Why 73% of Uber Drivers Are Actually Losing Money (And Don’t Know It)

5.9 min read

Updated: Dec 22, 2025 - 08:12:23

Driving for Uber looks like quick cash, but once you account for vehicle costs, taxes, and unpaid time, many drivers actually lose money. Studies show up to 73% of drivers earn below the federal minimum wage of $7.25/hour. In California, Uber, Lyft, and DoorDash spent over $200 million to pass Proposition 22, denying drivers benefits guaranteed under employee status. The IRS sets the 2025 mileage rate at $0.70 per mile, meaning even a $20/hour gross payout can vanish once real costs are factored in. Without careful tracking, most drivers unknowingly operate at a loss.

- Net earnings: MIT and Economic Policy Institute research show most Uber drivers take home less than minimum wage after expenses.

- Hidden costs: IRS mileage ($0.70/mile in 2025), fuel, maintenance, and 15.3% self-employment taxes slash pay.

- Prop 22 fallout: Uber, Lyft, and DoorDash spent $200M to block worker protections in California, reducing driver rights.

- Unpaid time: Waiting between rides and repositioning lowers effective hourly income far below app-reported rates.

- Better alternatives: Food delivery, local part-time jobs, or remote freelance work often provide steadier, more reliable pay.

Driving for Uber often looks like an easy way to make quick money: you log into the app, accept rides, and watch daily deposits land in your account. The numbers on the screen can be encouraging, but for most drivers, those figures mask a harsher financial reality. Once all costs are considered, a large share of rideshare drivers are earning less than minimum wage, and many don’t even realize they are operating at a loss.

Where the “73% lose money” number comes from

In 2018, a widely cited Massachusetts Institute of Technology (MIT) study estimated that the median Uber driver’s net pay after expenses was just $3.37 per hour. Although Uber disputed the methodology, follow-up surveys by advocacy groups like the Rideshare Drivers United and the Economic Policy Institute confirmed the same broad picture: a majority of drivers earn less than the federal minimum wage of $7.25/hour once expenses are deducted. The commonly referenced figure, that as many as 73% of drivers lose money after costs, emerged from these combined findings and has since become a rallying cry in debates about gig worker pay.

Uber, Lyft, and DoorDash Spent $200 Million to Circumvent Law And Deny Drivers Benefits

Before diving deep into the math of IRS mileage rates, it’s worth reminding drivers considering working for any of the rideshare companies, of just how much these businesses ‘have their back’.

Proposition 22 was passed by California voters on November 3, 2020, after Uber, Lyft, and DoorDash orchestrated one of the most expensive corporate manipulation campaigns in U.S. history. These companies spent over $200 million – making it the most expensive ballot measure in California history – to strip their own drivers of basic employment rights.

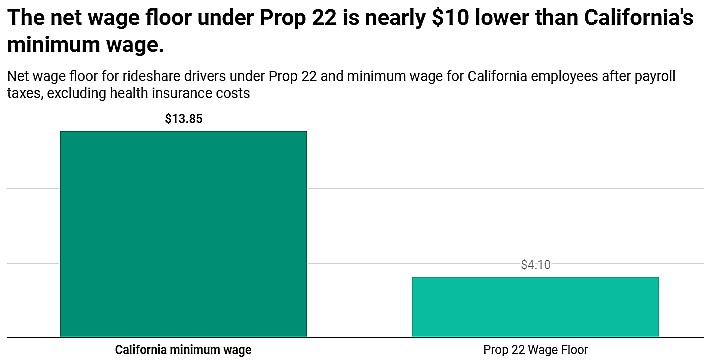

A $200 million campaign by Uber, Lyft and Doordash ensured their drivers in California would earn much less than the minimum wage. Source: National Equity Atlas

The companies created this ballot initiative specifically to circumvent Assembly Bill 5, an existing law which California’s legislature had passed in 2019 to protect gig workers by requiring proper employee classification. Rather than comply with the law and provide their drivers with minimum wage, overtime pay, sick leave, and other basic protections, these corporations chose to spend a fortune rewriting the rules in their favor.

The hidden costs most drivers overlook

Driving for Uber is considered self-employment, which means drivers carry the full weight of operating costs. While Uber’s app shows gross payouts, it doesn’t reflect the ongoing expenses that reduce true earnings.

-

Vehicle wear and tear: Cars depreciate rapidly, particularly when used intensively for ridesharing. The IRS sets the 2025 standard mileage rate at $0.70 per mile, this is the IRS’s estimate of what it costs you to operate your vehicle per mile. It includes depreciation, repairs, insurance, and registration costs. Over time, this hidden expense becomes one of the largest drains on net income.

-

Gas and maintenance: At an average gas price of $3.50 per gallon, a car achieving 25 mpg spends about $0.14 per mile on fuel. Oil changes, tire replacements, brake pads, and unexpected repairs add further weight to the budget.

-

Self-employment taxes: Unlike salaried employees, Uber drivers pay both the employer and employee portions of Social Security and Medicare, totaling 15.3% of net income. This tax obligation can catch new drivers off guard, especially when quarterly estimated payments are due.

-

Unpaid time: The Uber app records “active driving time,” but does not account for waiting between rides, repositioning to high-demand areas, or time spent cleaning the vehicle. This unpaid time often reduces effective hourly pay far below the app’s displayed rate.

Real-world example of Uber driver math

Consider a driver who earns a gross payout of $20/hour from Uber. If they drive 30 miles during that hour, the IRS mileage rate alone amounts to $20.10 in costs, already exceeding the gross income.

After subtracting self-employment taxes of 15.3% on any remaining net pay, the result is a net hourly wage of negative $0.10/hour. On paper, the driver appeared to earn $20, but in reality, they lost money.

Why drivers keep driving despite losses

If driving is so often unprofitable, why do so many continue? Part of the answer lies in the psychology of gig work. Instant deposits create a sense of quick reward. Many drivers don’t track expenses in detail and only see the gross numbers Uber shows them. Others hope surge pricing or incentive bonuses will offset losses, even though these opportunities are inconsistent and often offset by higher competition during peak times. For some, the appeal is flexibility: the ability to work on their own schedule outweighs short-term financial setbacks.

How to calculate your true net earnings

The only way for drivers to know if they’re truly profiting is by tracking all inputs. That means recording:

-

Miles driven compared to the IRS reimbursement rate.

-

Gas, insurance, and repair costs.

-

Hours worked, including unpaid waiting time.

-

Self-employment taxes and other withholdings.

Apps like Stride, Everlance, or QuickBooks Self-Employed can help automate expense tracking and give drivers a clearer picture of net income. Without such tracking, most drivers risk overestimating how much they actually take home.

Smarter alternatives for gig workers

For those who find rideshare unprofitable, alternatives can offer steadier returns. Food and package delivery services typically involve shorter trips and more tipping opportunities, which can improve margins. Local part-time jobs provide guaranteed hourly wages, often with benefits. Remote freelance work, ranging from online customer service to content creation, has grown significantly in recent years and may provide more sustainable earnings for people seeking flexible work arrangements.

Conclusion

Uber presents itself as an accessible, flexible path to extra income. But once the true costs of vehicle ownership, taxes, and unpaid labor are factored in, most drivers fall short of even minimum wage, with some unknowingly operating at a loss. While the app’s instant payouts can feel like progress, the reality is that the rideshare model often shifts financial risk from the company to the driver. For those considering Uber driving, careful expense tracking and honest comparison with other opportunities are essential steps in deciding whether it’s worth the time and effort.