Balance Transfer Cards for Bad Credit: The Requirements Nobody Talks About

6.1 min read

Updated: Dec 26, 2025 - 06:12:17

Balance transfer credit cards are often marketed as a fix for high-interest debt, but the best 0% APR deals are limited to borrowers with good to excellent credit (typically FICO 670+). If your score falls below that threshold, you’ll likely be denied or face short promotional periods, high fees, and low limits that make the strategy ineffective. For those with bad or fair credit, alternatives like debt consolidation loans, secured cards, and nonprofit debt management programs may provide more realistic paths toward financial recovery. Bottom line: unless your credit score is at least 670, balance transfer cards won’t deliver meaningful savings.

- Eligibility: Top offers (12–21 months 0% APR) require FICO 670+, with best approval odds at 700–750+.

- Risk for bad credit: Borrowers often face higher fees, limits too small to cover balances, and post-promo APRs of 25–30%.

- Alternatives: Consider debt consolidation loans, secured credit cards, credit-builder loans, or nonprofit debt management programs.

- Steps to qualify later: Reduce utilization, make on-time payments for 6–12 months, and check reports for errors to move into “good” credit range.

Balance transfer credit cards are often marketed as a simple solution for escaping high-interest debt. These d cards allow borrowers to move balances from one or more credit cards onto a single account, often with a 0% introductory APR. At first glance, it seems like a financial lifeline: the chance to stop interest charges, consolidate payments, and focus on reducing debt. For qualified borrowers, this strategy can save hundreds or even thousands of dollars in interest.

