Not All Bad: How the Big Beautiful Bill Could Put Extra Cash in Your Pocket

4.1 min read

Updated: Jan 8, 2026 - 11:01:52

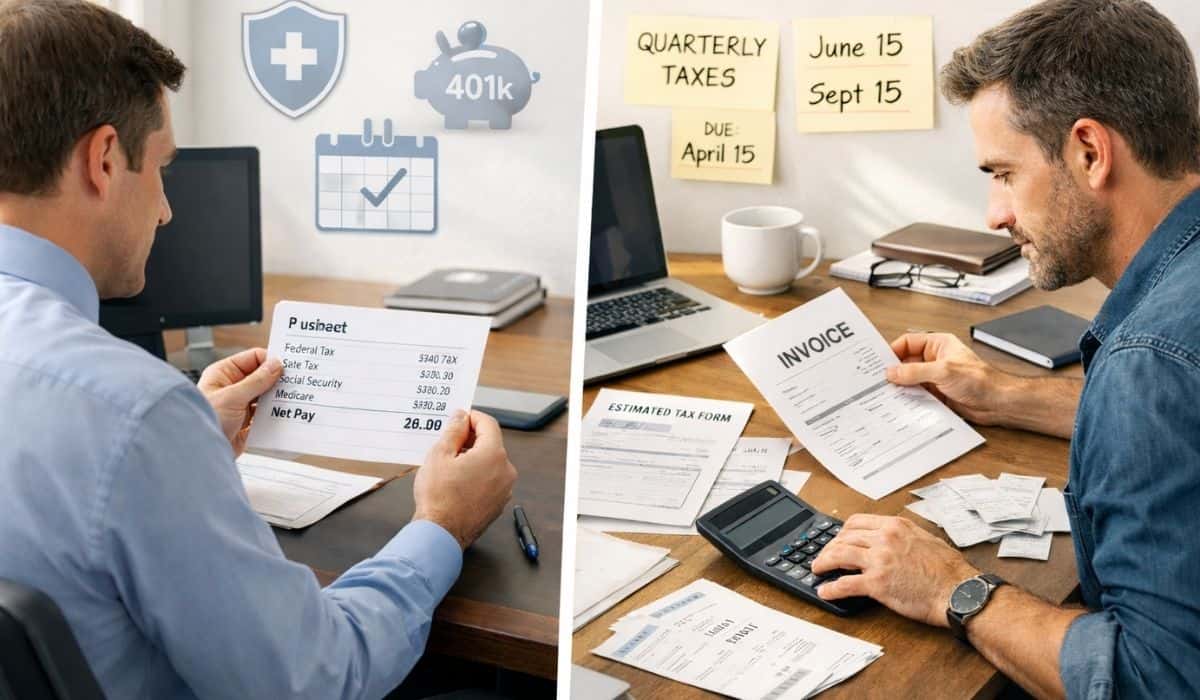

Signed into law on July 4, 2025 (Public Law 119-21), the One Big Beautiful Bill delivers a broad package of federal tax changes that may affect middle-income households, tip-reliant workers, small-business owners, and homeowners in high-tax states. Key provisions include new deductions for tips and overtime pay, a higher state and local tax (SALT) deduction cap, and incentives tied to the purchase of certain U.S.-assembled vehicles. While some changes are permanent—such as the extension of lower individual tax rates and the §199A Qualified Business Income (QBI) deduction—others expire after 2028, making timing, eligibility, and documentation important considerations.

Below is a practical overview of the most notable provisions and how they may apply, depending on your income, filing status, and tax situation.

- “No Tax on Tips” deduction: Up to $25,000 annually, subject to income phase-outs beginning at $150,000 MAGI ($300,000 joint), and limited to IRS-recognized tipped occupations.

- Overtime premium deduction: Deduct up to $12,500 (single) or $25,000 (joint) for qualifying overtime pay through 2028.

