What’s a Good Credit Utilization Ratio? Target for Different Credit Profiles

4.3 min read

Updated: Dec 26, 2025 - 06:12:46

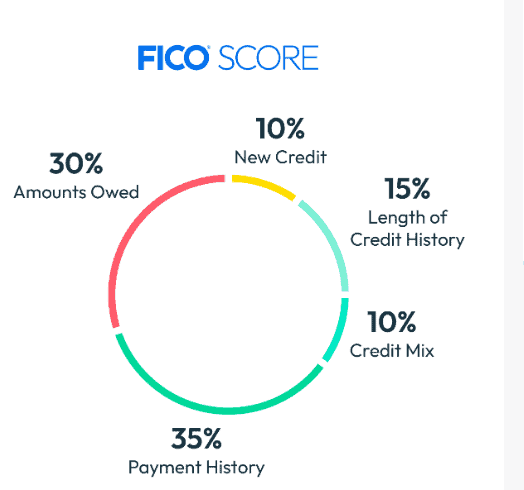

Your credit utilization ratio, the share of available revolving credit you’re using, makes up about 30% of your FICO Score. Keeping this ratio in the right range is one of the fastest, most controllable ways to improve your credit score, qualify for better loans, and secure lower interest rates. Lenders view high utilization as a warning sign, while consistently low usage signals strong credit management.

- Definition: Credit utilization is your revolving balance divided by total credit limits, for example, a $3,000 balance on $10,000 available = 30% utilization.

- Scoring impact: Accounts for ~30% of your FICO Score, second only to payment history.

- Best practices: Stay under 30% for good credit; under 10% for excellent credit.

- Quick fixes: Pay balances before statement close, request credit limit increases, spread spending across cards, and keep older accounts open.

- Avoid mistakes: Don’t carry a balance on purpose, ignore individual card ratios, or close high-limit accounts unnecessarily.

If you’ve ever applied for a credit card, car loan, or mortgage, your credit score was likely one of the deciding factors. Among the many variables that determine that score, your credit utilization ratio, the percentage of your available credit that you’re using, carries significant weight. Understanding how this ratio works and how to keep it in the right range can help you qualify for better loans, lower interest rates, and stronger overall financial health.

What Is Credit Utilization Ratio?

