investment A (Low Variance) | Investment B (High Variance) |

|---|---|---|

| 1 | +8% | -10% |

| 2 | +9% | +5% |

| 3 | +10% | +15% |

| 4 | +11% | +25% |

| 5 | +12% | +15% |

Both average 10% annually, but after five years the results diverge:

-

Investment A grows to $16,105

-

Investment B grows to $15,209

The difference comes from volatility drag, the way large swings eat into compounding, leaving you with less money in the end.

Your Personal Variance Tolerance

Variance isn’t only about numbers; it’s also about psychology. If your $50,000 portfolio suddenly fell to $40,000 in one month, would you stay calm and perhaps invest more, lose sleep but stay invested, or panic and sell? Your reaction defines how much variance you can tolerate.

Similarly, ask yourself whether you’d prefer steady 8% gains every year or a mix of 15% gains some years and 5% losses in others. Your preference will tell you whether you are naturally suited to high or low variance investing.

Why Professional Investors Care About Variance

Professionals often prefer lower-variance assets, even if their returns are modest, for three reasons. First, low variance protects compound interest. A 50% loss requires a 100% gain to recover, something less likely in volatile assets. Second, low variance helps protect investors from themselves. Behavioral finance research shows people panic when facing sharp declines, leading to selling at lows and missing rebounds. Third, low variance supports mental well-being, allowing investors to make rational decisions instead of emotional ones.

Measuring Variance in Practice

Investors don’t need advanced math to measure variance. For individual stocks, a quick check of a company’s beta score on financial platforms such as Yahoo Finance shows how volatile the stock is compared to the broader market. A beta above 1.5 suggests high volatility, while a beta below 0.8 suggests stability.

Mutual funds and ETFs often publish their standard deviation, which serves as a direct measure of variance. A higher standard deviation means wider swings. For entire portfolios, tools like Portfolio Visualizer allow investors to analyze historical performance and volatility.

Finding the Variance Sweet Spot

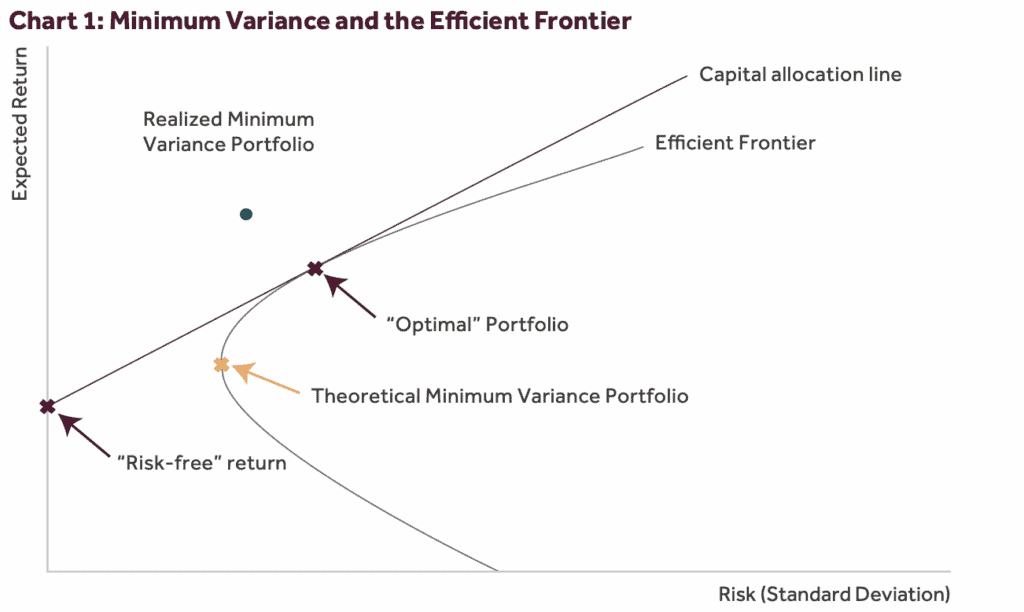

The goal isn’t to eliminate variance completely, without some risk, there is no return. The sweet spot is an allocation that balances growth potential with stability. This often means using diversified index funds or balanced portfolios as the foundation, supplemented with selective growth opportunities.

For example, an investor might place 70–80% of their capital in total market index funds, international equities, and some bonds for stability. The remaining 20–30% could go into individual stocks, sector funds, or targeted growth strategies. This structure allows participation in upside potential without letting volatility dominate the entire portfolio.

Warning Signs of Dangerous Variance

Variance becomes problematic when it threatens financial goals. If you are within 10 years of retirement, relying on investments for near-term expenses, or have never experienced a bear market, high-variance investments may jeopardize your plan. Red flags include daily price swings above 5%, annual results that differ by 30% or more, or investments frequently making sensational headlines promising explosive growth.

These signs indicate that while returns may look attractive, the underlying volatility could undermine compounding and cause behavioral mistakes.

Building a Sustainable Portfolio

The most resilient portfolios aren’t designed to chase the highest returns in any given year. They are designed to deliver consistent growth that aligns with both financial goals and personal comfort levels. By anchoring the majority of capital in broad, diversified, and relatively low-variance assets, while carefully allocating a smaller portion to higher-risk opportunities, investors can maintain both performance and peace of mind.

Conclusion

Variance is more than a statistical formula, it is a practical guide to building wealth without losing sleep. Average returns alone don’t tell the full story, because volatility shapes both outcomes and behavior. The investor who prioritizes manageable variance creates conditions for compounding to work steadily, for discipline to remain intact, and for long-term goals to be achieved.

The next time you evaluate an investment, ask not only what the return might be, but also how unpredictable the path will feel. In the long run, the steadier road often proves the most profitable.

About this topic

This article forms part of Mooloo’s investing education series, which explains how markets work, how risk and returns are generated, and how investors can make better long-term decisions.

Learn more in our How Investing Works guide.