- Higher SALT cap: Increased to $40,000 in 2025, with modest annual increases, benefiting taxpayers who itemize deductions in high-tax states.

- Auto loan interest deduction: Up to $10,000 annually for interest on loans for new U.S.-assembled vehicles purchased after December 31, 2024.

- Permanent stability: Lower individual tax rates and the §199A pass-through deduction are now permanent, supporting longer-term income and business planning.

The One Big Beautiful Bill is more than a political headline. It is a comprehensive set of tax law changes that reshape how certain households, workers, and businesses calculate taxable income. While the potential benefits are real, they are not automatic. Tax outcomes depend on eligibility rules, income thresholds, and whether deductions are properly claimed and documented.

Key Tax Breaks You Should Know

“No Tax on Tips” Deduction

One of the most publicized provisions is a new above-the-line deduction of up to $25,000 per year for qualified tips. These tips must be voluntarily paid, properly reported on W-2s, 1099s, or Form 4137, and earned in occupations that customarily and regularly received tips before December 31, 2024. The deduction applies whether or not a taxpayer itemizes.

The benefit begins to phase out for individuals with modified adjusted gross income above $150,000 ($300,000 for joint filers) and is gradually reduced at higher income levels. Importantly, this provision reduces federal income tax only; Social Security and Medicare taxes still apply, and most states continue to tax tips as ordinary income.

Overtime Pay Deduction

From 2025 through 2028, employees may deduct the overtime premium portion of their pay—the additional “half” in time-and-a-half compensation. The maximum annual deduction is $12,500 for single filers and $25,000 for married couples filing jointly, subject to the same MAGI phase-out thresholds as the tips deduction.

This deduction applies regardless of whether a taxpayer itemizes. For workers in industries where overtime is common, such as healthcare, logistics, and manufacturing, the provision may reduce federal taxable income, depending on earnings and withholding.

Higher SALT Deduction Cap

The law raises the SALT deduction cap from $10,000 to $40,000 starting in 2025, with small annual increases through 2029. A phase-down applies at higher income levels, but the cap does not fall below $10,000. This change primarily affects taxpayers who itemize deductions and live in states with higher income or property taxes.

Auto Loan Interest Deduction for U.S.-Assembled Vehicles

To encourage domestic manufacturing, the Bill allows a deduction of up to $10,000 per year for interest paid on loans used to purchase new, U.S.-assembled vehicles after December 31, 2024. Leases and used vehicles do not qualify. Eligibility and benefit size depend on financing terms and income level.

Permanent Extension of Lower Tax Rates and §199A Deduction

The legislation permanently extends the individual tax rate reductions originally enacted in 2017 and makes the §199A Qualified Business Income deduction permanent. This provides greater predictability for sole proprietors, LLC members, and S-corporation owners when planning compensation, distributions, and long-term business strategy.

Who Benefits Most and How to Think About Planning

Workers in tip-heavy or overtime-driven roles may see the most immediate impact, provided income stays below phase-out thresholds and earnings are properly reported. Homeowners in high-tax jurisdictions who already itemize deductions may benefit from the higher SALT cap, while small-business owners gain stability from the permanent extension of existing rate and QBI rules.

Because several provisions are temporary and subject to income limits, taxpayers may benefit from reviewing withholding, retirement contributions, and timing of income or major purchases. Some individuals may choose to work directly with IRS resources, while others may consult a qualified tax professional to evaluate how these provisions apply to their specific circumstances.

Important Caveats

Not all provisions are permanent. The tips deduction, overtime deduction, and auto loan interest deduction are scheduled to expire after 2028 unless extended by Congress. Eligibility rules, income phase-outs, and reporting requirements all affect whether a benefit can be claimed.

This overview is for general educational purposes only and does not constitute tax or legal advice. Tax outcomes vary based on individual facts and documentation, and taxpayers should verify details using official IRS guidance or qualified professionals.