Why Smart Retirees Never Claim Social Security at 62

4.8 min read

Updated: Dec 25, 2025 - 03:12:22

Deciding when to start Social Security is one of the most important retirement choices for Americans in their early 60s. Filing at 62 locks in a permanent reduction of about 30%, while delaying to Full Retirement Age (66–67) or age 70 can substantially increase lifetime income. Research from the Social Security Administration and the GAO shows that most retirees, especially those in good health or married, benefit financially from waiting. The right decision depends on health, income needs, and spousal planning, but patience usually pays off.

- Claiming at 62 reduces monthly benefits by ~30%, costing over $180,000 in lost lifetime income for many retirees.

- Waiting until Full Retirement Age ensures full benefits, higher survivor protections, and stronger long-term stability.

- Delaying until 70 grows benefits ~8% per year, providing maximum guaranteed, inflation-adjusted income for life.

- Filing early may still make sense for those with health issues, short life expectancy, or urgent income needs.

Choosing when to begin Social Security benefits is one of the most critical financial decisions Americans face in their early 60s. While benefits are available as early as 62, the decision carries long-term consequences. Research from the Social Security Administration (SSA) and independent studies show that filing early often results in a significant loss of income over a lifetime. For many retirees, patience and strategic planning provide greater financial security.

How Social Security Benefits Are Calculated

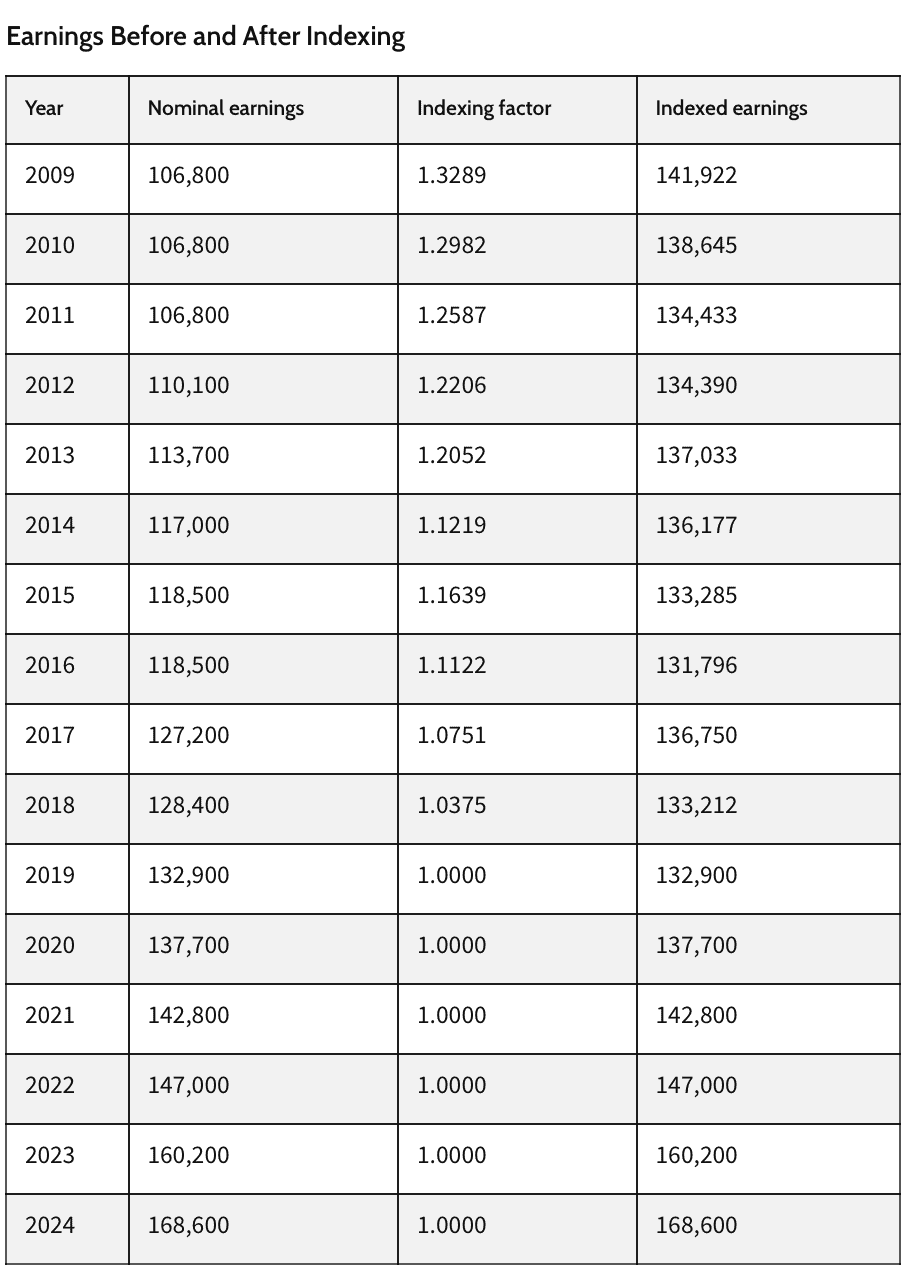

Social Security benefits are based on two factors: your earnings history and the age at which you begin collecting. The SSA calculates benefits using your highest 35 years of earnings. Every individual also has a Full Retirement Age (FRA), which falls between 66 and 67 depending on birth year.

Source: Investopedia

-

Filing before FRA leads to a permanent reduction in benefits.

-

Delaying beyond FRA earns delayed retirement credits, which increase benefits until age 70.

This system is designed to balance out over average life spans, but in reality, those who live longer gain a significant advantage by delaying.

The Cost of Claiming at 62

The earliest eligibility age comes with the steepest cut. According to SSA benefit formulas, if your FRA is 67 and you claim at 62, your monthly benefit is reduced by about 30%.

-

A worker entitled to $2,000 at FRA would receive about $1,400 at 62.

-

Over a 25-year retirement, this reduction amounts to more than $180,000 in lost lifetime benefits.

Actuarial life tables from the SSA Office of the Chief Actuary show that a 62-year-old man has an average life expectancy of 82, while a woman’s is 85. This means most retirees will live long enough to feel the impact of smaller monthly checks for decades.

The Benefits of Waiting Until Full Retirement Age

At FRA, retirees unlock their full calculated benefit, which can make a substantial difference compared with filing early. This means higher monthly income for life, income that also grows through annual cost-of-living adjustments. For many households, this increased baseline provides more stability and peace of mind.