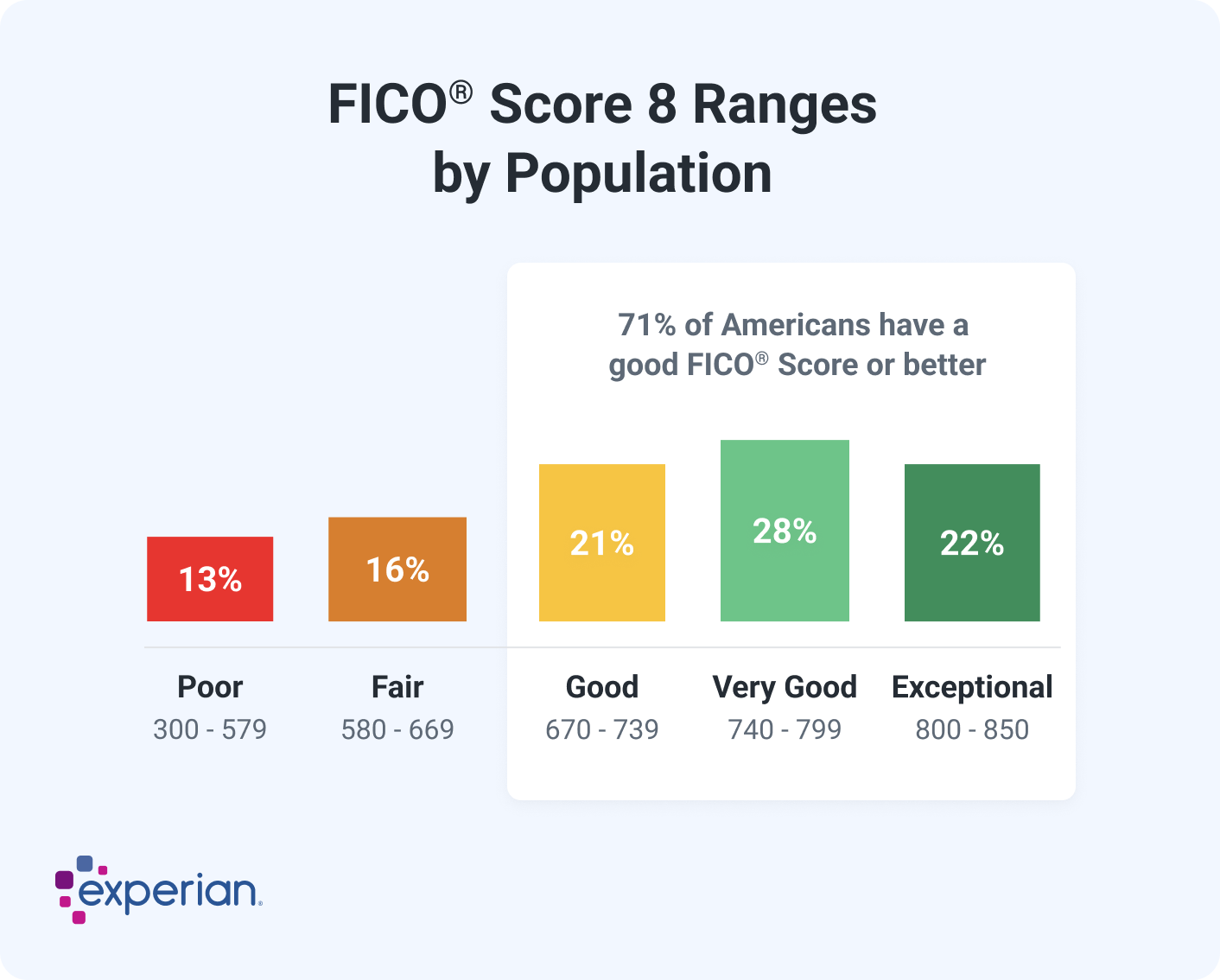

Yet beneath the marketing is a harder truth. Balance transfer cards are not designed for those who probably need them most – borrowers with bad credit. The best offers, those with long 0% APR windows and low transfer fees, are reserved for applicants with good to excellent credit (typically FICO 670+). People with poor or fair credit often face rejection or receive offers with higher fees, shorter promotional periods, and low credit limits that provide little relief.

Source: Experian

What Is a Balance Transfer Card?

A balance transfer credit card is a type of credit card that allows consumers to transfer existing balances from one or more accounts. The appeal comes from promotional APRs, which usually range from 12 to 21 months with 0% interest. During this time, every payment reduces the principal rather than being absorbed by interest charges.

The problem is that these deals are highly selective. Issuers use creditworthiness to decide who qualifies. Borrowers with strong repayment histories and lower utilization ratios are rewarded, while those with weaker credit profiles are excluded.

Best Credit Card Sign Up Bonuses

Documented Eligibility Criteria From Major Issuers

Eligibility requirements are rarely highlighted in advertisements but are crucial to understand. Major card issuers set the bar high:

-

BankAmericard: Typically requires a FICO score of 670 or higher. Sources like WalletHub suggest that 750+ improves approval odds significantly. This card is marketed for those with established, stable credit.

-

Citi Diamond Preferred: Applicants generally need good to excellent credit, falling between 670 and 850, with 700+ recommended for approval.

Independent research reinforces that balance transfer cards usually require at least a 670–700 FICO score – making them inaccessible to the borrowers who might need them most, those struggling with high balances and poor scores.

Why Borrowers With Bad Credit Struggle

The restrictive nature of these offers stems from risk management. Credit card issuers are businesses seeking to minimize defaults. A borrower with a low FICO score represents a higher risk of missed payments or charge-offs. To protect themselves, issuers limit access to promotional offers.

When borrowers with bad credit do manage to qualify, the terms are often far less generous. Promotional windows may be shortened to six or nine months, interest rates after the promotion can jump as high as 25–30 percent, and credit limits may fall far below what is needed. For example, a borrower with $8,000 in credit card debt may receive approval for only a $2,000 balance transfer limit. On top of that, a 5% transfer fee would add $250 immediately, undermining the financial benefit. Once the brief promotional period ends, if the balance has not been paid down, interest resumes at a punishing rate, wiping out any short-term savings.

This cycle underscores the reality: balance transfer cards favor those who least need them, borrowers with strong financial standing, while excluding or penalizing those who might benefit most.

Alternatives to Balance Transfer Cards

For borrowers with poor or fair credit, other debt-relief strategies are often more effective than pursuing a balance transfer card:

