Ethereum’s Institutional Revolution: ETFs, Treasuries, and Market Domination

4.8 min read

Updated: Jan 20, 2026 - 10:01:26

Ethereum’s 88% rally over the past two months is more than a speculative surge, it signals the start of structural institutional adoption. ETFs, corporate treasuries, and real-world asset tokenization are anchoring ETH as a financial pillar, with inflows and holdings at record highs. Upgrades like Dencun and Pectra further boost usability and lower costs, reinforcing Ethereum’s role as Wall Street’s token. Here’s why ETH’s trajectory may look less like a cycle and more like a long-term transformation:

- ETF inflows surge: Since U.S. spot ETF launches in July 2024, Ethereum ETFs have attracted nearly $10B, managing over $30B by August 2025, outpacing Bitcoin ETFs in recent weeks.

- Corporate treasuries buying big: Public companies now hold 4.4M ETH (~3.7% of supply), worth $19B, a threefold increase in August alone.

- Bold price targets: Standard Chartered projects ETH at $7,500 by year-end; Arthur Hayes suggests $20,000 this cycle, citing Ethereum’s dominance in stablecoins and tokenized assets.

- Network fundamentals strong: Transfer volumes topped $320B in August 2025, transactions and active addresses hit highs, while upgrades slashed rollup costs and lowered fees.

- ETH as infrastructure: With stablecoins projected to hit $2T by 2028 and Ethereum leading real-world asset tokenization, institutional adoption is becoming structural rather than speculative.

Ethereum’s recent rally is not just another bullish cycle; it marks the beginning of a structural transformation. Over the past two months, ETH has surged 88%, breaking into a new all-time high. But behind the price action lies a bigger story: the rapid institutionalization of Ethereum through ETFs, treasuries, and corporate adoption.

ETFs: The Relentless Bid

One of the strongest forces driving Ethereum’s momentum is the explosion of spot ETFs. Since their U.S. debut in July 2024, Ethereum ETFs have attracted nearly $10 billion in inflows, with $4 billion pouring in during August alone. Today, these funds collectively manage over $30 billion in assets, with flows running at a pace ten times greater than Bitcoin ETFs in recent weeks.

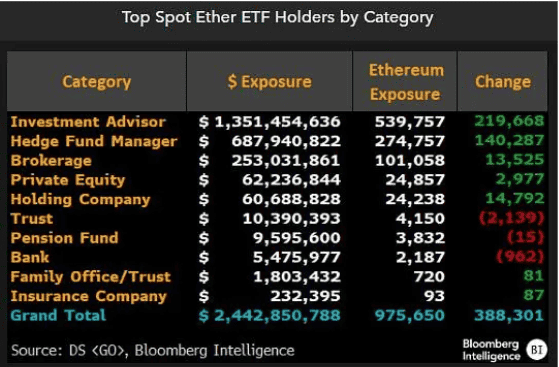

The scale of institutional adoption inside ETFs is striking. In Q2 2025, major financial players accumulated nearly 388,000 ETH, worth about $1.35 billion, bringing their total ETF-related holdings close to 540,000 ETH.

Source: Bloomberg Intelligence

Hedge funds more than doubled their exposure, and Goldman Sachs emerged as the single largest holder with 288,000 ETH.

Source: Bloomberg Intelligence

ETF inflows set fresh records into late August, underscoring the strength and persistence of institutional demand.

Corporate Treasuries: Quiet but Massive Buyers

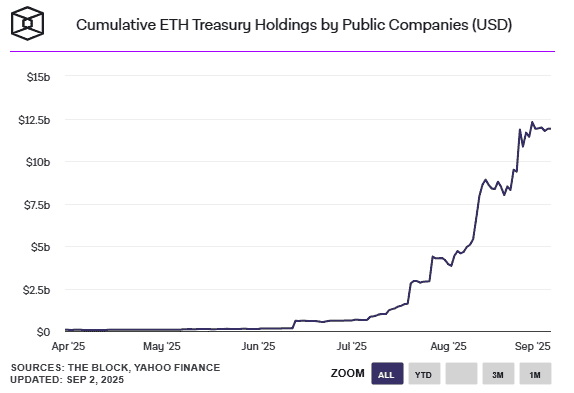

While ETFs grab headlines, corporate treasuries have been quietly establishing themselves as a powerful new force in Ethereum’s market. Public companies’ cumulative ether holdings climbed from $4 billion in early August to more than $12 billion by the end of the month.