For couples, delaying until FRA has another advantage: survivor benefits. Because the surviving spouse’s benefit is based on the higher earner’s claim, waiting can help ensure that the surviving partner enjoys stronger financial protection.

Why Some Retirees Delay Until 70

The case for waiting becomes even more compelling when looking beyond FRA. For each year that claiming is delayed up to age 70, benefits grow by about 8% annually. Unlike investments that fluctuate with markets, this increase is guaranteed and inflation-adjusted.

Consider someone eligible for $2,000 at FRA. By waiting until 70, their monthly check would rise to about $2,480. That difference compounds over time as annual cost-of-living adjustments are applied. Financial planning research shows that, for individuals in good health, delaying until 70 maximizes total lifetime income and provides stronger protection against the risk of outliving savings.

Claiming Patterns and Common Mistakes

Despite the clear financial advantages of waiting, many retirees still file early. According to a Government Accountability Office (GAO) report, roughly one-third of Americans begin claiming at 62. This pattern often arises from misconceptions about longevity, immediate financial pressures, or concerns about the long-term solvency of the Social Security program.

Yet, academic research suggests that most households, especially married couples, stand to benefit from delaying. Because survivor benefits depend on the higher earner’s claim, filing early can leave the surviving spouse at a disadvantage.

When Early Claiming May Be the Right Choice

Not all retirees are best served by waiting. Filing at 62 can be a reasonable choice in certain circumstances. These include situations where health concerns or a shorter life expectancy mean that long-term benefits are unlikely to be collected in full. It may also be appropriate for those who lack sufficient income to meet essential expenses and cannot bridge the gap with savings. In some cases, couples coordinate claims strategically, with one spouse filing early while the other delays, balancing immediate needs with long-term income growth.

Key Takeaways for Retirement Planning

Under this heading, bullet points are useful to emphasize the main conclusions:

-

Claiming at 62 locks in permanently reduced checks that often last for decades.

-

Waiting until FRA ensures the full benefit amount and offers stronger long-term stability.

-

Delaying until 70 maximizes guaranteed, inflation-adjusted income, protecting against longevity risk.

Bottom Line

Choosing when to claim Social Security is not simply a question of timing, it is a decision that can shape your financial security throughout retirement. While claiming at 62 may provide quick access to income, actuarial data and financial modeling consistently show that waiting, when possible, leads to stronger lifetime outcomes. For many retirees, especially those in good health, patience pays. Careful consideration of personal health, financial needs, and family circumstances is essential, but for the majority, delaying benefits is one of the most effective strategies for building a secure retirement.

For a full overview of Social Security benefits, rules, and common questions, see our Social Security Explained guide.