-

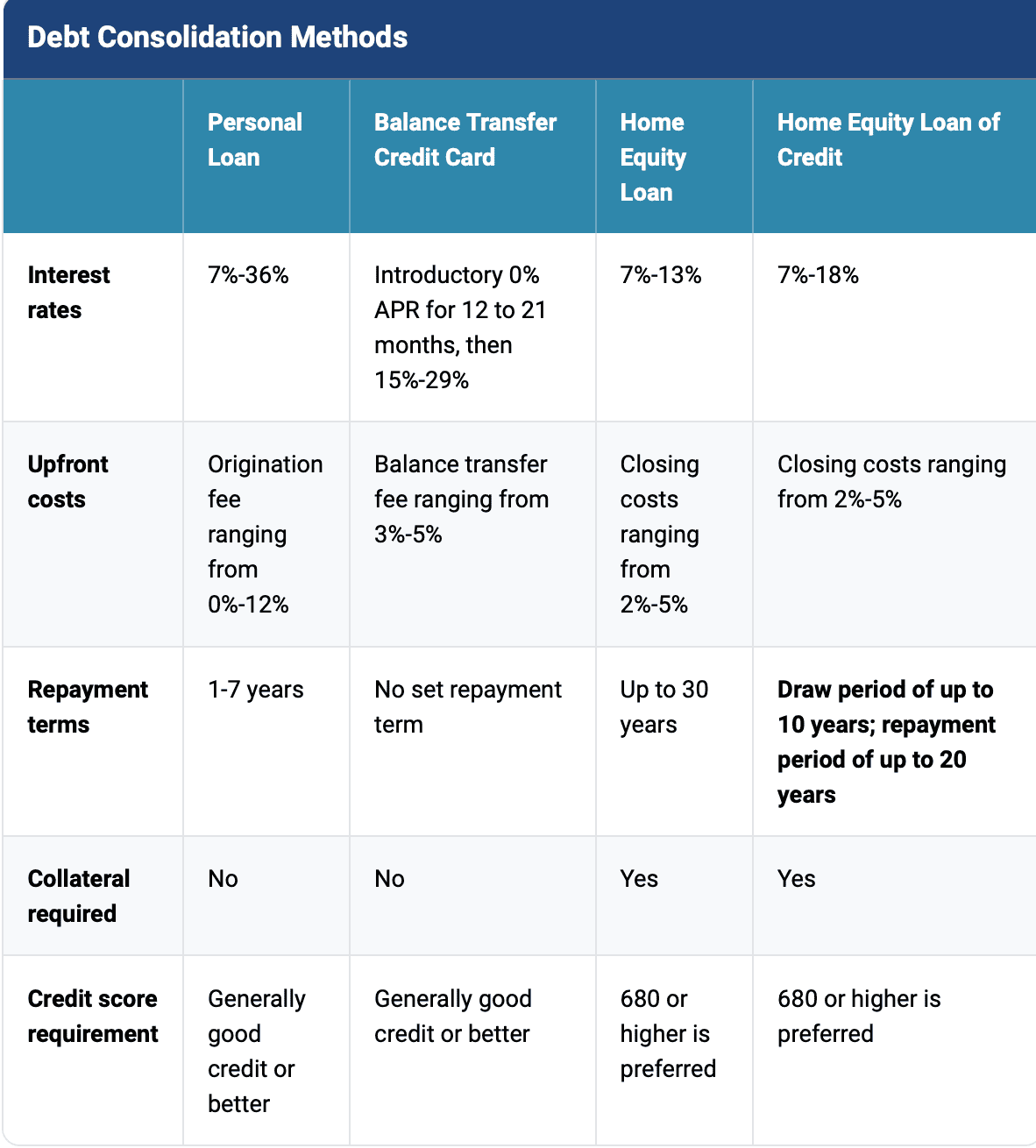

Debt consolidation loans: These loans can carry lower interest rates than credit cards and provide structured, fixed monthly payments. For many, this offers predictability and a path out of revolving debt.

Source: Experian

-

Secured credit cards: These require a refundable deposit but allow borrowers to rebuild their credit by demonstrating responsible use. Over time, consistent payments can help raise credit scores.

-

Credit-builder loans: Offered by many credit unions, these small installment loans exist specifically to help individuals establish or repair credit histories.

-

Debt management programs: Nonprofit agencies can negotiate with creditors to reduce interest rates, lower monthly payments, and consolidate bills into one manageable payment.

Each of these alternatives focuses less on temporary relief and more on sustainable financial improvement.

How to Work Toward Eligibility

The long-term solution for borrowers with bad credit is to improve their credit profile so they can qualify for better offers. Several steps can accelerate this process:

-

Check credit reports for errors. Review your history from all three major bureaus and dispute inaccuracies.

-

Reduce credit utilization. High balances relative to credit limits heavily impact scores. Paying down balances can quickly improve ratios.

-

Build a history of on-time payments. Consistency over six to twelve months makes a measurable difference in credit scores.

-

Limit new applications. Multiple hard inquiries within a short time frame can reduce scores further.

Over time, these measures can move a borrower from the “fair” category into “good” or “excellent” territory, opening access to the strongest balance transfer offers on the market.

Final Thoughts

Balance transfer credit cards are often presented as an easy solution to high-interest debt, but in reality, they serve those with already strong credit profiles. Borrowers with poor or fair credit rarely qualify for meaningful offers, and when they do, the terms often provide little benefit. High fees, short promotional periods, and low limits make these cards impractical as a tool for financial recovery.

For those struggling with debt and bad credit, the path forward lies in improving financial health through responsible repayment, credit-building tools, and, in some cases, nonprofit assistance. Only by strengthening a credit profile can borrowers gain access to the top-tier promotional offers that truly save money.

The key takeaway: unless your credit score is at least 670, balance transfer credit cards won’t deliver the benefits advertised. Instead, prioritize rebuilding your credit and consider alternatives until you qualify for the deals that can genuinely make a difference. All that said, though, if you’re simply somebody who’s gotten into a whole with a few credit cards, and have a good credit rating, then a balance transfer card is a good option to efficiently consolidate your debt and slash card interest payments.

Related: This topic is part of the broader credit system. For an overview of how credit scores, loans, and debt work together, see our Credit & Debt guide.