Source: The Block

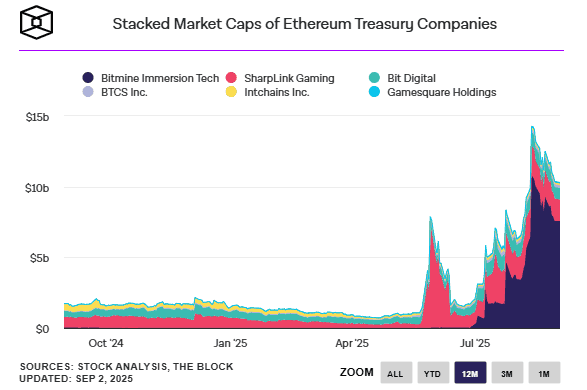

This surge was led by significant additions from BitMine Immersion and SharpLink Gaming, with treasuries now collectively holding 4.4 million ETH, equivalent to 3.7% of the total supply, worth over $19 billion.

Source: The Block

As Standard Chartered’s Geoffrey Kendrick observed, these treasuries represent structural demand because they are unlikely to liquidate their positions, creating a persistent source of buying pressure that underpins Ethereum’s price.

Predictions: Bold Targets for ETH

The scale of institutional adoption has inspired bold forecasts for Ethereum’s future.

-

Joseph Lubin, Ethereum co-founder and Consensys CEO, suggested ETH could “100x from here” as Wall Street increasingly builds on Ethereum rails.

-

VanEck’s CEO Jan van Eck described Ether as the “Wall Street token.”

-

Standard Chartered issued one of the strongest calls, projecting $7,500 by year-end, making ETH one of the bank’s top conviction digital assets.

-

Arthur Hayes, sees potential for ETH to hit $20,000 this cycle.

The reasoning behind these projections is clear: Ethereum already dominates two sectors that are expanding rapidly, stablecoins and real-world assets.

Stablecoins and Real-World Assets: Ethereum’s Growth Engines

Ethereum has positioned itself at the center of two critical growth markets:

-

Stablecoins: Since 2023, the stablecoin market has doubled to $280 billion and is projected to reach $2 trillion by 2028. More than half of these stablecoins are built on Ethereum, tying the network’s success directly to global payment flows.

Source: @wint3rmute on Dune Analytics

-

Real-World Assets (RWAs): Ethereum is leading the tokenization wave, from treasuries and funds to equities. As adoption accelerates, Ethereum is becoming the default infrastructure for institutional-grade asset tokenization.

Together, these sectors ensure that Ethereum’s adoption is no longer speculative, it is tied to the backbone of global financial transactions.

Technicals and Network Strength

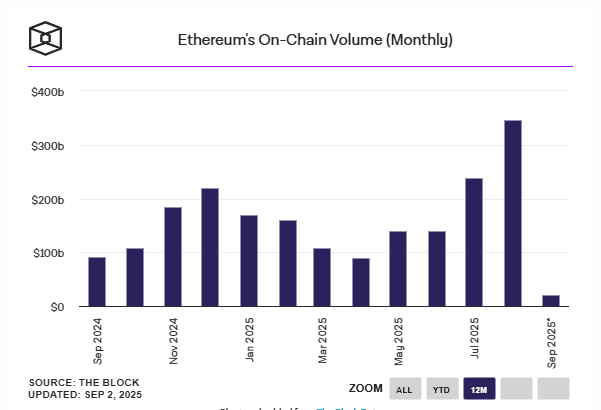

Ethereum’s on-chain data confirms that the institutional rally is backed by robust fundamentals.

-

Monthly adjusted transfer volume surpassed $320 billion in August 2025, the highest since May 2021 and the third-largest on record.

Source: The Block

-

Thirty-day transactions hit fresh highs.

-

Monthly active addresses reached their second-highest level ever.

-

Total Value Locked (TVL) remains near all-time highs.

At the same time, Ethereum’s usability has improved thanks to major upgrades. Dencun (proto-danksharding) and Pectra have reduced rollup costs, enhanced account abstraction, and streamlined application usability. This has pushed transaction fees near five-year lows, even as activity has surged.

Final Thoughts: ETH as the Big Idea

Ethereum has moved beyond being “just a smart contract platform.” With ETFs absorbing supply, treasuries locking in billions, and adoption booming across stablecoins and real-world assets, ETH is evolving into a structural pillar of modern finance.

Institutional adoption is no longer a side note, it is the dominant narrative. For banks, hedge funds, and corporations alike, Ethereum is becoming Wall Street’s token, and this may only be the beginning of its institutional journey.