How To Pick A Growth Stock – Why 90% of Investors Get This Wrong

5.7 min read

Updated: Dec 28, 2025 - 07:12:17

Growth stocks, companies with earnings expected to expand faster than the market, can deliver outsized returns. But studies show that nearly 90% of retail investors underperform when stock-picking, largely due to hype-chasing, ignoring valuation, and misjudging growth durability. To succeed, investors must use disciplined frameworks grounded in fundamentals rather than narratives.

- Common pitfalls: Retail investors often overpay for hype sectors like AI or EVs, neglect financial health, and assume unrealistic growth durability.

- Valuation discipline: Even quality companies can become poor investments if purchased at extreme multiples; history from the dot-com bubble proves inflated P/Es often end in steep losses.

- Keys to success: Look for consistent revenue growth, rising profit margins, free cash flow strength, and management with a proven track record.

- Moats matter: Durable competitive advantages, patents, brands, or network effects, separate lasting growth companies from speculative plays.

- Balance growth and price: Tools like the PEG ratio help investors avoid overpaying; historical research shows valuation discipline is critical for long-term returns.

A growth stock is typically defined as a company whose earnings and revenue are projected to expand faster than the broader market average. Investors buy these stocks with the expectation that rapid business expansion will drive share prices higher. Unlike value stocks, which trade at lower multiples relative to their fundamentals, growth stocks often command higher price-to-earnings (P/E) ratios because the market prices in future potential rather than current performance.

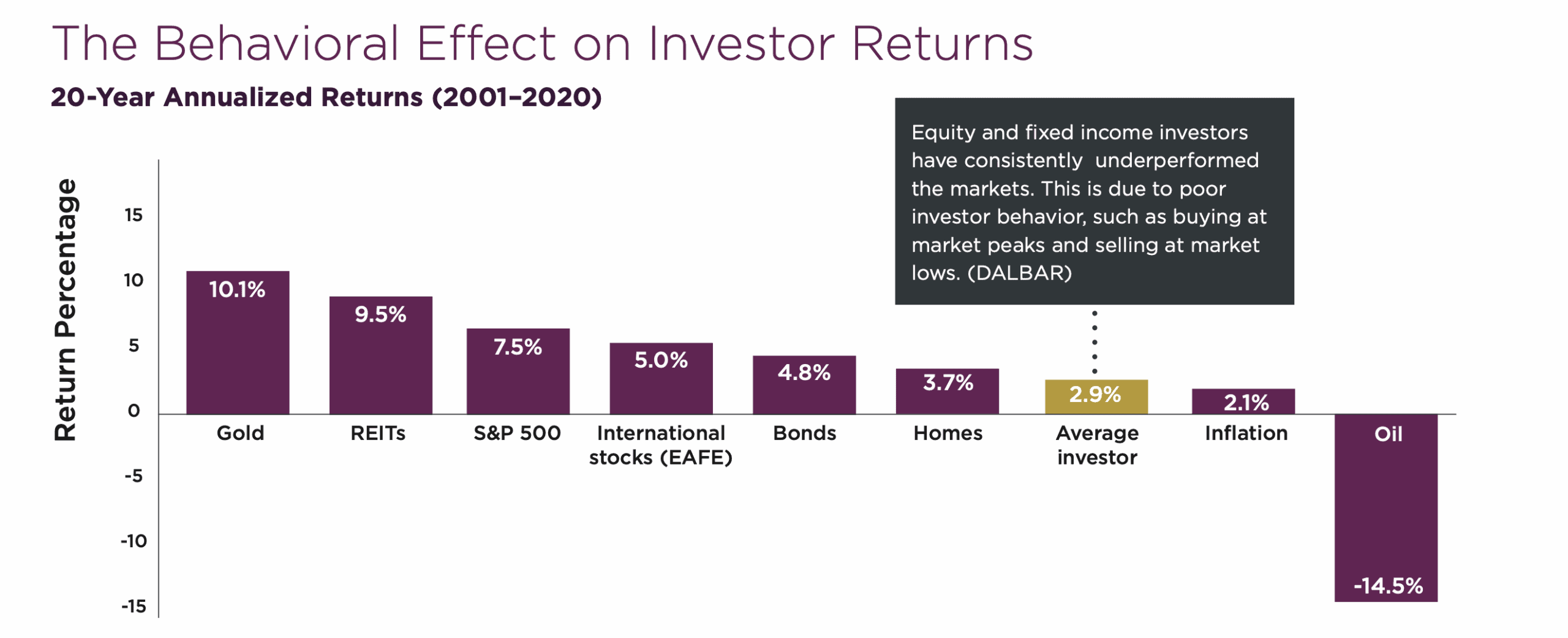

This approach can be rewarding, but the majority of retail investors struggle to do it successfully. According to a study on investor behavior, the average equity investor has consistently underperformed the S&P 500 over the past three decades, largely due to poor timing and chasing trends.