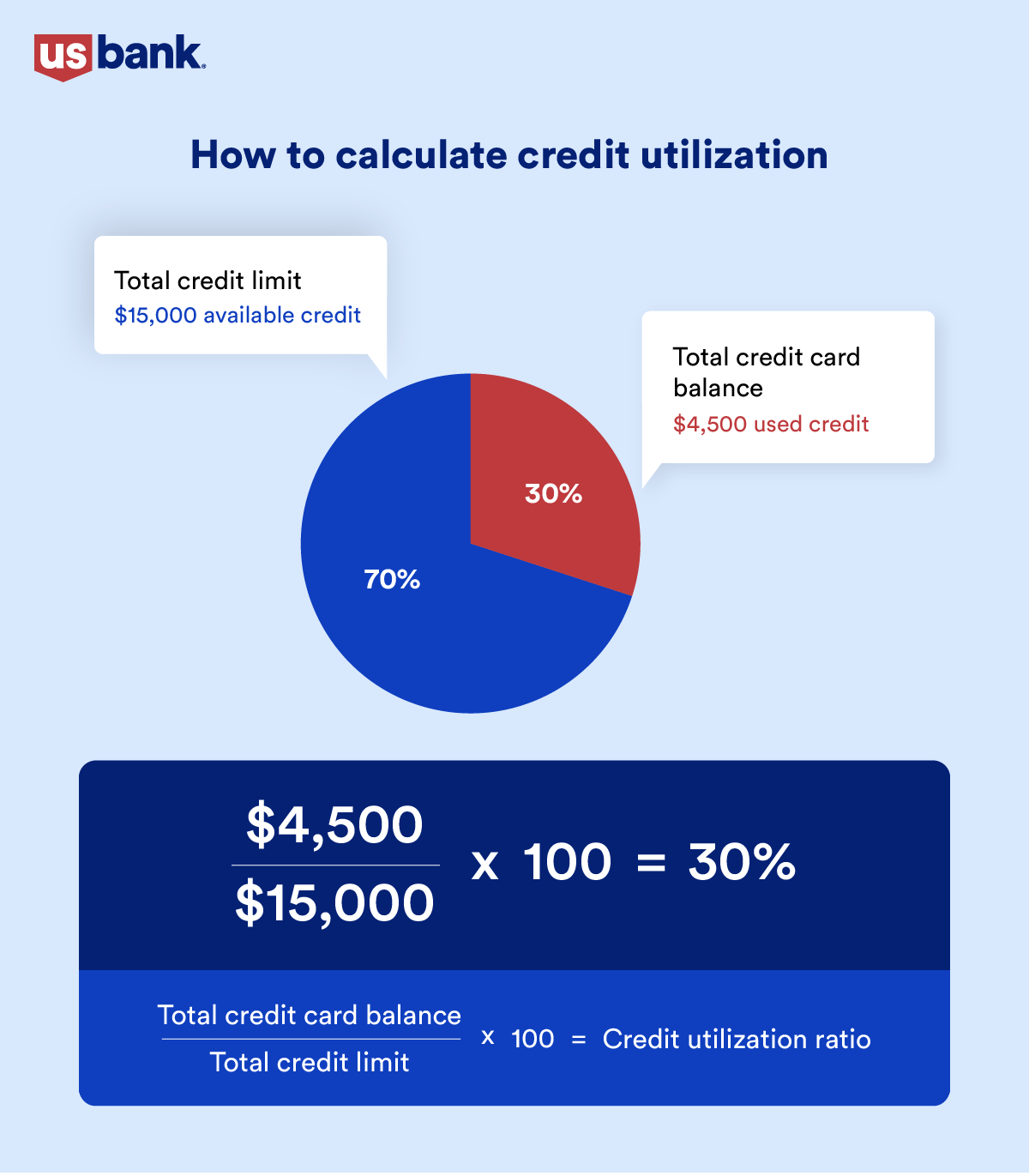

Credit utilization ratio refers to the amount of revolving credit you’ve used divided by your total available credit. Revolving credit includes accounts like credit cards and personal lines of credit, which allow you to borrow, repay, and borrow again.

For example, if your total credit limit is $10,000 and your outstanding balance is $3,000, your utilization ratio is 30%. Credit scoring models such as the widely used FICO Score consider both your overall utilization across all cards and the utilization on individual accounts.

Source: myFICO

Why Credit Utilization Matters

According to Experian, credit utilization makes up about 30% of your FICO Score, making it the second most influential factor after payment history. A high ratio suggests to lenders that you may be financially stretched, even if you’ve never missed a payment, and this perception increases your risk profile.

By contrast, maintaining a low utilization ratio signals that you manage credit responsibly without over-reliance. This practice not only protects your credit score but also improves your chances of approval for future loans at more favorable rates.

What’s a Good Credit Utilization Ratio?

Most financial institutions, including U.S. Bank, advise keeping your utilization below 30% to be considered “good.” However, borrowers seeking excellent credit scores often benefit from keeping their ratio below 10%.

Source: USbank

It is important to note that a utilization ratio of 0% is not always ideal. Credit scoring systems want to see that you actively use credit and pay it off. A healthy pattern usually involves small, consistent charges that are repaid in full.

Targets for Different Credit Profiles

| Credit Profile | Recommended Target Utilization | Notes |

|---|---|---|

| Poor / Fair (300–669) | Keep below 30–35% | Avoid maxing out cards, as higher usage raises red flags. |

| Good (670–739) | Keep below 20% | Strengthens your score over time. |

| Very Good (740–799) | Aim for 10–15% | Helps reach the “excellent” range. |

| Excellent (800+) | Under 10% | Consistently low ratios unlock the best offers. |

How to Improve Your Ratio

If your utilization is higher than you’d like, these practical steps can help bring it down:

-

Pay balances early or multiple times a month. Since card issuers often report balances at statement closing rather than the due date, early payments reduce the balance shown to credit bureaus.

-

Request a credit limit increase. With the same spending level, a higher limit instantly lowers utilization. For instance, raising a $5,000 limit to $7,500 reduces a $1,500 balance from 30% to 20%.

-

Distribute spending across multiple cards. Spreading purchases prevents any single account from showing high usage.

-

Keep older accounts open. Closing cards lowers your available credit and can raise utilization.

-

Use spending alerts. Many banks offer alerts when balances approach a percentage threshold, helping you stay proactive.

Mistakes to Avoid

Many borrowers misunderstand how utilization works and make counterproductive decisions. Carrying a balance on purpose is one common mistake, as it adds unnecessary interest without improving your score.

Another is focusing only on overall utilization while ignoring individual card ratios; maxing out one card can harm your profile even if your total usage is low. Similarly, paying in full does not eliminate the risk of high utilization reporting, since lenders may record balances before they are cleared. Closing high-limit accounts is another pitfall, as it immediately reduces available credit and inflates utilization.

Conclusion

A strong rule of thumb is to keep your credit utilization under 30%, but those aiming for top-tier scores should strive for under 10%. By paying early, distributing spending, and keeping long-standing credit lines open, you can maintain a low utilization ratio and strengthen your credit profile. Over time, these habits not only build a healthier score but also open the door to better financial opportunities.

This topic is part of the broader credit system. For an overview of how credit scores, loans, and debt work together, see our Credit & Debt guide.