Source: DARRNALL SIKES

Research from Morningstar also shows that investors in high-growth funds often earn lower returns than the funds themselves because they enter at peaks and exit after downturns. In practice, nearly 90% of retail investors underperform the market when stock-picking strategies are applied to growth investing.

Why Most Investors Get Growth Stocks Wrong

Hype Over Fundamentals

Retail investors frequently get swept up in popular narratives, whether it’s artificial intelligence, electric vehicles, or biotech breakthroughs. These industries may indeed have long-term potential, but many of the individual companies lack strong balance sheets or reliable revenue streams. Without checking fundamentals, investors are essentially betting on a story rather than a business.

Ignoring Valuation

Even great companies can become terrible investments if purchased at inflated valuations. When a stock trades at 80x earnings, for example, it needs years of uninterrupted growth to justify its price. If growth slows or expectations reset, valuations compress, and investors face steep losses. Historical analysis of the dot-com bubble shows that many companies with real technologies still collapsed because valuations ran far ahead of earnings.

Overestimating Growth Durability

Sustaining 30-40% annual growth is extremely rare. Academic studies on business life cycles confirm that most firms’ growth rates slow as they mature. When investors assume high growth will continue indefinitely, disappointment follows as the company normalizes. Misjudging this transition leads to repeated underperformance.

How to Pick a Growth Stock the Right Way

Revenue and Profitability Trends

Consistent double-digit revenue growth coupled with rising profit margins is a sign of scalable business strength. Companies that grow only by spending heavily and losing money every quarter often burn out or dilute shareholders through new funding rounds. Examining financial statements, particularly free cash flow trends, helps separate sustainable businesses from speculative plays.

Quality of Leadership and Strategy

Strong leadership is often the difference between temporary momentum and long-term success. Research on corporate performance suggests that firms with experienced, adaptable management teams outperform peers in navigating competitive pressures. Reviewing annual reports, shareholder letters, and executive track records provides insight into whether management can execute on its vision. For example, the current trend of failing companies rebranding with ‘crypto treasury’ strategies and positioning should be treated very skeptically – after all, these companies are usually helmed by the same management team that failed in their core business.

Competitive Advantages (The Moat)

Warren Buffett’s famous concept of a “moat” is critical in growth investing. Competitive advantages like patents, brand strength, or network effects make it harder for rivals to erode profits. Without these protections, fast-growing firms may lose ground quickly once competitors enter. A useful framework here is Michael Porter’s Five Forces, which helps investors assess how durable a company’s advantages really are.

Balancing Growth With Valuation

The PEG ratio (price-to-earnings-to-growth) is widely used by professionals to judge whether a stock’s valuation is reasonable compared to its growth outlook. A PEG near 1 is often considered fairly priced, while a PEG significantly above 1 may suggest overvaluation. Historical studies of growth stock performance have shown that paying too high a premium almost always erodes future returns, even if the company grows.

Practical Example: Comparing Two Growth Companies

-

Company A reports 25% year-over-year revenue growth, a 15% profit margin, and trades at 30x earnings.

-

Company B grows faster at 35% annually but posts –5% profit margins and trades at 80x earnings.

Although Company B looks flashier, it is riskier because it is unprofitable and overpriced. Company A, with steady growth, profitability, and a reasonable valuation, is the more sustainable investment.

This mirrors real-world lessons from tech markets: during the dot-com bubble, firms with both profitability and discipline, such as Amazon, survived, while many high-growth, unprofitable competitors collapsed.

Risks Investors Must Acknowledge

Growth stocks, even when carefully chosen, come with above-average risks.

-

Volatility: They often swing more sharply than the market, especially around earnings announcements.

-

Competition: Attractive markets draw rivals quickly, which can squeeze margins and slow growth.

-

Macroeconomic Pressure: Rising interest rates reduce the present value of future earnings, disproportionately affecting high-valuation stocks.

The SPIVA Scorecard published by S&P Dow Jones Indices shows that most active managers underperform the index over time, underscoring how difficult it is to consistently pick the right growth stocks amid these risks.

Final Takeaways

Picking growth stocks successfully is less about predicting the next hot sector and more about applying a disciplined framework. Investors must analyze financial fundamentals, evaluate management quality, assess competitive moats, and pay attention to valuation metrics. Supported by decades of investment performance studies and investor behavior data, the evidence is clear: most retail investors fail because they chase stories, ignore valuations, and overestimate growth.

Those who combine optimism with discipline stand a better chance of being in the minority that outperforms the market. Growth investing can deliver extraordinary rewards, but only when it is grounded in evidence, strategy, and patience.

About this topic

This article forms part of Mooloo’s investing education series, which explains how markets work, how risk and returns are generated, and how investors can make better long-term decisions.

Learn more in our How Investing Works guide.